Home>Finance>What Is The Minimum Payment On A Target Credit Card

Finance

What Is The Minimum Payment On A Target Credit Card

Published: February 26, 2024

Learn about the minimum payment for a Target credit card and how it impacts your finances. Find out more about managing your credit card payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of the Minimum Payment on a Target Credit Card

When it comes to managing your finances and credit card payments, understanding the concept of the minimum payment is crucial. In the realm of credit cards, the minimum payment refers to the smallest amount of money that you are required to pay by a specific due date to keep your account in good standing. This is particularly relevant for Target credit cardholders, as it directly impacts their financial well-being and credit score.

Making only the minimum payment on your Target credit card may seem like a convenient option, especially when you're facing financial constraints. However, it's essential to comprehend the implications of this decision, as it can have long-term consequences on your financial health. By delving into the factors that affect the minimum payment, the potential repercussions of making only the minimum payment, and effective strategies for managing your Target credit card payments, you can gain a comprehensive understanding of this critical aspect of personal finance. Let's explore the nuances of the minimum payment on a Target credit card and how it influences your financial journey.

Understanding the Target Credit Card Minimum Payment

As a Target credit cardholder, comprehending the dynamics of the minimum payment is fundamental to maintaining a healthy financial standing. The minimum payment on your Target credit card is the smallest amount you are required to pay each month to avoid late fees and potential negative impacts on your credit score. It typically consists of a percentage of your total balance, a fixed dollar amount, or a combination of both. Understanding the specific calculation method used by Target for determining the minimum payment can provide valuable insights into managing your credit card obligations effectively.

When you receive your Target credit card statement, it will clearly indicate the minimum payment amount and the due date. It’s crucial to review this information meticulously, as missing the minimum payment deadline can result in late fees and a negative mark on your credit report. By ensuring that you meet at least the minimum payment requirement, you can uphold the positive status of your Target credit card account and avoid potential financial repercussions.

Moreover, comprehending the minimum payment structure empowers you to make informed decisions regarding your credit card usage and repayment strategy. By understanding the components that contribute to the minimum payment calculation, such as the outstanding balance, interest rate, and any applicable fees, you can proactively manage your finances and work towards reducing your credit card debt efficiently.

By gaining a comprehensive understanding of the minimum payment on your Target credit card, you can navigate your financial responsibilities adeptly, maintain a favorable credit standing, and work towards achieving your long-term financial goals.

Factors Affecting the Minimum Payment

Several key factors influence the calculation of the minimum payment on your Target credit card. Understanding these factors is essential for effectively managing your credit card obligations and making informed financial decisions. Here are the primary elements that contribute to the determination of your Target credit card’s minimum payment:

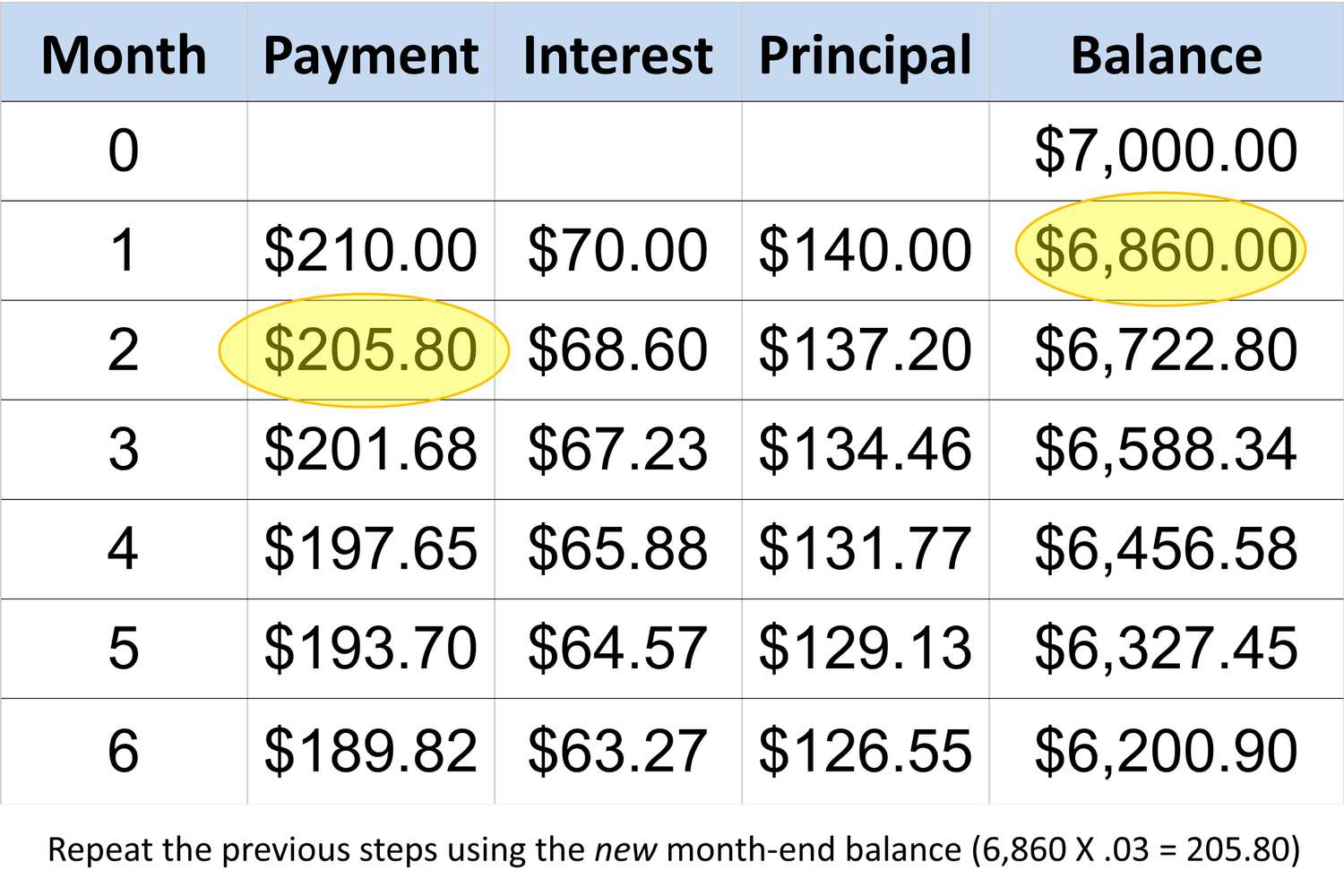

- Outstanding Balance: The total amount you owe on your Target credit card, including purchases, cash advances, and any applicable fees, directly impacts the minimum payment. Typically, the minimum payment is calculated as a percentage of the outstanding balance, ensuring that you make progress in repaying your debt each month.

- Interest Rate: The annual percentage rate (APR) associated with your Target credit card plays a significant role in minimum payment calculation. A higher interest rate results in a larger portion of your minimum payment being allocated to interest, potentially extending the time needed to pay off your balance if only minimum payments are made.

- Fixed Minimum Amount: In some cases, credit card issuers, including Target, set a minimum fixed dollar amount that cardholders must pay each month, regardless of the outstanding balance. This ensures a baseline level of repayment, especially for accounts with lower balances.

- Late Fees and Penalties: If you have incurred late fees, over-limit fees, or other penalties on your Target credit card, these additional charges can contribute to an increase in the minimum payment amount for the subsequent billing cycle.

By recognizing these influential factors, you can gain insight into the dynamics of the minimum payment calculation and strategize your repayment approach effectively. It’s essential to stay informed about how these elements interplay to determine your minimum payment, enabling you to make sound financial choices and work towards managing your credit card debt responsibly.

Consequences of Making Only the Minimum Payment

While making the minimum payment on your Target credit card may offer temporary relief, it’s crucial to grasp the potential long-term consequences associated with this approach. By understanding the ramifications of solely meeting the minimum payment requirement, you can make informed decisions regarding your financial management and debt repayment strategies. Here are the key consequences of consistently making only the minimum payment on your Target credit card:

- Accruing Interest Charges: By making only the minimum payment, a significant portion of your payment goes towards covering the interest accrued on your outstanding balance. This can prolong the time required to pay off your debt and result in higher overall interest charges over the repayment period.

- Extended Repayment Period: Opting to pay only the minimum amount can extend the duration needed to clear your credit card balance. This protracted repayment timeline can impede your financial progress and lead to a prolonged cycle of debt accumulation.

- Impact on Credit Score: Consistently making only the minimum payment may negatively impact your credit score over time. Credit utilization, which measures the amount of available credit you are using, is a crucial factor in credit scoring models. Maintaining high balances relative to your credit limit, often associated with making minimum payments, can adversely affect your credit score.

- Financial Strain: Relying solely on minimum payments may result in a perpetual cycle of debt, leading to increased financial stress and limitations on your ability to pursue other financial goals or address unexpected expenses.

By recognizing these potential consequences, you can proactively assess your financial situation and consider alternative approaches to managing your Target credit card payments. Prioritizing higher payments to reduce your outstanding balance, exploring balance transfer options, or consolidating your debt through strategic financial planning can mitigate the adverse effects of making only the minimum payment. Additionally, seeking professional financial guidance or leveraging resources offered by Target to support responsible credit card management can aid in navigating these challenges effectively.

Tips for Managing Your Target Credit Card Minimum Payment

Effectively managing your Target credit card minimum payment is essential for maintaining financial stability and working towards debt reduction. By implementing strategic approaches and leveraging practical tips, you can navigate your credit card obligations adeptly and foster a positive financial trajectory. Here are valuable tips for managing your Target credit card minimum payment:

- Create a Budget: Develop a comprehensive budget that prioritizes your Target credit card minimum payment while addressing other essential expenses. Allocating a specific portion of your income towards credit card payments can help you meet the minimum requirement consistently.

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due on your Target credit card. By allocating additional funds towards reducing your outstanding balance, you can expedite debt repayment and minimize interest charges.

- Monitor Your Spending: Stay vigilant about your spending habits and strive to minimize discretionary expenses. By curbing unnecessary purchases, you can free up resources to allocate towards higher credit card payments, ultimately reducing your outstanding balance more rapidly.

- Explore Balance Transfer Options: Consider transferring high-interest credit card balances, including your Target credit card balance, to a card with a lower interest rate. This can potentially reduce interest charges and facilitate more efficient debt repayment.

- Seek Financial Assistance: If you encounter difficulties in meeting your Target credit card minimum payment, explore available financial assistance programs or hardship options offered by Target. These resources can provide temporary relief and support you in managing your credit card obligations effectively.

- Utilize Auto-Pay Features: Take advantage of auto-pay features offered by Target to ensure that your minimum payment is consistently made by the due date. This can help you avoid late fees and maintain the positive status of your credit card account.

By incorporating these practical tips into your financial management approach, you can proactively address your Target credit card minimum payment and work towards achieving greater financial resilience. Additionally, staying informed about credit card policies, seeking guidance from financial professionals, and actively monitoring your credit card statements can contribute to a comprehensive and effective strategy for managing your Target credit card obligations.