Finance

Where To Mail IRS Extension Form 4868

Published: November 1, 2023

Need more time to file your taxes? Learn where to mail the IRS extension form 4868. Simplify your finance process and ensure timely tax filing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

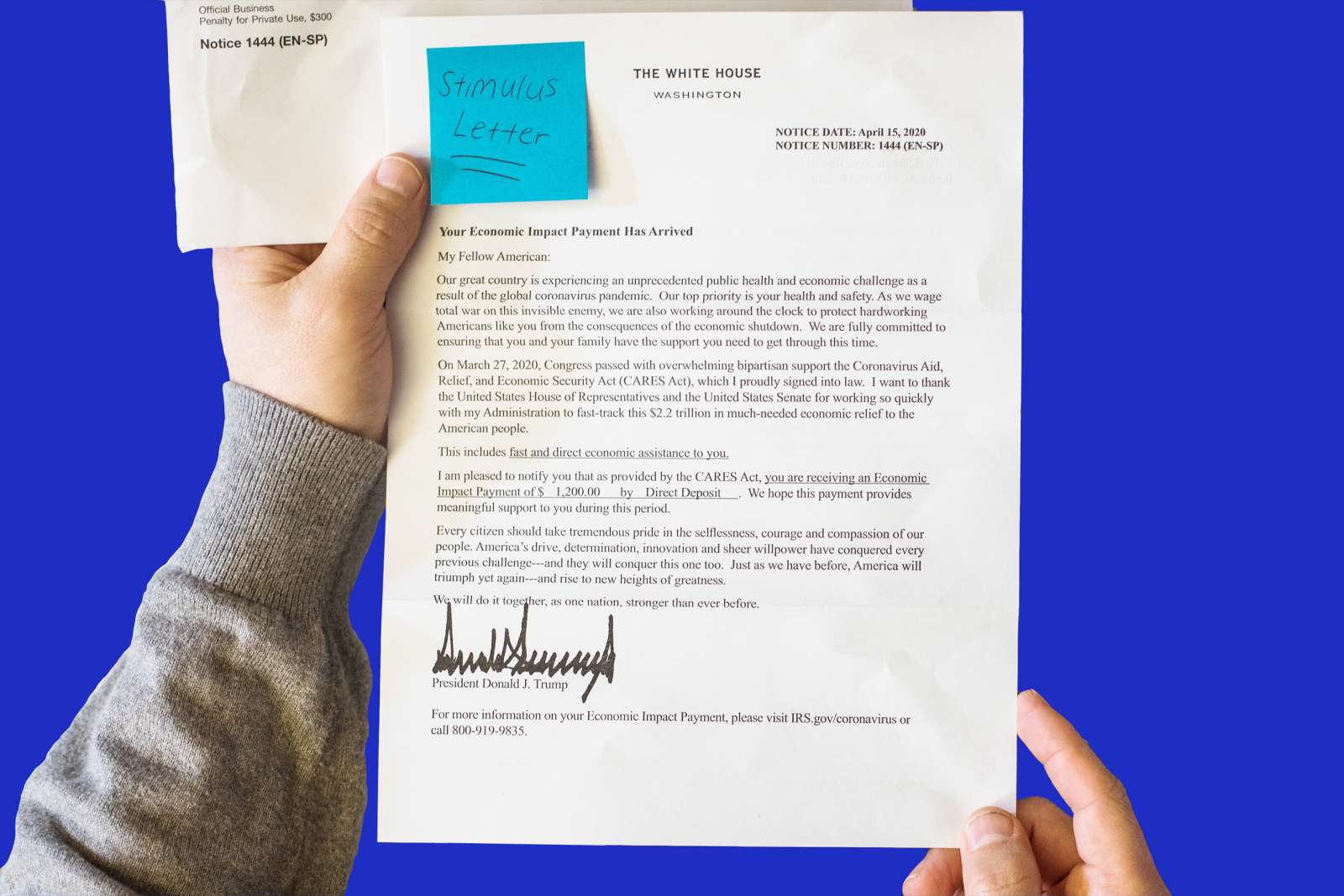

