Finance

What Is Liquidity Mining?

Published: February 23, 2024

Learn how liquidity mining works in the world of finance and how it can help you earn passive income through decentralized finance (DeFi) protocols. Understand the potential risks and rewards of participating in liquidity mining.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Liquidity mining has emerged as a pivotal concept within the realm of decentralized finance (DeFi), revolutionizing the traditional financial landscape. This innovative mechanism offers individuals the opportunity to earn rewards by providing liquidity to decentralized exchanges and protocols. As the financial ecosystem continues to evolve, liquidity mining has garnered substantial attention due to its potential for generating passive income and fostering liquidity within DeFi platforms.

Liquidity mining, also known as yield farming, represents a groundbreaking incentive structure that incentivizes users to contribute their assets to liquidity pools. These pools facilitate the seamless execution of trades and transactions on decentralized exchanges, thereby enhancing the overall efficiency of DeFi platforms. By actively participating in liquidity mining, individuals play a crucial role in fortifying the liquidity of digital assets, which is essential for the sustained operation of decentralized financial protocols.

This article aims to elucidate the fundamental principles of liquidity mining, providing a comprehensive understanding of its mechanics, benefits, and associated risks. By delving into real-world examples of liquidity mining platforms, readers will gain valuable insights into the diverse opportunities and potential considerations associated with this innovative financial practice. Furthermore, the exploration of the advantages and drawbacks of liquidity mining will empower individuals to make informed decisions regarding their participation in this burgeoning facet of decentralized finance.

