Finance

How Do You Use Your Kikoff Credit

Modified: February 21, 2024

Learn how to effectively use your Kikoff Credit for your finances and achieve your financial goals. Discover practical tips and strategies to maximize your financial potential.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, having access to credit can be a valuable tool. It allows you to make purchases, handle emergencies, and build your credit history. However, not everyone has access to traditional credit options, especially if they are new to the financial world or have a limited credit history.

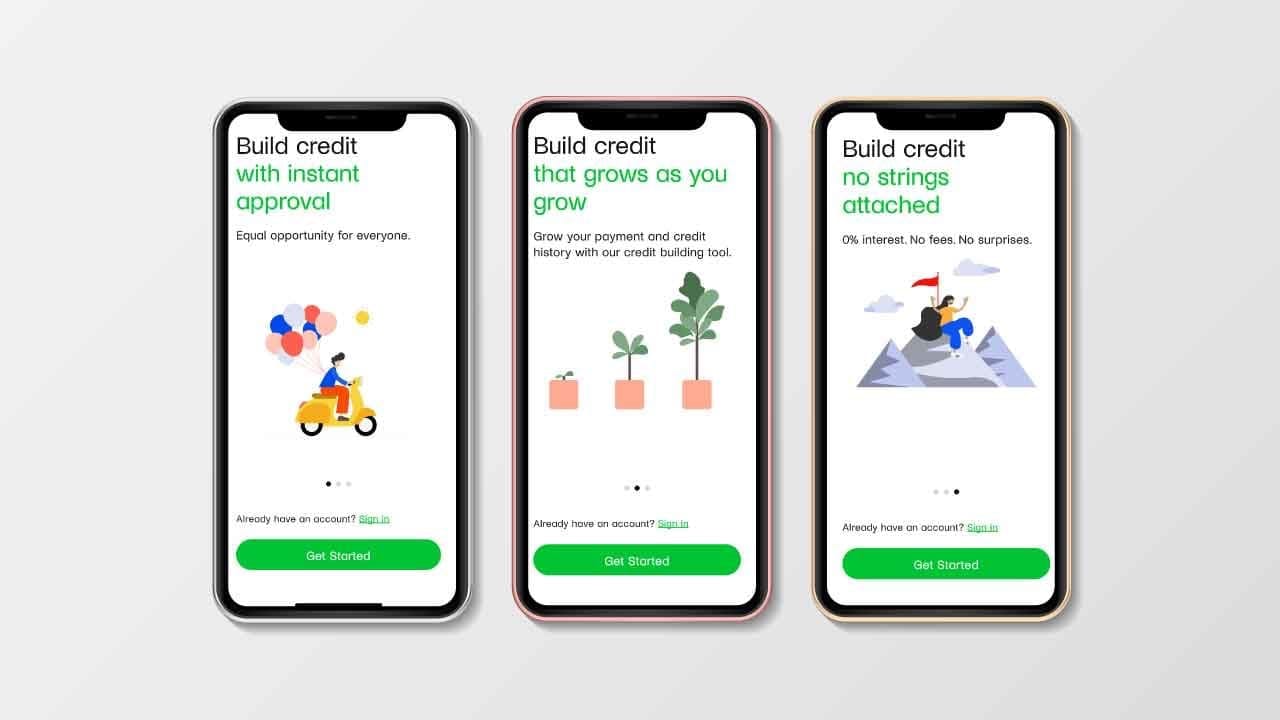

This is where Kikoff Credit comes in. Kikoff Credit is a unique credit-building platform that provides individuals with a way to establish and build credit history, even without a traditional credit card. This innovative service offers a line of credit that can be used for various purchases, helping you improve your credit profile over time.

In this article, we will explore how to use your Kikoff Credit to its fullest potential. Whether you are new to credit or looking for alternative ways to build your credit history, Kikoff Credit can be a great solution. From applying for Kikoff Credit to managing your payments and building a solid credit foundation, we will guide you through each step of the process.

