Finance

What Is Trade Credit?

Published: January 7, 2024

Learn what trade credit is and how it can impact your business finances. Discover the benefits and drawbacks of this finance option.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Trade credit is a term that is commonly used in the world of finance and business. It refers to a type of credit arrangement between suppliers and customers, where the supplier allows the customer to purchase goods or services on credit, and the customer agrees to pay for those goods or services at a later date. Essentially, trade credit is a form of short-term financing that can help businesses manage their cash flow and facilitate smooth transactions.

Trade credit is a vital component of the business-to-business (B2B) ecosystem, as it allows businesses to maintain a healthy cash flow by deferring payments for goods or services. This flexibility can be especially beneficial for small and medium-sized enterprises (SMEs), as it provides them with the opportunity to access goods and services without immediate payment, ultimately supporting their growth and development.

When businesses establish trade credit arrangements, it not only benefits them but also strengthens the relationships between suppliers and customers. By offering trade credit, suppliers can foster customer loyalty and build long-term partnerships with their clients. This mutually beneficial arrangement allows suppliers to retain customers and increase sales volume, while customers have the opportunity to defer their payment obligations and free up working capital.

In the following sections, we will explore the definition and importance of trade credit, along with its advantages, disadvantages, different types, how it works, factors affecting trade credit, and tips for managing trade credit effectively.

Definition of Trade Credit

Trade credit is a form of credit extended by suppliers to their customers, allowing them to purchase goods or services on credit terms. It involves an arrangement where the supplier agrees to provide the goods or services upfront, while the customer agrees to make the payment at a later date, typically within a specified time frame.

What sets trade credit apart from other forms of credit is that it is often provided by the supplier directly, rather than a financial institution. This makes it a unique financing option that is specific to business-to-business transactions. The terms of trade credit can vary depending on the agreement between the supplier and customer, but it usually includes the payment due date, any applicable discounts or incentives, and penalties for late payments.

Trade credit is a common practice in various industries, such as manufacturing, retail, wholesale, and distribution. It serves as a short-term financing solution that enables businesses to manage their cash flow effectively. By allowing customers to defer payment, trade credit provides them with the opportunity to generate revenue from the goods or services before having to pay for them.

Trade credit can be extended in different forms. One common form is open account credit, where the supplier provides goods or services without requesting immediate payment. In this case, the supplier usually invoices the customer with a payment due date, typically within 30, 60, or 90 days. Another form is trade credit in the form of promissory notes or bills of exchange where there is a formal agreement to repay the debt within a specified period with interest.

Overall, trade credit is a mutually beneficial arrangement that helps businesses maintain a healthy cash flow while facilitating transactions between suppliers and customers. It is a critical financial tool that plays a significant role in the smooth functioning of the business-to-business economy.

Importance of Trade Credit

Trade credit plays a crucial role in the functioning of the business world and is of significant importance to both suppliers and customers. Here are some key reasons why trade credit is important:

- Improves Cash Flow: One of the primary benefits of trade credit is that it helps businesses manage their cash flow effectively. By allowing customers to purchase goods or services on credit terms, suppliers can receive their revenue upfront while providing the customers with the flexibility to pay at a later date. This helps businesses maintain a steady cash flow and meet their immediate financial obligations.

- Facilitates Business Growth: For many businesses, access to trade credit can be essential for growth and expansion. By utilizing trade credit, businesses can acquire the necessary inventory, equipment, or materials required to operate and expand their operations. This enables them to meet customer demand, fulfill orders, and ultimately grow their market share.

- Builds Strong Supplier-Customer Relationships: Trade credit arrangements can help build and strengthen relationships between suppliers and customers. When suppliers extend credit to their customers, it fosters trust and loyalty, as it demonstrates a level of confidence in the customer’s ability to honor their payment obligations. This can lead to long-term partnerships and repeat business, benefiting both parties in the transaction.

- Supports Small and Medium-Sized Enterprises (SMEs): Trade credit is particularly significant for small and medium-sized enterprises (SMEs) who may face challenges in obtaining traditional financing options. By allowing SMEs to access goods and services without immediate payment, trade credit provides them with the necessary resources to operate and compete in the market. It levels the playing field and enables SMEs to grow and thrive.

- Enhances Efficiency in Supply Chain: Trade credit helps to streamline the supply chain by allowing goods or services to flow smoothly between suppliers and customers. By providing credit terms, suppliers encourage customers to purchase more frequently and in larger quantities, which can lead to economies of scale and cost savings in the production and distribution processes. This drives efficiency and competitiveness in the supply chain.

