Finance

What Is Offset In Accounting

Published: October 13, 2023

Discover the concept of offset in accounting and its significance in finance. Gain insights into how offsetting transactions impact financial statements and ensure accurate record-keeping.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and accounting, being familiar with various terms and concepts is crucial. One such term is ‘offset,’ which holds significant importance in the field of accounting. Understanding the concept of offset is essential for professionals and individuals alike. This article aims to provide a comprehensive overview of offset in accounting and its implications in financial management.

Offset is a term commonly used in the accounting world to refer to the act of balancing or neutralizing the effects of certain transactions or accounts. It involves the practice of matching debits and credits to ensure accuracy and maintain the integrity of financial records. By offsetting specific entries, accountants can provide a clear and accurate representation of a company’s financial situation.

The primary purpose of offsetting is to ensure that all financial transactions are reflected accurately in an organization’s books. It helps in maintaining consistency and transparency in financial reporting, enabling businesses to make informed decisions. Additionally, offsetting plays a vital role in complying with accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

There are various types of offsets utilized in accounting, each serving a specific purpose. One common type is the offsetting of revenues and expenses, which involves matching revenue generated from a particular activity with the related costs incurred. This practice allows businesses to measure profitability accurately and assess the financial success of specific operations or products.

Another common type of offset is the offsetting of assets and liabilities. This involves balancing the value of an asset with the corresponding liability associated with that asset. For example, when a company purchases machinery using a loan, the machinery’s value and the outstanding loan amount would be offset against each other to provide an accurate depiction of the company’s financial position.

Offsetting can also be used to neutralize the effects of certain financial instruments, such as derivatives or hedging contracts. By offsetting the gains or losses incurred from these instruments, businesses can mitigate risk and manage their exposure to market fluctuations.

Overall, the concept of offset in accounting is vital for maintaining accuracy and transparency in financial reporting. It enables organizations to present reliable financial statements, assess their financial position, and make informed decisions. However, offsetting does come with its challenges and limitations, which will be discussed in detail later in this article.

Definition of Offset in Accounting

In accounting, offset refers to the practice of balancing or neutralizing the effects of certain transactions or accounts. It involves matching debits and credits to ensure accurate financial reporting and provide a clear view of an organization’s financial position.