So, if you are ready to take control of your financial future and make the most of your Kikoff Credit, let’s dive in and explore how to effectively use this credit-building tool.

What is Kikoff Credit?

Kikoff Credit is a unique credit-building platform that aims to help individuals establish and improve their credit history. It offers a line of credit that can be used for various purposes, such as making purchases, covering emergency expenses, or even starting a small business. The primary goal of Kikoff Credit is to provide access to credit for individuals who may have difficulty obtaining traditional credit options.

Unlike traditional credit cards, Kikoff Credit does not require a credit check or a pre-existing credit history. This makes it an ideal choice for individuals who are new to credit or who have a limited credit history. The application process is quick and simple, allowing users to get approved and start using their Kikoff Credit within minutes.

One of the unique features of Kikoff Credit is the flexible repayment terms. While traditional credit cards typically require monthly payments, Kikoff Credit allows users to choose a repayment plan that best suits their needs. You can make weekly or monthly payments, giving you more control over your finances and allowing you to build a consistent payment history.

Another noteworthy aspect of Kikoff Credit is the credit education and monitoring features. The platform provides users with valuable educational resources to help them understand how credit works and how to manage it effectively. Additionally, Kikoff Credit offers free credit score monitoring, allowing users to track their progress and make informed decisions about their financial future.

Overall, Kikoff Credit is a powerful tool for individuals who are looking to establish or improve their credit history. By providing access to credit and offering educational resources, Kikoff Credit empowers users to take control of their financial journey and build a solid credit foundation.

Step 1: Applying for Kikoff Credit

Getting started with Kikoff Credit is simple and straightforward. To apply for Kikoff Credit, you’ll need to follow these steps:

- Visit the Kikoff Credit website: Start by visiting the official Kikoff Credit website. You’ll find all the information you need about the service, including the application process and the benefits of using Kikoff Credit.

- Create an account: Click on the “Sign Up” or “Get Started” button to create an account. You’ll need to provide some basic information, such as your name, email address, and a secure password.

- Complete the application: Once you’ve created your account, you’ll need to fill out the Kikoff Credit application. This will include providing details such as your date of birth, Social Security number, and income information. Don’t worry about your credit history – Kikoff Credit does not require a credit check.

- Verify your identity: As part of the application process, you may be asked to verify your identity. This is a standard security measure to ensure that you are who you say you are. You may be asked to provide additional documentation, such as a photo ID or proof of address.

- Review and accept the terms: Before submitting your application, take the time to review the terms and conditions of Kikoff Credit. It’s important to understand the fees, repayment terms, and other important details before proceeding.

- Submit your application: Once you’ve reviewed and accepted the terms, you can submit your application. The Kikoff Credit team will review your application and assess your eligibility for the credit line.

- Get approved and set your limit: Upon approval, you’ll be notified of your approved credit limit. This limit determines the amount you can borrow using your Kikoff Credit line. It’s important to remember that responsible borrowing and timely repayments will help you build a positive credit history.

Applying for Kikoff Credit is a quick and hassle-free process. By following these steps, you can gain access to a line of credit that can be used to make purchases and start building a positive credit history. Remember to provide accurate information and read the terms carefully to ensure a smooth application process.

Step 2: Understanding Your Credit Usage

Once you’re approved for Kikoff Credit, it’s important to understand how to effectively use your credit to build a positive credit history. Here are some key factors to consider:

- Know your credit limit: Your approved credit limit determines the maximum amount you can borrow using your Kikoff Credit. It’s essential to stay within this limit to manage your credit usage effectively. Exceeding your credit limit may have negative consequences on your credit score and financial health.

- Monitor your utilization ratio: The utilization ratio is the percentage of your available credit that you’re currently using. It’s a crucial factor that lenders consider when evaluating your creditworthiness. It’s generally recommended to keep your utilization ratio below 30% to demonstrate responsible credit usage.