In summary, trade credit is important for businesses as it improves cash flow, facilitates growth, builds strong relationships, supports SMEs, and enhances supply chain efficiency. It is a valuable financial tool that enables businesses to operate effectively and seize opportunities for success in a dynamic and competitive marketplace.

Advantages of Trade Credit

Trade credit offers several advantages to both suppliers and customers, making it a valuable financing option in the business-to-business (B2B) landscape. Here are some key advantages of trade credit:

- Flexible Payment Terms: Trade credit provides customers with the flexibility to purchase goods or services without immediate payment. This allows businesses to manage their cash flow effectively and allocate their financial resources to other critical areas of the business.

- Improved Working Capital: By deferring payment obligations, trade credit helps businesses free up their working capital. Instead of paying for inventory or services upfront, businesses can utilize their cash resources for other essential business operations, such as marketing, equipment upgrades, or expansion.

- Opportunity for Sales Growth: Suppliers who offer trade credit can stimulate sales growth by attracting more customers. By allowing customers to make purchases on credit, suppliers can increase their sales volume and reach a wider customer base. This can lead to higher revenue and market share.

- Establishing and Building Credit History: Trade credit can help businesses establish or strengthen their credit history. Timely payments and responsible credit management can contribute to a positive credit rating, which can be beneficial when seeking additional financing or negotiating favorable terms with suppliers.

- Enhancing Supplier-Customer Relationships: By extending trade credit, suppliers can develop strong and loyal relationships with their customers. Offering credit terms demonstrates trust and confidence in the customer’s ability to make timely payments, which can foster long-term partnerships and repeat business.

- Supporting Cash Flow Management: Trade credit plays a crucial role in managing cash flow for businesses. It allows companies to delay payments until after they have generated revenue from the goods or services. This helps businesses maintain a healthy cash flow, minimizing the risk of financial strain or liquidity issues.

Overall, trade credit offers numerous advantages for businesses. It provides flexibility in payment terms, improves working capital, stimulates sales growth, helps build credit history, enhances supplier-customer relationships, and supports effective cash flow management. By leveraging these advantages, businesses can navigate financial challenges and grow sustainably within the B2B ecosystem.

Disadvantages of Trade Credit

While trade credit can be beneficial for businesses, it is important to consider the potential disadvantages associated with this financing option. Here are some common disadvantages of trade credit:

- Risk of Payment Delays or Default: Trade credit introduces the risk of payment delays or default by customers. If customers are unable or unwilling to make timely payments, suppliers may face cash flow issues and find it challenging to meet their own financial obligations, such as paying suppliers or meeting operational expenses.

- Loss of Financial Control: By extending trade credit, suppliers relinquish immediate control over their cash flow. They rely on customers to fulfill their payment obligations within the agreed-upon timeframe. This lack of control can make it challenging for suppliers to accurately forecast and plan their finances.

- Opportunity Cost: When offering trade credit, suppliers essentially provide goods or services without immediate payment. This can tie up their working capital and restrict their ability to invest in other areas of the business. Suppliers must carefully evaluate the opportunity cost of trade credit and consider alternative financing options.

- Risk of Bad Debt: There is always a risk of customers defaulting on their payment obligations, leading to bad debt for suppliers. This can significantly impact the financial stability of suppliers, especially if they rely heavily on trade credit as a source of revenue and cash flow.

- Increased Administrative Effort: Managing trade credit requires additional administrative effort, such as credit checks, invoicing, and follow-ups on payment collections. This can add complexity to the business operations and increase the workload for the finance and accounting teams.

- Potential Strain on Supplier-Customer Relationships: Disputes and disagreements may arise when managing trade credit. Late payments, disputes over product quality, or changes in credit terms can strain the relationship between suppliers and customers. It requires effective communication and resolution strategies to prevent any negative impact on the business partnership.

It is important for businesses to carefully assess the disadvantages of trade credit and develop strategies to mitigate risk. Implementing credit check procedures, establishing credit limits, maintaining a robust receivables management system, and diversifying customer base can help manage these disadvantages effectively.

Overall, while trade credit offers numerous advantages, businesses must weigh these against the potential disadvantages and take appropriate measures to ensure successful management of trade credit arrangements.

