Home>Finance>With Regard To Futures Contracts, What Does The Word “Margin” Mean?

Finance

With Regard To Futures Contracts, What Does The Word “Margin” Mean?

Published: December 24, 2023

Learn about the meaning of "margin" in finance as it relates to futures contracts, and how it can impact your investments. Gain insight into this important concept in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of futures contracts! As you delve into the intricacies of this fascinating financial instrument, one term that you will undoubtedly encounter is “margin.” In the context of futures contracts, margin plays a pivotal role in determining the financial obligations and risk management strategies of market participants. Understanding what margin means and how it affects your trading activities is crucial for anyone venturing into the world of futures trading.

When you trade futures contracts, you enter into an agreement to buy or sell an asset at a predetermined price and date in the future. These contracts are widely used in various industries, including commodities, currencies, and financial instruments, to speculate, hedge risks, or lock in future prices.

Margin, in simple terms, refers to the amount of money or collateral that traders must deposit to initiate and maintain their futures positions. It is a crucial element of futures trading, ensuring the integrity of the market and mitigating potential defaults. By requiring traders to deposit an initial margin and maintain a certain level of margin throughout the life of their positions, futures exchanges can amplify market stability and provide participants with the confidence to engage in these derivative contracts.

In this article, we will delve deeper into the meaning of margin in futures contracts, explore different types of margin requirements, and discuss the significance of margin in managing risk.

Definition of Futures Contracts

Before delving into the concept of margin, it is important to have a clear understanding of what futures contracts are. Futures contracts are legally binding agreements between two parties to buy or sell an asset, such as commodities, currencies, or financial instruments, at a predetermined price and date in the future.

These contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). The standardized nature of futures contracts allows for easy trading and liquidity in the marketplace.

Unlike stock or bond investments, where ownership is transferred immediately upon purchase, futures contracts represent a commitment to buy or sell the underlying asset at a later date. This delayed settlement allows traders to speculate on the price movements of the asset, mitigate risks associated with price volatility, or lock in future prices for hedging purposes.

Traders who enter into futures contracts are classified into two categories: the buyer (long position) and the seller (short position). The buyer agrees to purchase the asset at the specified price on the contract’s expiration date, while the seller agrees to deliver the asset at that price.

It is important to note that most futures contracts are not held until their expiration date. Instead, traders often engage in offsetting transactions to close out their positions before expiration. This allows them to realize profits or limit losses based on fluctuations in the market price of the underlying asset.

Now that we have a clear understanding of what futures contracts are, let’s explore the concept of margin and its significance in futures trading.

Purpose of Margin in Futures Contracts

Margin serves several important purposes in futures contracts. Its primary function is to ensure that market participants have enough financial resources to meet their obligations and minimize the risk of default. By requiring traders to deposit margin, exchanges can maintain a secure and orderly marketplace.

One of the key benefits of margin is that it allows traders to enter into futures contracts with a fraction of the total contract value. This concept is known as leverage. By leveraging their capital, market participants can control larger positions and potentially amplify their profits. However, it is important to note that leverage can also magnify losses, making proper risk management crucial in futures trading.

Margin requirements act as a protective measure against adverse price movements. By depositing initial margin, traders demonstrate their commitment to fulfilling their contractual obligations. This helps to ensure market integrity by discouraging speculative behavior that could destabilize prices or create excessive risks.

In addition to mitigating counterparty risks, margin also aids in price discovery and market efficiency. When traders are required to deposit margin, it increases their cost of holding positions. This cost is passed on in the form of bid-ask spreads, which contribute to accurate pricing and liquidity in the futures markets.

Furthermore, margin plays a crucial role in risk management for both traders and exchanges. Margin requirements are designed to protect traders from losses and prevent them from taking on excessive risk. By maintaining sufficient margin, traders can absorb market fluctuations and avoid margin calls, which could lead to forced liquidation of their positions.

For exchanges, margin acts as a risk management tool by ensuring that clearing members have enough capital to cover potential losses. Clearing members, who act as intermediaries between traders and the exchange, are responsible for guaranteeing the financial performance of their clients. Margin requirements help to mitigate the risk of default, ensuring the stability and integrity of the market.

