Finance

What Is A Minimum Payment For A Credit Card

Published: February 25, 2024

Learn about the importance of minimum payments for credit cards and how they impact your finances. Understand the significance of managing credit card debt effectively. Discover more about finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing credit card payments, understanding the concept of minimum payments is crucial. Many credit cardholders are familiar with the term “minimum payment,” but the specifics of what it entails and its implications may not be as well-known. In this article, we will delve into the intricacies of minimum payments for credit cards, exploring how they are calculated, their impact on overall debt, and strategies for effectively managing them.

For individuals who carry a balance on their credit cards, the minimum payment represents the lowest amount they are required to pay each month to maintain their account in good standing. While making the minimum payment may seem like a convenient way to manage finances, it’s essential to comprehend the long-term consequences and costs associated with this approach.

By gaining a comprehensive understanding of minimum payments, cardholders can make informed decisions about their financial obligations, avoid potential pitfalls, and work towards achieving greater stability and control over their credit card debt. Let’s embark on a journey to unravel the mysteries of minimum payments and empower ourselves with the knowledge needed to navigate the complex terrain of credit card management.

Understanding Minimum Payments

Minimum payments on credit cards are the lowest amount that cardholders are required to pay each month to keep their accounts in good standing. This figure is determined by the credit card issuer and is typically calculated as a percentage of the outstanding balance, subject to a minimum fixed amount. While the precise calculation method may vary among different credit card companies, understanding the implications of making only the minimum payment is crucial for responsible financial management.

It’s important to recognize that the minimum payment is designed to ensure that cardholders meet their immediate financial obligations to the credit card issuer. However, solely making the minimum payment can lead to long-term financial challenges due to accruing interest and prolonged repayment periods. By comprehending the significance of minimum payments, individuals can make informed decisions about their credit card usage and payment strategies.

Moreover, understanding the factors that influence minimum payments, such as the outstanding balance, interest rates, and any fees or charges, empowers cardholders to take control of their financial responsibilities. By gaining insight into the mechanics of minimum payments, individuals can proactively manage their credit card debt and work towards achieving greater financial stability.

