Finance

What Are Liquidity Needs?

Published: February 23, 2024

Learn about liquidity needs in finance and how they impact businesses and individuals. Understand the importance of managing liquidity for financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

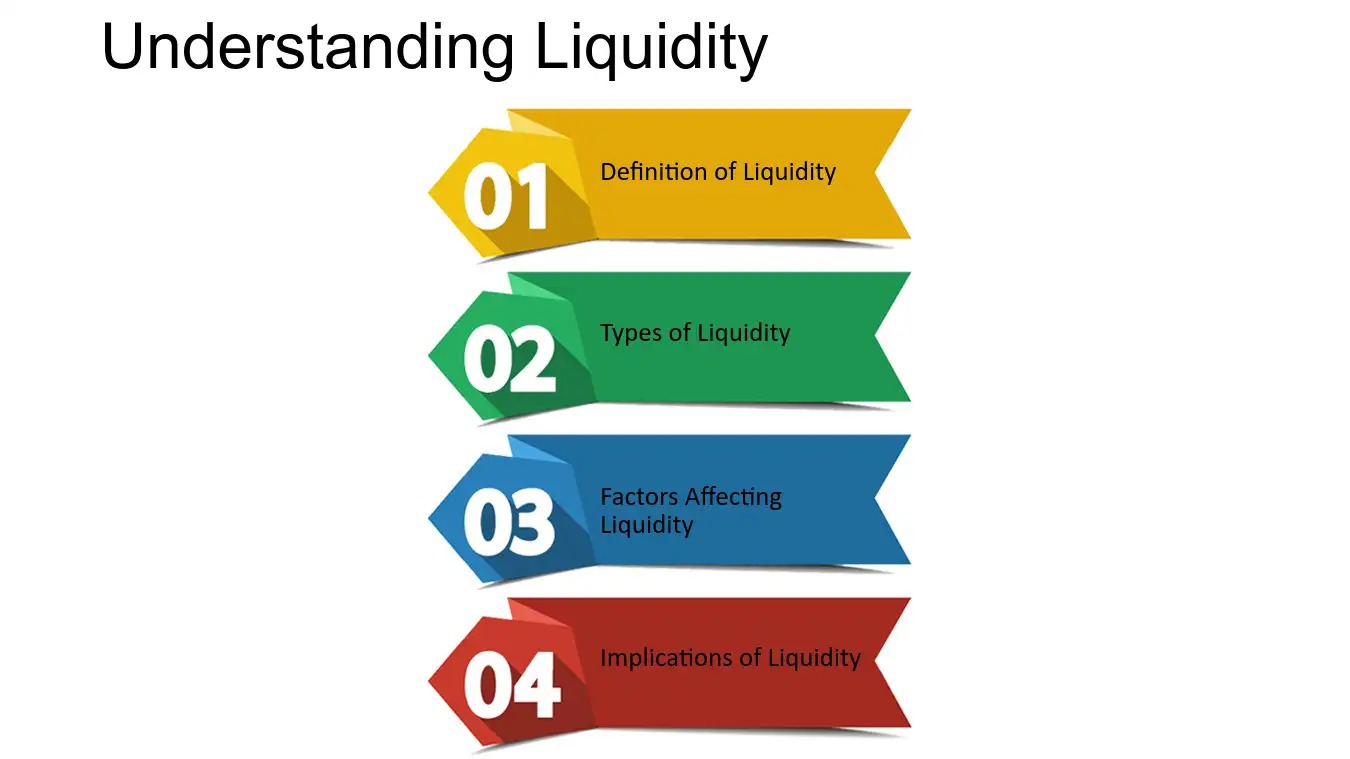

Understanding Liquidity Needs

In the realm of finance, liquidity needs represent a fundamental aspect of financial management for both individuals and businesses. The concept of liquidity pertains to the ability to access cash or quickly convert assets into cash without causing a significant loss in value. Understanding liquidity needs is crucial for maintaining financial stability and meeting short-term obligations. This article delves into the intricacies of liquidity needs, explores the factors influencing them, and offers strategies for effectively managing liquidity requirements.

Liquidity needs are essentially the demand for readily available funds to cover immediate expenses or seize unforeseen opportunities. Individuals often encounter liquidity needs when facing sudden medical expenses, car repairs, or other unexpected financial burdens. Similarly, businesses must address liquidity needs to fulfill payroll obligations, settle short-term debts, or capitalize on advantageous investment prospects. Without adequate liquidity, both individuals and organizations may find themselves in precarious financial positions, unable to address pressing financial demands.

By comprehending liquidity needs, individuals and businesses can make informed financial decisions and establish robust financial plans to mitigate potential liquidity challenges. This entails striking a balance between maintaining sufficient cash reserves and optimizing the utilization of assets to ensure liquidity without compromising long-term financial goals. Understanding liquidity needs empowers individuals and businesses to navigate financial uncertainties and capitalize on opportunities, fostering financial resilience and stability.

Understanding Liquidity Needs

In the realm of finance, liquidity needs represent a fundamental aspect of financial management for both individuals and businesses. The concept of liquidity pertains to the ability to access cash or quickly convert assets into cash without causing a significant loss in value. Understanding liquidity needs is crucial for maintaining financial stability and meeting short-term obligations. This article delves into the intricacies of liquidity needs, explores the factors influencing them, and offers strategies for effectively managing liquidity requirements.

Liquidity needs are essentially the demand for readily available funds to cover immediate expenses or seize unforeseen opportunities. Individuals often encounter liquidity needs when facing sudden medical expenses, car repairs, or other unexpected financial burdens. Similarly, businesses must address liquidity needs to fulfill payroll obligations, settle short-term debts, or capitalize on advantageous investment prospects. Without adequate liquidity, both individuals and organizations may find themselves in precarious financial positions, unable to address pressing financial demands.

