Home>Finance>What Is Price Discovery? Definition, Process, And Vs. Valuation

Finance

What Is Price Discovery? Definition, Process, And Vs. Valuation

Published: January 10, 2024

Learn the definition and process of price discovery in finance, and understand how it compares to valuation. Explore the key aspects of price determination in the financial market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Price Discovery in Finance

In the world of finance, price discovery is a crucial concept that plays a fundamental role in determining the value of various financial assets. But what exactly does price discovery mean and how does it work? In this blog post, we will delve into the definition, process, and the difference between price discovery and valuation.

Key Takeaways:

- Price discovery is the process of determining the market value of a financial asset through the interaction of buyers and sellers.

- It is a continuous and dynamic process influenced by various factors, including supply and demand, market sentiment, and economic indicators.

Definition of Price Discovery

Price discovery refers to the mechanism by which the market determines the fair value of a financial asset at any given point in time. This value reflects the perceived worth of the asset based on the interactions between buyers and sellers in the market.

The process of price discovery involves the aggregation of all available information and opinions from market participants. The buying and selling decisions made by individuals and institutions contribute to establishing the equilibrium price at which the asset will trade.

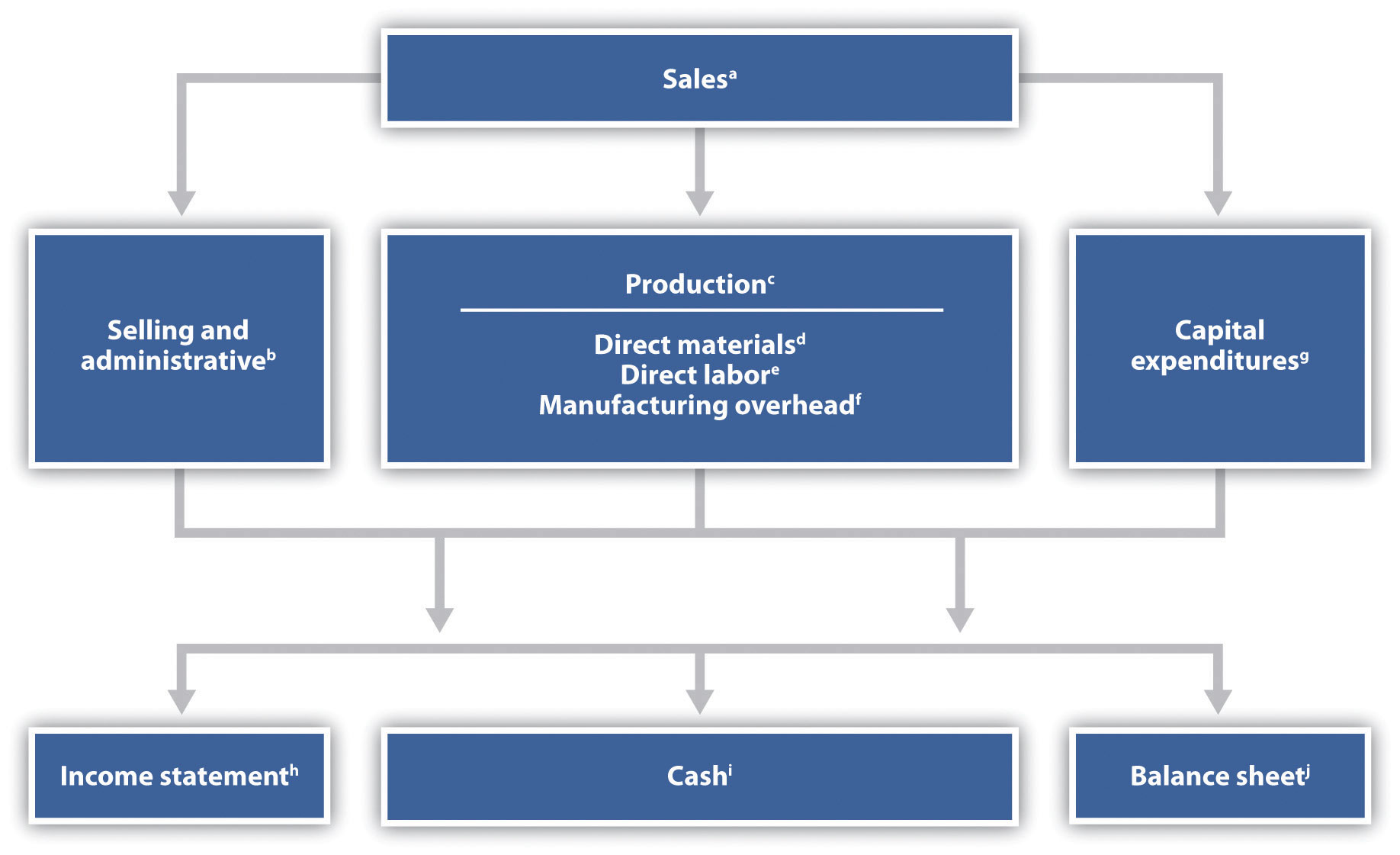

The Process of Price Discovery

Price discovery is an ongoing and ever-evolving process. Here’s a breakdown of the steps involved:

- Supply and Demand: The forces of supply and demand play a significant role in determining prices. If the demand for an asset exceeds the available supply, its price is likely to increase. Conversely, if supply surpasses demand, the price may decrease.

- Market Sentiment: Investor sentiment and market psychology influence price discovery. Positive sentiment can drive prices higher, while negative sentiment can lead to price declines.

- Market Participants: Buyers and sellers in the market, including individuals, institutions, and traders, contribute to price discovery by executing trades based on their own analysis, strategies, and expectations.

- Information and News: News, economic data, financial statements, and other information impact price discovery. Market participants interpret this information to make buy and sell decisions, altering the asset’s perceived value.

- Efficiency and Transparency: An efficient and transparent market facilitates price discovery by ensuring that relevant information is available to all participants without any significant time delays or manipulation.

Price Discovery Vs. Valuation

While price discovery and valuation both pertain to determining the worth of financial assets, they differ in their approach and purpose:

- Price Discovery: Focuses on determining the current market value of an asset based on supply, demand, and other aforementioned factors.

- Valuation: Involves determining the intrinsic value or future worth of an asset by analyzing quantitative factors such as financial statements, cash flows, growth prospects, and other relevant metrics.

Valuation is often a more in-depth and comprehensive analysis that considers factors beyond just market dynamics. While price discovery focuses on the market’s perception of value at any given time, valuation involves a more forward-looking assessment of an asset’s potential.

Conclusion

Price discovery is the essential process by which financial assets are valued in the market. It relies on the interactions of market participants, supply and demand dynamics, investor sentiment, and available information. Understanding price discovery helps investors make informed decisions based on the current market value of assets, while valuation provides a broader perspective on their long-term potential.