Finance

What Is CDD In Banking

Published: October 11, 2023

Learn about the significance of CDD in banking and its impact on finance. Explore how this crucial process ensures compliance and mitigates risks within the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking, where financial institutions play a crucial role in managing and safeguarding the assets of individuals and businesses. Behind the scenes, banks employ various measures to ensure the integrity of their operations and protect against illicit activities such as money laundering, fraud, and terrorism financing. One of the key components in this effort is Customer Due Diligence (CDD).

CDD refers to the process by which banks gather and verify information about their customers to assess the level of risk they may pose. It involves obtaining relevant identification and financial documents, conducting background checks, and evaluating the suitability and legitimacy of customer relationships. The ultimate goal of CDD is to mitigate risks, maintain compliance with regulatory requirements, and foster trust and transparency in the banking industry.

In recent years, CDD has gained significant importance due to the increasing complexity and sophistication of financial crimes. With rapid advancements in technology and the globalization of the banking sector, criminals are finding new ways to exploit the system. As a result, banks must constantly adapt and enhance their CDD processes to stay ahead of these evolving threats.

As a regulation-driven practice, CDD is not only essential for protecting banking institutions but also for safeguarding the overall financial system. By conducting thorough due diligence on their customers, banks can contribute to the prevention of money laundering, the financing of terrorism, and other illicit activities that can have far-reaching consequences for the economy and society as a whole.

In the following sections, we will explore the importance of CDD in banking, its objectives, components, and the challenges faced in its implementation. We will also delve into the regulatory framework surrounding CDD and discuss best practices that banks can adopt to strengthen their due diligence processes.

Definition of CDD

Customer Due Diligence (CDD) is a process used by banks and other financial institutions to identify and verify the identity of their customers. It involves gathering information about customers, assessing the risks they pose, and ensuring compliance with regulatory requirements. The objective of CDD is to understand the nature of the customer’s business, the source of their funds, and to detect any potential red flags or suspicious activities.

CDD is a critical part of the Know Your Customer (KYC) framework, which acts as the first line of defense against financial crimes. KYC regulations aim to ensure that banks have a comprehensive understanding of their customers’ profiles, including their identity, background, and financial activities, in order to prevent money laundering, terrorist financing, fraud, and other illicit activities.

There are three main components of CDD:

- Customer Identification: Banks are required to collect and verify documents such as a customer’s identification card, passport, or driver’s license. This is to establish the identity and legal existence of the customer and any associated entities.

- Customer Verification: Once the customer’s identity is established, banks must verify the information provided. This may involve cross-referencing the information with trusted databases, conducting background checks, and verifying the customer’s address, employment, and other relevant details.

- Risk Assessment: Banks need to assess the level of risk associated with each customer. The risk assessment takes into account factors such as the customer’s business activities, geographic location, sources of income, and the overall reputation of the customer. This allows banks to determine the appropriate level of due diligence required and to identify any potential high-risk customers.

By conducting thorough CDD, banks can identify and mitigate potential risks early on, ensuring the integrity of their operations and protecting themselves and their customers from financial crimes. It is a proactive measure that demonstrates a bank’s commitment to maintaining a strong compliance culture and upholding the highest standards of ethical conduct.

Importance of CDD in Banking

Customer Due Diligence (CDD) plays a crucial role in the banking industry, as it helps financial institutions mitigate risks, uphold regulatory compliance, and safeguard their reputation. Here are several key reasons why CDD is of utmost importance in banking:

- Risk Mitigation: Conducting CDD allows banks to assess the level of risk associated with each customer. By gathering relevant information and conducting thorough background checks, banks can identify any red flags or suspicious activities. This helps in preventing money laundering, fraud, terrorist financing, and other financial crimes. CDD allows banks to identify and mitigate potential risks early on, reducing the likelihood of financial loss and reputational damage.

- Regulatory Compliance: CDD is an essential requirement mandated by regulatory bodies worldwide. Financial institutions are legally obligated to comply with Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and other relevant regulations. Failure to comply with these regulations can result in severe penalties, fines, and damage to the institution’s reputation. By implementing robust CDD practices, banks can demonstrate their commitment to regulatory compliance and avoid legal consequences.