- Plan your purchases wisely: While you have access to a line of credit, it’s important to make informed decisions about your purchases. Consider your needs and prioritize essential expenses. Avoid excessive spending and only use your credit for necessary purchases that fit within your budget.

- Make timely payments: To build a positive credit history, it’s essential to make your Kikoff Credit payments on time. Whether you choose a weekly or monthly repayment plan, ensure that you meet your payment obligations consistently. Late payments can have a negative impact on your credit score and financial reputation.

- Avoid carrying balances: It’s generally recommended to pay off your Kikoff Credit balance in full each month. Carrying balances can result in accumulating interest charges, which can be costly in the long run. Paying off your balance shows responsible credit management and helps improve your credit score.

- Create a repayment plan: Keeping track of your Kikoff Credit payments is crucial to stay on top of your financial obligations. Consider creating a repayment plan that fits your budget and ensures timely payments. Set reminders or use automatic payments to avoid missing due dates.

By understanding your credit usage and adopting responsible habits, you can make the most of your Kikoff Credit and build a positive credit history. Consistent and wise credit management will not only improve your financial well-being but also open doors to better credit opportunities in the future.

Step 3: Making Purchases with Kikoff Credit

With your Kikoff Credit line in hand, you can start making purchases and utilizing your credit. Here are some key points to consider when using your Kikoff Credit:

- Choose where to shop: Kikoff Credit is accepted at various online retailers and merchants. You can explore the Kikoff Credit dashboard or website to find a list of partner stores where you can use your credit. Take advantage of this wide selection to make purchases that align with your needs and preferences.

- Use your credit responsibly: While having access to credit can be exciting, it’s important to use your Kikoff Credit responsibly. Only make purchases that you can afford to repay. Be mindful of your credit limit and ensure that your purchases fit within your budget.

- Consider your credit utilization: As mentioned earlier, your credit utilization ratio is an important factor in your credit score. Aim to keep your utilization below 30% to demonstrate responsible credit usage. Regularly monitoring your credit utilization can help you stay on track.

- Review the terms and promotions: Some retailers may offer special promotions or financing options when using your Kikoff Credit. Take the time to review these offers and consider whether they align with your needs. Be aware of any interest charges, fees, or repayment terms associated with these promotions.

- Keep track of your purchases: It’s important to keep a record of your Kikoff Credit purchases. This will help you stay on top of your expenses and manage your overall credit usage. You can find a transaction history on your Kikoff Credit dashboard or by contacting customer support if needed.

- Consider refunds and returns: In case you need to return an item or request a refund, reach out to the retailer or merchant directly. They will guide you through their specific refund policy. It’s important to communicate any issues promptly to ensure a smooth resolution.

By being mindful of your credit usage, considering your financial capabilities, and utilizing your Kikoff Credit responsibly, you can make purchases that align with your needs while building a positive credit history. Remember to review your transactions regularly and keep track of your expenses to stay in control of your financial journey.

Step 4: Managing Your Kikoff Credit Payments

Managing your Kikoff Credit payments is vital for building a positive credit history and maintaining your financial well-being. Here are some key points to consider when it comes to managing your Kikoff Credit payments:

- Create a budget: It’s important to have a clear understanding of your income and expenses. By creating a budget, you can allocate funds for your Kikoff Credit payments and ensure that they are prioritized. Consider your repayment plan, whether weekly or monthly, and incorporate it into your budget.

- Set reminders or automate payments: Timely payments are crucial for a positive credit history. Set reminders or automate your Kikoff Credit payments to avoid missing due dates. This will help you stay on track and avoid any late payment penalties or negative marks on your credit report.

- Review your statements: Take the time to review your Kikoff Credit statements regularly. This will help you keep track of your payments, monitor your credit utilization, and detect any potential errors or discrepancies. If you notice any issues, reach out to Kikoff Credit customer support for assistance.

