Finance

How Are Sneakers Like Stocks?

Published: January 19, 2024

Discover the fascinating parallels between sneakers and stocks in the world of finance. Learn how these two seemingly different worlds share common trends and investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing, most people think about stocks, bonds, and other traditional financial instruments. However, there is another type of investment that has gained significant popularity in recent years – sneakers.

Yes, you read that right – sneakers. What was once considered just a fashion accessory is now being viewed as a potential financial asset. In fact, high-end sneakers from popular brands like Nike, Adidas, and collectible collaborations have become highly sought after by investors and collectors alike.

But you might be wondering, how can a pair of shoes be compared to stocks, which represent ownership in a company? Well, surprisingly, there are several similarities between the two. Both sneakers and stocks have value that can fluctuate based on market demand, scarcity, and overall popularity.

In this article, we will delve into the fascinating world of sneaker and stock investments and explore the similarities and differences between the two. We will discuss the factors that affect their values, the dynamics of supply and demand, pricing and valuation methods, as well as the investment potential and associated risks.

So, if you’re curious about how sneakers and stocks converge, read on to discover the intriguing connections between these seemingly unrelated assets.

Comparing Sneakers and Stocks

On the surface, sneaker investments and stock investments may seem worlds apart. After all, one is a tangible physical item while the other represents ownership in a company. However, when you dig deeper, you’ll find several interesting parallels between the two.

Firstly, both sneakers and stocks can be considered as assets. While stocks represent ownership in a company, sneakers have evolved into collectible assets with their own market value. Just like stocks, the value of sneakers can appreciate over time, making them a potential investment opportunity.

Secondly, both sneakers and stocks are subject to market demand. Just as the value of a stock can rise or fall based on investor sentiment and market trends, the value of a sneaker can fluctuate based on consumer demand and trends in the fashion and sneaker industry. A popular sneaker release can create a frenzy among enthusiasts, driving up its market value.

Furthermore, both sneakers and stocks can offer value beyond their original purchase price. While stocks can generate passive income through dividends and capital appreciation, sneakers can also appreciate in value over time, especially limited edition or rare releases. These valuable sneakers can be resold at a higher price, allowing investors to profit from their investment.

Moreover, both sneaker and stock investments require research and knowledge. When investing in stocks, investors analyze financial statements, industry trends, and other factors that may impact the company’s performance. Similarly, sneaker investors analyze factors such as brand popularity, collaborations, exclusivity, and cultural relevance to determine the investment potential of a particular sneaker.

It’s important to note that while there are similarities between sneaker and stock investments, there are also notable differences. Stocks offer ownership in a company, giving investors a stake in the company’s profits and decision-making. Sneakers, on the other hand, do not provide ownership rights in a company but rather serve as a collectible item with potential value appreciation.

In the next sections, we will explore the factors that affect the value of sneakers and stocks, the dynamics of supply and demand, pricing and valuation methods, as well as the investment potential and associated risks of each.

Factors that Affect Sneaker and Stock Values

When it comes to evaluating the value of sneakers and stocks, several key factors come into play. Understanding these factors can help investors make informed decisions and assess the potential profitability of their investments.

Brand and Reputation: In both the sneaker and stock markets, brand and reputation play a crucial role. High-end sneaker brands like Nike and Adidas have established a strong brand presence and loyal customer base. Similarly, well-established companies with a solid track record, positive reputation, and strong financial performance tend to attract more investor interest.

Scarcity and Exclusivity: Limited supply and exclusivity can significantly impact the value of both sneakers and stocks. Limited edition sneakers or those associated with celebrity collaborations are often in high demand among sneaker enthusiasts, which drives up their resale value. Similarly, stocks with a limited number of shares available or those that are considered exclusive due to certain investment requirements can command a higher market value.

Market Trends and Cultural Relevance: Both sneakers and stocks are influenced by market trends and cultural relevance. Sneaker trends, such as certain styles or designs being deemed fashionable or culturally significant, can greatly impact the desirability and value of specific sneaker models. Likewise, stocks of companies that align with current market trends or cater to emerging industries can experience substantial growth in value.

Economic and Financial Factors: Economic and financial conditions can have a direct impact on the value of both sneakers and stocks. Factors such as interest rates, inflation, consumer spending, and overall market conditions can affect investor sentiment and consumer purchasing power, thereby influencing the demand and value of sneakers as well as stock prices.