- Preventing Fraud: CDD helps banks identify and prevent fraudulent activities. By verifying the identity and legitimacy of customers, banks can detect and deter fraudsters who may attempt to use false identities or engage in fraudulent transactions. CDD also assists banks in identifying patterns of fraudulent behavior and implementing measures to protect their customers and the financial system as a whole.

- Protecting the Financial System: Financial crimes, such as money laundering and terrorist financing, pose significant risks to the stability and integrity of the financial system. By implementing robust CDD practices, banks contribute to the overall protection of the financial system. CDD helps to ensure that illicit funds are not channeled through the banking system and that reputable banking services are not abused for illegal activities. This contributes to the stability and trustworthiness of the financial sector.

- Enhancing Customer Trust: Implementing a robust CDD process helps build trust between banks and their customers. By demonstrating a commitment to protecting customer interests and preventing financial crimes, banks can enhance their reputation and strengthen customer relationships. Customers are more likely to trust banks that prioritize their security and comply with regulatory requirements, ultimately leading to long-term customer loyalty.

In summary, CDD is essential in banking to mitigate risks, comply with regulatory requirements, prevent fraud, protect the financial system, and foster customer trust. It is a vital component of a comprehensive risk management framework and an integral part of maintaining the integrity of the banking industry.

Objectives of CDD in Banking

Customer Due Diligence (CDD) in the banking industry serves several important objectives, aimed at ensuring compliance with regulations, mitigating risks, and maintaining the integrity of the banking system. Here are the key objectives of CDD:

- Identify and Verify Customer Identity: The primary objective of CDD is to accurately identify and verify the identity of customers. Banks need to establish the true identity of their customers to prevent identity theft, fraudulent activities, and the use of the financial system for illicit purposes. By collecting and verifying identification documents, banks can ensure that the customer is who they claim to be.

- Assess Customer Risk: Another objective of CDD is to assess the level of risk associated with each customer. This involves evaluating factors such as the nature of the customer’s business, sources of funds, geographic location, and the overall reputation of the customer. By conducting risk assessments, banks can determine the intensity of due diligence required and allocate resources accordingly.

- Detect Suspicious Activities: CDD aims to detect and prevent suspicious activities such as money laundering, fraud, and terrorist financing. By analyzing customer profiles and transaction patterns, banks can identify any unusual or suspicious activities that may indicate potential illicit activities. Recognizing these red flags allows banks to investigate further and take appropriate actions to mitigate risks.

- Comply with Regulatory Requirements: CDD is a compliance-driven process, and one of its objectives is to ensure banks adhere to regulatory requirements. Banks must comply with Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and other relevant regulations. CDD helps banks meet these obligations by maintaining a robust due diligence process, conducting ongoing monitoring, and promptly reporting any suspicious transactions.

- Protect the Bank’s Reputation: Maintaining a strong reputation is crucial for banks to attract customers and maintain stakeholder confidence. CDD plays a vital role in protecting a bank’s reputation by preventing involvement in illicit activities, fraud, and money laundering scandals. By implementing rigorous customer due diligence measures, banks can demonstrate their commitment to ethical and responsible banking practices.

- Contribute to the Stability of the Financial System: CDD ultimately aims to contribute to the stability and integrity of the broader financial system. By identifying and preventing money laundering, terrorist financing, and other financial crimes, CDD helps preserve the trustworthiness and soundness of the financial sector. It also assists in promoting economic growth by ensuring that legitimate funds flow through the banking system.

Overall, the objectives of CDD in banking are to establish customer identity, assess risk, detect suspicious activities, comply with regulations, protect the bank’s reputation, and contribute to the stability of the financial system. By fulfilling these objectives, banks can ensure a safe and secure environment for their customers and maintain their standing as trusted institutions in the financial industry.