Types of Trade Credit

There are different types of trade credit arrangements that businesses can utilize based on their unique needs and preferences. Let’s explore some common types of trade credit:

- Open Account Credit: This is the most common type of trade credit. It involves the supplier providing goods or services to the customer without requiring immediate payment. The supplier invoices the customer with a specified payment due date, typically within 30, 60, or 90 days. Open account credit is based on trust and is often extended to customers with established relationships and good credit standing.

- Revolving Trade Credit: Revolving trade credit is a type of credit arrangement where the supplier sets a credit limit for the customer, and the customer can make multiple purchases up to that limit without requiring individual credit approvals for each transaction. The customer can repay the outstanding balance over time, and as long as the credit limit is not exceeded, they can continue to make purchases on credit.

- Consignment: In a consignment arrangement, the supplier delivers goods to the customer, but the ownership of the goods remains with the supplier until they are sold by the customer. The customer has the opportunity to sell the goods and generate revenue before making payment to the supplier. This type of trade credit is often used in industries where inventory turnover is longer, such as art, antiques, or specialty products.

- Advance Payment: Although not technically trade credit, advance payment is a type of arrangement where the customer makes full or partial payment upfront before the supplier provides the goods or services. This can provide a sense of security and guarantee to the supplier, particularly when dealing with new or international customers.