- Consider making extra payments: If your financial situation allows, consider making extra payments towards your Kikoff Credit balance. By paying more than the minimum required, you can accelerate your credit-building journey and potentially save on interest charges.

- Monitor your credit score: Keeping an eye on your credit score is important to gauge your progress and identify areas for improvement. Kikoff Credit offers free credit score monitoring, allowing you to track changes in your score over time. This information can help you make informed decisions regarding your credit usage and overall financial health.

- Reach out for support: If you’re facing any financial difficulties or challenges with your payments, don’t hesitate to reach out to Kikoff Credit customer support. They may be able to provide guidance or present alternative solutions to help you manage your payments effectively.

By actively managing your Kikoff Credit payments, you can stay on top of your financial responsibilities, build a positive credit history, and maintain a healthy credit profile. Responsible payment management is key to achieving financial stability and unlocking future credit opportunities.

Step 5: Building Credit with Kikoff Credit

Building a strong credit history is crucial for your financial well-being and future opportunities. Kikoff Credit provides you with a valuable tool to establish and improve your credit. Here’s how you can effectively build credit with Kikoff Credit:

- Make timely payments: Consistently making your Kikoff Credit payments on time is one of the most important factors in building credit. Timely payments demonstrate your responsible financial behavior and contribute to a positive payment history, which is a significant component of your credit score.

- Keep your credit utilization low: As mentioned earlier, your credit utilization ratio plays a role in your credit score. Aim to keep your Kikoff Credit utilization below 30% of your available credit. This shows lenders that you can manage your credit responsibly and are not relying too heavily on credit.

- Monitor your credit score: Take advantage of Kikoff Credit’s free credit score monitoring feature. Regularly check your credit score to track your progress and make necessary adjustments to improve your creditworthiness. Monitoring your score allows you to address any potential issues or inaccuracies promptly.

- Stay informed about credit education: Kikoff Credit provides educational resources that can help you understand how credit works and how to manage it effectively. Take advantage of these resources to enhance your financial knowledge and make informed decisions about credit usage.

- Consider credit-building opportunities: In addition to using your Kikoff Credit for purchases, explore other credit-building opportunities. This could include becoming an authorized user on someone else’s credit card, applying for a secured credit card, or taking out a small personal loan. Responsible use of various credit accounts can further enhance your credit profile.

- Patience and consistency: Building credit takes time and patience. It’s important to be consistent with your credit management practices. Making regular payments, keeping your utilization low, and staying on top of your financial responsibilities will gradually improve your creditworthiness.

By following these steps and building a positive credit history with Kikoff Credit, you can strengthen your creditworthiness and set yourself up for future financial success. Good credit opens doors to better interest rates, loan approvals, and overall financial stability. Use your Kikoff Credit responsibly to build a solid foundation for your credit journey.

Conclusion

Kikoff Credit offers individuals a unique opportunity to establish and build their credit history. With its easy application process, flexible repayment options, and credit education resources, Kikoff Credit empowers users to take control of their financial journey.

By following the steps outlined in this article, you can effectively use your Kikoff Credit and maximize its benefits. Applying for Kikoff Credit is simple, allowing you to access a line of credit even without a traditional credit history. Understanding your credit usage and managing your payments responsibly are key factors in building a positive credit history.

With Kikoff Credit, you have the ability to make purchases, track your transactions, and monitor your credit score. By staying within your credit limit, making timely payments, and keeping your credit utilization low, you can demonstrate responsible credit management and improve your creditworthiness.

Remember that building credit is a process that requires patience and consistency. Along with using your Kikoff Credit, consider other credit-building opportunities and stay informed about credit education. Taking proactive steps to enhance your credit profile will open doors to better financial opportunities in the future.

In conclusion, Kikoff Credit is a valuable tool for those looking to establish and improve their credit history. By using your Kikoff Credit responsibly and following the steps outlined in this article, you can build a solid credit foundation and achieve financial success.