Home>Finance>What Is The Minimum Amount Of Margin That Must Be Kept In An Account For Futures Contracts Called

Finance

What Is The Minimum Amount Of Margin That Must Be Kept In An Account For Futures Contracts Called

Published: December 24, 2023

Learn about the minimum margin requirement for futures contracts in finance. Understand the importance of keeping an adequate margin in your account.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Margin in Futures Contracts

- Importance of Margin in Futures Contracts

- Minimum Margin Requirements for Futures Contracts

- Factors Influencing Minimum Margin Requirements

- Calculating the Minimum Amount of Margin for Futures Contracts

- Consequences of Not Maintaining Sufficient Margin

- Margin Calls and Forced Liquidation

- Examples of Minimum Margin Requirements in Futures Trading

- Conclusion

Introduction

In the world of finance, futures contracts play a vital role in investing and portfolio management. These contracts offer traders the opportunity to buy or sell an asset at a predetermined price and date in the future. However, unlike traditional stock trading, futures contracts require investors to maintain a certain amount of margin in their trading accounts.

Margin is a key concept in the world of futures trading. It is essentially a form of collateral or security deposit that traders must keep in their accounts to cover any potential losses. The margin acts as a safety net to protect both the trader and the clearinghouse, which serves as the intermediary between buyers and sellers in futures contracts.

Understanding the minimum amount of margin that must be kept in an account for futures contracts is crucial for traders to manage their risk effectively and avoid potential margin calls or forced liquidation. In this article, we will delve into the definition of margin in futures contracts, discuss its importance, explore the factors influencing minimum margin requirements, and provide examples of how to calculate the minimum amount of margin for futures contracts.

By gaining a thorough understanding of the minimum margin requirements for futures contracts, traders can make informed decisions and navigate the dynamic world of futures trading with confidence.

Definition of Margin in Futures Contracts

In the context of futures contracts, margin refers to the initial and ongoing amount of funds that traders must deposit into their accounts as collateral. It serves as a form of security to ensure that traders have the financial capacity to meet their obligations in case of adverse market movements.

There are two types of margin in futures contracts:

Initial Margin: This is the initial deposit required by the exchange or brokerage when a trader enters into a futures contract. It is typically a percentage of the total contract value, known as the margin rate. The initial margin acts as collateral and protects the exchange and other participants from potential losses if the trader cannot fulfill their obligations.

Maintenance Margin: After entering into a futures contract, traders must also maintain a certain level of margin in their accounts, known as the maintenance margin. This is the minimum amount of margin required to hold the position. If the account balance falls below the maintenance margin level, a margin call may be issued, requiring the trader to add funds to bring the margin back up to the required level.

It is important to note that margin requirements can vary depending on the asset class, the level of volatility, and the individual exchange or brokerage firm. Different instruments may have different margin rates and maintenance margin levels.

Margin requirements are set by regulatory bodies and exchange authorities to ensure the stability and integrity of the futures markets. These requirements serve as risk management tools and are designed to protect market participants from excessive leverage and potential default risks.

Understanding the definition of margin in futures contracts is essential because it governs the amount of funds traders must deposit and maintain to participate in futures trading. By adhering to margin requirements, traders can help maintain market stability and ensure that they have sufficient collateral to cover their positions.

Importance of Margin in Futures Contracts

Margin plays a crucial role in the world of futures contracts and has several key benefits and implications for traders and the overall market. Understanding the importance of margin is essential for effective risk management and successful trading. Here are a few reasons why margin is important in futures contracts:

1. Risk Management: Margin acts as a risk management tool by ensuring that traders have sufficient funds to cover potential losses. By requiring traders to maintain a certain level of margin, exchanges and clearinghouses protect both the trader and the counterparty from excessive risk. This helps to maintain the overall stability and integrity of the futures markets.

2. Leverage: Futures contracts offer traders the ability to control a large position with a fraction of the total contract value. This leverage is made possible by the margin requirements. By utilizing margin, traders can amplify their potential gains with a smaller amount of capital. However, it’s important to note that while leverage can increase potential profits, it can also magnify losses. Proper risk management and understanding margin requirements are crucial to avoid excessive leverage and its potential pitfalls.

3. Flexibility and Efficiency: Margin allows traders to take advantage of market opportunities without tying up a large amount of capital. For example, instead of paying the full value of a futures contract upfront, traders can allocate a smaller amount as margin and still participate in the contract. This flexibility and efficiency enable traders to diversify their portfolios and access a wider range of investment opportunities.