Components of CDD in Banking

Customer Due Diligence (CDD) in the banking industry consists of several key components that contribute to the thorough assessment and understanding of customers. These components ensure that banks gather and verify the necessary information to assess the risks associated with each customer. The following are the key components of CDD:

- Customer Identification: The first component of CDD is the identification of the customer. Banks must collect and verify identification documents, such as a customer’s passport, national ID card, or driver’s license. This step is crucial in establishing the customer’s true identity and ensuring they are not using false or stolen identities.

- Customer Verification: Once the customer’s identity is established, the next step is to verify the information provided. Banks may use reliable sources or databases to cross-reference the customer’s details, including their name, date of birth, address, and other identifying information. Customer verification helps confirm the authenticity of the provided information and reduces the risk of fraudulent activities.

- Source of Funds Verification: CDD requires banks to verify the source of a customer’s funds. This involves obtaining information on the income, assets, and financial background of the customer. Banks may request documentation such as bank statements, tax returns, business registrations, and employment contracts to establish the legitimacy of the customer’s funds and ensure they are not derived from illegal activities.

- Beneficial Ownership: Another important component of CDD is identifying the beneficial owners of the customer entity. Banks need to dig deeper to uncover the individuals who ultimately own or control the customer’s business. This information helps assess potential risks and prevents the misuse of the financial system for illicit activities by undisclosed parties.

- Customer Risk Assessment: Risk assessment is a critical component of CDD. Banks need to analyze and assess the level of risk associated with each customer. This involves considering factors such as the customer’s geographic location, nature of business, reputation, and the presence of any red flags or suspicious activities. Based on the risk assessment, banks can determine the appropriate level of due diligence required and the ongoing monitoring necessary for each customer.

- Ongoing Monitoring: CDD is not a one-time process; it requires continuous monitoring of customer activities. Banks need to keep a close eye on transactions, account behavior, and any changes in customer circumstances that may indicate potential risks. Ongoing monitoring assists in detecting any suspicious activities promptly and ensures that customer profiles remain up-to-date.

By incorporating these components into their CDD process, banks can obtain a comprehensive understanding of their customers and make informed decisions regarding account opening, ongoing relationships, and risk management. This holistic approach to CDD helps banks identify and mitigate risks, maintain regulatory compliance, and protect themselves and their customers from financial crimes.

