Finance

What Is Remediation In Banking

Published: October 11, 2023

Learn the importance of remediation in the banking industry and how it impacts the finance sector. Gain insight into the role remediation plays in ensuring compliance and risk management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Remediation in Banking

- Importance of Remediation in Banking

- Objectives of Remediation in Banking

- Types of Remediation in Banking

- Process of Remediation in Banking

- Challenges in Remediation in Banking

- Best Practices in Remediation in Banking

- Case Studies of Successful Remediation in Banking

- Conclusion

Introduction

Welcome to the exciting world of remediation in banking! In this article, we will delve into the concept of remediation in the context of the banking industry. As financial institutions navigate an ever-changing landscape, the need for effective remediation strategies has become paramount.

Remediation refers to the process of identifying, addressing, and resolving issues or problems that may arise within a bank’s operations. These could range from compliance violations to customer complaints, data breaches, or even internal control deficiencies. The objective of remediation is to rectify these issues swiftly and efficiently, ensuring that the bank can continue to provide secure and reliable financial services to its customers.

The importance of remediation in banking cannot be overstated. Not only does it help protect the bank’s reputation and customer trust, but it also enables the institution to meet regulatory requirements and adhere to industry best practices. A robust remediation framework is vital in today’s fast-paced and interconnected financial world.

At its core, remediation aims to mitigate risk and ensure compliance. Banks must actively identify and resolve issues to prevent potential negative impacts on stakeholders, such as customers, employees, regulators, and shareholders. By effectively managing and addressing these issues, banks can safeguard their operations, reputation, and ultimately, their bottom line.

Over the years, the role of remediation in banking has evolved significantly. With the increase in regulatory scrutiny and the growing complexity of financial products and services, banks have had to adapt their remediation processes to keep up with the changing landscape. Today, remediation encompasses a wide range of activities, including root cause analysis, corrective action plans, and ongoing monitoring and validation.

In the following sections, we will explore the objectives, types, and process of remediation in more depth. We will also examine the challenges faced by banks in implementing remediation strategies and highlight best practices to ensure successful outcomes. Additionally, we will share real-life case studies that exemplify the benefits and effectiveness of well-executed remediation initiatives.

So, fasten your seatbelt and get ready to dive into the fascinating world of remediation in banking!

Definition of Remediation in Banking

Remediation in banking is the process of identifying, addressing, and rectifying issues or problems within a bank’s operations, systems, or practices. It involves taking corrective action to resolve issues that may impact the bank’s compliance with regulations, customer satisfaction, operational efficiency, or overall risk management.

Remediation encompasses a wide range of activities and can include addressing compliance violations, customer complaints, data breaches, internal control deficiencies, or any other issues that may arise in the normal course of a bank’s operations. The goal of remediation is to quickly and effectively resolve these issues to ensure that the bank can continue to provide safe, secure, and reliable financial services to its customers.

In the context of banking, remediation is crucial for several reasons. First, it helps banks maintain compliance with regulatory requirements. Financial institutions are subject to a multitude of regulations, and failures to comply can result in severe consequences, including fines, penalties, reputational damage, or even legal action. Remediation ensures that banks promptly address any compliance violations and implement necessary changes to prevent them from recurring.

Second, remediation is essential for preserving customer trust and satisfaction. When customers encounter problems or issues with a bank’s products or services, prompt resolution is crucial to maintain their trust and confidence. Remediation allows banks to address customer complaints, rectify any negative experiences, and improve overall customer satisfaction. This, in turn, fosters customer loyalty and can attract new customers, enhancing the bank’s reputation.

In addition, remediation plays a crucial role in mitigating risks within the bank. It helps identify and rectify operational deficiencies or weaknesses in internal controls that may expose the bank to potential risks, such as fraud, cyber threats, or operational breakdowns. By addressing these risks promptly through remediation, banks can protect their assets, maintain operational resilience, and ensure the security of customer information.

Overall, remediation in banking is a proactive and ongoing process aimed at identifying and resolving issues or problems to ensure compliance, protect customer trust, and mitigate risks. It is an integral part of an effective risk management framework and is essential for the long-term success and sustainability of financial institutions.

Importance of Remediation in Banking

Remediation plays a crucial role in the banking industry due to its immense importance in ensuring regulatory compliance, maintaining customer trust, and managing risks effectively. Let’s explore the key reasons why remediation is essential in banking.