4. Margin Calls: Maintaining the required margin is essential to avoid margin calls. If the account balance falls below the maintenance margin level, a margin call is typically issued by the exchange or brokerage. A margin call requires the trader to add additional funds to bring the margin back to the required level. Failing to meet a margin call can lead to forced liquidation of positions, potentially resulting in significant losses for the trader.

5. Market Integrity: Margin requirements are set by regulatory authorities and exchanges to ensure the stability and integrity of the futures markets. By enforcing margin regulations, market authorities aim to prevent excessive speculation, promote fair trading practices, and maintain market transparency and efficiency.

Overall, margin is of utmost importance in futures contracts. It serves as a risk management tool, offers leverage for potential gains, provides flexibility and efficiency, helps maintain market integrity, and ensures traders have the financial capacity to fulfill their obligations. Understanding and adhering to margin requirements is essential for traders to navigate the dynamic world of futures trading effectively.

Minimum Margin Requirements for Futures Contracts

Minimum margin requirements are the minimum amount of margin that traders must maintain in their accounts to participate in futures contracts. These requirements are set by regulatory bodies and exchange authorities to ensure the stability and integrity of the futures markets.

The minimum margin requirements can vary depending on several factors, including the asset class, the level of volatility, and the individual exchange or brokerage firm. Different instruments may have different margin rates and maintenance margin levels.

Margin requirements are typically expressed as a percentage of the total contract value. For example, if the margin requirement for a particular futures contract is 5%, and the contract value is $100,000, the trader would need to deposit and maintain $5,000 as margin. This initial margin acts as collateral to cover potential losses.

It’s important to note that margin requirements can change over time. Regulatory bodies and exchanges regularly review and adjust margin rates based on market conditions and risk factors. Traders should stay updated with the latest margin requirements to ensure compliance.

By setting minimum margin requirements, regulatory bodies and exchanges aim to protect market participants from excessive leverage and mitigate potential default risks. These requirements promote responsible trading practices, maintain market liquidity, and safeguard the stability of the futures markets.

Failure to meet the minimum margin requirements can have significant consequences. If the account balance falls below the maintenance margin level, a margin call may be issued by the exchange or brokerage. This requires the trader to add additional funds to bring the margin back to the required level. If the margin call is not met, the broker may initiate forced liquidation of positions to cover the shortfall, potentially resulting in substantial losses for the trader.

Traders should be aware that individual brokers may have their own margin requirements that exceed the minimum standards set by regulatory bodies. It is essential to understand and adhere to the margin requirements of the specific broker or exchange being used for futures trading.

By maintaining the minimum margin requirements, traders can ensure they have sufficient collateral to participate in futures contracts, manage their risk effectively, and avoid margin calls and forced liquidation.

Factors Influencing Minimum Margin Requirements

Several factors can influence the minimum margin requirements set by regulatory bodies and exchanges for futures contracts. Understanding these factors is essential as they play a significant role in determining the amount of margin traders must maintain in their accounts. Here are some key factors that influence minimum margin requirements:

1. Volatility: Volatility refers to the degree of price fluctuation in a particular market or asset. Higher volatility typically results in higher margin requirements. This is because increased price swings can lead to larger potential losses, requiring traders to have a higher margin as a cushion to cover those losses.

2. Liquidity: The liquidity of a futures contract refers to how easily it can be bought or sold without impacting the market price. Contracts with higher liquidity generally have lower margin requirements. This is because the ability to enter and exit positions quickly reduces the risk of adverse price movements and allows for easier risk management.

3. Asset Class: Different asset classes have varying risk profiles, and therefore, different margin requirements. For example, commodities like gold or oil may have higher margin requirements compared to stock index futures. This is because commodity prices can be more volatile and subject to external factors such as supply and demand dynamics, geopolitical events, and weather conditions.

4. Regulatory Oversight: Regulatory bodies play a crucial role in setting margin requirements to ensure market stability and protect investors. These bodies perform comprehensive risk assessments and consider factors such as market conditions, systemic risks, and the overall financial health of the industry. Their decisions influence minimum margin requirements across different markets and exchanges.

5. Exchange or Brokerage Policy: In addition to regulatory requirements, individual exchanges and brokerage firms may have their own policies regarding minimum margin requirements. They may choose to adopt more conservative margin levels to mitigate risk further, or they may increase margin requirements for specific contracts or during periods of high market volatility.