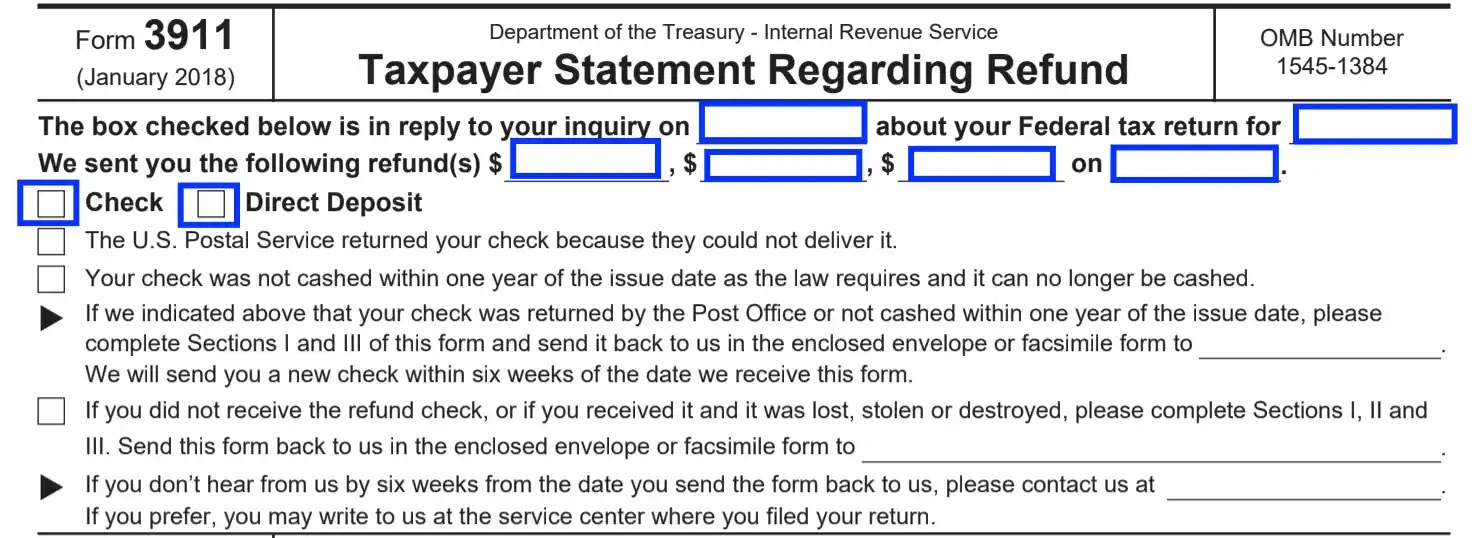

When it comes to filing your taxes, sometimes you may need more time to gather all the necessary documents and information. The IRS understands this, which is why they allow taxpayers to request an extension to file their taxes. One common form used to request an extension is Form 4868.

