Finance

What Is Pivot Health Insurance?

Published: October 30, 2023

Learn about Pivot Health Insurance and how it can provide financial security for your healthcare needs. Compare plans and find the right coverage for you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to protecting yourself and your family’s health, having the right insurance coverage is essential. In today’s ever-changing healthcare landscape, finding a plan that meets your needs and budget can be a daunting task. Luckily, there are insurance providers like Pivot Health that offer flexible and affordable options for individuals and families.

Pivot Health Insurance is a trusted name in the insurance industry, providing comprehensive coverage across various health insurance plans. Whether you’re between jobs, self-employed, or simply looking for an alternative to traditional health insurance, Pivot Health offers a range of options to suit different needs.

This article will provide an overview of Pivot Health Insurance, including its benefits and coverage options, how it works, eligibility and enrollment process, as well as the cost of coverage. We will also discuss the pros and cons of choosing Pivot Health Insurance, so you can make an informed decision about your healthcare coverage.

Whether you’re looking for short-term insurance during a transitional period in your life or seeking an affordable alternative to traditional health insurance, Pivot Health Insurance has solutions that can help you protect your health and finances.

Overview of Pivot Health Insurance

Pivot Health Insurance offers a range of flexible and affordable health insurance options for individuals and families. They understand that everyone’s healthcare needs are unique, which is why they provide a variety of plans to choose from.

One of the key advantages of Pivot Health Insurance is their commitment to offering coverage that fits your specific circumstances. Whether you need short-term coverage for a few months or a more comprehensive plan, Pivot Health has options that can be tailored to your needs.

With Pivot Health Insurance, you have access to a wide network of healthcare providers, ensuring you receive quality care wherever you are. Their plans cover a range of services, including doctor visits, prescription medications, hospital stays, and preventive care.

Additionally, Pivot Health understands the importance of convenience in managing your health insurance. They provide user-friendly online portals and mobile apps that allow you to review your coverage, find in-network providers, and manage your claims with ease.

Whether you’re an individual looking for coverage or a family in need of comprehensive healthcare, Pivot Health Insurance can provide you with options that suit your specific needs and budget. They prioritize customer satisfaction and strive to deliver reliable coverage and excellent customer service.

It’s important to note that Pivot Health Insurance is not the same as traditional major medical health insurance. While Pivot Health does offer comprehensive plans, they also specialize in short-term coverage that can bridge the gap between jobs, provide temporary coverage during life transitions, or offer an alternative to expensive long-term plans.

If you’re looking for a flexible and affordable health insurance solution that balances cost and coverage, Pivot Health Insurance may be an excellent option for you and your family. The next section will delve into the benefits and coverage options offered by Pivot Health.

Benefits and Coverage Options

Pivot Health Insurance offers a range of benefits and coverage options to ensure that individuals and families can find a plan that suits their healthcare needs. Here are some of the key benefits and coverage options provided by Pivot Health:

- Flexible Coverage: Pivot Health Insurance understands that your healthcare needs may change over time. That’s why they offer flexible coverage options that can be tailored to your specific circumstances. Whether you need coverage for a few months or longer, Pivot Health has plans that can accommodate your needs.

- Wide Network of Providers: Pivot Health Insurance works with a network of healthcare providers, ensuring that you have access to quality care wherever you are. Their extensive network includes doctors, hospitals, clinics, and specialists, providing you with a wide range of options for your healthcare needs.

- Comprehensive Coverage: Pivot Health Insurance plans cover a variety of healthcare services, including doctor visits, prescription medications, hospital stays, emergency care, and preventive care. They understand the importance of comprehensive coverage to protect your health and finances.

- Prescription Drug Coverage: Many Pivot Health Insurance plans include prescription drug coverage, helping you save on the cost of medications prescribed by your healthcare provider. This ensures that you can access the medications you need to manage your health conditions.

