Finance

What Is The Highest Late Fee Allowed By Law

Published: February 22, 2024

Learn about the legal limits for late fees in finance. Understand the highest late fee allowed by law and its implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Late Fees: Navigating the Legal Landscape

Introduction

Late fees are a common aspect of financial transactions, often applied to credit card payments, loan repayments, rent, and various other contractual obligations. While these fees serve as a deterrent against late payments, they have also sparked debates regarding their legality and the maximum amount that can be charged. Understanding the legal framework surrounding late fees is crucial for both businesses and consumers to ensure compliance and fairness in financial transactions.

Late fees are typically outlined in the terms and conditions of a contract or agreement, specifying the penalty incurred for failing to meet payment deadlines. These fees are designed to encourage timely payments and compensate for the administrative costs and inconveniences associated with processing late payments. However, concerns arise when late fees become exorbitant, potentially imposing undue financial burdens on individuals who may already be facing economic challenges.

In this comprehensive guide, we will delve into the legal limitations on late fees, exploring the regulations that govern their application and the potential consequences of charging excessive fees. By shedding light on this often-misunderstood aspect of financial transactions, we aim to empower both businesses and consumers with the knowledge needed to navigate the complexities of late fees within the bounds of the law. Let's embark on a journey to unravel the intricacies of late fees and the legal landscape that governs them.

Understanding Late Fees: Navigating the Legal Landscape

Understanding Late Fees

Late fees, also known as penalty fees, are charges imposed for failing to make a payment by a specified due date. They are prevalent in various financial agreements, including credit card accounts, loan repayments, rent, and utility bills. Late fees serve as a deterrent against delayed payments and are intended to compensate for the additional administrative costs and inconveniences incurred by the creditor or service provider.

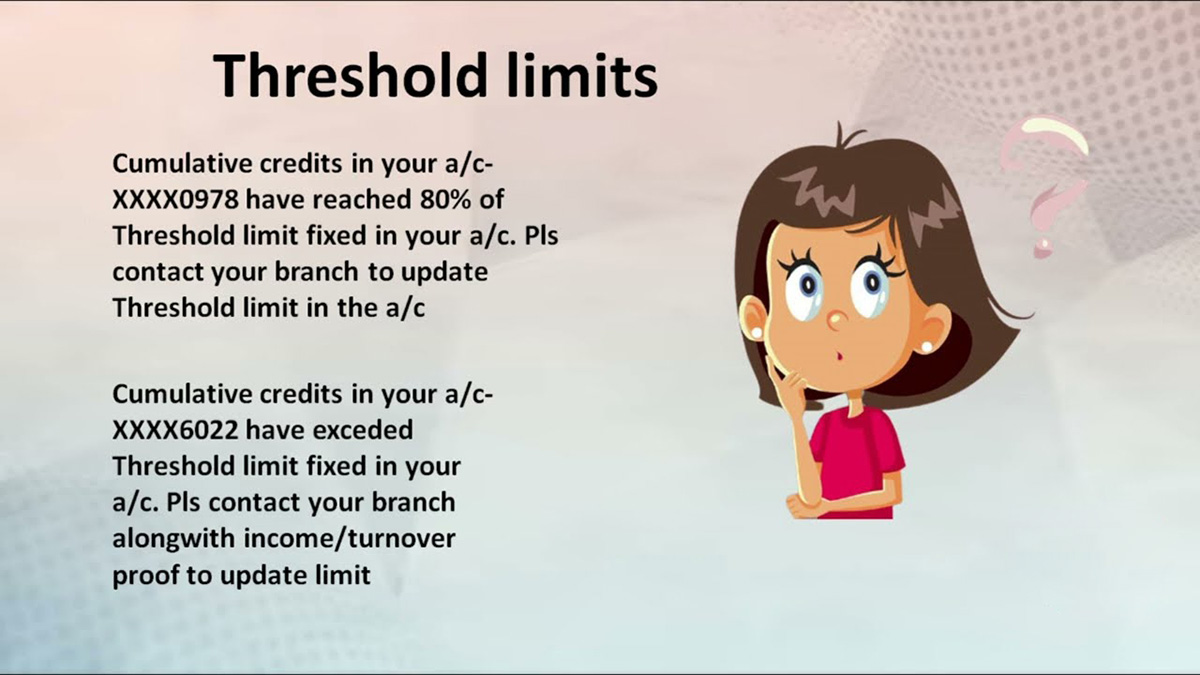

Typically, the terms and conditions of a contract outline the specifics of late fees, including the amount to be charged and the grace period allowed before the fee is imposed. While the imposition of late fees is a standard practice, the legality and maximum allowable amount of these fees are subject to regulatory oversight and may vary based on the jurisdiction and the nature of the financial agreement.