The CDD Process in Banking

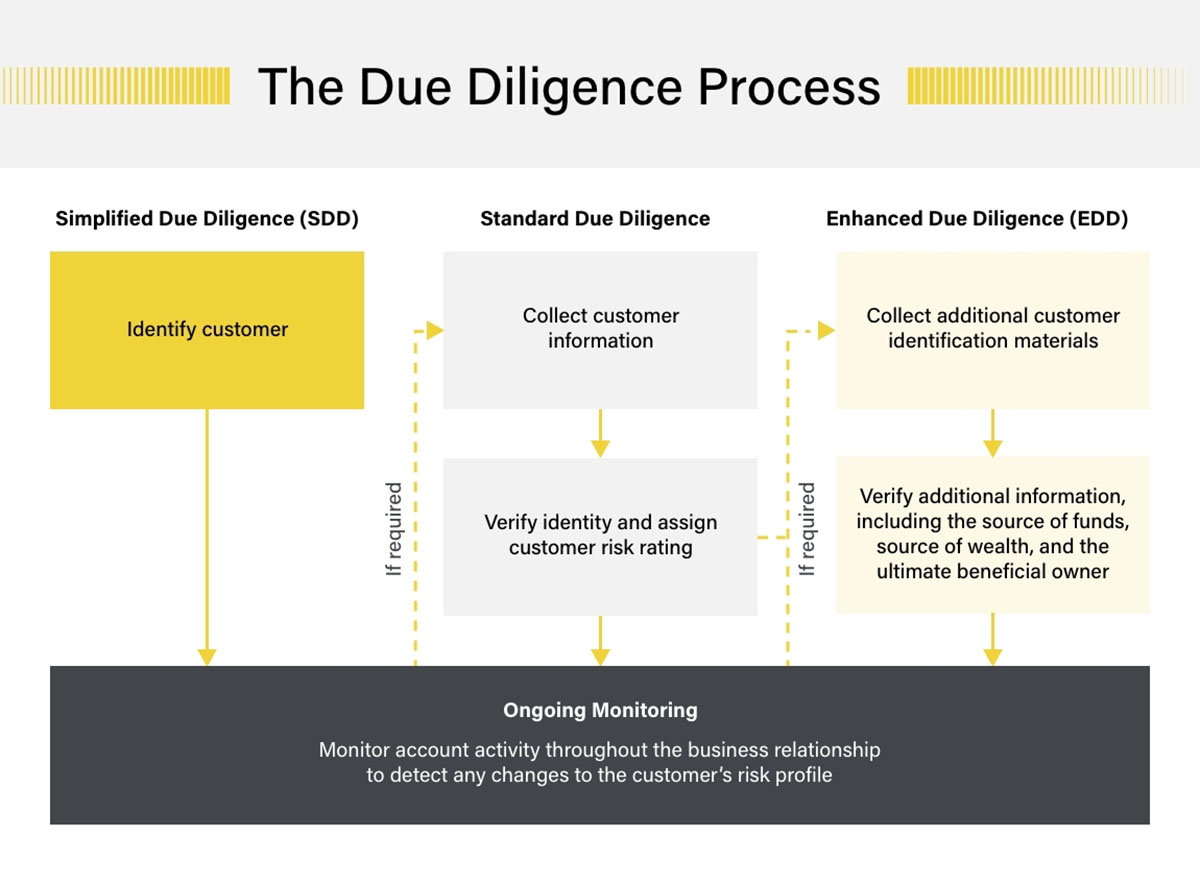

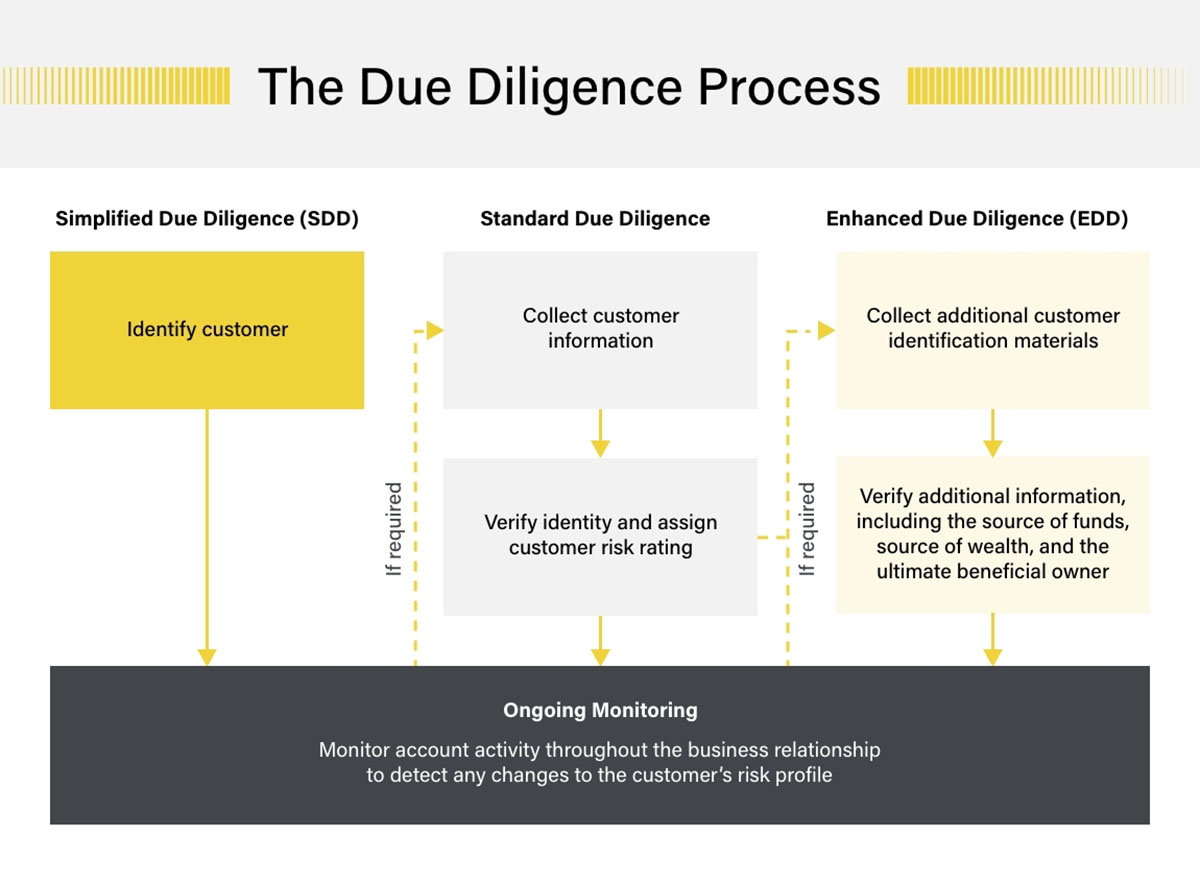

The Customer Due Diligence (CDD) process in banking involves a series of steps and procedures that banks follow to gather information, assess risks, and ensure compliance with regulatory requirements. The CDD process is designed to establish the identity of customers, verify the authenticity of their financial activities, and detect any potential red flags or suspicious transactions. The following are the typical steps involved in the CDD process:

- Customer Onboarding: The CDD process begins when a customer seeks to establish a relationship with the bank. The bank collects necessary information and documentation from the customer, including identification documents, proof of address, and other relevant details. This step helps establish the customer’s identity and lays the foundation for the subsequent steps.

- Customer Identification: In this step, the bank verifies the customer’s identity by examining and authenticating the provided identification documents. This helps ensure that the customer is not using false or stolen identities and establishes the legal existence of the customer entity.

- Customer Risk Assessment: Once the customer’s identity is established, the bank assesses the level of risk associated with that customer. This involves analyzing factors such as the nature of the customer’s business, geographic location, source of funds, and previous banking relationships. The objective is to gauge the potential risk of money laundering, fraudulent activities, or involvement in other illicit activities.

- Source of Funds Evaluation: Banks have a responsibility to verify the source of a customer’s funds to prevent money laundering or the financing of terrorism. This step involves examining the customer’s financial records, bank statements, tax returns, and other relevant documents to ensure that the funds are obtained legitimately and are not derived from illegal activities.