Product Quality and Innovation: The quality and innovation of the product itself can also impact its value. In the sneaker market, materials used, craftsmanship, design aesthetics, and technological advancements can elevate the desirability and value of a sneaker. Similarly, companies that consistently innovate and deliver high-quality products are more likely to experience growth and increased stock value.

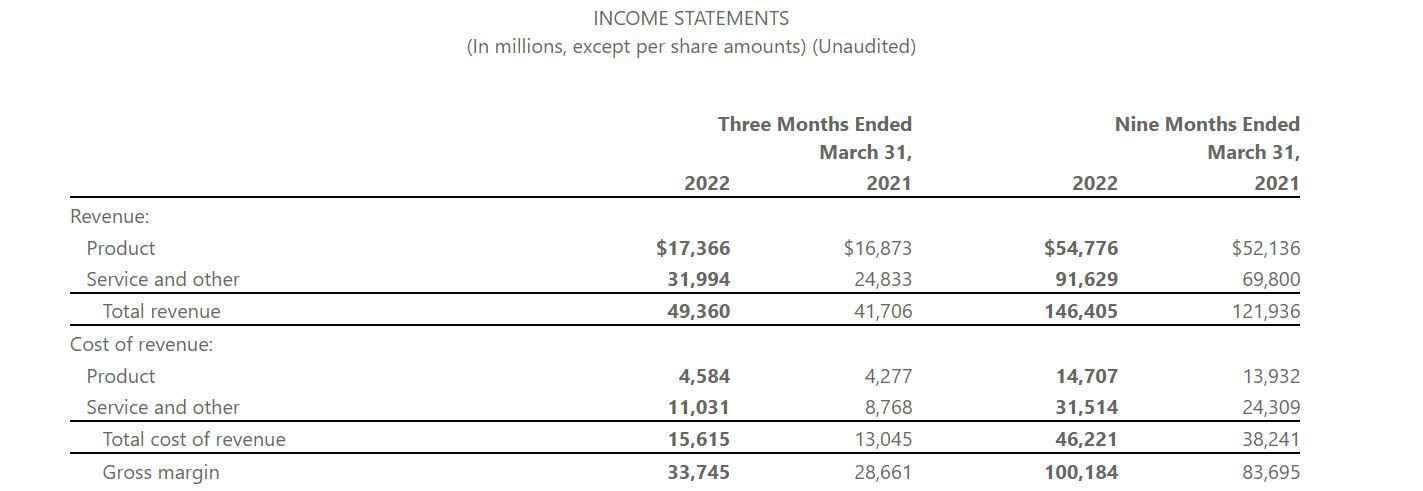

Company Performance and Financials: For stocks, the performance and financial health of the underlying company are crucial factors in assessing value. Factors such as revenue growth, profitability, debt levels, and future prospects can have a significant impact on the stock price. Sneakers, on the other hand, are not directly tied to company performance but can be influenced by brand reputation and collaborations.

By considering these factors, investors can gain insights into the potential value and growth prospects of both sneaker and stock investments. It is essential to stay informed and conduct thorough research to make informed investment decisions based on these factors.

Demand and Supply Dynamics

The demand and supply dynamics play a crucial role in determining the value of both sneakers and stocks. Understanding how these factors interact can provide valuable insights for investors.

In the sneaker market, demand is driven by various factors such as brand popularity, collaborations, exclusivity, and cultural relevance. Sneaker enthusiasts and collectors are constantly on the lookout for limited edition releases, rare colorways, and iconic collaborations. The scarcity of these sneakers creates a sense of urgency and drives up demand, leading to higher prices in the resale market.

Supply, on the other hand, refers to the number of sneakers available in the market. Limited supply, whether intentional or due to production constraints, can create a sense of exclusivity and rarity, further driving up demand. Sneaker manufacturers often create hype around new releases by intentionally limiting the number of pairs available, leading to increased demand and higher prices.

The stock market also operates on the fundamental principle of supply and demand. When the demand for a particular stock exceeds the available supply, the stock price tends to rise. Conversely, when the supply exceeds the demand, the stock price may decline. This dynamic is influenced by factors such as company performance, investor sentiment, market trends, and economic conditions.

Investor demand for stocks is driven by the perceived growth potential and profitability of the underlying company. Positive financial performance, innovation, strategic partnerships, and market dominance can attract investors and increase demand for a company’s stock. On the other hand, negative news, poor financial performance, or market uncertainties can lead to decreased demand and a decline in stock prices.