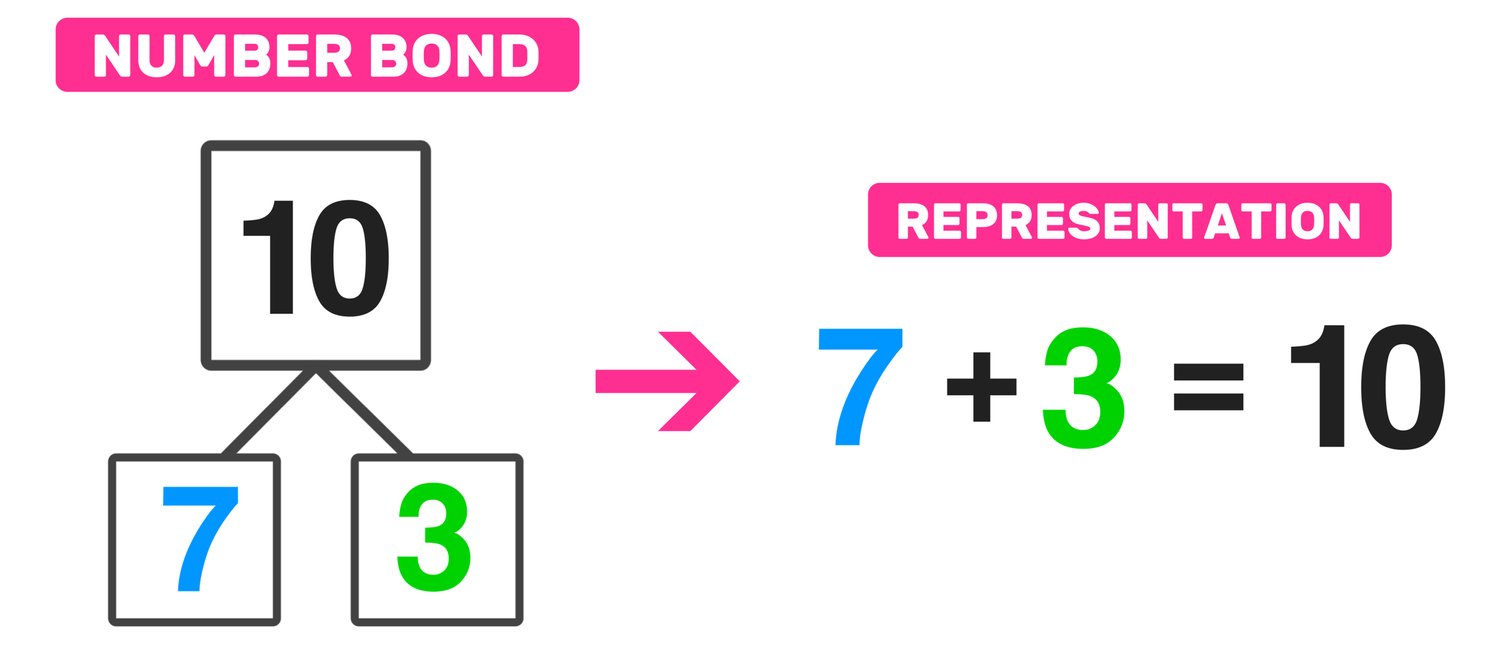

When a financial transaction occurs, it affects multiple accounts in different ways. Some accounts may see an increase in value (debit), while others may see a decrease (credit). The offsetting process involves identifying transactions that can be linked together and balancing their effects to accurately reflect the financial position.

The concept of offsetting is closely related to the fundamental accounting equation: Assets = Liabilities + Equity. By offsetting specific entries, the equation remains in balance, providing a true and fair representation of a company’s financial affairs.

There are two main types of offset used in accounting:

- Revenue and Expense Offset: This type of offset involves matching revenues generated from a specific activity with the related expenses incurred. By doing so, businesses can accurately determine the profitability of their operations and assess the financial success of individual products or services.

- Asset and Liability Offset: This type of offset focuses on balancing the value of an asset with the corresponding liability associated with it. For example, when a company acquires a new asset through financing, the value of the asset and the outstanding liability are offset against each other to provide an accurate picture of the organization’s financial position.

Offsets can also be used to neutralize the effects of financial instruments like derivatives or hedging contracts. By offsetting gains or losses from these instruments, companies can minimize risk and effectively manage their exposure to market fluctuations.

It is essential to note that offsetting does not eliminate the original transactions or accounts. Instead, it aims to accurately represent their impact and maintain the integrity of financial records. By effectively utilizing offsetting techniques, organizations can ensure consistency and transparency in their financial reporting processes.

Purpose of Offset in Accounting

The purpose of offset in accounting is to ensure accuracy, consistency, and transparency in financial reporting. By matching debits and credits, offsetting helps accountants maintain the integrity of financial records and provide a clear view of an organization’s financial position. Here are some key purposes of using offset in accounting:

- Accurate Financial Reporting: Offset is crucial for ensuring that financial transactions are accurately reflected in an organization’s books. By matching debits and credits, offsetting helps accountants avoid errors and provide a true and fair representation of the financial state of the company.

- Consistency and Compliance: Offset is used to comply with accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). It ensures that financial statements are prepared in a standardized manner, making them comparable across different organizations and industries.

- Measuring Profitability: Offset enables businesses to accurately measure the profitability of their operations. By matching revenues with related expenses, offsetting allows accountants to determine the net income or loss generated from specific activities or products.

- Assessing Financial Position: By offsetting assets and liabilities, accountants can provide an accurate depiction of an organization’s financial position. This allows stakeholders, such as investors, lenders, and management, to assess the company’s ability to meet its obligations and make informed decisions.

- Risk Management: Offset can be used in financial instruments like derivatives or hedging contracts to mitigate risk. By offsetting gains or losses from these instruments, businesses can effectively manage their exposure to market fluctuations and minimize potential losses.

- Facilitating Decision-Making: Accurate financial reporting through offsetting provides decision-makers with reliable information. This helps management in strategic planning, budgeting, and forecasting, as well as evaluating the financial performance and viability of various projects or investments.

The purpose of offset in accounting goes beyond mere bookkeeping. It plays a vital role in ensuring the reliability and usefulness of financial information, which is essential for stakeholders to make informed decisions and have confidence in an organization’s financial health and performance.

Types of Offset in Accounting

In accounting, offsetting is a versatile practice that can be applied to various types of transactions and accounts. By matching debits and credits, offsetting helps maintain accuracy and balance in financial records. Here are some common types of offset used in accounting:

- Revenue and Expense Offset: This type of offset involves matching revenues generated from a specific activity with the related expenses incurred. For example, if a company sells a product and incurs costs such as production expenses and marketing expenses, the revenue from the sale would be offset against those expenses. This allows businesses to accurately determine the profitability of their operations and evaluate the financial success of individual products or services.

- Asset and Liability Offset: In this type of offset, the value of an asset is balanced with the corresponding liability associated with it. For example, when a company acquires a new asset through financing, the value of the asset and the outstanding liability are offset against each other. This provides an accurate representation of the company’s financial position by showing the net value of the asset after considering the related liability.

