Home>Finance>What Situation Should You Not Change Capital Structure

Finance

What Situation Should You Not Change Capital Structure

Modified: December 30, 2023

Discover when it is not advisable to alter the capital structure in finance. Gain insight into situations where maintaining stability outweighs the potential benefits of change.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

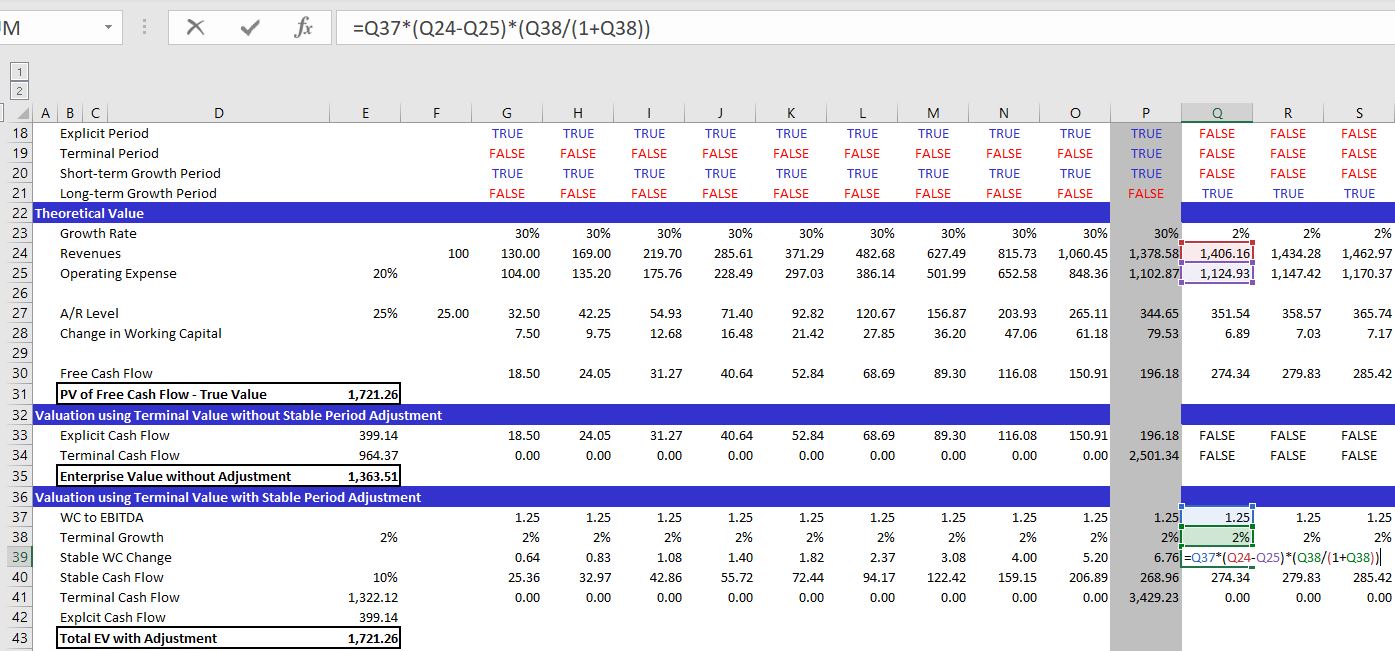

Welcome to our comprehensive guide on capital structure in finance! Capital structure refers to the way a company finances its operations by using a combination of equity and debt. It plays a crucial role in determining a company’s financial health and stability. The right capital structure ensures that a company has the necessary funds to support its growth, manage risk, and maximize shareholder value.

Capital structure decisions are not to be taken lightly. They require careful consideration of various factors, such as the company’s industry, growth prospects, profitability, and risk appetite. Changing the capital structure can have significant implications for a company’s financial position, cost of capital, and ability to meet debt obligations.

In this article, we will explore the importance of capital structure and the factors that companies should consider when deciding whether or not to change their capital structure. Furthermore, we will delve into specific situations where it is advisable for businesses to refrain from changing their capital structure.

By understanding the intricacies of capital structure and the situations where it should not be altered, companies can make informed decisions that safeguard their financial stability and promote long-term success.

Importance of Capital Structure

The capital structure of a company is crucial as it directly affects its financial position, risk profile, and ability to generate returns for its shareholders. Here are some key reasons why capital structure matters:

- Optimal Use of Financial Resources: A well-designed capital structure allows a company to strike a balance between equity and debt financing. By carefully considering the cost of equity and debt, companies can optimize their capital structure to minimize the cost of capital and maximize the value of their financial resources.

- Financial Stability: An appropriate capital structure helps ensure the financial stability of a company. By having a mix of equity and debt financing, a company can diversify its sources of funding and reduce its reliance on a single financing channel. This diversification of risk can help buffer the company against economic downturns or unexpected financial challenges.

- Flexibility in Operations: A well-managed capital structure provides a company with the flexibility to pursue growth opportunities, such as acquisitions, expansions, or research and development. By having access to both equity and debt financing, companies can fund their strategic initiatives and capitalize on favorable market conditions.

- Enhanced Creditworthiness: Maintaining an optimal capital structure improves a company’s creditworthiness in the eyes of lenders. A balanced mix of equity and debt financing demonstrates the company’s ability to manage debt obligations and pay interest expenses. This, in turn, makes it easier for the company to secure favorable terms and conditions on debt financing.