1. Regulatory Compliance: Banks operate in a highly regulated environment, with numerous laws, regulations, and guidelines that they must adhere to. Compliance failures can result in significant penalties, fines, legal consequences, and reputational damage. Remediation helps banks identify and rectify compliance violations promptly, ensuring that the institution meets regulatory requirements and avoids costly repercussions.

2. Customer Trust and Satisfaction: Customer trust is vital for the success of any bank. When customers encounter issues or problems, effective remediation processes are crucial to address their concerns promptly and satisfactorily. By resolving customer complaints and issues, banks demonstrate their commitment to customer satisfaction, which helps build trust, loyalty, and long-term relationships.

3. Risk Management: Risk management is a fundamental aspect of banking. Remediation helps identify and address operational deficiencies, weaknesses in internal controls, and potential risks that may arise within a bank’s systems or practices. By mitigating these risks through remediation, banks can enhance their risk management framework, safeguard their assets, protect against fraud or cyber threats, and maintain operational resilience.

4. Reputation Management: A bank’s reputation is a valuable asset that can be easily tarnished by negative incidents or scandals. Effective remediation processes allow banks to respond swiftly to reputation-threatening events, such as data breaches or compliance violations, and take necessary actions to address and rectify the issues. By managing reputational risks through remediation, banks can protect their brand image, maintain customer confidence, and preserve their market position.

5. Continuous Improvement: Remediation provides an opportunity for banks to identify and learn from their mistakes. By conducting thorough root cause analysis and implementing corrective actions, banks can improve their internal processes, enhance efficiency, and prevent similar issues from recurring in the future. Remediation helps foster a culture of continuous improvement within the organization, enabling banks to adapt to changing market dynamics and emerging risks.

In summary, the importance of remediation in banking cannot be understated. It ensures regulatory compliance, maintains customer trust, manages risks effectively, protects the bank’s reputation, and promotes continuous improvement. By implementing robust and comprehensive remediation strategies, banks can enhance their operational resilience, safeguard customer interests, and prosper in an increasingly competitive industry.

Objectives of Remediation in Banking

Remediation in banking serves several key objectives that are essential for the effective management and operation of financial institutions. Let’s explore the primary objectives of remediation in the banking industry:

1. Compliance: One of the primary objectives of remediation in banking is to ensure compliance with applicable laws, regulations, and industry standards. Financial institutions operate in a highly regulated environment, and non-compliance can result in significant penalties, fines, legal consequences, and reputational damage. Remediation aims to identify and rectify compliance gaps and violations, ensuring that banks meet their regulatory obligations and maintain a strong compliance posture.

2. Risk Mitigation: Remediation plays a pivotal role in mitigating risks within a bank. It involves identifying and addressing operational deficiencies, control weaknesses, and other risk factors that could potentially expose the institution to financial, operational, or reputational risks. By implementing remedial actions, banks can minimize the likelihood and impact of risks, strengthen their risk management framework, and protect the interests of their stakeholders.

3. Customer Satisfaction: Another important objective of remediation is to enhance customer satisfaction. Banks aim to provide exceptional customer service, and remediation helps achieve this goal by promptly addressing customer complaints and concerns. By resolving issues in a timely and satisfactory manner, banks can build trust, increase customer loyalty, and maintain strong relationships with their clients.

4. Operational Efficiency: Remediation seeks to improve operational efficiency within a bank. It involves identifying and addressing process inefficiencies, bottlenecks, and control weaknesses that may hinder the smooth functioning of the institution. By implementing remedial measures, banks can streamline processes, reduce costs, enhance productivity, and improve overall operational effectiveness.

5. Continuous Improvement: Remediation aims to foster a culture of continuous improvement within financial institutions. It involves conducting thorough root cause analysis to identify the underlying issues that led to the need for remediation. By addressing these root causes and implementing corrective actions, banks can prevent similar issues from recurring in the future and drive ongoing enhancements in their policies, procedures, and practices.

6. Reputation Management: Maintaining a strong reputation is crucial for banks, and remediation plays a critical role in managing reputational risks. It allows banks to address incidents or issues that have the potential to damage their reputation promptly. By taking proactive actions to rectify these issues, banks can demonstrate their commitment to resolving problems, protecting customer interests, and safeguarding their brand image.