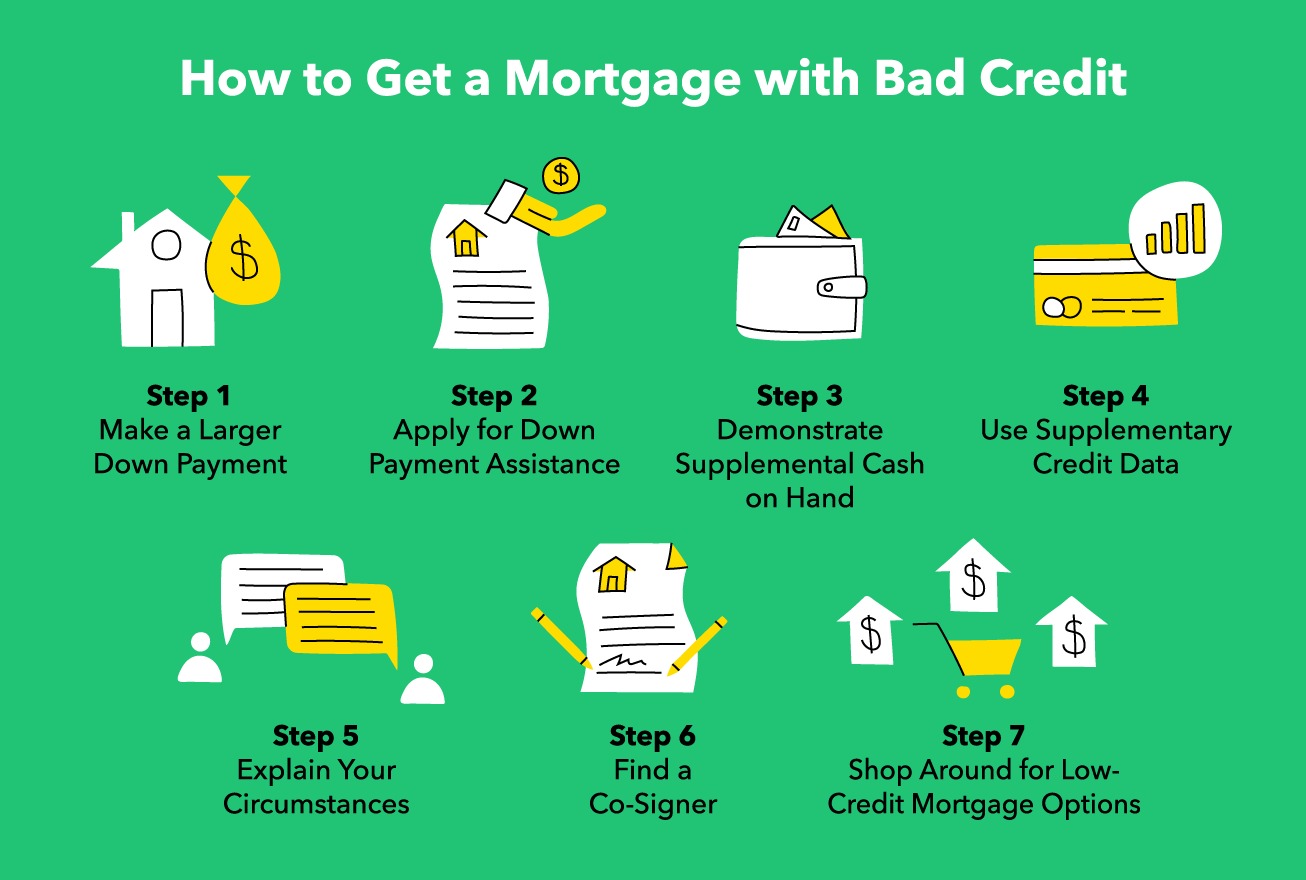

- Letter of Credit: A letter of credit is a document issued by a bank on behalf of the buyer, guaranteeing payment to the supplier once certain conditions are met. The bank acts as an intermediary and ensures that the supplier is paid promptly once the requirements outlined in the letter of credit are satisfied. This type of trade credit is commonly used in international trade to mitigate the risk for both buyers and sellers.

It’s important for businesses to understand the different types of trade credit and choose the most suitable option based on their business model, industry, and specific requirements. Each type of trade credit offers its own advantages and considerations, and businesses should carefully evaluate which option aligns best with their overall financial strategy.

How Trade Credit Works

Trade credit works by establishing a credit arrangement between a supplier and a customer. Here is an overview of how trade credit typically operates:

- Order Placement: The customer selects the goods or services they wish to purchase from the supplier. They communicate their order either through a purchase order or a verbal agreement.

- Goods or Services Delivery: Once the order is placed, the supplier delivers the goods or provides the agreed-upon services to the customer. Depending on the terms of the trade credit agreement, the supplier may deliver the goods immediately or over a specified period.

- Invoice: After the delivery, the supplier generates an invoice detailing the purchase amount, payment due date, and any applicable discounts or incentives. The invoice serves as a formal request for payment.

- Payment Terms and Credit Period: The trade credit agreement specifies the payment terms, including the credit period within which the customer is expected to make full payment. The credit period can range from 30, 60, or 90 days, but it can vary based on the agreement between the supplier and customer.

- Payment: The customer is responsible for making payment by the agreed-upon due date. Payment can be made through various methods, such as electronic transfer, check, or online payment platforms.

- Reconciliation and Follow-ups: The supplier reconciles the received payment with the corresponding invoice. If the payment is made in full and on time, the transaction is considered complete. In cases of late or partial payment, the supplier may follow up with the customer to resolve any outstanding issues and collect the remaining amount.

- Building Credit History: Successful trade credit transactions contribute to the establishment and improvement of the customer’s credit history. Consistent and timely payments can enhance the customer’s creditworthiness, allowing them to access trade credit from other suppliers in the future.

It is important for both suppliers and customers to maintain clear communication and transparency throughout the trade credit process. Open and honest dialogue helps to ensure that both parties understand and fulfill their respective obligations, minimizing the risk of disputes or payment delays.

Furthermore, businesses can use trade credit as an opportunity to negotiate favorable terms, such as early payment discounts or extended credit periods. By leveraging the benefits of trade credit, businesses can effectively manage their cash flow and strengthen relationships within the business ecosystem.

Factors Affecting Trade Credit

Several factors can influence the terms and conditions of trade credit arrangements between suppliers and customers. Understanding these factors is crucial for both parties to negotiate favorable credit terms. Here are some key factors that impact trade credit:

- Customer’s Creditworthiness: The creditworthiness of the customer is a critical factor in determining trade credit terms. Suppliers assess the customer’s ability to honor payment obligations based on their credit history, financial stability, and industry reputation. Customers with a strong credit score and positive payment track record are more likely to receive more favorable credit terms.

- Industry Norms and Standards: Certain industries have established norms and standards when it comes to trade credit terms. Suppliers may offer similar credit terms to their customers to remain competitive and align with industry practices. Understanding the prevailing norms within an industry can help both suppliers and customers negotiate fair trade credit terms.

- Supplier’s Financial Position: The financial health and stability of the supplier can influence trade credit terms. Suppliers with strong financial backing and a stable cash flow position are more likely to offer flexible payment terms or higher credit limits to customers. On the other hand, suppliers facing financial constraints may enforce stricter payment terms to mitigate risks.

- Length of Relationship: The duration of the business relationship between the supplier and customer can impact trade credit terms. Suppliers may be more willing to extend favorable credit terms to loyal and long-standing customers as they have built trust and established a track record of timely payments.