- Ongoing Monitoring: CDD is not a one-time event; it is an ongoing process. Banks are required to continuously monitor customer accounts and transactions to identify any suspicious activities, changes in risk profile, or anomalies. This ongoing monitoring helps detect any red flags and ensures that customer profiles remain up-to-date and reflective of their current activities.

- Enhanced Due Diligence (EDD): In certain cases, where customers pose a higher risk, banks may need to conduct enhanced due diligence. This involves conducting more extensive background checks, gathering additional information, and implementing stricter controls on the customer’s account. EDD is typically applied to customers with complex ownership structures, politically exposed persons (PEPs), or customers from high-risk jurisdictions.

The CDD process is guided by regulatory requirements and the internal policies and procedures of the bank. It is important for banks to ensure that their CDD process is robust, well-documented, and consistently implemented across all customer relationships. By effectively executing the CDD process, banks can mitigate risks, protect against financial crimes, and foster trust and transparency in the banking sector.

Techniques for Conducting CDD

When it comes to conducting Customer Due Diligence (CDD) in the banking industry, there are various techniques and methods that banks can employ to gather information, assess risks, and ensure compliance. These techniques help banks effectively carry out the CDD process and make informed decisions regarding customer relationships. The following are some common techniques for conducting CDD:

- Document Collection: Banks rely on documents to gather essential information about their customers. These documents include identification cards, passports, utility bills, bank statements, business licenses, and other relevant paperwork. Banks must collect and verify these documents to establish the identity of the customer, assess risk, and ensure compliance with regulatory requirements.