- Intercompany Offset: Intercompany transactions occur when different entities within the same parent company engage in financial transactions. Offset is used to eliminate the double counting or duplication of transactions between these entities. By offsetting the intercompany transactions, financial statements of the parent company can accurately reflect the consolidated financial position and performance.

- Derivative Offset: Derivatives, such as options or futures contracts, often result in gains or losses that need to be accounted for. Offset is used to neutralize or offset these gains or losses against related positions. This helps businesses manage their risk exposure and avoid reporting inflated profits or losses.

- Foreign Currency Offset: When conducting business in multiple currencies, companies may be exposed to exchange rate fluctuations. Foreign currency offsetting allows businesses to manage these exposures by matching gains and losses from foreign currency transactions. This helps minimize the impact of exchange rate volatility on their financial statements.

- Tax Offset: Tax offset refers to the practice of using certain tax credits or deductions to offset a taxpayer’s tax liability. It allows individuals or businesses to reduce the amount of tax they owe by offsetting it against eligible credits or deductions. This ultimately results in a lower tax burden.

These are just a few examples of the types of offset used in accounting. The specific types of offset employed by organizations may vary based on their industry, operations, and financial reporting requirements. Understanding these different types of offset is essential for accountants and financial professionals to accurately represent the financial position and performance of a business.

Examples of Offset in Accounting

Offsetting is a fundamental practice in accounting that helps balance transactions and accounts, ensuring accurate financial reporting. Here are some examples of offset in accounting:

- Revenue and Expense Offset: Let’s say a company generates $10,000 in revenue from the sale of a product. In the same period, it incurs $6,000 in production costs and $2,000 in marketing expenses related to that product. To accurately reflect the profitability of the operation, the revenue of $10,000 would be offset against the expenses of $8,000 ($6,000 + $2,000), resulting in a net income of $2,000.

- Asset and Liability Offset: Suppose a company purchases a piece of machinery for $50,000 using a loan. At the time of purchase, both the machinery and the outstanding loan amount would be recorded separately in the company’s books. However, through offsetting, the value of the machinery and the liability associated with the loan would be balanced against each other, giving a clear picture of the net value of the asset after considering the related liability.

- Intercompany Offset: A parent company owns multiple subsidiaries. If one subsidiary sells goods to another subsidiary, an intercompany transaction occurs. To avoid double counting or duplication, offsetting is used to eliminate the revenue and expenses related to the intercompany transaction. This ensures that the consolidated financial statements of the parent company accurately reflect the overall financial position and performance.

- Derivative Offset: Let’s say a company enters into a futures contract to hedge against the fluctuations in the price of a commodity. If the contract results in a loss, offsetting can be applied to neutralize the loss against related positions or gains from other derivative contracts. This enables the company to accurately report the overall impact of derivative transactions and manage the risk associated with them.

- Foreign Currency Offset: When conducting international business, companies may have transactions in different currencies. If the exchange rates fluctuate, it can impact the financial statements. Foreign currency offsetting is used to match gains and losses from foreign currency transactions, ensuring that the financial statements reflect a true and fair view of the company’s financial position, regardless of any exchange rate fluctuations.

- Tax Offset: Tax offset refers to the practice of using eligible tax deductions or credits to offset a taxpayer’s tax liability. For example, if an individual is eligible for a tax credit of $1,000 and owes $2,000 in taxes, the tax offset can be applied to reduce the tax liability to $1,000.

These examples illustrate how offsetting is used in various accounting scenarios to balance transactions, accurately represent financial results, and ensure compliance with accounting principles and standards.

Importance of Offset in Accounting

Offsetting is a critical aspect of accounting that holds immense importance in maintaining accurate and transparent financial records. Here are some key reasons highlighting the significance of offset in accounting:

- Accurate Financial Reporting: Offset ensures that financial transactions are appropriately recorded and presented in an organization’s books. By matching debits and credits, offsetting helps prevent errors and provides a true and fair representation of the company’s financial position. This accuracy in financial reporting is crucial for making informed business decisions and meeting regulatory requirements.

- Consistency and Compliance: Offset is essential for complying with accounting principles and standards, such as GAAP and IFRS. These standards provide guidelines for financial reporting, and offsetting helps ensure that financial statements are prepared consistently and in accordance with these principles. Consistency in financial reporting allows for comparability across different organizations and industries, enabling stakeholders to make meaningful comparisons and assessments.

- Measuring Profitability: By offsetting revenues against related expenses, accountants can accurately measure the profitability of specific operations, products, or services. This information is vital for evaluating business performance, identifying areas of strength or weakness, and making informed decisions to improve profitability.