7. Regulatory Reporting: Remediation also supports the objective of accurate and timely regulatory reporting. Banks are required to provide regulators with comprehensive and reliable information on the remediation activities undertaken. By maintaining robust records and documented evidence of remedial actions, institutions can effectively meet their regulatory reporting obligations.

In summary, the objectives of remediation in the banking industry encompass compliance, risk mitigation, customer satisfaction, operational efficiency, continuous improvement, reputation management, and accurate regulatory reporting. By aligning their remediation efforts with these objectives, banks can ensure a strong and resilient operational framework that fosters trust, confidence, and long-term success.

Types of Remediation in Banking

Remediation in banking encompasses various types of activities and initiatives aimed at addressing different issues or problems within the financial institution. Let’s explore some of the common types of remediation in the banking industry:

1. Compliance Remediation: Compliance remediation focuses on addressing non-compliance with regulatory requirements, laws, and industry standards. It involves identifying gaps in compliance and implementing corrective actions to ensure adherence to applicable regulations. This type of remediation may involve updating policies and procedures, enhancing internal controls, training employees on compliance requirements, and implementing remedial measures to rectify any deficiencies.

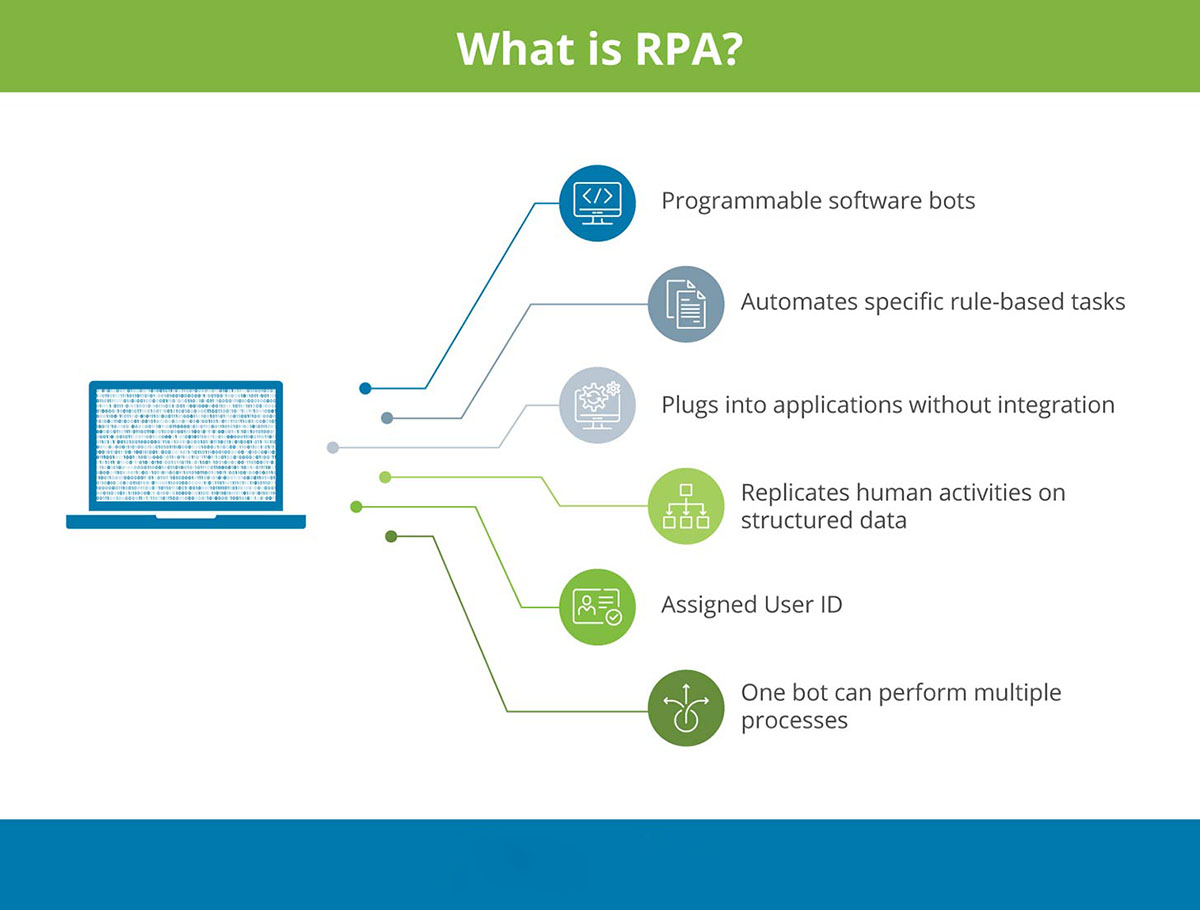

2. Operational Remediation: Operational remediation aims to improve operational efficiency and effectiveness within the bank. It involves identifying process inefficiencies, control weaknesses, or bottlenecks that impede smooth operations. Remedial actions may include process redesign, technology enhancements, automation, or streamlining of workflows to improve productivity and reduce operational risks. The objective is to enhance day-to-day operations and ensure optimal performance.

3. Customer Remediation: Customer remediation focuses on resolving issues or complaints raised by customers. It involves prompt response and resolution of customer concerns to ensure their satisfaction. This type of remediation may include addressing billing errors, resolving disputes, compensating customers for any losses incurred, or implementing measures to prevent similar issues from recurring in the future. The aim is to maintain strong customer relationships and trust.

4. Cybersecurity Remediation: Cybersecurity remediation is critical in today’s digital landscape. It involves identifying and addressing vulnerabilities and weaknesses in the bank’s information systems and cybersecurity infrastructure. This may include patching software vulnerabilities, enhancing network security controls, conducting regular security assessments, implementing incident response plans, and training employees on cybersecurity best practices. The objective is to protect the bank and its customers from potential cyber threats and data breaches.