Overall, the purpose of margin in futures contracts is to promote market stability, protect traders and exchanges from default risks, and facilitate efficient price discovery. Understanding the meaning of margin and its role in risk management is crucial for anyone venturing into futures trading.

Meaning of “Margin” in Futures Contracts

In the context of futures contracts, “margin” refers to the amount of money or collateral that traders must deposit with their broker or clearinghouse to initiate and maintain their positions. It serves as a form of financial security to protect both the trader and the exchange from potential losses.

When opening a futures position, traders are required to deposit an initial margin, also known as the initial margin requirement. This initial margin is a percentage of the total contract value and is determined by the exchange and regulatory authorities. It acts as a good faith deposit, demonstrating the trader’s commitment and ability to meet their obligations.

Additionally, margin serves as a form of collateral for the position. If the market moves against the trader, causing the value of their position to decrease, the exchange may issue a margin call. A margin call is a notice from the broker or clearinghouse requesting the trader to deposit additional funds to maintain the minimum margin level required.

There are two main components of margin in futures contracts:

- Initial Margin: The initial margin is the initial deposit required to enter into a futures position. It is a percentage of the total contract value and is intended to cover potential losses that may occur during adverse market conditions.

- Variation Margin: Also known as mark-to-market margin, variation margin refers to the daily settlement of gains and losses in a trader’s futures position. At the end of each trading day, the exchange determines the profit or loss of each position based on the difference between the contract’s settlement price and the previous day’s settlement price. If there are losses, the trader must deposit the variation margin to cover those losses, while any gains are credited to their account.

In addition to initial and variation margin, there is also the concept of maintenance margin. Maintaining a sufficient margin is crucial to avoid margin calls and potential liquidation of positions.

Understanding the meaning of margin in futures contracts is essential for traders to effectively manage their positions and minimize the risk of forced liquidation. By ensuring adequate margin levels, traders can protect themselves from adverse market movements, meet their financial obligations, and navigate the dynamic world of futures trading.