The supply of stocks is determined by the number of shares available for trading. Initial public offerings (IPOs), stock splits, and share buybacks can impact the supply of stocks in the market. Companies may issue new shares through IPOs, which increases the available supply, while stock splits can increase the number of shares outstanding. Conversely, share buybacks reduce the supply of stocks, potentially leading to increased demand and higher prices.

Understanding the interplay between demand and supply is critical for investors. In the sneaker market, limited supply and high demand for certain sneakers can create opportunities for investors to buy and resell at a profit. Similarly, in the stock market, investors can capitalize on stocks with high demand and limited supply, potentially generating returns through capital appreciation.

Ultimately, both sneaker and stock investors must gauge the demand and supply dynamics to make informed decisions. Staying up to date with market trends, conducting thorough research, and monitoring consumer behavior and investor sentiment can provide valuable insights into these dynamics.

Pricing and Valuation of Sneakers and Stocks

Pricing and valuation play a crucial role in determining the value of both sneakers and stocks. Let’s explore how these assets are priced and evaluated in their respective markets.

In the sneaker market, the pricing of sneakers is primarily influenced by factors such as brand reputation, rarity, exclusivity, demand, and condition. Limited edition or rare sneakers that are in high demand often command higher prices in the resale market. Factors such as celebrity endorsements, collaborations with popular brands or designers, and cultural relevance can also contribute to increased pricing. Sneakers in pristine condition, with original packaging and tags, may be valued higher than those that show signs of wear.

Valuation of sneakers is often subjective and can vary greatly based on individual preferences and market trends. Sneaker collectors and enthusiasts assess the value of a sneaker based on factors such as its desirability, historical significance, and resale potential. Online marketplaces, sneaker forums, and auctions can provide insights into the current market value of specific sneakers.

On the other hand, stocks are priced based on the supply and demand dynamics within the stock market. The price of a stock is determined by the last price at which it was traded in the market. This price is influenced by various factors such as company performance, financials, market sentiment, and economic conditions. Stocks of well-performing companies with strong growth prospects tend to have higher stock prices, while underperforming companies may have lower stock prices.

Stock valuation involves assessing the intrinsic value of a stock by analyzing financial statements, earnings projections, industry trends, and other relevant factors. Valuation metrics such as price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and dividend yield are commonly used to determine the relative attractiveness of a stock’s valuation. Fundamental analysis and comparison with industry peers assist in evaluating whether a stock is undervalued or overvalued.

It’s important to note that while sneakers and stocks are both subject to pricing and valuation, the methodologies and factors involved are distinct. Sneaker valuation relies heavily on collectors’ and enthusiasts’ perceptions of value, while stocks are valued based on financial performance and market dynamics.

Both sneaker and stock investors should thoroughly research and analyze the factors that contribute to the pricing and valuation of their chosen assets. Keeping a close eye on market trends, understanding supply and demand dynamics, and considering the potential growth prospects can assist in making informed investment decisions.

Investment Potential of Sneakers and Stocks

Both sneakers and stocks offer unique investment potential, albeit in different ways. Understanding the investment potential of each asset class is crucial for investors seeking to diversify their portfolio and maximize returns.

Investing in sneakers can provide opportunities for profitable returns. Limited edition and rare sneakers, especially those associated with popular brands or collaborations, have demonstrated the potential for significant value appreciation over time. Sneaker collectors and investors can buy sought-after sneakers at retail prices and sell them in the resale market at a premium. This can lead to sizable profits, particularly if a sneaker becomes highly coveted or attains iconic status. Additionally, the sneaker market can offer a level of cultural relevance and personal enjoyment beyond financial gains.

Investing in stocks, on the other hand, allows investors to gain a stake in companies and participate in their growth and profitability. Stocks provide the potential for long-term capital appreciation through share price appreciation and the receipt of dividends. By investing in publicly traded companies, investors can benefit from their success, product innovations, market share expansion, and overall company performance. Additionally, stocks offer liquidity, allowing investors to buy and sell shares relatively easily.

Both sneakers and stocks have their unique risks and rewards. Investing in sneakers requires knowledge of the market, understanding of trends, and the ability to identify valuable and in-demand sneakers. While it can provide lucrative returns, the sneaker market is not as regulated as the stock market and is subject to potential volatility and the risk of counterfeit products.

Stock investments involve assessing the financial health of companies, analyzing market trends, and making educated predictions about future performance. While stocks can generate consistent returns, they are also influenced by broader market forces and company-specific risks. Economic downturns, corporate scandals, and industry disruptors can affect stock prices and investor confidence.