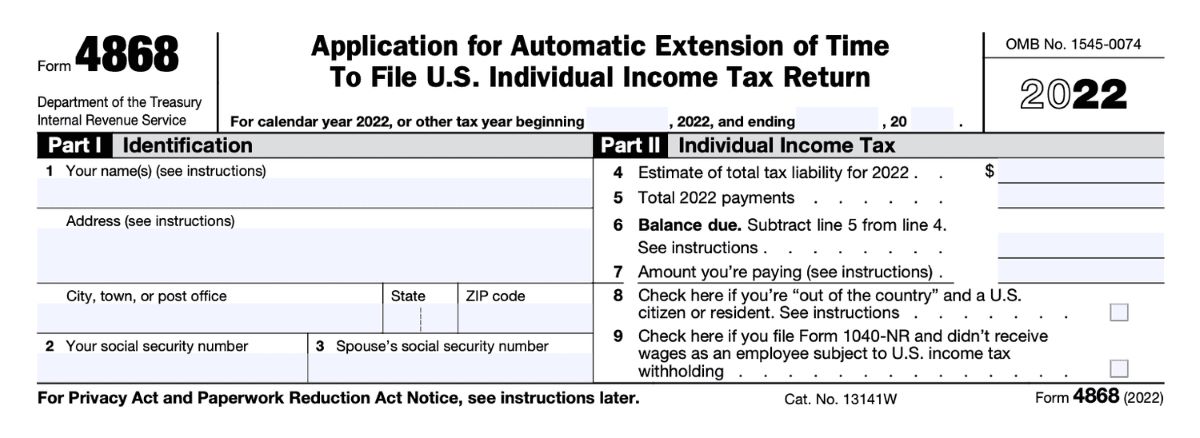

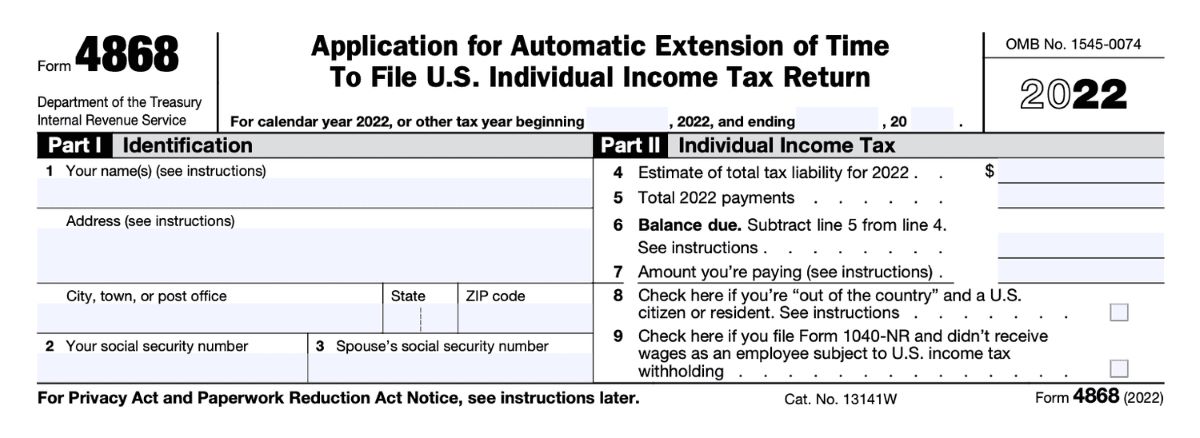

Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, provides an additional six months for individuals to file their tax returns. This means that instead of the traditional April 15th deadline, you’ll have until October 15th to submit your return.

Whether it’s because you’re waiting for important tax forms, need additional time to organize your records, or simply haven’t had the chance to complete your return, filing Form 4868 can give you the breathing room you need to ensure accurate and timely tax filing.

While the process of filing for an extension may seem daunting, it’s actually quite simple. In this article, we will guide you through the steps of filing Form 4868 and provide you with the mailing addresses where you can send your completed form.

It’s important to note that while Form 4868 grants an extension for filing your tax return, it does not grant an extension for paying any taxes owed. If you anticipate owing taxes, it’s recommended to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

Now that we have a general understanding of Form 4868 and its purpose, let’s delve deeper into why filing for an extension can be beneficial.

Understanding Form 4868

Form 4868 is a tax form used by individual taxpayers to request an extension of time to file their federal income tax return. By filing this form, you are asking the IRS to grant you an additional six months to submit your tax return, changing the original deadline from April 15th to October 15th.

It’s important to note that filing Form 4868 does not extend the deadline for paying any taxes owed. Any taxes that you owe must still be paid by the original deadline to avoid penalties and interest charges. However, if you need more time to gather the necessary documentation, reconcile your financial records, or consult with a tax professional, Form 4868 can provide you with the extra time you need.