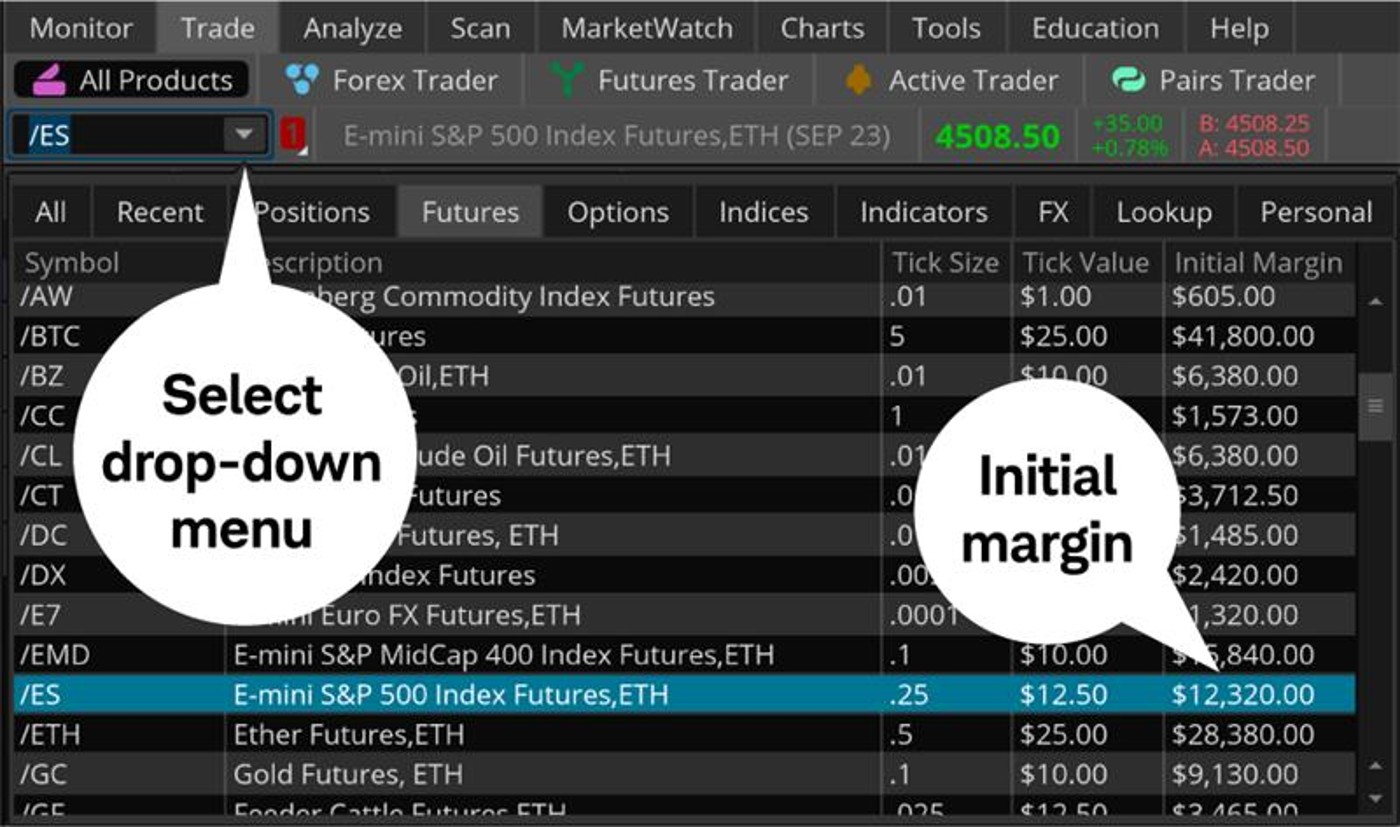

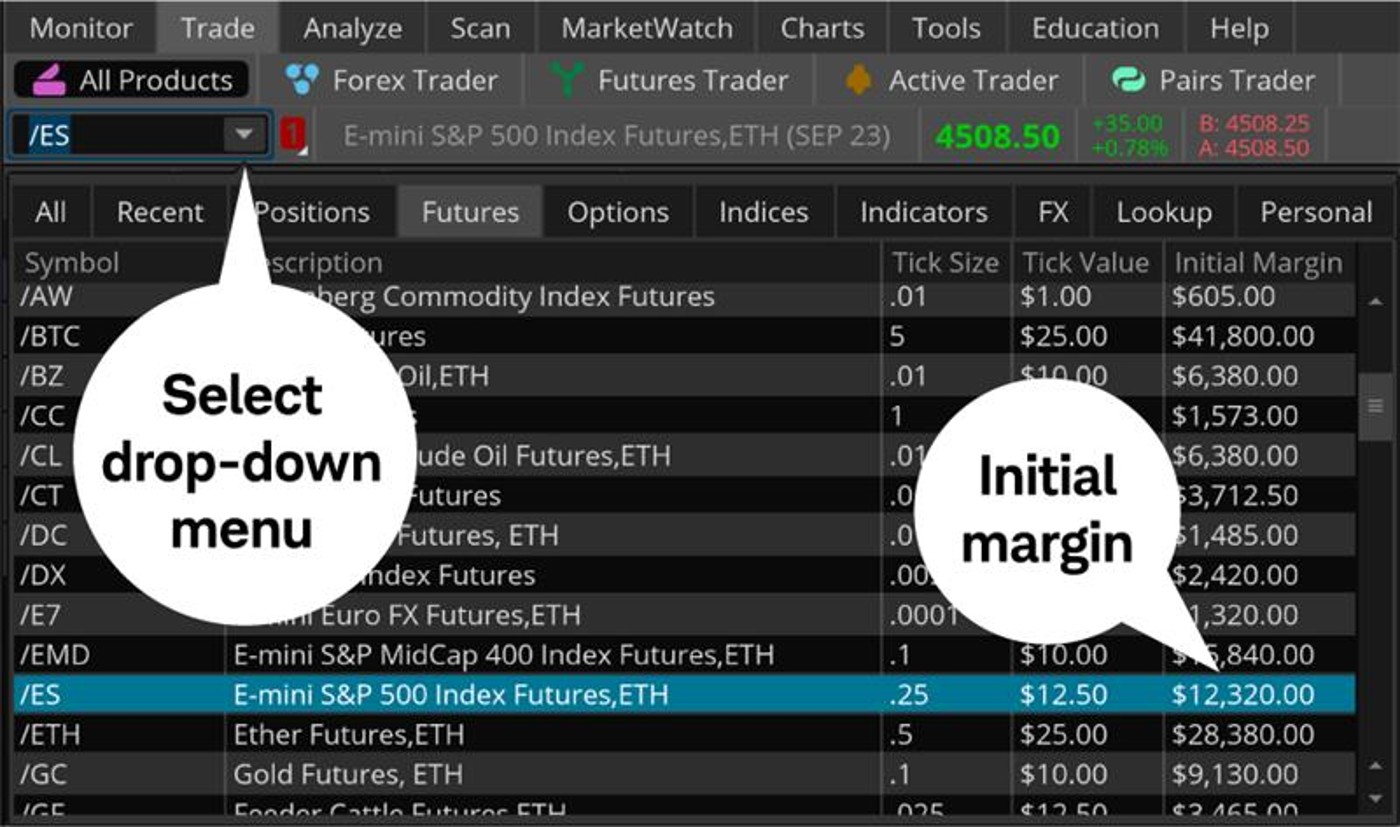

Initial Margin Requirement

The initial margin requirement is the minimum amount of funds or collateral that traders must deposit to initiate a futures position. This requirement is set by the exchange and regulatory authorities and is typically a percentage of the total contract value.

The purpose of the initial margin requirement is to protect the market from potential default risks and ensure that traders have sufficient capital to cover potential losses. By requiring traders to deposit an initial margin, exchanges and clearinghouses can mitigate the risk of default and maintain market stability.

The specific percentage of the initial margin requirement varies depending on factors such as the volatility of the underlying asset, the liquidity of the market, and regulatory guidelines. Higher-risk contracts or those with higher volatility generally require a higher initial margin to account for potential losses that may occur due to market fluctuations.

For example, if the initial margin requirement for a futures contract is set at 10%, and the total contract value is $10,000, a trader would need to deposit $1,000 as the initial margin to enter into the position. The remaining $9,000 represents the leverage provided by the margin, allowing the trader to control a larger position with a smaller initial investment.

It’s important to note that the initial margin serves as a form of collateral for the trader’s position. The margin is held by the clearinghouse, ensuring that funds are available to cover potential losses if the market moves against the trader.