Ultimately, the investment potential of sneakers and stocks depends on an individual’s risk appetite, financial goals, and investment strategy. Some investors may find the tangible nature of sneakers and the potential for high returns appealing, while others may prefer the stability and growth potential of stocks.

It’s important for investors to conduct thorough research, diversify their portfolios, and seek professional advice when venturing into either the sneaker or stock market. A balanced approach to investing that considers both asset classes can help investors mitigate risk and potentially achieve a well-rounded investment portfolio.

Risks Associated with Sneaker and Stock Investments

While both sneaker and stock investments can offer lucrative opportunities, it’s essential for investors to be aware of the risks involved. Understanding and managing these risks is crucial for protecting your investment capital. Here are some of the key risks associated with sneaker and stock investments:

Market Volatility: Both sneaker and stock markets can be subject to significant volatility. Prices and values can fluctuate due to factors such as changes in consumer demand, economic conditions, market trends, and investor sentiment. Rapid changes in market conditions can result in losses or decreased value of investments.

Counterfeit Products: In the sneaker market, the presence of counterfeit products is a risk that investors need to be cautious of. Counterfeit sneakers can not only devalue the market for genuine sneakers but can also result in financial losses for investors who unknowingly purchase or invest in fake products. It’s crucial to authenticate the authenticity of sneakers before making any investment.

Supply and Demand Imbalances: Both sneaker and stock values can be influenced by supply and demand dynamics. If demand for a particular sneaker or stock outweighs the available supply, prices can rise rapidly, making it challenging to enter the market at a favorable price. On the other hand, oversupply can lead to diminished interest and lower prices.

Lack of Regulation: The sneaker market operates with less regulation compared to the stock market. This lack of regulation can make it challenging to navigate the market and protect against fraudulent activities. Investors need to conduct thorough due diligence and be cautious when engaging in sneaker investments.

Company and Industry Risks: Investing in stocks comes with inherent risks associated with specific companies and industries. Factors such as poor financial performance, management issues, regulatory changes, competition, and technological advancements can impact individual stocks and the overall industry. Investors should diversify their stock portfolio and stay informed about the companies they invest in.

Limited Liquidity: Unlike stocks, which can be easily bought and sold on the stock market, sneaker investments may have limited liquidity. Finding a buyer for a specific sneaker at a desired price can be challenging, especially for less sought-after sneakers. Investors may face difficulty in selling their sneakers quickly or at a desired price.

External Factors: Both sneaker and stock values are subject to external factors beyond an investor’s control, such as geopolitical events, economic downturns, natural disasters, and changes in consumer behavior. These factors can have a significant impact on the overall market sentiment and the value of investments.

To mitigate these risks, investors should maintain a diversified portfolio, conduct thorough research, stay updated on market trends, and consider seeking professional advice. It’s essential to assess your risk tolerance and investment goals before entering into sneaker or stock investments and to make informed decisions based on your individual circumstances.

Conclusion

In conclusion, the fascinating intersection between sneakers and stocks showcases the evolving landscape of investment opportunities. While sneakers and stocks may seem vastly different, they share similarities in terms of value appreciation, market demand, and investment potential.

Sneaker investments have gained traction in recent years, with limited edition releases and collaborations driving up prices in the resale market. Investors can leverage their knowledge of sneaker trends, brand reputation, and exclusivity to capitalize on potential profits. However, it is important to be aware of risks such as market volatility and counterfeit products.

Stock investments, on the other hand, offer ownership stakes in companies and the potential for long-term growth. By analyzing financial performance, market trends, and industry dynamics, investors can make informed decisions to maximize returns. However, stock investments carry risks such as market fluctuations, company-specific risks, and external factors beyond an investor’s control.

Both sneaker and stock investments require research, knowledge, and a balanced investment approach. Assessing factors such as brand reputation, scarcity, market trends, and financial health is crucial in determining the value and potential returns of these investments.

Ultimately, the decision to invest in sneakers, stocks, or a combination of both depends on an individual’s risk appetite, investment goals, and preferences. Diversifying one’s investment portfolio can help spread risk and capture opportunities in different asset classes.

Whether you choose to invest in sneakers, stocks, or both, it’s essential to stay informed, adapt to market trends, and make decisions based on thorough analysis. Remember to seek professional advice if needed and maintain a disciplined approach to financial investments.

As the world of finance continues to evolve, the convergence of sneakers and stocks serves as a reminder that investment opportunities can arise from unexpected places. So, embrace the possibilities, explore new avenues, and make informed investment decisions to pave the way for financial success.