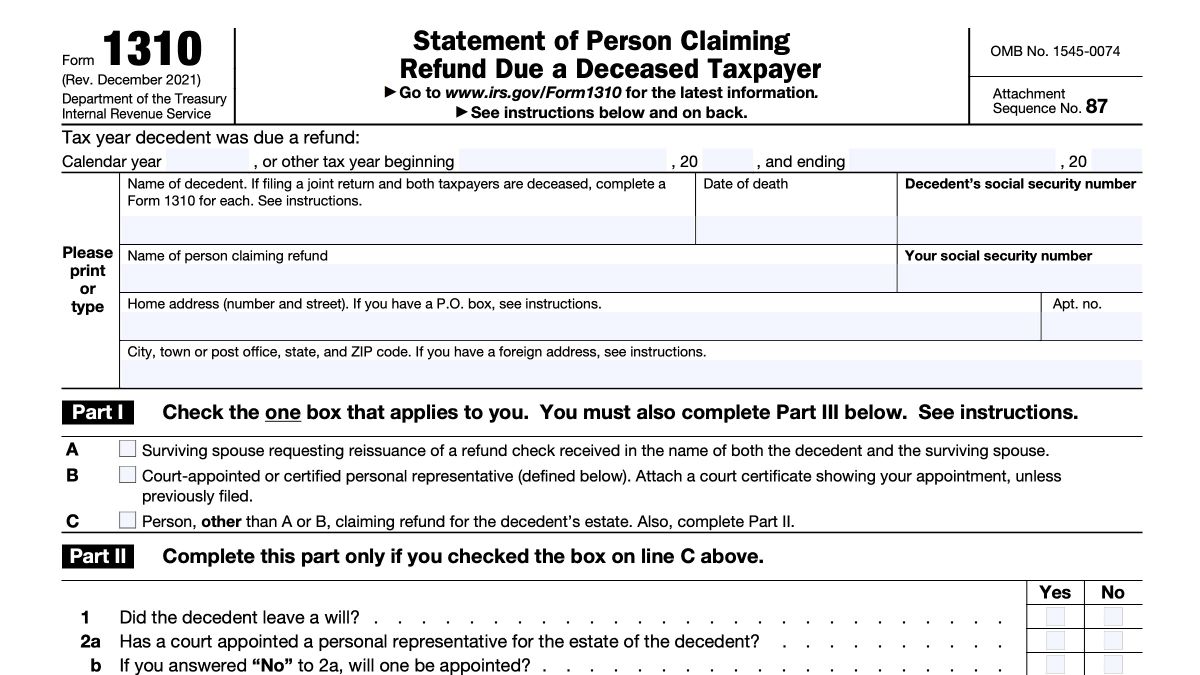

Form 4868 is relatively straightforward and can be completed by individuals who meet the requirements. The form will ask for basic personal information, such as your name, address, and Social Security number. You’ll also need to estimate your total tax liability for the year and any payments you’ve already made. It’s important to make an accurate estimate to avoid penalties for underpayment of taxes.