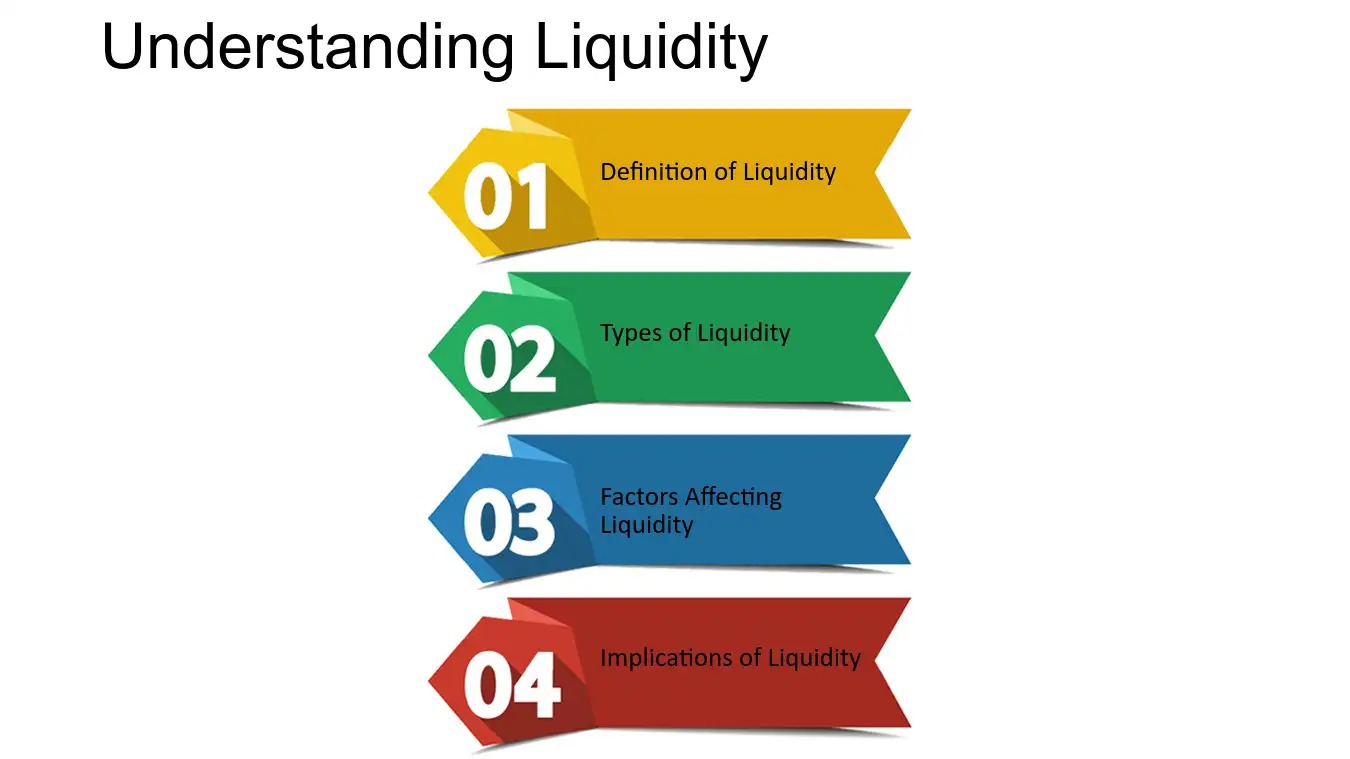

Understanding Liquidity Mining

Liquidity mining encompasses a strategic process through which individuals contribute their digital assets to liquidity pools, thereby enabling the seamless exchange of cryptocurrencies on decentralized platforms. By engaging in liquidity mining, participants effectively bolster the liquidity of these assets, which is essential for the efficient operation of decentralized exchanges and protocols. This practice is underpinned by the concept of yield farming, wherein users are incentivized to provide liquidity in the form of cryptocurrency pairs to decentralized finance platforms.

At its core, liquidity mining revolves around the concept of incentivization, wherein users receive rewards for their active participation in liquidity provision. These rewards typically manifest in the form of additional tokens or fees generated from the trading activities facilitated by the liquidity pools. As a result, liquidity providers are able to earn passive income while simultaneously contributing to the liquidity and overall functionality of DeFi platforms.

Furthermore, liquidity mining serves as a mechanism to bootstrap the adoption and utilization of new decentralized protocols and exchanges. By offering attractive incentives to liquidity providers, DeFi platforms can attract a steady influx of assets, thereby fostering a vibrant and liquid ecosystem for digital asset trading. This, in turn, contributes to the sustainability and growth of decentralized finance, creating a mutually beneficial environment for both platform users and the protocols themselves.

Understanding the intricacies of liquidity mining is crucial for individuals looking to engage in this practice. By comprehending the underlying mechanisms and incentives driving liquidity mining, participants can make informed decisions regarding their involvement in various DeFi platforms. This knowledge empowers users to assess the potential risks and rewards associated with liquidity mining, enabling them to navigate this burgeoning landscape with confidence and prudence.

How Liquidity Mining Works

Liquidity mining operates on a fundamentally simple yet impactful premise. Participants, referred to as liquidity providers, contribute their funds to liquidity pools, which are utilized to facilitate decentralized trading on various DeFi platforms. These pools typically consist of two paired assets, such as Ether and a stablecoin like DAI, and are essential for executing trades in a decentralized and automated manner.

When a user adds funds to a liquidity pool, they receive liquidity pool tokens representing their share of the pool. These tokens can be staked or utilized in other protocols to earn additional rewards. The act of providing liquidity not only enables seamless transactions but also enhances the overall liquidity of the paired assets, thereby contributing to the efficiency and stability of decentralized exchanges.

The rewards accrued through liquidity mining are often distributed in the form of governance tokens or a portion of the trading fees generated by the platform. These incentives are designed to encourage continued participation in liquidity provision, thereby fostering a robust and sustainable ecosystem for decentralized finance. Additionally, some platforms may offer yield optimization strategies, allowing liquidity providers to maximize their returns by actively managing their positions within liquidity pools.

Decentralized finance platforms leverage smart contracts to automate the distribution of rewards, ensuring transparency and trust within the ecosystem. The allocation of rewards is typically proportional to the amount of liquidity provided, incentivizing users to contribute substantial assets to the pools. This mechanism not only encourages liquidity provision but also aligns the interests of liquidity providers with the long-term success and growth of the underlying DeFi protocols.

Overall, the workings of liquidity mining revolve around the symbiotic relationship between liquidity providers and decentralized platforms, wherein participants are incentivized to contribute their assets to liquidity pools, thereby enhancing the functionality and liquidity of the broader DeFi ecosystem.

Benefits and Risks of Liquidity Mining

Liquidity mining presents a plethora of potential benefits for participants, including the opportunity to earn passive income, gain exposure to new and emerging tokens, and actively contribute to the liquidity and efficiency of decentralized finance platforms. By providing liquidity to pools, individuals can earn rewards in the form of governance tokens, trading fees, or other incentives, thereby diversifying their asset holdings and generating additional income streams.