- Customer Interviews: Direct communication with the customer through interviews or questionnaires is another technique employed in CDD. Banks may conduct face-to-face or remote interviews to clarify information, understand the customer’s background, and assess the legitimacy of their business activities. Interviews can provide valuable insights and help banks detect any potential red flags or inconsistencies.

- Database Checks: Banks often use trusted databases and screening tools to conduct checks on customers. These databases include government databases, sanction lists, PEP (Politically Exposed Person) lists, and other reliable sources. Screening against these databases helps banks identify any individuals or entities that may pose a higher risk due to their involvement in financial crimes or political positions.

- Third-Party Services: Banks may leverage the services of third-party providers specializing in identity verification, risk assessment, and background checks. These services can provide access to broader databases, artificial intelligence algorithms, and enhanced verification techniques. Utilizing third-party services can increase the efficiency and effectiveness of the CDD process while maintaining compliance with regulatory requirements.

- Data Analytics: Advanced data analytics and artificial intelligence technologies can be utilized to analyze customer data and transaction patterns. By employing these techniques, banks can identify unusual or suspicious activities, detect potential money laundering or fraud, and promptly address any deviations from the customer’s normal behavior. Data analytics enhances the overall effectiveness of the CDD process by providing insights and automating certain aspects of risk assessment.

- Expert Knowledge and Judgment: A highly effective technique in the CDD process is the expertise and judgment of experienced professionals in the banking institution. These professionals possess intricate knowledge of risk factors, red flags, and suspicious indicators. They can assess the legitimacy of customer transactions, evaluate complex ownership structures, and apply their expertise to make informed decisions. Expert knowledge is invaluable in detecting potential risks and ensuring the thoroughness of the CDD process.

It is important for banks to adopt a risk-based approach and employ the appropriate techniques based on the risk profile of each customer. The combination of document collection, customer interviews, database checks, third-party services, data analytics, and expert judgment ensures that banks gather the necessary information, assess risks accurately, and comply with regulatory requirements. Implementing these techniques helps banks enhance the effectiveness of their CDD processes and mitigate the risks posed by money laundering, fraud, and other illicit activities.

Challenges in Implementing CDD in Banking

Implementing Customer Due Diligence (CDD) in the banking industry comes with its fair share of challenges. While CDD is critical for mitigating risks, ensuring compliance, and protecting against financial crimes, several obstacles can make its implementation complex and demanding. The following are some of the challenges banks face when implementing CDD:

- Complex Customer Structures: Customers often have complex ownership structures, involving multiple entities and stakeholders. Unraveling and understanding these structures can be challenging, especially when customers operate across different jurisdictions or have offshore accounts. Banks must dedicate additional resources and expertise to ensure they thoroughly comprehend the ownership and control dynamics of their customers.

- Changing Regulations and Compliance Requirements: The regulatory landscape in the banking industry is continuously evolving. Keeping up with changing regulations and compliance requirements poses a challenge for banks. They must adapt their CDD processes to align with new laws, guidelines, and industry standards. Staying aware of the latest regulatory developments and integrating them into their operations requires ongoing efforts and a commitment to staying updated.

- Balancing Risk and Customer Experience: Striking a balance between conducting thorough CDD and delivering a seamless customer experience is a constant challenge. Customers expect banks to provide efficient and convenient services, but robust CDD processes may add complexity and time to onboarding and account opening procedures. Banks must find ways to streamline the CDD process without compromising risk assessment accuracy or regulatory compliance.

- Data Quality and Integrity: The effectiveness of CDD relies heavily on accurate and reliable data. Banks must ensure the quality and integrity of the data they collect and use for risk assessment. However, data discrepancies, outdated information, and unreliable sources can undermine the accuracy of CDD outcomes. Banks must invest in data validation processes, data management systems, and mechanisms to address data quality issues to maintain the effectiveness of their CDD efforts.