It is important for consumers to carefully review the terms of their financial contracts to understand the implications of late payments and the associated fees. Additionally, businesses must ensure that the late fees they impose adhere to legal requirements to avoid potential repercussions. By gaining a deeper understanding of late fees, both parties can navigate financial transactions with greater clarity and confidence.

Furthermore, the rationale behind late fees extends beyond compensation for delayed payments. These fees also play a vital role in promoting responsible financial behavior, encouraging timely payments, and discouraging delinquency. However, concerns arise when late fees exceed reasonable limits, potentially burdening consumers with disproportionately high penalties.

As we delve into the legal framework governing late fees, it becomes evident that a balanced approach is essential to ensure that late fees fulfill their intended purpose without unduly burdening individuals facing financial challenges. By exploring the nuances of late fees and their legal underpinnings, we can foster a more informed and equitable financial environment for both businesses and consumers.

Legal Limitations on Late Fees

While late fees are a common feature of financial agreements, their imposition is subject to legal constraints to prevent unfair practices and protect consumers from exorbitant penalties. The legal limitations on late fees are designed to ensure that the fees imposed are reasonable and proportionate to the actual costs incurred by the creditor or service provider due to the late payment.

Regulatory authorities and consumer protection laws often define the maximum allowable late fees that businesses can charge. These limitations aim to strike a balance between compensating for the administrative expenses associated with late payments and preventing the imposition of punitive fees that could place an undue burden on consumers.

It is important for businesses to be cognizant of the legal restrictions on late fees to avoid potential legal challenges and reputational damage. By adhering to the prescribed limitations, businesses can demonstrate their commitment to fair and transparent financial practices, fostering trust and goodwill among their customer base.

For consumers, understanding the legal limitations on late fees is crucial in asserting their rights and holding businesses accountable for any excessive fees imposed. Familiarizing themselves with the applicable regulations empowers consumers to challenge unfair late fees and seek recourse through legal channels if necessary.

Moreover, the legal limitations on late fees serve as a safeguard against predatory lending practices and exploitative financial arrangements. By establishing clear boundaries for late fee imposition, regulators aim to promote financial fairness and protect vulnerable consumers from unjust financial burdens.

While the specifics of legal limitations on late fees may vary across jurisdictions and types of financial agreements, the overarching goal is to ensure that late fees remain a reasonable and justified component of financial transactions, rather than a tool for imposing punitive measures on consumers.

As we navigate the landscape of late fees and their legal constraints, it becomes evident that a harmonious balance between the interests of businesses and the protection of consumer rights is essential. By upholding the prescribed legal limitations, businesses can cultivate a reputation for ethical conduct, while consumers can engage in financial transactions with confidence, knowing that they are shielded from unjustifiably high late fees.

State-Specific Regulations

In the United States, the regulations governing late fees are not only subject to federal laws but also to state-specific statutes that may further delineate the permissible limits and conditions for imposing late fees. While federal laws provide a framework for consumer protection, individual states have the authority to enact specific regulations tailored to their unique economic and social contexts.

State-specific regulations can significantly impact the maximum allowable late fees, grace periods, and other related provisions, thereby influencing the dynamics of financial transactions within each state. It is imperative for businesses operating across multiple states to familiarize themselves with the diverse regulatory landscape and ensure compliance with the applicable laws in each jurisdiction.

Consumers also benefit from state-specific regulations, as these laws may offer additional safeguards and recourse mechanisms in the event of unfair or excessive late fees. By understanding the nuances of late fee regulations in their respective states, consumers can assert their rights and seek redress if they encounter unjust practices.