5. Risk Remediation: Risk remediation focuses on addressing risks identified through risk assessments or audits within the bank. It involves implementing measures to mitigate risks and strengthen the risk management framework. Remedial actions may include updating risk management policies, enhancing risk monitoring and reporting processes, conducting employee training on risk awareness, or implementing controls to address specific risk areas such as credit, market, or operational risk.

6. Data Remediation: Data remediation is aimed at improving data integrity, accuracy, and accessibility within the bank. This may involve cleansing and validating data, updating data governance policies, implementing data quality controls, or enhancing data extraction and reporting processes. The objective is to ensure that the bank’s data is reliable, consistent, and readily available for decision-making, regulatory reporting, and customer interactions.

7. Reputational Remediation: Reputational remediation focuses on managing and repairing the bank’s reputation following incidents or negative events that could harm its image. This may include implementing communication strategies to address public concerns, engaging in public relations activities, establishing measures to prevent future reputation-damaging events, and demonstrating transparency and accountability. The objective is to rebuild trust and maintain a positive perception among customers, stakeholders, and the public.

These are just a few examples of the types of remediation activities in banking. The specific types of remediation undertaken will depend on the issues or problems faced by the bank and its strategic priorities. Effective remediation involves a tailored approach that addresses the unique challenges and requirements of each financial institution.

Process of Remediation in Banking

The process of remediation in banking involves a systematic approach to identifying, addressing, and resolving issues or problems that may arise within the institution. While the specific steps may vary depending on the nature of the issue and the bank’s internal processes, there are common elements in the remediation process. Let’s explore the typical steps involved in remediation in banking:

1. Issue Identification: The first step in the remediation process is to identify the issue or problem that needs to be addressed. This could be anything from a compliance violation, operational inefficiency, customer complaint, or a cybersecurity incident. This involves conducting thorough investigations, audits, or assessments to identify areas where remedial actions are required.

2. Root Cause Analysis: Once the issue is identified, the next step is to perform a root cause analysis. This involves delving deeper into the problem to understand the underlying causes or contributing factors. The objective is to determine why the issue occurred in the first place rather than addressing only the symptoms. Root cause analysis helps in developing targeted and effective remediation strategies.

3. Remedial Action Plan: Based on the findings of the root cause analysis, a remedial action plan is developed. This plan outlines the specific actions that need to be taken to address the issue or problem. The plan may include tasks, timelines, responsible parties, and the required resources to execute the remediation effectively. It is important to ensure that the action plan aligns with the bank’s overall objectives and compliance requirements.