- Technological Advancements and Data Security: Rapid technological advancements introduce both opportunities and challenges in implementing CDD. While advanced technologies such as artificial intelligence and data analytics can enhance the efficiency and effectiveness of CDD, they also present data security risks. Banks must ensure the privacy and security of customer data and have appropriate safeguards in place to prevent data breaches and unauthorized access.

- Resource Allocation: Conducting thorough CDD requires significant resources, including human resources, technology, and infrastructure. Allocating resources effectively and ensuring their efficient utilization can be a challenge. Banks must strike a balance between resource allocation and risk management needs, considering the varying risk profiles of customers and optimizing resource utilization for effective CDD implementation.

By acknowledging these challenges, banks can proactively address them and develop strategies to overcome them. This may involve employing advanced technologies, enhancing staff training and expertise, staying updated on regulatory changes, and leveraging partnerships with external service providers to augment their CDD capabilities. Overcoming these challenges is crucial for banks to establish robust CDD frameworks that effectively mitigate risks and maintain compliance in an ever-changing banking landscape.

Regulatory Framework for CDD in Banking

Customer Due Diligence (CDD) in the banking industry operates within a comprehensive regulatory framework aimed at combating money laundering, terrorist financing, fraud, and other financial crimes. Regulatory authorities worldwide have established guidelines, laws, and regulatory frameworks to ensure that banks implement robust CDD processes. The following are key components of the regulatory framework for CDD in banking:

- Anti-Money Laundering (AML) Regulations: AML regulations are at the core of the CDD framework. These regulations require banks to establish and maintain effective policies, procedures, and controls to prevent money laundering activities. They include requirements for customer identification, ongoing monitoring, and training programs for bank staff. AML regulations also mandate reporting suspicious transactions to the relevant authorities.

- Know Your Customer (KYC) Requirements: KYC requirements stipulate that banks should have a comprehensive understanding of their customers and their financial activities. This includes verifying customer identities, assessing customer risks, and conducting ongoing monitoring. KYC regulations aim to enhance transparency, combat financial crime, and prevent the misuse of the banking system for illicit activities.

- Counter-Terrorist Financing (CTF) Measures: CTF measures are designed to prevent funds from being used to finance terrorism. Banks must assess and identify any potential links between their customers and terrorist organizations or individuals involved in terrorist activities. CTF measures are closely aligned with AML and KYC requirements and aim to detect and prevent the financing of terrorism through the banking system.

- Politically Exposed Persons (PEP) Regulations: PEP regulations require banks to exercise enhanced due diligence when dealing with individuals who hold prominent public positions or are closely associated with them. PEPs have an increased potential risk for corruption, bribery, and money laundering. Banks must conduct thorough background checks and ongoing monitoring to mitigate the risks associated with PEP relationships.

- Data Privacy and Protection Laws: Data privacy and protection laws govern the handling and storage of customer data. These laws ensure that banks collect, process, and store customer information securely and responsibly. Banks must obtain customer consent for data collection, implement appropriate security measures, and adhere to data protection regulations within their jurisdiction.

- International Standards and Collaboration: International organizations such as the Financial Action Task Force (FATF) set global standards and provide guidance for AML and CDD practices. Banks are encouraged to adopt these standards and collaborate with regulatory authorities and other financial institutions to combat financial crimes effectively. International cooperation is vital for ensuring consistent CDD practices and aligning efforts in the global fight against money laundering and terrorist financing.

To comply with the regulatory framework for CDD, banks must establish robust policies, procedures, and controls that reflect the requirements set by regulatory authorities. Banks must also ensure ongoing training and education for staff, implement advanced technologies for customer identification and monitoring, and maintain a culture of compliance throughout the organization. Compliance with the regulatory framework is essential to uphold the integrity of the banking sector, protect against financial crimes, and maintain public trust in the financial system.

Best Practices for CDD in Banking

Implementing effective Customer Due Diligence (CDD) practices is crucial for banks to mitigate risks, ensure compliance, and protect against financial crimes. By adopting best practices, banks can enhance the efficiency and effectiveness of their CDD processes. The following are some key best practices for CDD in banking:

- Risk-Based Approach: Banks should adopt a risk-based approach to CDD, where the level of diligence is commensurate with the risk associated with each customer. This involves identifying risk factors, assessing risks, and tailoring the CDD process accordingly. This approach helps banks allocate resources effectively and focus on high-risk customers who require enhanced due diligence.