Traders should also be aware that initial margin requirements may change over time. Exchanges and regulatory authorities periodically review margin requirements to align with market conditions, volatility levels, and risk management practices.

Understanding and meeting the initial margin requirement is essential for traders to enter into futures contracts and maintain their positions. By ensuring adequate initial margin, traders can participate in the futures market, manage their risks effectively, and capitalize on potential opportunities.

Variation Margin

Variation margin, also known as mark-to-market margin, is a key component of margin requirements in futures contracts. It refers to the daily settlement of gains and losses in a trader’s position.

At the end of each trading day, the exchange calculates the profit or loss of each futures position based on the difference between the contract’s settlement price and the previous day’s settlement price. If the position has incurred losses, the trader is required to deposit the variation margin to cover those losses. On the other hand, if the position has generated gains, the trader’s account is credited with the corresponding amount.

The purpose of variation margin is to ensure that traders maintain adequate margin levels throughout the life of their positions. By settling gains and losses on a daily basis, it helps to prevent excessive losses from accumulating and minimize the risk of default.

Let’s consider an example to illustrate how variation margin works. Suppose a trader holds a long futures position with a settlement price of $100 and the next day, the settlement price increases to $105. In this case, the trader would have a $5 gain on the position. The exchange would credit the trader’s account with this $5 gain, which increases the available funds in their account.