- Telemedicine Services: Pivot Health understands the convenience and efficiency of telemedicine. Many of their plans include telemedicine services, allowing you to consult with healthcare professionals remotely via phone or video call. This can be particularly useful for minor health issues or accessing medical advice while traveling.

- Value for Money: Pivot Health Insurance aims to provide value for your money by offering affordable coverage options. They understand the importance of balancing cost and coverage, ensuring that their plans are competitively priced.

It’s important to review the specific benefits and coverage options of each plan offered by Pivot Health to ensure they meet your individual needs. By exploring their plans, you can select the one that provides the right balance of coverage and affordability for you and your family.

The next section will explain how Pivot Health Insurance works and how you can enroll in their plans.

How Pivot Health Insurance Works

Pivot Health Insurance offers a straightforward and user-friendly process for obtaining and managing your health insurance coverage. Here’s how it works:

- Plan Selection: Start by exploring the various coverage options provided by Pivot Health. Consider your healthcare needs, budget, and the duration of coverage you require. Pivot Health offers both short-term and long-term plans, so you can choose the option that suits your circumstances.

- Quote & Enrollment: Once you’ve selected a plan, you can request a quote from Pivot Health Insurance. The quote will outline the costs and coverage details specific to the plan you’ve chosen. If you’re satisfied with the quote, you can proceed with the enrollment process.

- Application: When enrolling in Pivot Health Insurance, you will need to provide some personal and medical information, such as your age, address, and any pre-existing medical conditions. This information will help Pivot Health determine your eligibility and provide accurate coverage details.

- Approval & Effective Date: Once your application is processed and approved, you will receive confirmation of your coverage. The effective date of your policy will depend on the plan you’ve chosen, and coverage typically begins shortly after enrollment.