6. Trader’s Experience and Risk Profile: Some brokers may take into account the experience and risk profile of individual traders when determining margin requirements. Traders with a proven track record and extensive experience may be granted lower margin requirements, while those with a higher risk appetite or less experience may be subject to higher margin requirements.

It is important for traders to be aware of the factors that influence minimum margin requirements as they can impact trading strategies, risk management decisions, and overall profitability. By understanding these factors, traders can make informed choices and ensure they have the necessary margin to participate in futures contracts.

Calculating the Minimum Amount of Margin for Futures Contracts

Calculating the minimum amount of margin required for futures contracts involves understanding the margin rate and the total contract value. The margin rate is expressed as a percentage of the contract value and represents the initial margin requirement set by the exchange or brokerage.

Here is a step-by-step guide on how to calculate the minimum amount of margin for futures contracts:

- Determine the contract specifications: Start by identifying the specific futures contract you are interested in trading. This includes understanding the underlying asset, contract size, and the margin rate set by the exchange or brokerage.

- Calculate the total contract value: Multiply the contract size by the current futures price to calculate the total contract value. For example, if the contract size is 100 barrels of oil and the current price is $50 per barrel, the total contract value would be $5,000 (100 barrels x $50).

- Apply the margin rate: Multiply the total contract value by the margin rate expressed as a decimal. For instance, if the margin rate is 5%, you would multiply $5,000 by 0.05 to get $250 as the minimum amount of margin required.

It is important to note that maintaining the minimum amount of margin is necessary to keep the position open. Falling below the maintenance margin level can trigger a margin call, requiring the trader to add additional funds to bring the margin back to the required level.

Traders should also be aware that different brokers may have variations in their margin requirements. Some brokers may impose higher margin rates or additional margin requirements, so it is essential to understand and adhere to the margin rules of the specific broker or exchange being used for futures trading.

Calculating the minimum amount of margin for futures contracts is crucial for traders to ensure they have sufficient funds to participate in trading and manage their risk effectively. By maintaining the required margin, traders can avoid margin calls and potential forced liquidation of positions.

Consequences of Not Maintaining Sufficient Margin

Failing to maintain sufficient margin in futures trading accounts can have significant consequences for traders. When traders do not have enough funds to cover potential losses, it raises concerns about their ability to fulfill their contractual obligations. Here are some of the consequences of not maintaining sufficient margin:

1. Margin Calls: If the account balance falls below the maintenance margin level, a margin call may be issued by the exchange or the brokerage. A margin call requires the trader to deposit additional funds to bring the margin back up to the required level. This means that traders must inject more capital into their accounts to maintain their positions. Failure to comply with margin calls can have severe consequences, including forced liquidation.

2. Forced Liquidation: If a trader cannot meet a margin call by depositing additional funds, the broker may initiate forced liquidation of their positions. Forced liquidation involves selling the trader’s open positions to cover the shortfall in margin. The brokerage will typically sell the most liquid positions first to close the margin deficit. Forced liquidation can result in significant losses for the trader, as it may occur during unfavorable market conditions or at prices that are less favorable than desired.

3. Loss of Capital: Not maintaining sufficient margin and being subjected to forced liquidation can lead to substantial losses for traders. The price at which positions are liquidated may be unfavorable, resulting in greater losses than anticipated. Additionally, forced liquidation can disrupt a trader’s overall investment strategy and potentially lead to missed opportunities.

4. Reputation and Future Opportunities: Failing to meet margin requirements can have a negative impact on a trader’s reputation within the industry. Brokers and other market participants may view this as a sign of financial instability or poor risk management. This may limit future trading opportunities and make it more challenging to establish relationships with reputable brokers and institutional investors.

5. Legal Implications: Not meeting margin requirements could potentially result in legal consequences. Contracts typically have legal provisions to address situations where traders fail to meet their financial obligations. Legal action may be pursued to recover losses incurred due to the trader’s inability to maintain sufficient margin.

To avoid these consequences, it is crucial for traders to closely monitor their margin levels and ensure they maintain sufficient funds in their accounts. Employing sound risk management practices, such as setting stop-loss orders and diversifying positions, can also help mitigate the risk of not maintaining adequate margin.

By understanding the potential consequences and actively managing margin requirements, traders can protect themselves from unnecessary financial risks and maintain a stable and successful trading experience in the futures market.