How Minimum Payments Are Calculated

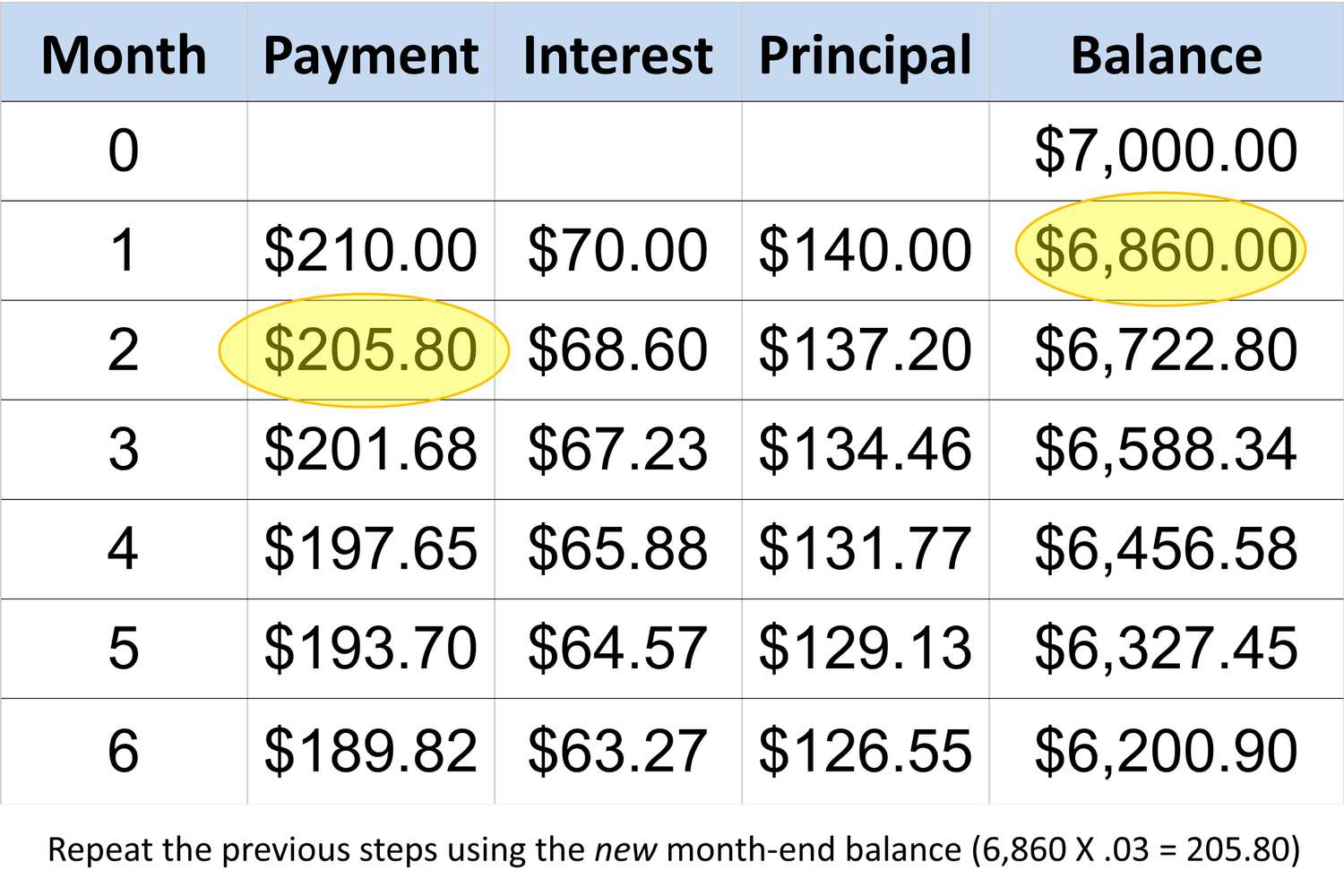

The calculation of minimum payments for credit cards typically involves a predetermined percentage of the outstanding balance, often subject to a minimum fixed amount. While specific methodologies may vary among credit card issuers, the general approach involves combining a percentage of the remaining balance with any applicable fees and interest charges.

Commonly, credit card companies calculate the minimum payment as a small percentage of the total balance, usually around 1% to 3%, with a minimum fixed amount. For example, a credit card issuer might stipulate that the minimum payment is the greater of $25 or 1% of the outstanding balance. This ensures that cardholders are required to make a minimum payment that reflects both a proportion of the balance and a baseline amount, thereby addressing both small and large balances.

It’s important for cardholders to review their credit card agreements and disclosures to understand the specific formula used by their credit card issuer to calculate minimum payments. By familiarizing themselves with this information, individuals can gain clarity on how their minimum payments are determined and anticipate the financial implications of different outstanding balances and interest rates.

Furthermore, comprehending the calculation of minimum payments enables cardholders to make strategic decisions about their repayment strategies, potentially accelerating the reduction of their credit card debt and minimizing interest costs. By understanding the mechanics behind minimum payments, individuals can take proactive steps to manage their financial obligations and work towards achieving greater financial freedom.

Impact of Making Minimum Payments

While making the minimum payment on a credit card may provide temporary relief by meeting the immediate payment obligation, it can have significant long-term implications on overall debt and financial well-being. By making only the minimum payment, cardholders may find themselves trapped in a cycle of persistent debt, characterized by prolonged repayment periods and substantial interest costs.

One of the primary consequences of making minimum payments is the accumulation of interest on the remaining balance. Credit card companies typically apply interest to any outstanding balance, and by making only the minimum payment, cardholders may continue to carry a significant portion of their balance from month to month, incurring interest charges on the unpaid amount. As a result, the total interest accrued over time can substantially increase the overall cost of the debt.

Moreover, consistently making minimum payments can extend the time required to pay off the credit card balance. By paying only the minimum amount each month, cardholders may find themselves in a prolonged repayment cycle, delaying the achievement of debt-free status and perpetuating the burden of credit card debt.

Furthermore, the impact of making minimum payments extends beyond financial costs, potentially affecting individuals’ credit scores and financial stability. High credit card balances relative to the credit limit, known as a high credit utilization ratio, can negatively impact credit scores. By carrying significant balances and making only the minimum payments, cardholders may inadvertently diminish their creditworthiness, limiting their access to favorable financial opportunities in the future.

Understanding the far-reaching consequences of making minimum payments underscores the importance of proactive debt management and strategic repayment approaches. By recognizing the potential pitfalls associated with minimum payments, individuals can explore alternative strategies to accelerate debt reduction, minimize interest costs, and achieve greater financial freedom.

Tips for Managing Credit Card Minimum Payments

Effectively managing credit card minimum payments is essential for maintaining financial stability and working towards debt reduction. By implementing strategic approaches and proactive financial habits, cardholders can navigate the challenges associated with minimum payments and make meaningful progress towards achieving greater control over their credit card debt.

- Pay More Than the Minimum: While the minimum payment is the required amount to keep the account in good standing, allocating additional funds towards the credit card balance can expedite debt repayment and reduce overall interest costs. By paying more than the minimum, cardholders can make significant strides towards achieving a debt-free status.

- Create a Repayment Plan: Developing a structured repayment plan can help individuals prioritize their credit card payments and allocate resources effectively. By outlining a clear strategy for debt reduction, cardholders can proactively work towards paying off their balances and minimizing the impact of interest charges.

- Avoid New Charges: To focus on reducing existing credit card balances, it’s advisable to refrain from making additional charges on the card whenever possible. By limiting new expenditures, individuals can direct their financial resources towards paying down existing debt and gradually regaining control over their finances.

- Explore Balance Transfer Options: In certain circumstances, transferring high-interest credit card balances to a card with a lower interest rate can offer potential savings on interest costs. However, it’s essential to carefully evaluate the terms and conditions of balance transfer offers to ensure that they align with long-term financial goals.

- Monitor Credit Card Statements: Regularly reviewing credit card statements enables cardholders to stay informed about their balances, transactions, and any changes in terms or interest rates. This proactive approach allows individuals to identify any discrepancies or unauthorized charges and maintain a clear understanding of their financial standing.

By incorporating these tips into their financial practices, individuals can proactively manage their credit card minimum payments, work towards debt reduction, and ultimately achieve greater financial stability and freedom.