- Market Conditions: The overall economic and market conditions can influence trade credit terms. In times of economic uncertainty or downturns, suppliers may tighten credit standards to mitigate the risk of default. Conversely, during periods of economic growth, suppliers may offer more flexible credit terms to incentivize sales and maintain competitive advantage.

- Size and Volume of Transactions: The size and volume of transactions between the supplier and customer can impact trade credit terms. Larger orders or consistent high-volume purchases may lead to more favorable credit terms, such as higher credit limits or extended payment periods.

It is important for both suppliers and customers to consider these factors when negotiating trade credit terms. Open communication, transparency, and a mutual understanding of each other’s needs and constraints can help establish a fair trade credit arrangement that benefits both parties.

Additionally, monitoring and regularly reassessing these factors is essential as changes in creditworthiness, market conditions, or financial stability can impact trade credit terms over time.

Managing Trade Credit

Effectively managing trade credit is crucial for both suppliers and customers to ensure smooth transactions and maintain healthy financial operations. Here are some tips for managing trade credit:

- Perform Credit Checks: Suppliers should conduct thorough credit checks on prospective customers before extending trade credit. This helps assess the customer’s creditworthiness, payment history, and financial stability, reducing the risk of default.

- Set Clear Credit Terms: Suppliers should clearly define the credit terms, including the payment due date, any applicable discounts or penalties, and any special conditions. Communicating these terms clearly helps avoid any confusion or disputes in the future.

- Establish Credit Limits: Determine appropriate credit limits for each customer based on their creditworthiness, payment history, and business volume. Setting credit limits helps manage risk and prevents overextension of credit to customers who may have difficulty making timely payments.

- Monitor Receivables: Regularly monitor and track outstanding receivables to ensure timely payment collections. Implementing an effective receivables management system helps identify any payment delays or issues early on, allowing for prompt follow-up and resolution.

- Encourage Early Payments: Offer incentives such as early payment discounts to encourage customers to make payments before the due date. This can help improve cash flow and minimize the risk of late payments.

- Establish Collection Procedures: Develop a clear process for handling late payments or delinquencies. Promptly contact customers for outstanding payments, send reminders, and escalate collection efforts as necessary, while maintaining professionalism and customer relationships.

- Review and Adjust Credit Policies: Regularly review and reassess credit policies based on market conditions, customer performance, and overall business goals. Make adjustments as needed to optimize credit terms and mitigate risk.

- Utilize Technology: Leverage automated accounting and receivables management systems to streamline processes and enhance efficiency. Technology can help track invoices, automate payment reminders, and generate reports for better credit management.

For customers, it is important to effectively manage trade credit by adhering to the agreed-upon payment terms, maintaining open communication with suppliers, and proactively addressing any potential payment issues. Timely and accurate payments contribute to building a positive credit reputation and fosters stronger relationships with suppliers.

By implementing these strategies and best practices, both suppliers and customers can optimize the benefits of trade credit while mitigating the associated risks, ensuring a mutually beneficial and sustainable trade credit relationship.

Conclusion

Trade credit is a vital component of the business-to-business (B2B) landscape, offering a flexible and valuable financing option for suppliers and customers. It enables businesses to manage cash flow, support growth, and strengthen relationships within the B2B ecosystem. While trade credit offers advantages such as flexible payment terms, improved working capital, and enhanced supplier-customer relationships, it also comes with potential disadvantages like payment delays, loss of financial control, and the risk of bad debt.

Understanding the factors influencing trade credit, such as creditworthiness, industry norms, and market conditions, is crucial for both suppliers and customers. By effectively managing trade credit, businesses can optimize cash flow, minimize risk, and maintain healthy financial operations.

Suppliers should conduct credit checks, set clear credit terms, and establish credit limits to mitigate risk. They should also monitor receivables, encourage early payments, and establish collection procedures to ensure timely and complete payment collections.

Customers, on the other hand, should adhere to payment terms, maintain open communication with suppliers, and proactively address any potential payment issues. Timely and accurate payments contribute to building a positive credit reputation, fostering stronger relationships with suppliers.

In summary, trade credit is a valuable tool that enables businesses to navigate financial challenges, support growth, and streamline transactions. By understanding and effectively managing trade credit, businesses can forge strong partnerships, improve cash flow, and thrive in the dynamic B2B environment.