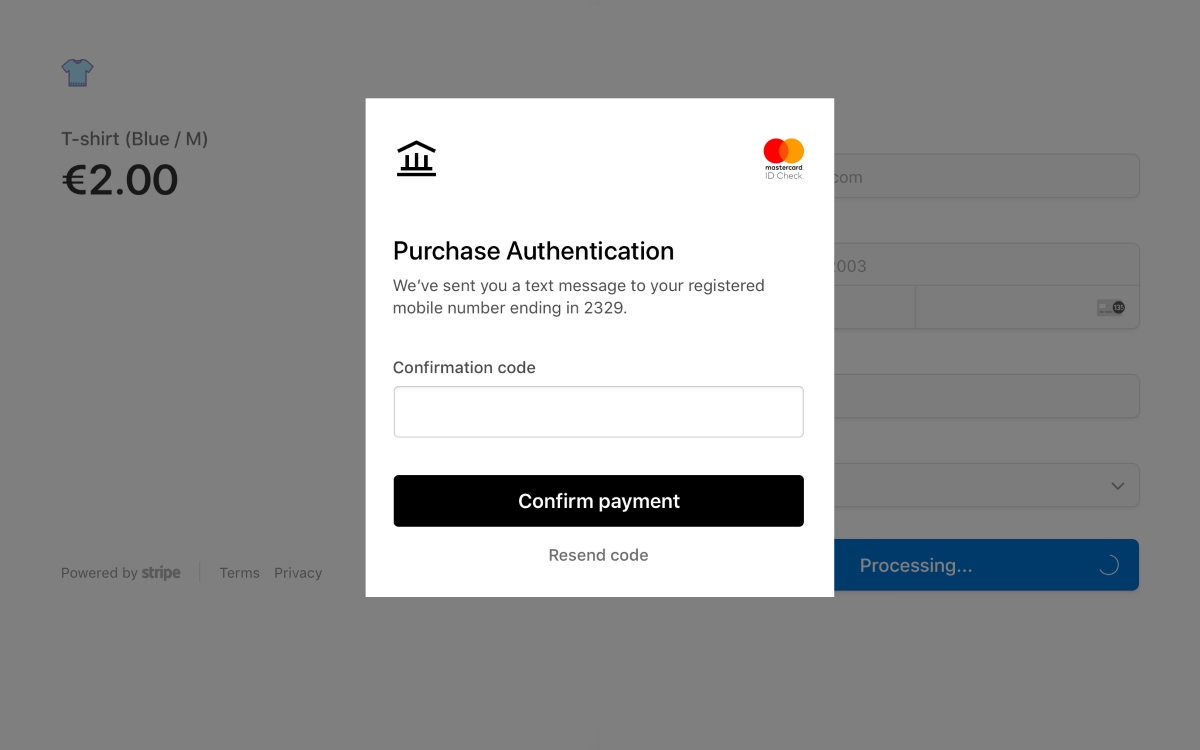

- Payment & Premiums: To maintain your coverage, you will need to make regular premium payments to Pivot Health Insurance. The specific payment schedule will be outlined in your policy documents. Pivot Health offers various payment options, including online payments and automatic bank withdrawals, for your convenience.

- Accessing Healthcare: With your Pivot Health Insurance coverage in place, you can start accessing healthcare services. Depending on the plan you’ve chosen, you may have to meet certain deductibles or copayments before full coverage kicks in. It’s important to review the details of your plan to understand the cost-sharing requirements and benefits.

- Managing Your Coverage: Pivot Health Insurance provides user-friendly online portals and mobile apps that allow you to manage your coverage easily. You can review your policy details, find in-network providers, file claims, and track your healthcare expenses with just a few clicks.

It’s essential to familiarize yourself with the specific terms and conditions of your chosen Pivot Health Insurance plan to ensure that you fully understand how it works and what is covered. By familiarizing yourself with the process, you can make the most of your coverage and effectively manage your healthcare needs.

The next section will outline the eligibility requirements and enrollment process for Pivot Health Insurance.

Eligibility and Enrollment Process

Eligibility criteria and the enrollment process for Pivot Health Insurance may vary depending on the specific plan and your location. Here is a general overview of the eligibility requirements and enrollment process:

Eligibility:

Pivot Health Insurance offers coverage to a wide range of individuals, including those who are between jobs, self-employed, early retirees, temporary or seasonal workers, and students. They also cater to individuals and families who are seeking an alternative to traditional health insurance or need coverage during transitional periods.

While Pivot Health Insurance aims to provide coverage to as many individuals as possible, there may be certain eligibility criteria to meet, such as age and residency requirements. It’s best to review the specific eligibility criteria for the plan you’re interested in to ensure you meet the requirements.

Enrollment Process:

Enrolling in Pivot Health Insurance is a simple and straightforward process. Here are the general steps to follow:

- Research and Plan Selection: Explore the different coverage options provided by Pivot Health and select the plan that best suits your needs and budget. Consider factors such as coverage duration, benefits, and cost.

- Quote Request: Request a quote from Pivot Health Insurance for the chosen plan. The quote will provide you with the specific details of coverage and associated costs.

- Application: Fill out the necessary application forms provided by Pivot Health Insurance. You will need to provide personal information, such as your name, address, date of birth, and any relevant medical history.

- Review and Approval: After submitting your application, Pivot Health will review your information and determine your eligibility for coverage. Once your application is approved, you will receive confirmation of coverage.

- Payment: To activate your coverage, you will need to make the required premium payments as outlined in your policy documents. Pivot Health offers various payment options, such as online payments and automatic bank withdrawals, to ensure convenience.

- Effective Date: Your coverage will become effective as of the start date specified in your policy. It’s important to note that coverage typically begins shortly after enrollment, but the exact effective date may vary depending on the plan you’ve chosen.

It’s important to carefully review the terms and conditions of your chosen Pivot Health Insurance plan before enrolling to ensure that you understand the coverage details, limitations, and any additional requirements.

The next section will discuss the cost aspects of Pivot Health Insurance.

Cost of Pivot Health Insurance

The cost of Pivot Health Insurance will vary depending on several factors, including the specific plan you choose, your age, location, and any additional coverage options you select. It’s important to consider these factors when determining the cost of your coverage.