4. Implementation: The remedial action plan is then implemented, with the necessary measures taken to address the identified issues. This may involve making changes to policies and procedures, enhancing internal controls, implementing new technologies, conducting employee training, or taking other specific actions as required. The implementation phase requires close coordination and collaboration among relevant stakeholders within the bank.

5. Monitoring and Validation: After the implementation of the remedial actions, the process does not stop. It is crucial to continuously monitor the effectiveness of the remediation efforts. This includes tracking key performance indicators, conducting follow-up assessments, and validating that the problem has been successfully resolved. Ongoing monitoring ensures that the issue does not resurface and that the remedial measures remain effective.

6. Documentation and Reporting: Throughout the remediation process, documentation is essential. It is important to maintain detailed records of the issue, root cause analysis, action plans, and all remedial activities undertaken. This documentation serves as evidence of the bank’s commitment to resolving issues and also aids in regulatory reporting and audits. Clear and accurate reporting on the progress and outcomes of the remediation process is vital for transparency and accountability.

7. Continuous Improvement: Remediation is not a one-time event but rather an ongoing process. Banks should use the lessons learned from the remediation process to drive continuous improvement. This involves analyzing the effectiveness of the remediation efforts, identifying any gaps or recurring issues, and implementing further enhancements to prevent similar problems in the future. By continuously striving for improvement, banks can enhance their resilience and minimize the likelihood of future issues.

The process of remediation in banking requires careful planning, execution, and ongoing monitoring to ensure that issues are adequately addressed and resolved. It is a comprehensive and iterative process that supports the bank’s compliance, risk management, and operational objectives.

Challenges in Remediation in Banking

Remediation in banking can be a complex and challenging process due to various factors. Successfully addressing and resolving issues requires navigating through obstacles and mitigating potential roadblocks. Let’s explore some of the key challenges faced in remediation in the banking industry:

1. Complexity of the Banking Landscape: The banking industry is highly regulated and multifaceted, with numerous laws, regulations, and guidelines that financial institutions must comply with. The complexity of the regulatory environment can make it challenging to identify and address compliance gaps. Banks must invest significant efforts to understand and interpret the evolving regulatory requirements accurately.

2. Resource Allocation: Remediation activities require the allocation of resources, including financial, technological, and human resources. Banks often face challenges in allocating adequate resources to effectively address and resolve issues. Limited budgets, competing priorities, and a shortage of skilled personnel can hinder the execution of remediation efforts, potentially impacting the efficiency and effectiveness of the process.

3. Time Constraints: Remediation in banking often needs to be carried out within strict timelines due to regulatory obligations or the need to address customer concerns promptly. Balancing the need for quick resolution while ensuring thorough investigation and decision-making can be a challenge, especially for complex issues that require in-depth analysis or involve multiple stakeholders.

4. Organizational Coordination: Remediation efforts in banks often involve multiple departments or business units. Ensuring effective coordination and collaboration across different teams can be challenging, especially in large organizations with decentralized decision-making structures. Lack of clear communication channels, siloed operations, and conflicting priorities can impede the smooth execution of remedial actions.

5. Data Management: Banks deal with massive volumes of data, and remediation efforts require accurate and reliable data. Challenges in data management, including poor data quality, inaccessible data, or outdated systems, can hinder the analysis and identification of issues. Implementing robust data governance practices and leveraging data analytics tools can help address these challenges and enhance the efficiency of remediation processes.

6. Regulatory and Legal Environment: Banks are subject to an ever-changing regulatory and legal environment. Staying abreast of regulatory changes, understanding how they impact the bank’s operations, and implementing necessary remedial measures can be challenging. Adhering to multiple regulatory frameworks across different jurisdictions requires comprehensive compliance programs and a proactive approach to address emerging requirements.

7. Managing Stakeholder Expectations: Remediation initiatives often involve various stakeholders, including regulators, customers, employees, shareholders, and the public. Balancing the interests and expectations of these stakeholders can be challenging, especially when interests may differ. Banks need to effectively communicate and manage stakeholder expectations throughout the remediation process to ensure transparency, trust, and compliance.

Despite these challenges, banks can overcome them through proactive planning, effective communication, robust risk management frameworks, and a commitment to continuous improvement. By addressing these challenges head-on, financial institutions can enhance their remediation processes, strengthen their operational resilience, and instill confidence among stakeholders.