Margin Calls and Forced Liquidation

Margin calls and forced liquidation are critical processes that occur when traders fail to maintain sufficient margin in their futures trading accounts. These mechanisms are in place to protect both traders and the overall integrity of the market. Let’s take a closer look at margin calls and forced liquidation:

Margin Calls: A margin call is a notification issued by the exchange or brokerage when the account balance falls below the maintenance margin level. It serves as a warning to the trader that additional funds need to be deposited to bring the margin back up to the required level. Margin calls are typically communicated through electronic notifications or direct communication with the trader.

When a margin call is initiated, it is crucial for traders to respond promptly. Failing to meet a margin call can have significant consequences, including forced liquidation of positions.

Forced Liquidation: Forced liquidation occurs when a trader does not meet a margin call by depositing additional funds. In this scenario, the broker may initiate forced liquidation of the trader’s positions to cover the margin shortfall.

During forced liquidation, the broker will typically sell the most liquid positions first to close the margin deficit. This means that the broker may sell the trader’s positions at potentially unfavorable prices, especially if market conditions are volatile or illiquid at the time of liquidation. The goal of forced liquidation is to recover the required margin and protect the broker from potential losses, but it can result in significant losses for the trader.

Forced liquidation is a risk management measure implemented by brokers to ensure that traders have sufficient funds to cover their positions. It helps maintain the overall stability and financial integrity of the futures market.

To avoid margin calls and forced liquidation, traders need to proactively manage their margin levels. This includes regularly monitoring account balances, adjusting positions as needed, and ensuring sufficient funds are available to cover potential losses. Implementing effective risk management strategies, such as setting stop-loss orders and keeping a diversified portfolio, can also help mitigate the risk of margin calls and forced liquidation.

It is important for traders to understand the potential consequences of not meeting margin calls and the impact of forced liquidation on their trading activities. By maintaining sufficient margin and promptly addressing margin calls, traders can preserve their positions, minimize losses, and maintain a successful trading experience in the futures market.