Furthermore, state-specific regulations may encompass provisions related to disclosure requirements, ensuring that businesses transparently communicate the terms and conditions governing late fees to consumers. This transparency fosters trust and accountability, enabling consumers to make informed decisions regarding their financial commitments.

While the variation in state-specific regulations may present challenges for businesses operating nationally, it underscores the importance of meticulous compliance and a nuanced understanding of the legal frameworks in each state. By proactively addressing state-specific regulations, businesses can mitigate legal risks and demonstrate their commitment to ethical and lawful business practices.

As consumers and businesses navigate the intricacies of late fee regulations, it is essential to recognize the impact of state-specific laws on the dynamics of financial transactions. By embracing a nuanced understanding of these regulations, both parties can contribute to a financial landscape characterized by fairness, transparency, and legal compliance.

Consequences of Charging Excessive Late Fees

Charging excessive late fees can have far-reaching repercussions for both businesses and consumers, impacting financial stability, consumer trust, and legal compliance. When businesses impose late fees that exceed the legally permissible limits or are disproportionate to the actual costs incurred due to late payments, they risk facing a range of adverse consequences.

From a legal standpoint, charging excessive late fees can lead to regulatory scrutiny, potential fines, and legal disputes. Regulatory authorities and consumer protection agencies actively monitor the imposition of late fees to ensure compliance with applicable laws. Businesses found to be charging unjustifiably high late fees may face penalties and reputational damage, tarnishing their standing in the marketplace.

Moreover, excessive late fees can erode consumer trust and loyalty. When consumers perceive late fees as unfairly punitive or exploitative, they may opt to disengage from the business relationship, seek alternative providers, or vocalize their grievances through public forums and social media. This can result in reputational harm and a loss of customer goodwill, impacting the long-term sustainability of the business.

Financially, the imposition of excessive late fees can lead to increased delinquencies and defaults as consumers struggle to meet inflated payment obligations. This, in turn, can disrupt cash flow for businesses, strain customer relationships, and necessitate costly efforts to recover outstanding payments. The cumulative impact of these financial repercussions underscores the importance of prudently assessing and applying late fees within legal boundaries.

For consumers, the consequences of facing excessive late fees extend beyond immediate financial burdens. They may experience heightened stress, financial insecurity, and a sense of injustice, particularly when confronted with fees that appear unjustified or unreasonably high. This can detrimentally affect consumer well-being and trust in financial institutions and service providers.

By understanding the potential consequences of charging excessive late fees, businesses can proactively review and adjust their fee structures to align with legal limitations and consumer expectations. Prioritizing fair and transparent fee practices not only mitigates the risk of adverse repercussions but also fosters a positive and sustainable relationship with consumers.

Conclusion

As we conclude our exploration of late fees and their legal dimensions, it becomes evident that these charges are a pivotal aspect of financial transactions, serving to incentivize timely payments while compensating for administrative inconveniences. However, the imposition of late fees is not without boundaries, as legal limitations and state-specific regulations aim to ensure fairness and prevent excessive financial burdens on consumers.

Businesses and consumers alike must navigate the complexities of late fees with a nuanced understanding of the legal landscape. For businesses, adherence to legal limitations is imperative to avoid regulatory scrutiny, reputational damage, and financial instability resulting from excessive fee imposition. By prioritizing transparent and fair fee practices, businesses can cultivate trust and loyalty among their customer base, fostering long-term sustainability.

Consumers, armed with knowledge of their rights and the legal constraints on late fees, can advocate for fair treatment and seek recourse in the face of unjust practices. State-specific regulations further empower consumers by offering tailored safeguards and avenues for addressing unfair fees, reinforcing the importance of understanding the legal nuances within their respective states.

Ultimately, the conscientious application of late fees within legal boundaries is essential to promote financial fairness, consumer protection, and ethical business conduct. By striking a harmonious balance between incentivizing timely payments and safeguarding consumer rights, businesses and consumers can contribute to a financial landscape characterized by transparency, trust, and equitable practices.

As we embrace a future shaped by evolving financial dynamics, the principles of legality, fairness, and consumer empowerment will continue to underpin the interactions between businesses and consumers. By upholding these principles, we can collectively foster a financial environment where late fees serve their intended purpose without imposing undue hardships, ensuring a more equitable and sustainable financial ecosystem for all.