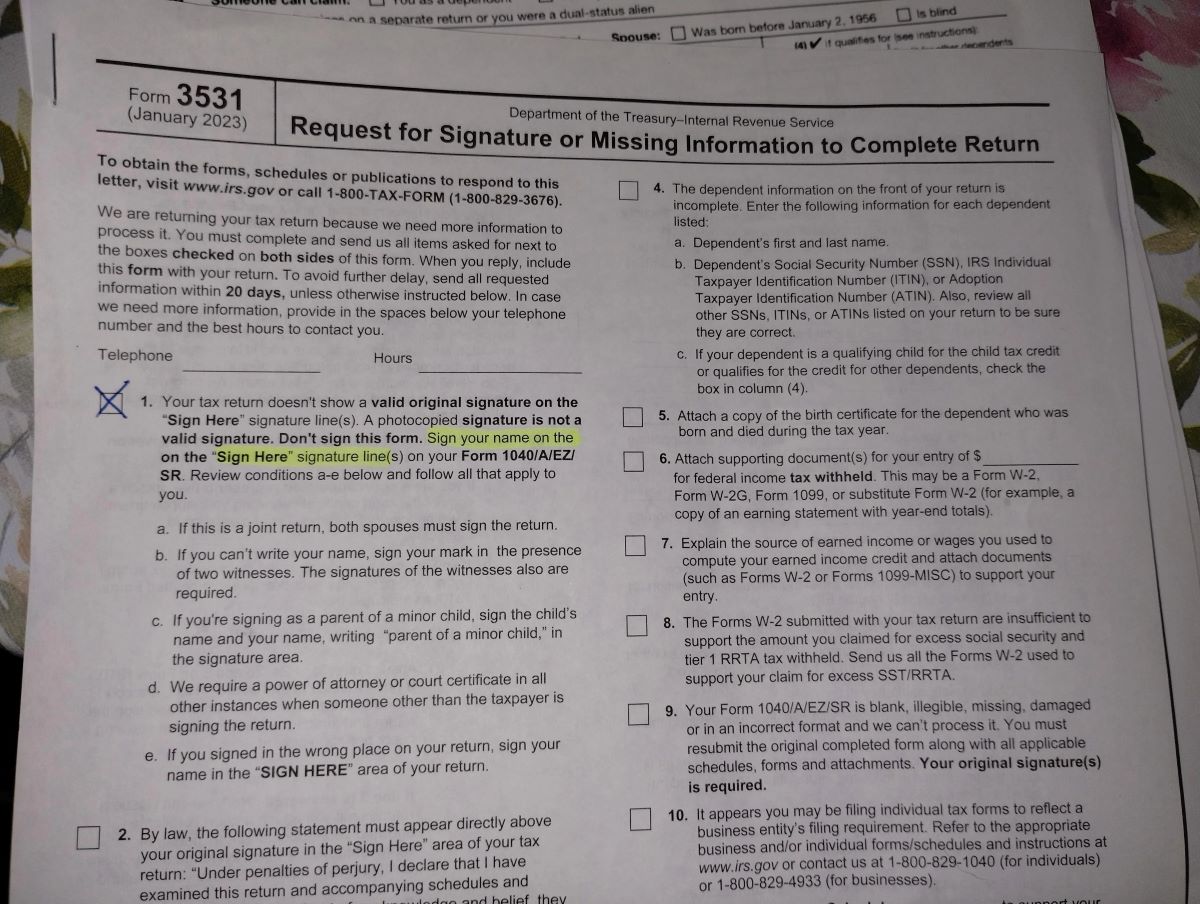

Once you’ve completed Form 4868, you have several options for filing it. You can file electronically through e-file options, which offer convenience and faster processing. Alternatively, you can complete a paper form and mail it to the designated mailing address. In the next sections, we will provide you with the specific mailing addresses for both the Internal Revenue Service (IRS) and private delivery services.

It’s important to note that filing Form 4868 does not automatically grant you an extension. The IRS will review your request and determine whether to approve it. If your request is approved, you will receive a confirmation notice. However, if your request is denied, you will be required to file your tax return by the original deadline, including any taxes due.

Now that we have a clear understanding of Form 4868 and its purpose, let’s explore some of the reasons why filing for an extension can be beneficial.

Why File for an Extension?

There are several reasons why individuals may choose to file for an extension using Form 4868. Let’s explore some of the common scenarios where requesting an extension can be advantageous:

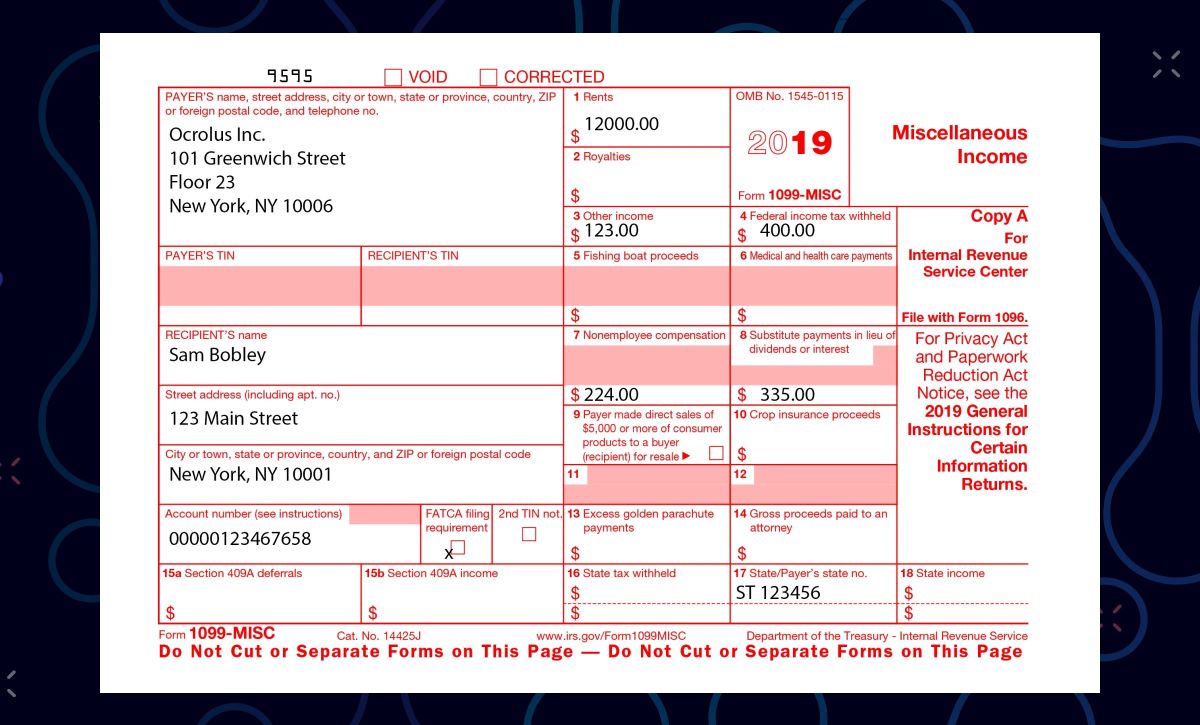

- Gathering necessary documents: Sometimes, taxpayers may be waiting to receive important tax forms such as W-2s or 1099s. Filing for an extension can provide additional time to gather all the required documentation to accurately complete your tax return.

- Organization and accuracy: Filing an extension can give you the opportunity to take your time to organize your financial records and ensure that your tax return is complete and accurate. Rushing through your taxes may lead to errors or missed deductions.

- Tax law changes: Tax laws can be complex and subject to changes from year to year. If you anticipate significant changes or have questions about recent tax law amendments, filing for an extension can allow you to consult with a tax professional and gain clarity before submitting your return.

- Financial hardship: In some cases, individuals may be experiencing financial hardships that make it challenging to complete their tax returns by the original deadline. Requesting an extension can provide some relief and extra time to navigate through any financial difficulties.

- Minimizing mistakes: Filing in a rush can increase the chances of making mistakes on your tax return. Taking advantage of the extension can allow you to carefully review your information and ensure that you’ve accurately reported all income, deductions, and credits.

By filing for an extension, you can alleviate some of the stress associated with tax filing and ensure that you have ample time to complete your tax return correctly. However, it’s important to note that while requesting an extension grants you additional time to file your return, it does not extend the deadline for paying any taxes owed. Any outstanding tax liability must still be paid by the original due date to avoid penalties and interest charges.

Now that we understand the reasons why filing for an extension can be beneficial, let’s move on to the steps involved in filing Form 4868.

Steps to File Form 4868

Filing Form 4868 is a straightforward process that can be completed by individuals who need additional time to file their federal income tax return. Below are the steps involved in filing Form 4868:

- Gather your information: Before you begin, gather all the necessary information such as your name, address, Social Security number, and an estimate of your total tax liability for the year.

- Choose your filing method: You have two options for filing Form 4868. You can either file electronically using IRS e-file options or complete a paper form to mail to the appropriate address. Electronic filing is recommended for faster processing and convenience.

- Provide accurate information: Whether you choose to file electronically or by mail, ensure that you provide accurate and complete information on the form. Double-check your Social Security number, address, and tax liability estimate to avoid any delays or errors in processing your extension request.

- E-file options: If you choose to file electronically, you can use IRS Free File, a commercial tax software, or a certified e-file provider. Follow the instructions provided by the chosen method to accurately complete and submit Form 4868 online.

- Mail-in option: If you prefer to complete a paper form, you can download Form 4868 from the IRS website. Fill out the form using black ink and ensure that all fields are completed. Sign and date the form before mailing it to the appropriate address.

- File by the deadline: It’s important to file Form 4868 by the original tax filing deadline, which is typically April 15th. However, if April 15th falls on a weekend or holiday, the deadline shifts to the next business day.

- Keep a copy for your records: Once you have completed and filed Form 4868, make sure to keep a copy for your records. This will serve as proof that you’ve requested an extension and can be helpful if any questions or issues arise later.

By following these steps and ensuring the accuracy of your information, you can successfully file Form 4868 and request an extension to submit your federal income tax return. Keep in mind that filing for an extension does not extend the deadline for paying any taxes owed. If you anticipate owing taxes, it’s important to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

Next, we will provide you with the mailing addresses where you can send your completed Form 4868.