- Culture of Compliance: Establishing a strong culture of compliance is essential. This involves promoting a sense of responsibility and commitment to adherence to regulatory requirements throughout the organization. Staff should receive regular training on AML and CDD practices, and compliance expectations should be clearly communicated to all employees.

- Robust Policies and Procedures: Banks must establish robust policies and procedures for CDD. These should be well-documented, regularly reviewed, and updated to align with changing regulatory requirements. Clear guidelines should be provided on customer identification, ongoing monitoring, reporting of suspicious transactions, and other relevant CDD processes.

- Investment in Technology: Banks should leverage advanced technologies to enhance CDD processes. This includes incorporating data analytics, artificial intelligence, and machine learning to automate certain aspects of CDD, improve risk assessment accuracy, and streamline operations. Investing in efficient and secure technologies helps banks identify red flags, detect suspicious activities, and ensure compliance with regulatory requirements.

- Information Sharing and Collaboration: Banks should collaborate with regulatory authorities, industry bodies, and other financial institutions to share information and insights on emerging risks and best practices. This information sharing helps banks stay current with regulatory changes, gain industry intelligence, and strengthen their ability to combat financial crimes collectively.

- Ongoing Monitoring: CDD is an ongoing process, and banks should establish systems and processes for continuous monitoring of customer transactions and risk profiles. This includes implementing transaction monitoring tools, setting up alerts for suspicious activities, conducting periodic reviews of customer relationships, and updating customer profiles as necessary.

- Continuous Staff Training: Banks must provide regular and comprehensive training to their employees on CDD practices, regulatory requirements, and emerging risks. Training programs should be tailored to the specific roles and responsibilities of staff, ensuring that they are equipped with the knowledge and skills necessary to effectively fulfill their CDD obligations.

- Independent Audits and Reviews: Regular independent audits and reviews of the bank’s CDD processes are essential. These audits help identify gaps, assess the effectiveness of controls, and ensure that the CDD practices align with regulatory requirements. Audits provide valuable insights and recommendations for enhancing the CDD framework.

By implementing these best practices, banks can strengthen their CDD processes, mitigate risks, maintain regulatory compliance, and protect against financial crimes. CDD should be treated as an integral part of the overall risk management framework within banks, allowing them to safeguard their operations, protect their customers, and contribute to the stability and integrity of the banking industry as a whole.

Conclusion

Customer Due Diligence (CDD) is a critical process in the banking industry that plays a pivotal role in mitigating risks, ensuring compliance, and protecting against financial crimes. By implementing robust CDD practices, banks can establish a strong foundation for maintaining integrity, trust, and transparency in their operations.

CDD involves identifying and verifying customer identities, assessing risks, detecting suspicious activities, and complying with regulatory requirements. It is guided by a comprehensive regulatory framework that includes Anti-Money Laundering (AML) regulations, Know Your Customer (KYC) requirements, Counter-Terrorist Financing (CTF) measures, and data privacy and protection laws.

While implementing CDD in banking may present challenges such as complex customer structures, evolving regulations, and data security risks, banks can overcome these challenges by adopting best practices. These include taking a risk-based approach, fostering a culture of compliance, leveraging technology, and engaging in information sharing and collaboration.

By adhering to best practices, banks can enhance the effectiveness and efficiency of their CDD processes, ensuring accurate risk assessment, timely detection of suspicious activities, and strengthened compliance with regulatory requirements. This helps protect the bank and its customers from financial crimes, contributes to the stability of the financial system, and fosters trust and confidence in the banking industry.

In conclusion, CDD is not just a regulatory obligation; it is a fundamental pillar of responsible banking. By implementing robust CDD practices, banks can uphold ethical standards, protect against financial crimes, and maintain the integrity and trust that underpin the global financial system.