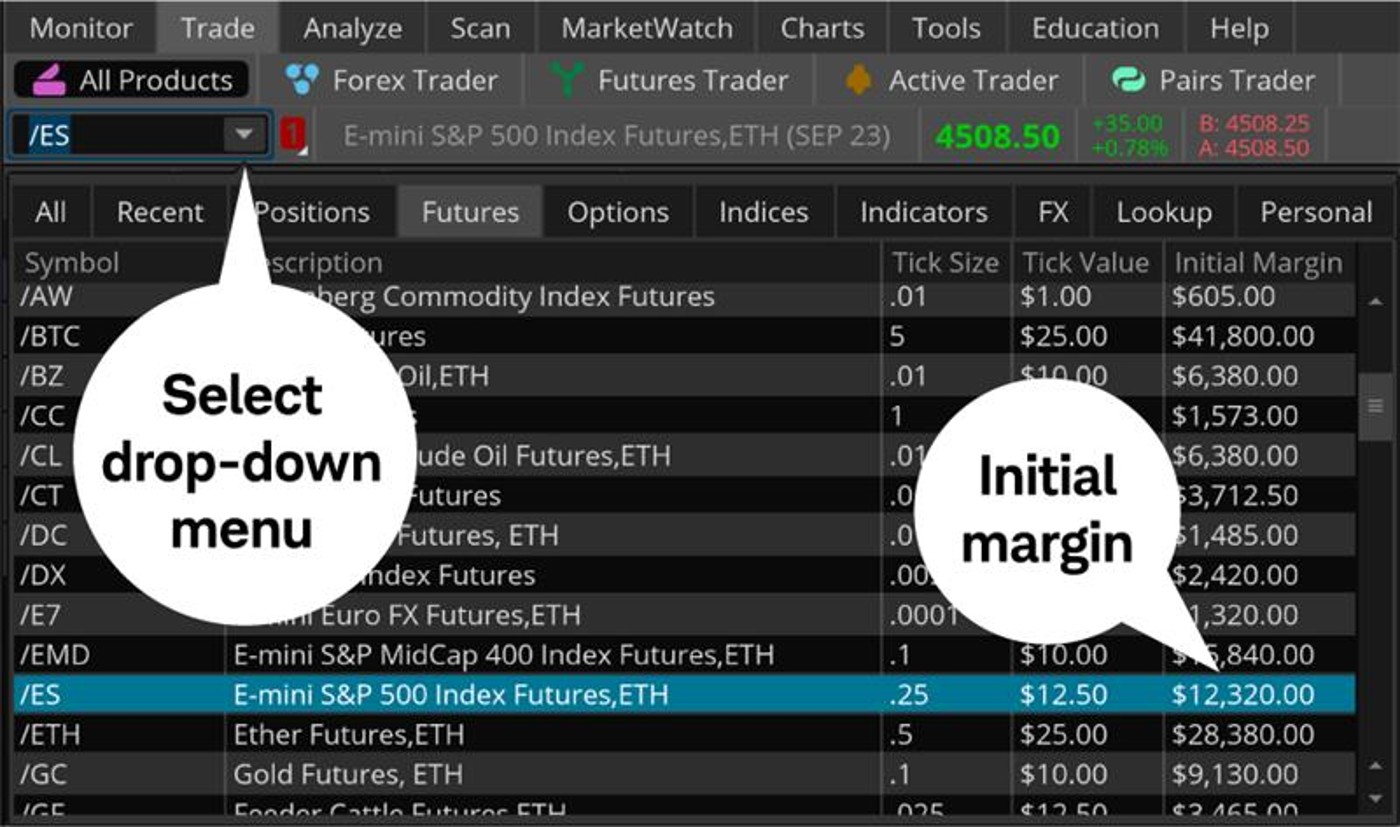

Examples of Minimum Margin Requirements in Futures Trading

Minimum margin requirements can vary across different futures contracts and exchanges. The specific margin rates are determined by regulatory bodies and individual exchanges to ensure sufficient collateral is maintained in trading accounts. Here are a few examples of minimum margin requirements in futures trading:

Example 1: E-Mini S&P 500 Futures: The E-Mini S&P 500 Futures contract is one of the most popular futures contracts. Traders who wish to trade this contract may be required to maintain an initial margin of around 5% of the contract value, while the maintenance margin could be around 3%. This means that if the contract value is $50,000, traders would need to maintain a minimum margin of $2,500 as an initial margin and $1,500 as a maintenance margin.

Example 2: Crude Oil Futures: Crude oil futures contracts are widely traded in the commodities market. The margin requirements for crude oil futures can vary depending on market conditions and the exchange being used. For instance, a brokerage firm may set an initial margin rate of 10% and a maintenance margin rate of 7%. If the total contract value is $100,000, traders would need to maintain an initial margin of $10,000 and a maintenance margin of $7,000.

Example 3: Gold Futures: Gold futures contracts also have their margin requirements. The margin rates for gold futures can differ between exchanges. Let’s assume an exchange sets an initial margin rate of 8% and a maintenance margin rate of 5%. If the contract value is $150,000, traders would need to maintain an initial margin of $12,000 and a maintenance margin of $7,500.

It is important to note that these examples are for illustrative purposes only, and actual margin requirements can vary. Different brokers and exchanges may have their own margin rates, and these rates can change based on market conditions, volatility, and other factors.

Traders should closely monitor margin requirements and stay informed about any updates or changes. Failure to maintain the minimum margin required by the exchange or brokerage can result in margin calls, forced liquidation, and potential financial losses.

By understanding the specific margin requirements for the futures contracts they trade, traders can ensure they have sufficient funds in their accounts to meet the margin obligations and effectively manage their risk.

Conclusion

Margin requirements are a crucial aspect of futures trading, serving as a risk management tool and ensuring the stability of the market. Traders must maintain a minimum amount of margin in their accounts to participate in futures contracts effectively. Understanding the concept of margin, its importance, and the factors influencing minimum margin requirements is vital for traders to navigate the world of futures trading successfully.

Margin acts as a form of collateral, protecting both traders and clearinghouses from potential losses. It allows for leverage, flexibility, and efficient capital utilization in futures trading. However, failing to maintain sufficient margin can lead to margin calls and forced liquidation, resulting in significant losses and potential damage to a trader’s reputation.

Traders must calculate the minimum amount of margin required for each futures contract by considering the margin rate and total contract value. They should also be aware of factors such as volatility, liquidity, asset class, and regulatory oversight that influence minimum margin requirements.

By maintaining sufficient margin and promptly addressing margin calls, traders can mitigate risk, preserve their positions, and participate in futures trading with confidence. Implementing sound risk management strategies, staying informed about margin requirements, and closely monitoring account balances are essential to ensuring compliance and avoiding unnecessary financial risk.

As the futures trading landscape continues to evolve, it is crucial for traders to stay updated with margin regulations and adaptation to changing market conditions. Overall, a thorough understanding of margin requirements and their implications is essential for traders to make informed decisions, manage risk effectively, and achieve success in futures trading.