Mailing Addresses for Form 4868

If you have chosen to file Form 4868 by mail rather than electronically, it’s important to send your completed form to the appropriate mailing address. The address you should use depends on whether you are sending your form to the Internal Revenue Service (IRS) or using a private delivery service. Let’s explore both options:

Internal Revenue Service (IRS) Mailing Addresses:

- If you are making a payment with your Form 4868, use the payment voucher included in the form and mail the payment and the completed form to the address provided in the instructions on the form.

- If you are not making a payment, mail your completed Form 4868 to the appropriate IRS mailing address based on your state:

- Residents of Alabama, Georgia, Kentucky, Louisiana, Mississippi, Tennessee, Texas, a foreign address, or a U.S. possession: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0045

- Residents of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, or Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0045

- Residents of Arkansas, Connecticut, Delaware, District of Columbia, Florida, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, Virginia, or West Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0045

- Residents of APO, FPO, or DPO addresses: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215

Private Delivery Service Mailing Addresses:

If you are using a private delivery service to send your Form 4868, use one of the following addresses:

- Internal Revenue Service, 201 W. Rivercenter Blvd., Covington, KY 41011 (for residents of Alabama, Georgia, Kentucky, Missouri, New Jersey, North Carolina, South Carolina, Tennessee, Virginia, or West Virginia)

- Internal Revenue Service, 2970 Market St., Philadelphia, PA 19104 (for residents of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Michigan, Minnesota, Montana, Nevada, New Mexico, Ohio, Oregon, Utah, Washington, Wisconsin, or Wyoming)

- Internal Revenue Service, 333 W. Pershing Rd., Kansas City, MO 64108 (for residents of Arkansas, Connecticut, Delaware, District of Columbia, Iowa, Kansas, Maine, Maryland, Massachusetts, Missouri, Nebraska, New Hampshire, New York, Oklahoma, Pennsylvania, Rhode Island, Texas, Vermont)

It’s crucial to double-check the mailing address based on your state or use of a private delivery service to ensure your Form 4868 reaches the correct IRS office. Failing to use the correct address may result in processing delays or lost documents.

Now that you know where to send your completed Form 4868, let’s go over some helpful tips for mailing it successfully.

Internal Revenue Service (IRS) Mailing Addresses

When filing Form 4868, it’s essential to send your completed form to the appropriate Internal Revenue Service (IRS) mailing address. The address you should use may vary depending on your state or whether you are making a payment with your form. Let’s explore the different IRS mailing addresses for Form 4868:

If you are making a payment with your Form 4868, use the payment voucher included in the form. The payment and the completed form should be sent to the address provided in the instructions on the form.

If you are not making a payment, follow the guidelines below to determine the correct IRS mailing address based on your state:

- Residents of Alabama, Georgia, Kentucky, Louisiana, Mississippi, Tennessee, Texas, a foreign address, or a U.S. possession: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0045

- Residents of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, or Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0045

- Residents of Arkansas, Connecticut, Delaware, District of Columbia, Florida, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, Virginia, or West Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0045

- Residents of APO, FPO, or DPO addresses: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215

Make sure to use the correct mailing address based on your state. Using the wrong address may result in processing delays or lost documents, which can lead to complications or penalties.

Filing for an extension using Form 4868 can provide you with the additional time you need to file your federal income tax return. However, it’s important to note that the extension only applies to filing your return, not paying any taxes owed. If you anticipate owing taxes, it’s recommended to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

Now that you know the proper IRS mailing addresses for Form 4868, let’s move on to the mailing addresses for individuals using private delivery services.

Private Delivery Service Mailing Addresses

If you are using a private delivery service to send your completed Form 4868, it’s important to use the appropriate mailing address designated by the Internal Revenue Service (IRS). Below are the mailing addresses for Form 4868 when using a private delivery service:

- Residents of Alabama, Georgia, Kentucky, Missouri, New Jersey, North Carolina, South Carolina, Tennessee, Virginia, or West Virginia:

- Residents of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Michigan, Minnesota, Montana, Nevada, New Mexico, Ohio, Oregon, Utah, Washington, Wisconsin, or Wyoming:

- Residents of Arkansas, Connecticut, Delaware, District of Columbia, Iowa, Kansas, Maine, Maryland, Massachusetts, Missouri, Nebraska, New Hampshire, New York, Oklahoma, Pennsylvania, Rhode Island, Texas, or Vermont:

Internal Revenue Service

201 W. Rivercenter Blvd.

Covington, KY 41011

Internal Revenue Service

2970 Market St.

Philadelphia, PA 19104

Internal Revenue Service

333 W. Pershing Rd.

Kansas City, MO 64108

When using a private delivery service, it’s crucial to ensure that the address is accurately entered, and the service provider is able to deliver to the specified IRS office. Failing to use the correct mailing address may result in processing delays or lost documents, which can lead to complications or penalties.

Remember, filing Form 4868 grants you an extension to file your federal income tax return, but it does not extend the deadline for paying any taxes owed. It’s essential to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

Now that you know the mailing addresses for both the IRS and private delivery services, let’s go over some helpful tips for mailing Form 4868 successfully.

Tips for Mailing Form 4868

When mailing your completed Form 4868, it’s important to take certain precautions to ensure that it reaches the designated recipient without any issues or delays. Here are some helpful tips for mailing Form 4868:

- Use the correct mailing address: Double-check the mailing address provided by the Internal Revenue Service (IRS) or the private delivery service. Use the appropriate address based on your state or the delivery service you are using to ensure that your form reaches the correct IRS office.

- Ensure accurate and complete information: Fill out all the required fields on Form 4868 accurately to avoid any processing delays or errors. Double-check your name, address, Social Security number, and estimated tax liability to ensure everything is entered correctly.

- Consider certified mail or tracking: If you are sending your form by regular mail, consider using certified mail or a tracking service to have proof of delivery. This can provide peace of mind and help you track the progress of your mail.

- Keep a copy for your records: Before sending your completed form, make a copy for your records. This copy serves as proof that you have filed for an extension and can be useful for reference later if needed.

- Send the form on time: Be sure to send Form 4868 by the original tax filing deadline, typically April 15th. If the deadline falls on a weekend or holiday, the due date may be shifted to the next business day. Sending the form on time can help you avoid late filing penalties.

- Consider electronic filing: Electronic filing offers convenience, faster processing, and a reduced chance of errors compared to mailing paper forms. If possible, consider filing Form 4868 electronically using IRS e-file options.

- Maintain proof of mailing: If you choose to mail your form, keep a record of the date you mailed it. This can be useful in case there are any issues or discrepancies regarding the receipt of your form.

By following these tips, you can ensure that your completed Form 4868 is mailed accurately and reaches the IRS on time. Remember, filing for an extension using Form 4868 grants you additional time to submit your tax return, but it does not extend the deadline for paying any taxes owed. Be sure to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

Now that you have an understanding of the process and tips for mailing Form 4868, let’s conclude this article.

Conclusion

Filing for a tax extension using Form 4868 can provide you with the extra time you need to complete your federal income tax return accurately. In this article, we explored the process and benefits of filing Form 4868, as well as the mailing addresses for both the Internal Revenue Service (IRS) and private delivery services.

Form 4868 allows you to extend the deadline for filing your tax return from the traditional April 15th to October 15th, giving you more time to organize your financial records, gather necessary documents, and consult with tax professionals if needed. It’s important to note that filing an extension does not grant you an extension for paying any taxes owed. It’s crucial to estimate and pay the required amount by the original due date to avoid penalties and interest charges.

If you choose to file Form 4868 by mail, make sure to use the correct IRS mailing address based on your state or private delivery service. Using the wrong address may result in processing delays or lost documents. Consider certified mail or tracking services for added peace of mind and keep a copy of your completed form for your records.

By following the steps outlined in this article and considering the provided tips, you can successfully file Form 4868 and obtain the additional time needed for your tax filing process.

Remember, while filing taxes may seem overwhelming, requesting an extension can provide you with the necessary breathing room to ensure accurate and timely tax reporting. Whether you’re waiting for crucial tax forms, need additional time to organize your records, or are facing financial hardships, filing Form 4868 can be a beneficial option.

Take advantage of the opportunity to request an extension if you need it, and remember to file your tax return by the extended deadline to fulfill your tax obligations. With proper preparation and understanding, you can navigate the tax filing process with confidence.