- Assessing Financial Position: Offset is crucial for presenting a reliable and accurate depiction of an organization’s financial position. By offsetting assets against corresponding liabilities, financial statements provide an understanding of the net value of the company’s resources after considering its obligations. This information helps stakeholders assess risk, evaluate solvency, and determine the ability to meet financial obligations.

- Risk Management: Offset plays a role in managing financial risk. For example, in derivative transactions, where gains or losses can be volatile, offsetting helps neutralize the impact of these transactions, reducing potential losses and ensuring accurate reporting. Proper risk management through offsetting helps protect businesses from unexpected financial shocks and enhances overall financial stability.

- Enhancing Decision-Making: Accurate financial reporting facilitated by offsetting provides decision-makers with reliable information for strategic planning, budgeting, and forecasting. By understanding the financial performance and position of the organization, management can make informed decisions regarding resource allocation, investment opportunities, and growth strategies.

Overall, the importance of offset in accounting lies in its ability to ensure accuracy, consistency, and transparency in financial reporting. It contributes to reliable financial information, regulatory compliance, effective risk management, and informed decision-making. Without offsetting, financial records may be incomplete, misleading, or prone to errors, leading to inaccurate assessments of an organization’s financial health and performance.

Challenges and Limitations of Offset in Accounting

While offsetting plays a crucial role in maintaining accurate financial records, there are certain challenges and limitations that need to be considered. Understanding these challenges is essential for accountants and financial professionals to ensure reliable financial reporting. Here are some common challenges and limitations of offset in accounting:

- Complexity: Offset can become complex, especially in large organizations with numerous transactions and accounts. Identifying and matching corresponding entries requires careful analysis and attention to detail. Complexity can increase the risk of errors or omissions, impacting the accuracy of financial records.

- Subjectivity: Determining which transactions should be offset against each other may involve a level of subjectivity. Accounting standards provide guidelines, but interpretation may vary. This subjectivity can create challenges in achieving consistency across different organizations or even within the same organization.

- Timing and Timing Differences: Timing differences can pose challenges when offsetting certain transactions. For example, revenue and expenses may occur at different times, leading to a timing difference between when they should be offset. This can impact the accuracy of financial reporting for specific periods and may require adjustments or estimates.

- Incomplete Offset: In some cases, complete offsetting may not be possible due to the nature of transactions or complexities within the accounting system. This can result in residual balances that cannot be fully offset, potentially affecting the accuracy of financial statements and requiring additional disclosures.

- Changes in Accounting Standards: As accounting standards evolve, the requirements for offsetting may change. Staying updated with these changes and ensuring compliance can be challenging for organizations, particularly if they operate in multiple jurisdictions with different accounting regulations.

- Legal and Regulatory Constraints: In some cases, legal or regulatory requirements may limit the offsetting of certain transactions. For example, tax laws may restrict the offset of certain tax credits or deductions. Compliance with these constraints adds complexity to the offsetting process.

- Misapplication: The misapplication of offsetting can lead to inaccurate financial reporting. If entries are incorrectly matched or offset, it can distort the true financial position and performance of an organization. Maintaining proper internal controls and ensuring trained and knowledgeable accounting professionals can help mitigate the risk of misapplication.

Despite these challenges and limitations, offsetting remains a significant practice in accounting. By acknowledging and addressing these challenges, accountants can ensure the accuracy and integrity of financial reporting, enabling stakeholders to make informed decisions and have confidence in the organization’s financial position.

Conclusion

Offsetting is a fundamental concept in accounting that plays a crucial role in maintaining accurate and transparent financial records. By matching debits and credits, offsetting helps ensure accuracy, consistency, and compliance in financial reporting. Throughout this article, we have explored various aspects of offset in accounting, including its definition, purpose, types, examples, and challenges.

The primary purpose of offsetting is to provide an accurate representation of a company’s financial position and performance. It allows for the measurement of profitability, assessment of financial health, and effective risk management. Offset assists decision-makers in strategic planning, budgeting, and forecasting, ensuring informed decision-making.

Examples of offset include the matching of revenues and expenses, assets and liabilities, intercompany transactions, derivatives, foreign currency transactions, and tax credits. Each type of offset serves a unique purpose, contributing to accurate financial reporting and compliance with accounting standards.

However, offsetting does present challenges and limitations. Complexity, subjectivity, timing differences, incomplete offset, changes in accounting standards, legal constraints, and the potential for misapplication are factors that need to be addressed to ensure the reliability of offsetting practices.

In conclusion, offsetting is a powerful tool in the accounting profession, enabling businesses to accurately present their financial position and performance. By overcoming challenges and applying offsetting techniques effectively, organizations can maintain transparency, make informed decisions, and build trust with stakeholders.