Home>Finance>What Percentage Of The Balance Is The Minimum Payment On Lowe’s Credit

Finance

What Percentage Of The Balance Is The Minimum Payment On Lowe’s Credit

Published: February 27, 2024

Learn about the minimum payment percentage on Lowe's credit and how it impacts your finances. Find out more about managing your credit balance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit card payments, where understanding the dynamics of minimum payments is crucial for maintaining financial health. Whether you're a seasoned credit card user or new to the world of plastic money, comprehending the significance of minimum payments, especially in the context of Lowe's credit card, is essential.

Managing credit card payments can be a daunting task, but with the right knowledge, you can navigate this financial landscape with confidence. In this article, we'll delve into the specifics of minimum payments on Lowe's credit card, shedding light on the percentage of the balance that constitutes the minimum payment. Additionally, we'll explore the factors that influence minimum payments and provide practical tips for effectively managing credit card payments.

Understanding the intricacies of minimum payments is vital for making informed financial decisions and avoiding potential pitfalls associated with credit card debt. So, let's embark on this enlightening journey to unravel the mysteries of minimum payments on Lowe's credit card and empower ourselves with the knowledge to navigate the world of credit card finances.

Understanding Minimum Payments

Minimum payments represent the lowest amount a credit card holder must pay each month to keep the account in good standing. While making the minimum payment by the due date helps avoid late fees and negative credit reporting, it’s important to recognize that this approach can lead to long-term debt and substantial interest payments.

When it comes to credit cards, understanding the concept of minimum payments is crucial. The minimum payment typically includes a combination of the interest accrued on the outstanding balance, a portion of the principal amount, and any fees or charges. It’s important to note that paying only the minimum due prolongs the time required to pay off the balance and increases the total interest paid over the life of the debt.

For Lowe’s credit cardholders, comprehending the specifics of minimum payments is particularly important. By understanding the composition of the minimum payment and its implications, cardholders can make informed decisions regarding their financial obligations and debt management strategies.

Moreover, grasping the relationship between the minimum payment and the outstanding balance is essential for maintaining financial stability and avoiding the pitfalls of revolving credit. It’s imperative for cardholders to recognize that the minimum payment is typically calculated as a percentage of the outstanding balance, and this percentage can have a significant impact on the ability to manage and ultimately pay off the debt.

As we continue our exploration of minimum payments, we’ll delve into the specific percentage of the balance that constitutes the minimum payment on Lowe’s credit card, shedding light on the factors that influence this percentage and providing valuable insights for effectively managing credit card payments.

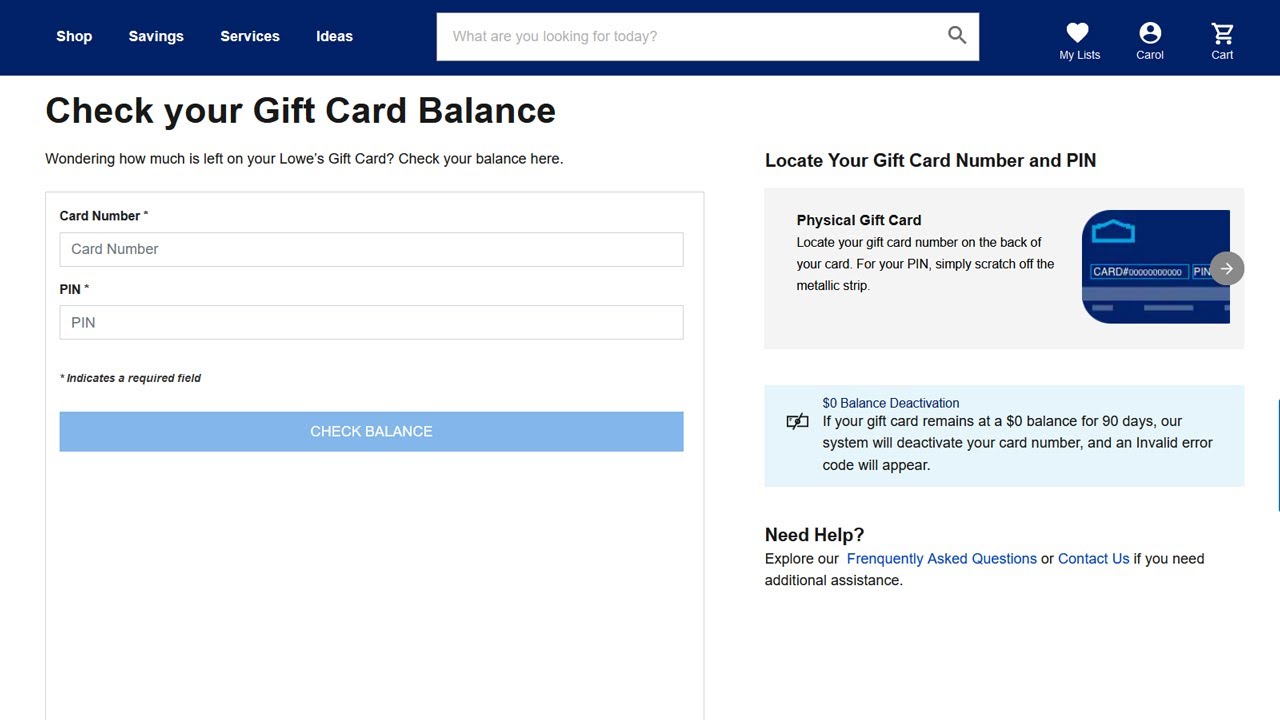

Lowe’s Credit Card Minimum Payment Percentage

When it comes to Lowe’s credit card, the minimum payment percentage is a crucial factor that directly impacts cardholders’ financial obligations. The minimum payment percentage represents the portion of the outstanding balance that cardholders are required to pay each month to maintain their account in good standing.