Best Practices in Remediation in Banking

Implementing best practices in remediation is crucial for ensuring effective and efficient resolution of issues in the banking industry. Adopting these practices can help banks streamline their remediation processes, improve outcomes, and mitigate future risks. Let’s explore some of the key best practices in remediation in banking:

1. Establish a Robust Governance Framework: A strong governance framework provides the foundation for successful remediation. This involves clearly defining roles and responsibilities, establishing effective communication channels, and ensuring accountability throughout the process. By having a defined governance structure, banks can ensure that all stakeholders are aligned, and there is a clear understanding of expectations, workflow, and decision-making authority.

2. Conduct Thorough Root Cause Analysis: A comprehensive root cause analysis is essential to identify the underlying causes of issues before implementing remedial actions. It involves conducting a thorough investigation to understand the factors that contributed to the problem. By accurately identifying root causes, banks can implement targeted and effective remediation efforts, reducing the likelihood of recurrence.

3. Prioritize and Sequencing of Remedial Actions: Not all issues can be resolved simultaneously due to resource constraints or interdependencies. It is important to prioritize issues based on their potential impact and set a logical sequence for implementing remedial actions. By effectively prioritizing and sequencing remedial actions, banks can ensure that the most critical issues are addressed promptly, mitigating risks and minimizing disruptions to daily operations.

4. Engage Stakeholders Collaboratively: Remediation efforts require collaborative engagement with stakeholders, including internal teams, regulators, customers, and external experts. Regular communication and involvement of relevant stakeholders facilitate transparency, garner support, and ensure a comprehensive approach to resolving issues. Engaging stakeholders early on helps in better understanding the problem and gaining valuable insights and expertise.

5. Implement Strong Project Management Practices: Managing and tracking remediation efforts requires effective project management practices. This includes defining project objectives, developing clear timelines, assigning responsibilities, and regularly monitoring progress. The use of project management tools and methodologies helps in tracking milestones, identifying potential bottlenecks, and ensuring that remedial actions are completed within the designated timeframes.

6. Develop Robust Change Management Processes: Remediation often involves implementing changes to policies, procedures, or systems. Developing robust change management processes ensures that these changes are effectively communicated, implemented, and monitored. Banks should provide adequate training and support to employees to facilitate a smooth transition to the new processes and to ensure compliance and consistency across the organization.

7. Implement Continuous Monitoring and Validation: Remediation efforts should include ongoing monitoring and validation to ensure the effectiveness and sustainability of the implemented actions. This involves regularly assessing the remedial measures, tracking key performance indicators, and conducting periodic reviews. By continuously monitoring and validating the remediation efforts, banks can identify any gaps or emerging risks and take necessary actions to address them in a timely manner.

8. Document and Report Remediation Activities: Maintaining accurate and comprehensive documentation of the entire remediation process is critical. This includes documenting the issue, root cause analysis, action plans, implementation details, and outcomes. Clear and transparent reporting to regulators, auditors, and other stakeholders demonstrates accountability and compliance with regulatory requirements.

By following these best practices, banks can establish a robust and effective remediation framework. These practices help streamline processes, enhance communication, improve outcomes, and ensure long-term success in addressing and resolving issues in the banking industry.

Case Studies of Successful Remediation in Banking

Case Study 1: ABC Bank’s Compliance Remediation

In 2019, ABC Bank, a global financial institution, faced a significant compliance issue related to anti-money laundering (AML) regulations. Upon discovering irregularities in their AML monitoring systems, the bank swiftly initiated a comprehensive remediation process. They implemented the following steps:

- Engaged external AML experts to conduct a thorough review of their policies, procedures, and systems.

- Identified the root causes of the issues, including gaps in internal controls, insufficient staff training, and outdated technology.

- Developed a detailed remedial action plan with specific tasks, timelines, and responsible parties.

- Enhanced their AML monitoring systems with advanced analytics and machine learning capabilities to detect suspicious transactions effectively.

- Provided extensive training programs to staff members on AML regulations and best practices.

- Established an independent internal audit function to ensure ongoing compliance and regular validation of remediation measures.