Furthermore, liquidity mining offers participants the chance to actively engage with innovative DeFi protocols, fostering a deeper understanding of the underlying mechanisms and functionalities. This hands-on involvement can provide valuable insights into the broader decentralized finance landscape, empowering individuals to make informed investment and participation decisions within the rapidly evolving crypto space.

However, it is crucial to acknowledge the inherent risks associated with liquidity mining. Price volatility, impermanent loss, and smart contract vulnerabilities are among the potential pitfalls that participants must consider. Price volatility in the cryptocurrency market can lead to fluctuations in the value of assets held within liquidity pools, impacting the overall returns generated through liquidity provision.

Impermanent loss, a phenomenon unique to providing liquidity, occurs when the value of assets in a liquidity pool diverges from the initial deposit value. This can result in reduced returns compared to simply holding the assets. Additionally, smart contract vulnerabilities and platform-specific risks pose potential threats to participants’ deposited assets and accrued rewards, necessitating a thorough assessment of the security measures and risk factors associated with each liquidity mining platform.

By weighing the potential benefits against the inherent risks, individuals can make informed decisions regarding their participation in liquidity mining. Diligent research, risk management strategies, and a comprehensive understanding of the underlying protocols are essential for mitigating risks and maximizing the potential advantages of engaging in liquidity mining within the decentralized finance landscape.

Examples of Liquidity Mining Platforms

Several prominent decentralized finance platforms have implemented liquidity mining programs, offering users the opportunity to actively participate in liquidity provision and earn rewards. One notable example is Uniswap, a leading decentralized exchange that has pioneered liquidity mining within the DeFi space. Uniswap’s liquidity providers contribute to various liquidity pools, earning a share of the trading fees generated by the platform in proportion to their provided liquidity. In addition, liquidity providers receive UNI governance tokens, which confer voting rights and additional rewards within the Uniswap ecosystem.

SushiSwap, a decentralized exchange and automated market maker, also features a robust liquidity mining mechanism. By staking liquidity pool tokens, users can earn SUSHI tokens, the platform’s native governance and incentive token. SushiSwap’s liquidity mining program incentivizes users to contribute assets to the platform’s liquidity pools, fostering a vibrant and liquid trading environment while rewarding participants for their active involvement.

Curve Finance, renowned for its focus on stablecoin trading and low slippage, offers a compelling liquidity mining opportunity for users. By providing liquidity to Curve’s stablecoin pools, participants can earn trading fees and CRV governance tokens. This incentivizes liquidity providers to contribute to stablecoin liquidity pools, thereby enhancing the stability and efficiency of decentralized trading while earning rewards for their participation.

Balancer, a versatile automated portfolio manager and decentralized exchange, features a unique liquidity mining program that allows users to earn BAL governance tokens. By contributing assets to Balancer’s customizable liquidity pools, participants can earn fees and governance rights, effectively playing a role in shaping the platform’s development and direction.

These examples underscore the diverse opportunities available within the liquidity mining landscape, showcasing the innovative incentive structures and rewards offered by leading DeFi platforms. By actively participating in liquidity provision on these platforms, individuals can earn rewards, gain exposure to new tokens, and contribute to the liquidity and functionality of decentralized exchanges and protocols.

Conclusion

Liquidity mining stands as a transformative force within the decentralized finance space, offering individuals the opportunity to actively engage with DeFi platforms, earn passive income, and contribute to the liquidity and efficiency of decentralized exchanges. By providing liquidity to various pools, participants can earn rewards in the form of governance tokens, trading fees, and other incentives, thereby diversifying their crypto holdings and generating additional income streams.

While liquidity mining presents compelling benefits, it is essential for individuals to approach this practice with a thorough understanding of the associated risks. Price volatility, impermanent loss, and smart contract vulnerabilities underscore the importance of diligent research, risk management strategies, and a comprehensive assessment of the platforms in which one intends to participate in liquidity mining.

Real-world examples such as Uniswap, SushiSwap, Curve Finance, and Balancer illustrate the diverse opportunities available within the liquidity mining landscape. These platforms have established robust liquidity mining programs, incentivizing users to contribute assets to liquidity pools, thereby fostering a liquid and vibrant trading environment while rewarding participants for their active involvement.

As decentralized finance continues to evolve, liquidity mining is poised to play a pivotal role in shaping the future of digital asset trading and DeFi adoption. By staying informed, exercising prudence, and actively engaging with reputable platforms, individuals can harness the potential benefits of liquidity mining while mitigating associated risks, contributing to the continued growth and innovation within the decentralized finance ecosystem.