Conversely, if the settlement price decreases to $95, the trader would have a $5 loss on the position. The exchange would then require the trader to deposit the $5 as variation margin to cover this loss. This ensures that the trader maintains the minimum margin level required to support the position.

Variation margin plays a crucial role in managing risk in futures trading. By settling gains and losses daily, traders are more likely to have sufficient funds to cover potential losses and meet their margin obligations. It helps to prevent margin calls, which could lead to forced liquidation of positions.

It’s important to note that variation margin is separate from the initial margin requirement. While the initial margin is the initial deposit required to enter into a futures position, variation margin reflects the ongoing adjustments based on daily price movements.

Understanding the concept of variation margin and its significance in futures contracts is essential for traders to effectively manage their positions, monitor their margin levels, and navigate the dynamic nature of the futures market.

Maintenance Margin

Maintenance margin is a critical component of margin requirements in futures contracts. It represents the minimum level of margin that traders must maintain in their accounts to support their positions and avoid margin calls.

When traders enter into futures contracts, they are required to deposit an initial margin to initiate the position. However, maintaining the initial margin alone is not sufficient to sustain the position indefinitely. This is where the concept of maintenance margin comes into play.

Maintenance margin is typically lower than the initial margin requirement. It serves as a cushion to absorb potential losses and ensure that traders have enough funds to cover adverse price movements. Falling below the maintenance margin level triggers a margin call from the broker or clearinghouse.

When a margin call occurs, the trader is required to deposit additional funds into their account to restore their margin to the required maintenance level. Failure to meet the margin call may result in forced liquidation of the position, as the broker or clearinghouse has the authority to close out the position to protect against further losses.

The specific percentage of the maintenance margin requirement is determined by the exchange and regulatory authorities. It is essential for traders to monitor their margin levels and ensure that they maintain adequate funds in their accounts to satisfy the maintenance margin requirement.

For example, let’s say the initial margin requirement for a futures contract is set at 10% and the maintenance margin requirement is 7%. If the total contract value is $10,000, the required initial margin deposit would be $1,000 (10% of $10,000). However, to avoid a margin call, the trader must maintain at least $700 (7% of $10,000) as the maintenance margin in their account.

Maintenance margin serves as a risk management tool, ensuring that traders have sufficient capital to manage potential losses and honor their obligations in the futures market. It helps to maintain the financial integrity of the market and protect both traders and exchanges from default risks.

Understanding and adhering to the maintenance margin requirement is crucial for traders to avoid margin calls, sustain their positions, and effectively manage their risks in futures trading.

Example of Margin Calculation

To better understand how margin is calculated in futures contracts, let’s walk through an example. Suppose you are interested in trading a gold futures contract, and the contract size is 100 ounces of gold.

The exchange where the gold futures contract is traded has set an initial margin requirement of $5,000 per contract and a maintenance margin requirement of $3,000 per contract. The current market price of gold is $1,800 per ounce.

To calculate the initial margin, multiply the contract size by the market price of gold and then multiply it by the initial margin requirement percentage:

Initial Margin = Contract Size * Market Price * Initial Margin Requirement

Initial Margin = 100 * $1,800 * 0.10

Initial Margin = $18,000

Therefore, to enter into a gold futures position, you would be required to deposit $18,000 as the initial margin.

Now let’s consider the calculation of maintenance margin. The maintenance margin requirement is typically lower than the initial margin requirement. In this example, the maintenance margin requirement is $3,000 per contract.

If the market price of gold falls, you need to ensure that your account maintains at least the maintenance margin amount. Let’s say the market price of gold declines to $1,700 per ounce. To calculate the maintenance margin, use the same formula as above:

Maintenance Margin = Contract Size * Market Price * Maintenance Margin Requirement

Maintenance Margin = 100 * $1,700 * 0.07

Maintenance Margin = $11,900

In this case, you would need to have at least $11,900 in your account to meet the maintenance margin requirement.