Pivot Health Insurance aims to provide affordable options for individuals and families, offering plans that balance cost and coverage. They understand the importance of finding a plan that fits within your budget while still providing the necessary healthcare coverage.

When evaluating the cost of Pivot Health Insurance, it’s essential to consider the following aspects:

- Premiums: Premiums are the regular payments you make to maintain your coverage. The amount of your premiums will depend on the specific plan you choose, as well as your age and location. Pivot Health offers various payment options, and the premium amounts will be outlined in your policy documents.

- Deductibles and Copayments: Some Pivot Health Insurance plans may include deductibles and copayments. A deductible is a set amount you must pay before your coverage kicks in, while a copayment is a fixed fee you pay for specific healthcare services. It’s important to understand these cost-sharing requirements as they can affect your out-of-pocket expenses.

- Add-On Options: Pivot Health Insurance may offer additional coverage options that you can add to your plan for an extra cost. These options might include dental coverage, vision coverage, or a prescription drug benefit. The cost of these add-ons will vary depending on the specific coverage and the plan you choose.

- Out-of-Pocket Maximum: Pivot Health Insurance plans typically have an out-of-pocket maximum, which is the maximum amount you will be required to pay in a policy period. Once you reach this maximum, the insurance company will cover 100% of eligible expenses. It’s important to understand this limit and factor it into your cost considerations.

- Provider Network: While Pivot Health Insurance works with a wide network of healthcare providers, it’s essential to check if your preferred doctors and hospitals are in-network. Out-of-network care may result in higher costs, so it’s important to understand the network coverage and associated cost implications.

To get a precise understanding of the cost of Pivot Health Insurance, it is recommended to request a quote. The quote will provide you with specific details regarding premiums, deductibles, copayments, and any additional coverage options you may be interested in.

By carefully reviewing the cost aspects of Pivot Health Insurance and comparing it with your budget and healthcare needs, you can make an informed decision about the coverage that best fits your financial situation.

The next section will outline the pros and cons of choosing Pivot Health Insurance.

Pros and Cons of Pivot Health Insurance

Choosing the right health insurance provider is a crucial decision that requires careful consideration of the pros and cons. Here are the key advantages and disadvantages of selecting Pivot Health Insurance:

Pros:

- Flexibility: Pivot Health Insurance offers flexible coverage options that can be tailored to your specific healthcare needs. Whether you require short-term coverage during a transitional period or a long-term plan, Pivot Health has options to accommodate different circumstances.

- Wide Network: Pivot Health Insurance works with a vast network of healthcare providers, ensuring that you have access to quality care wherever you are. This network includes doctors, hospitals, clinics, and specialists, offering you a range of options for your healthcare needs.

- Affordable Coverage: Pivot Health Insurance aims to provide affordable coverage options that balance cost and coverage. They understand the importance of finding a plan that fits within your budget while still offering the necessary healthcare benefits.

- Comprehensive Benefits: Pivot Health Insurance plans offer comprehensive coverage for a variety of healthcare services, including doctor visits, prescription medications, hospital stays, emergency care, and preventive care. This ensures that you have access to the necessary medical treatments and services to protect your health.

- Convenient Access to Care: Pivot Health understands the importance of convenience in managing your healthcare. They provide user-friendly online portals and mobile apps that allow you to review your coverage, find in-network providers, manage your claims, and track your healthcare expenses easily.

Cons:

- Limited Coverage Options: While Pivot Health Insurance offers a range of coverage options, it’s important to note that they specialize in short-term and alternative health insurance plans. If you’re looking for traditional long-term major medical coverage, you may need to explore other options.

- Out-of-Network Costs: While Pivot Health has a wide network of providers, it’s crucial to ensure your preferred doctors and hospitals are in-network to avoid higher out-of-pocket costs. If you need to seek care out-of-network, it may result in additional expenses.

- Policy Limitations: Like any insurance provider, Pivot Health Insurance has policy limitations. It’s important to review the terms and conditions of your plan to understand any limitations or exclusions that may impact your coverage.