By comprehending liquidity needs, individuals and businesses can make informed financial decisions and establish robust financial plans to mitigate potential liquidity challenges. This entails striking a balance between maintaining sufficient cash reserves and optimizing the utilization of assets to ensure liquidity without compromising long-term financial goals. Understanding liquidity needs empowers individuals and businesses to navigate financial uncertainties and capitalize on opportunities, fostering financial resilience and stability.

Factors Affecting Liquidity Needs

Several factors influence an individual’s or organization’s liquidity needs, shaping the amount of readily available funds required to meet financial obligations. Understanding these factors is paramount for devising effective liquidity management strategies. The following elements significantly impact liquidity needs:

- Income Stability: Individuals with irregular income streams may have higher liquidity needs to cushion against income fluctuations and unexpected expenses. Similarly, businesses experiencing revenue variability often require greater liquidity to ensure ongoing operations and financial stability.

- Debt Obligations: The presence of outstanding debts, such as mortgages, loans, or credit lines, can elevate liquidity needs. Servicing debt requires consistent cash flow, necessitating sufficient liquidity to meet repayment deadlines and avoid financial strain.

- Market Volatility: Fluctuations in financial markets and economic conditions can impact liquidity needs. Heightened market volatility may necessitate increased liquidity to capitalize on investment opportunities or mitigate potential losses.

- Business Seasonality: Seasonal businesses, such as those in tourism or retail, often experience fluctuating revenue throughout the year, influencing their liquidity requirements. During low seasons, these entities may need to bolster their liquidity to sustain operations.

- Regulatory Requirements: Regulatory standards and compliance obligations can affect liquidity needs for businesses. Industries subject to stringent regulatory frameworks may need to allocate additional funds to meet compliance-related expenses.

- Growth and Expansion: Organizations pursuing growth initiatives or expansion projects may encounter heightened liquidity needs. Funding expansion efforts and capitalizing on growth opportunities necessitate adequate liquidity to support these strategic endeavors.

By recognizing and assessing these factors, individuals and businesses can tailor their liquidity management approaches to align with their unique financial circumstances and goals. Proactively addressing these influences enables the development of robust liquidity strategies that cater to specific needs and promote financial resilience.

Strategies for Managing Liquidity Needs

Effectively managing liquidity needs is paramount for individuals and businesses to navigate financial uncertainties and maintain stability. Implementing prudent strategies can help ensure the availability of sufficient funds to meet short-term obligations and capitalize on opportunities. The following are key strategies for managing liquidity needs:

- Establishing Cash Reserves: Building and maintaining adequate cash reserves is essential to address unforeseen expenses and financial emergencies. Individuals are advised to maintain an emergency fund equivalent to 3-6 months’ worth of living expenses, while businesses should establish cash reserves aligned with their operational needs and industry dynamics.

- Utilizing Lines of Credit: Securing a revolving line of credit can serve as a valuable safety net for addressing short-term liquidity needs. This financial tool provides access to funds when necessary, offering flexibility and mitigating the risk of cash flow shortages.

- Optimizing Working Capital: Streamlining accounts receivable and accounts payable processes can enhance working capital management, thereby freeing up cash and bolstering liquidity. Businesses can negotiate favorable payment terms with suppliers while expediting the collection of receivables to optimize cash flow.

- Investing in Highly Liquid Assets: Allocating a portion of financial portfolios or corporate reserves to highly liquid assets, such as money market instruments or short-term securities, facilitates easy access to cash when needed. These investments offer a balance of liquidity and potential returns.

- Scenario Planning: Engaging in scenario analysis and stress testing can help anticipate potential liquidity challenges and devise contingency plans. By simulating adverse scenarios, individuals and businesses can proactively prepare for liquidity disruptions and implement preemptive measures.

- Monitoring and Forecasting Cash Flow: Regularly monitoring cash inflows and outflows enables proactive liquidity management. By forecasting future cash requirements and identifying potential shortfalls, individuals and businesses can take preemptive actions to mitigate liquidity risks.

Employing these strategies empowers individuals and businesses to proactively address liquidity needs, fortify financial resilience, and capitalize on opportunities while safeguarding against unforeseen financial adversities.

Conclusion

Understanding and effectively managing liquidity needs are critical components of sound financial management. Whether at the individual or organizational level, liquidity plays a pivotal role in ensuring financial stability, meeting short-term obligations, and capitalizing on opportunities. By comprehending the factors influencing liquidity needs and implementing prudent strategies, individuals and businesses can navigate financial uncertainties with confidence and resilience.

It is imperative for individuals to maintain adequate cash reserves to address unexpected expenses and mitigate financial vulnerabilities. Establishing an emergency fund and optimizing cash flow through prudent budgeting and expense management are essential steps in addressing personal liquidity needs. Similarly, businesses must strike a balance between maintaining sufficient working capital and leveraging financial instruments to optimize liquidity.

Market volatility, income stability, debt obligations, and regulatory requirements are among the myriad factors that can impact liquidity needs. By proactively assessing these influences, individuals and organizations can tailor their liquidity management approaches to align with their unique financial circumstances and goals, fostering financial resilience and stability.

Implementing strategies such as establishing cash reserves, leveraging lines of credit, optimizing working capital, and investing in highly liquid assets empowers individuals and businesses to proactively address liquidity needs. Scenario planning, stress testing, and diligent cash flow monitoring further fortify liquidity management efforts, enabling proactive risk mitigation and strategic decision-making.

In conclusion, a comprehensive understanding of liquidity needs and the implementation of effective liquidity management strategies are pivotal for financial well-being and resilience. By addressing liquidity needs with foresight and prudence, individuals and businesses can navigate financial challenges, capitalize on opportunities, and maintain a robust financial foundation.