If the value of your position falls below the maintenance margin level, you would receive a margin call from your broker or clearinghouse. You would be required to deposit additional funds into your account to bring your margin back to the maintenance level and avoid forced liquidation of your position.

Calculating and understanding margin requirements is vital to manage risk effectively in futures trading. It ensures that you have adequate funds to cover potential losses and meet your margin obligations throughout the life of your futures positions.

Importance of Margin in Managing Risk

Margin plays a crucial role in managing risk in futures trading. It provides a mechanism that allows traders to control larger positions with a relatively smaller initial investment. By understanding and effectively utilizing margin, traders can implement risk management strategies and navigate the volatile nature of the futures market.

One of the primary benefits of margin is the ability to amplify potential profits through leverage. By depositing a fraction of the total contract value as the initial margin, traders gain exposure to a larger position. This leverage can potentially magnify profits if the market moves in the desired direction. However, it is important to note that leverage can also amplify losses, making risk management even more critical.

Margin acts as a protective measure against adverse price movements. By requiring traders to deposit an initial margin, exchanges ensure that market participants have sufficient funds to cover potential losses. This reduces the risk of default and helps to maintain market stability.

Margin also allows traders to manage risk by actively monitoring their positions. By maintaining adequate margin levels, traders can absorb market fluctuations and avoid margin calls. This provides them with the flexibility to make informed decisions about when to hold, close, or adjust their positions based on market conditions.

Furthermore, margin offers traders the ability to hedge against price volatility and mitigate potential losses. Hedging involves taking opposing positions in the futures market to offset potential losses in another position. By using margin to enter into hedging strategies, traders can protect themselves from adverse price movements and stabilize their overall portfolio.

Margin requirements contribute to proper risk management in two significant ways. Firstly, they encourage traders to assess their risk tolerance and allocate capital accordingly. By considering the potential losses and margin requirements, traders can determine the appropriate size of their positions and avoid excessive risk-taking.

Secondly, margin plays a role in monitoring and adjusting positions proactively. Traders who closely monitor their margin levels can identify potential risks and adjust their positions accordingly. By maintaining sufficient margin, they can avoid margin calls and prevent forced liquidation of their positions.

In summary, margin is a vital tool in managing risk in futures trading. It allows traders to control larger positions, amplify potential profits, and implement risk management strategies. By understanding margin requirements, maintaining adequate margin levels, and monitoring their positions, traders can navigate the dynamic nature of the futures market and protect themselves from potential losses.

Conclusion

In conclusion, margin is a fundamental concept in futures contracts that plays a crucial role in trading and risk management. It represents the amount of money or collateral that traders must deposit to initiate and maintain their positions. Margin requirements, including initial margin, variation margin, and maintenance margin, ensure that traders have sufficient funds to cover potential losses and meet their margin obligations.

The purpose of margin in futures contracts goes beyond financial security. It promotes market stability by mitigating the risk of default and maintaining orderly trading. Margin also allows traders to leverage their capital, controlling larger positions and potentially amplifying profits. However, it is important to exercise caution and employ proper risk management strategies, as leverage can also magnify losses.

Understanding margin requirements and managing margin levels is essential for traders to navigate the dynamic nature of the futures market. By monitoring margin levels, traders can protect themselves from margin calls and forced liquidation of positions. Margin provides the flexibility to adjust positions based on market conditions, implement hedging strategies, and effectively manage risk.

In the world of futures trading, margin acts as a facilitator for market participants. It ensures market integrity, promotes efficient price discovery, and provides traders with the opportunity to engage in diverse trading strategies. Through a proper understanding of margin and its significance, traders can participate in futures contracts with confidence and manage risk in a disciplined and strategic manner.

As you embark on your futures trading journey, it is imperative to familiarize yourself with the specific margin requirements of the exchanges you trade on, as they can vary across different contracts and markets. Always prioritize risk management, maintain sufficient margin levels, and continuously educate yourself on the evolving landscape of futures trading.

By recognizing the importance of margin and its role in managing risk, you can navigate the exciting world of futures contracts with confidence, strategy, and a focus on long-term success.