- Short-Term Coverage Duration: While Pivot Health offers plans that can extend coverage for a few months, it’s important to note that short-term coverage may not provide the same level of benefits and long-term security as traditional major medical insurance.

Considering the advantages and disadvantages listed above is key to making an informed decision about whether Pivot Health Insurance is the right choice for your healthcare needs and financial situation.

The next section will address some frequently asked questions about Pivot Health Insurance.

Frequently Asked Questions

Here are some frequently asked questions about Pivot Health Insurance:

- What is Pivot Health Insurance?

- Who is eligible for Pivot Health Insurance?

- What types of coverage options are offered by Pivot Health Insurance?

- How do I enroll in Pivot Health Insurance?

- Is Pivot Health Insurance available nationwide?

- Can I cancel my Pivot Health Insurance coverage?

- Can I see any healthcare provider with Pivot Health Insurance?

Pivot Health Insurance is a provider of flexible and affordable health insurance plans for individuals and families. They offer both short-term and long-term coverage options to accommodate various healthcare needs.

Pivot Health Insurance is available to a wide range of individuals, including those who are between jobs, self-employed, early retirees, temporary workers, students, and individuals seeking an alternative to traditional health insurance.

Pivot Health Insurance offers a range of coverage options, including short-term health insurance, fixed benefit indemnity plans, dental and vision coverage, prescription drug coverage, and accident and critical illness coverage.

To enroll in Pivot Health Insurance, you can start by requesting a quote for the plan you’re interested in. Once you’ve reviewed the quote and are satisfied, you can complete the application process, providing the necessary personal and medical information. After approval, you will need to make the required premium payments to activate your coverage.

Yes, Pivot Health Insurance is available in multiple states across the United States. However, coverage options may vary by state, so it’s important to check the availability and specific plans offered in your location.

Yes, you can typically cancel your Pivot Health Insurance coverage. However, the cancellation process and any associated fees or refund policies may vary depending on the specific plan you’ve chosen. It’s essential to review the terms and conditions of your policy or contact Pivot Health directly for information on canceling coverage.

Pivot Health Insurance works with a network of healthcare providers. It’s crucial to check if your preferred doctors and hospitals are in-network to ensure the highest level of coverage. Going out-of-network may result in additional out-of-pocket costs.

If you have specific questions regarding your eligibility, coverage, or any other concerns, it’s recommended to contact Pivot Health Insurance directly. They will be able to provide you with the most accurate and up-to-date information regarding your inquiry.

The next section will conclude the article.

Conclusion

Pivot Health Insurance offers a range of flexible and affordable health insurance options for individuals and families. With their comprehensive coverage, wide network of providers, and user-friendly online portals, Pivot Health strives to provide accessible and convenient healthcare solutions to meet the diverse needs of their policyholders.

While Pivot Health Insurance specializes in short-term and alternative health insurance plans, they also offer long-term coverage options. It’s important to review the specifics of each plan and consider factors such as premiums, deductibles, copayments, and any additional coverage options to determine the best fit for your healthcare needs and budget.

Pros of choosing Pivot Health Insurance include the flexibility of coverage options, a wide network of providers, affordability, comprehensive benefits, and convenient access to care. However, it’s important to consider some potential limitations, such as out-of-network costs and policy restrictions.

By understanding the eligibility requirements, enrollment process, and cost considerations of Pivot Health Insurance, you can make an informed decision about selecting the right coverage for you and your family’s healthcare needs.

Remember, it’s crucial to review the specific terms and conditions of your chosen policy to gain a comprehensive understanding of the coverage, limitations, and any additional requirements that may apply.

Ultimately, Pivot Health Insurance can be a valuable option for individuals and families seeking flexible and affordable healthcare coverage that suits their unique circumstances. Consider your healthcare needs, budget, and preferences, and take the time to explore the options provided by Pivot Health to make the best choice for your health and financial well-being.