- Shareholder Value Maximization: Capital structure decisions have a significant impact on shareholder value. By effectively managing the capital structure, a company can optimize its cost of capital, leading to higher profitability and increased returns for shareholders.

In summary, a well-designed capital structure is vital for the financial health and success of a company. It enables efficient resource allocation, enhances financial stability, provides operational flexibility, boosts creditworthiness, and maximizes shareholder value. Understanding the importance of capital structure is essential for companies seeking to thrive in a competitive business landscape.

Factors to Consider for Changing Capital Structure

Changing the capital structure of a company is a significant decision that requires careful consideration. While there is no one-size-fits-all approach, several key factors should be taken into account when evaluating the need for a capital structure change:

- Current Financial Position: Assessing the company’s current financial position is crucial. Analyze key financial metrics such as liquidity, profitability, and solvency ratios. A company with healthy financials is better positioned to explore capital structure changes without significantly increasing risk.

- Cost of Capital: Evaluate the cost of capital associated with the current capital structure and compare it to alternative capital structures. Analyze the cost of equity and debt financing, taking into consideration interest rates, dividends, and any associated transaction costs. A lower cost of capital can improve profitability and increase shareholder value.

- Risk Profile: Assess the risk appetite and tolerance of the company. A higher debt-to-equity ratio increases financial leverage and may result in higher interest payments, increasing the risk of financial distress. Evaluate the company’s ability to handle debt obligations and maintain adequate cash flow in different business scenarios.

- Industry and Market Dynamics: Consider the specific characteristics of the company’s industry and market. Different industries have varying capital structure norms and requirements. Analyze the debt-to-equity ratios of peer companies to assess industry benchmarks and understand the impact of changing the capital structure on the company’s competitiveness and market position.

- Growth Prospects: Evaluate the company’s growth prospects and the capital required to fund future initiatives. A capital structure change may be necessary if the company is planning significant investments, expansions, or acquisitions. Consider the availability of external financing options and the potential impact on the company’s future financial performance.

It is important to note that these factors should be evaluated in conjunction with each other, as they are interrelated. Any decision to change the capital structure should be based on a comprehensive analysis of the company’s financial position, cost of capital, risk profile, industry dynamics, and growth prospects. Seeking the guidance of financial professionals and conducting thorough due diligence is recommended before making any capital structure changes.

Situations Where Capital Structure Should Not be Changed

While there are circumstances that may warrant a capital structure change, there are also situations where it is advisable for companies to refrain from making such changes. Here are a few scenarios where capital structure should not be altered:

- Stable Financial Position: If the company’s financial position is stable, with healthy cash flows, manageable debt levels, and consistent profitability, it may be unnecessary to make changes to the capital structure. Altering the capital structure in such cases may introduce unnecessary risk and potentially disrupt the stability that has been achieved.

- Unfavorable Market Conditions: During periods of economic uncertainty or unfavorable market conditions, it may be wise to maintain the current capital structure. Changing the capital structure in volatile times may expose the company to increased financial risk, as securing favorable financing terms and conditions could be challenging.

- Upcoming Debt Obligations: If the company has significant upcoming debt obligations, such as bond maturities or loan repayments, it is generally not advisable to alter the capital structure. Changing the capital structure too close to these obligations may disrupt the company’s ability to meet its debt payments and negatively impact its creditworthiness.

- Cost and Time Constraints: Capital structure changes can be time-consuming and costly, involving legal, accounting, and advisory fees. If the anticipated benefits of altering the capital structure do not outweigh the costs and time involved, it may be better to maintain the current structure and focus on other areas of business improvement.

- Limited Growth Opportunities: If the company is not planning significant growth initiatives or expansions in the near future, the existing capital structure may be adequate. Changing the structure without a clear growth strategy or the need for additional funding may not yield significant benefits and could divert resources from other areas of the business.

It is important to thoroughly evaluate the specific circumstances and goals of the company before making a decision regarding the capital structure. If the company’s financial position is stable, market conditions are uncertain, debt obligations are looming, costs and time constraints are significant, or growth opportunities are limited, it may be prudent to refrain from changing the capital structure.

Ultimately, the decision to modify the capital structure should be based on a thorough analysis of the potential benefits and risks involved, taking into consideration the unique characteristics and objectives of the company.

Conclusion

Capital structure plays a vital role in the financial success and stability of a company. Making informed decisions regarding the capital structure can have a significant impact on a company’s cost of capital, risk profile, and ability to generate shareholder value. However, there are situations where it is advisable for companies to refrain from changing their capital structure.

Before making any changes to the capital structure, it is important for companies to evaluate their current financial position, cost of capital, risk profile, industry dynamics, and growth prospects. Factors such as stability, market conditions, upcoming debt obligations, cost constraints, and growth opportunities all play a role in determining whether or not a capital structure change is necessary.

In stable financial situations, during unfavorable market conditions, close to imminent debt obligations, or when the costs and time involved outweigh the potential benefits, it is generally wise to maintain the existing capital structure. It is important to consider the potential consequences of altering the capital structure, such as increased risk, financial distress, or diverting resources away from other areas of the business.

Ultimately, the decision regarding the capital structure should be made after careful analysis and consideration of the unique circumstances and objectives of the company. Seeking the guidance of financial professionals can provide valuable insights and assist in making well-informed decisions.

By understanding the importance of capital structure and the situations where changes should or should not be made, companies can navigate the complexities of finance efficiently, enhance their financial stability, and optimize their value creation for shareholders.