While the specific minimum payment percentage may vary based on the terms and conditions of the Lowe’s credit card, it typically ranges from 1% to 3% of the outstanding balance. This means that cardholders are generally expected to pay a minimum of 1% to 3% of their total balance each month to avoid late fees and negative credit reporting.

Understanding the minimum payment percentage is essential for Lowe’s credit cardholders, as it directly influences their monthly financial commitments and the overall timeline for paying off their balances. By recognizing the percentage of the balance that constitutes the minimum payment, cardholders can make informed decisions about their repayment strategies and budgeting efforts.

It’s important to note that while paying the minimum due can help avoid immediate penalties, it can also result in prolonged debt and increased interest payments over time. Therefore, Lowe’s credit cardholders are encouraged to consider paying more than the minimum whenever possible to expedite the repayment process and minimize interest expenses.

By gaining insights into the minimum payment percentage on Lowe’s credit card and its implications, cardholders can proactively manage their financial responsibilities and work towards achieving greater stability and control over their credit card debt.

Factors Affecting Minimum Payments

Several key factors influence the calculation of minimum payments on Lowe’s credit card, shaping cardholders’ financial obligations and repayment requirements. Understanding these factors is essential for navigating the dynamics of minimum payments and making informed decisions regarding credit card debt management.

- Outstanding Balance: The outstanding balance on the Lowe’s credit card directly impacts the minimum payment amount. As the balance fluctuates, so does the minimum payment, with a higher balance leading to a larger minimum payment and vice versa.

- Minimum Payment Percentage: The minimum payment percentage, typically ranging from 1% to 3% of the outstanding balance, directly influences the minimum payment amount. A higher percentage results in a larger minimum payment requirement, affecting cardholders’ monthly financial commitments.

- Interest Rate: The annual percentage rate (APR) associated with the Lowe’s credit card plays a significant role in determining the minimum payment. A higher interest rate leads to greater interest accrual on the outstanding balance, subsequently impacting the minimum payment amount.

- Fee and Charges: Additional fees and charges, such as late fees or over-limit fees, can contribute to the minimum payment amount, increasing cardholders’ financial obligations for the billing cycle.

- Payment History: Cardholders’ payment history, including any missed or late payments, can influence the minimum payment amount. A history of delinquency may lead to higher minimum payments as the card issuer seeks to mitigate risk.

By recognizing these factors, Lowe’s credit cardholders can gain valuable insights into the dynamics of minimum payments and proactively manage their financial responsibilities. Moreover, understanding the interplay of these factors empowers cardholders to make informed decisions about their repayment strategies and take proactive steps towards achieving greater financial stability and control over their credit card debt.

Tips for Managing Credit Card Payments

Effectively managing credit card payments is essential for maintaining financial stability and minimizing the long-term impact of credit card debt. Whether you’re a Lowe’s credit cardholder or manage other credit accounts, implementing sound strategies for handling credit card payments can significantly impact your financial well-being. Here are some valuable tips to help you navigate the world of credit card payments:

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum due. By making additional payments, you can expedite the repayment process and reduce the total interest paid over time.

- Create a Budget: Establish a realistic budget that allocates funds for credit card payments. Prioritize paying more than the minimum required to make meaningful progress in reducing your outstanding balance.

- Monitor Your Spending: Keep a close eye on your credit card usage and strive to maintain responsible spending habits. Avoid unnecessary purchases that could lead to increased credit card debt.

- Set Up Payment Reminders: Consider setting up payment reminders to ensure that you never miss a due date. Timely payments can help you avoid late fees and negative impacts on your credit score.

- Explore Balance Transfer Options: If feasible, explore the possibility of transferring high-interest credit card balances to a card with a lower interest rate. This can help reduce interest expenses and facilitate debt repayment.

- Communicate with Your Card Issuer: In case of financial hardships or unexpected challenges, don’t hesitate to communicate with your card issuer. They may offer assistance or alternative payment arrangements to help you manage your credit card payments effectively.

By implementing these tips, you can take proactive steps to manage your credit card payments responsibly and work towards achieving greater financial freedom. Whether you’re dealing with a Lowe’s credit card or other credit accounts, these strategies can empower you to navigate the complexities of credit card payments with confidence and control.

Conclusion

As we conclude our exploration of minimum payments on Lowe’s credit card, it’s evident that understanding the dynamics of credit card payments is essential for maintaining financial health and stability. The percentage of the balance that constitutes the minimum payment directly impacts cardholders’ monthly financial obligations and the overall timeline for paying off their balances. By gaining insights into the factors influencing minimum payments and implementing sound strategies for managing credit card payments, cardholders can navigate the complexities of credit card finances with confidence.

For Lowe’s credit cardholders and individuals managing other credit accounts, the importance of paying more than the minimum due cannot be overstated. By prioritizing additional payments and adopting responsible spending habits, cardholders can expedite the repayment process and reduce the long-term impact of credit card debt. Moreover, staying informed about budgeting, payment reminders, and potential balance transfer options empowers cardholders to take proactive steps towards achieving greater financial freedom and control over their credit card finances.

Ultimately, effective credit card payment management requires a combination of financial literacy, responsible spending, and proactive decision-making. By implementing the tips outlined in this article and maintaining a clear understanding of minimum payment dynamics, cardholders can work towards achieving their financial goals and minimizing the burden of credit card debt. Whether it’s paying more than the minimum, creating a realistic budget, or exploring alternative payment arrangements, taking proactive steps today can lead to a brighter and more financially secure tomorrow.