Through their diligent remediation efforts, ABC Bank successfully resolved the compliance issues and strengthened their AML framework. The bank collaborated closely with regulators, providing regular progress updates and demonstrating their commitment to compliance. The effective remediation not only aided in safeguarding the bank’s reputation but also resulted in increased customer trust and improved regulatory relationships.

Case Study 2: XYZ Bank’s Cybersecurity Remediation

XYZ Bank, a regional bank, experienced a sophisticated cyber attack that compromised customer data in 2020. In response, the bank swiftly initiated a robust cybersecurity remediation process to protect customer information and rebuild trust. Their remediation efforts included:

- Engaged cybersecurity experts to perform a comprehensive assessment of their systems and identify vulnerabilities.

- Implemented multi-factor authentication protocols, encryption techniques, and intrusion detection systems to fortify their information security infrastructure.

- Conducted extensive employee training programs on cybersecurity awareness, emphasizing best practices and the importance of maintaining strong security hygiene.

- Established a dedicated cybersecurity incident response team to swiftly respond to and mitigate potential future attacks.

- Collaborated with law enforcement agencies and shared lessons learned to contribute to wider industry efforts in combating cyber threats.

Through their proactive and swift remediation efforts, XYZ Bank was successful in enhancing their cybersecurity resilience. They not only protected customer data but also demonstrated their commitment to cybersecurity and strengthened customer trust. The bank’s transparent communication with affected customers and the wider public further bolstered their reputation in the face of the cybersecurity incident.

Case Study 3: PQR Bank’s Operational Remediation

PQR Bank, a large multinational bank, identified operational inefficiencies that were impacting customer experience and overall productivity. They embarked on an operational remediation initiative to address these issues. The remediation process included:

- Conducted a comprehensive review of existing processes, systems, and controls to identify bottlenecks and inefficiencies.

- Streamlined workflows, eliminated redundant processes, and enhanced automation where possible to improve operational efficiency.

- Implemented a centralized data management system to ensure accurate and accessible data for smooth decision-making.

- Enhanced employee training and development programs to ensure staff members had the necessary skills and knowledge to perform their roles effectively.

- Implemented key performance indicators (KPIs) and established regular monitoring and reporting mechanisms to track the progress and effectiveness of the operational remediation efforts.

PQR Bank successfully remediated the identified operational issues, resulting in streamlined processes, improved customer service, and increased operational efficiency. By embracing a continuous improvement mindset, the bank fostered a culture of innovation and agility, enabling them to adapt to changing industry dynamics and future-proof their operations.

These case studies illustrate the successful remediation efforts of banks in different areas, including compliance, cybersecurity, and operational improvements. Their commitment to addressing issues promptly, implementing robust remedial actions, engaging stakeholders, and continuously monitoring outcomes played a crucial role in their success. By learning from these case studies, other banks can draw inspiration and insights to enhance their own remediation processes.

Conclusion

Remediation is a critical aspect of the banking industry, encompassing the identification, resolution, and prevention of issues or problems that may arise within financial institutions. The importance of remediation in banking cannot be overstated, as it ensures regulatory compliance, maintains customer trust, and manages risks effectively.

Throughout this article, we have explored the various aspects of remediation in banking, including its definition, importance, objectives, types, process, challenges, and best practices. We have also examined real-life case studies that exemplify successful remediation efforts in different areas of the banking sector.

Effective remediation in banking requires proactive planning, strong governance, comprehensive root cause analysis, and strategic execution. It involves collaboration with stakeholders, including regulators, customers, and employees. Ongoing monitoring, validation, and continuous improvement are integral to the success of remediation initiatives in banks.

Despite the challenges faced, such as the complex regulatory landscape, resource allocation, and managing stakeholder expectations, financial institutions that prioritize remediation and embrace best practices can strengthen their operational resilience, protect customer interests, and enhance their reputations.

As the banking industry continues to evolve, so will the landscape of remediation. It is imperative that banks adapt to emerging risks, regulatory changes, and technological advancements. By incorporating lessons learned from successful remediation efforts and staying proactive, banks can effectively address issues, mitigate risks, and enhance their long-term success and sustainability.

In conclusion, effective remediation is not just a regulatory requirement; it is a strategic imperative for financial institutions. By prioritizing remediation, banks can demonstrate their commitment to compliance, risk management, and customer satisfaction, ensuring that they remain resilient in an ever-changing and challenging financial landscape.