Finance

Capital Structure Pertains To What

Modified: March 1, 2024

Discover the importance of capital structure in finance and understand its impact on a company's financial stability and risk management. Learn more about capital structure and its role in financial decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Capital Structure

- Importance of Capital Structure

- Factors Affecting Capital Structure

- Types of Capital Structure

- Optimal Capital Structure

- Determining the Capital Structure

- Trade-off Theory of Capital Structure

- Pecking Order Theory of Capital Structure

- Capital Structure and Firm Performance

- Conclusion

Introduction

When it comes to managing the financial health of a company, one of the key aspects that must be considered is the capital structure. Capital structure refers to the way a company finances its operations and investments through a combination of debt and equity.

Having an optimal capital structure is crucial for a company’s success and long-term sustainability. It plays a vital role in determining the right balance of debt and equity that allows a company to maximize its value, manage risk, and ensure financial stability.

In this article, we will delve into the concept of capital structure, its importance, the factors affecting it, different types of capital structures, and how to determine the most optimal one for a company.

Understanding capital structure is essential for both business owners and investors, as it can significantly impact the company’s financial performance, cost of capital, and overall profitability. By grasping the intricacies of capital structure management, businesses can make informed decisions and increase their chances of success in a competitive market.

Join us as we explore the fascinating world of capital structure and unravel the complexities associated with it. Whether you are an aspiring entrepreneur or a seasoned investor, this article will provide valuable insights into the crucial role that capital structure plays in shaping the financial landscape of a company.

Definition of Capital Structure

Capital structure refers to the way a company finances its operations and investments by utilizing a combination of different sources of funding, such as debt and equity. It represents the composition of a company’s capital, including long-term debt, short-term debt, and equity.

In simpler terms, the capital structure of a company represents the mix of debt and equity used to finance its assets and operations. It outlines the financial framework that supports a company’s growth and determines the ownership and control rights of its stakeholders.

Debt, in the context of capital structure, refers to the money borrowed by a company from external sources, such as banks or financial institutions, which is repaid over a specific period with interest. Equity, on the other hand, represents the ownership interest in the company held by its shareholders.

Capital structure is a crucial aspect of financial management as it shapes the overall risk and return profile of a company. The decision regarding the right mix of debt and equity is made by considering various factors, including financial stability, cost of capital, tax implications, and flexibility in financial management.

It is important to note that the capital structure of a company can change over time, depending on its financial needs, business strategy, and market conditions. A company may choose to alter its capital structure by issuing new stocks, repurchasing shares, or taking on additional debt to fund its growth or expansion plans.

By understanding and effectively managing the capital structure, companies can strike a balance between the different sources of financing to optimize their cost of capital, manage risk, and maximize shareholder value.

Now that we have a clear understanding of what capital structure entails, let’s explore the importance of capital structure in the next section.

Importance of Capital Structure

The capital structure of a company plays a crucial role in its financial health and overall success. It has a significant impact on various aspects, including the cost of capital, risk management, and shareholder value. Let’s delve into the key reasons why capital structure is important:

1. Cost of Capital: The capital structure affects the cost of capital for a company, which is the minimum return required by investors for investing in the company. A well-structured capital mix can lower the cost of capital by utilizing cheaper sources of financing, such as debt. This, in turn, enhances the company’s profitability and valuation.

2. Risk Management: Capital structure helps in managing the risk associated with the company’s operations. By diversifying the sources of financing, a company can reduce its reliance on a single type of funding and mitigate the potential financial risks. Maintaining an appropriate balance between debt and equity ensures that the company can meet its financial obligations, even during challenging times.

3. Financial Flexibility: Capital structure provides companies with the flexibility to raise funds as needed. By having a mix of debt and equity, companies can tap into different sources of financing. This allows them to take advantage of growth opportunities, invest in new projects, or navigate through economic uncertainties without relying solely on internal cash flows.

4. Tax Implications: The capital structure can have tax implications for the company. Interest paid on debt is tax-deductible, which can result in a lower tax liability for the company. By utilizing debt financing strategically, companies can optimize their tax benefits and ultimately enhance their after-tax profitability.

5. Shareholder Value: The capital structure directly impacts the value of the company and the wealth of its shareholders. A well-optimized capital structure can increase the company’s profitability, cash flows, and overall financial performance. This, in turn, enhances shareholder value and attracts potential investors in the market.

6. Industry and Market Considerations: The capital structure should also align with the industry norms and market expectations. Different industries may have varying capital structure preferences based on their risk profiles and capital-intensive nature. Adhering to industry standards can help companies maintain their competitiveness and gain credibility among investors and stakeholders.

It is important for companies to regularly evaluate and adjust their capital structure to adapt to changing market conditions, business requirements, and financial goals. Striking the right balance is a delicate decision that requires careful analysis and consideration of various factors.

Next, we will explore the factors that influence the capital structure decisions of companies.

Factors Affecting Capital Structure

The capital structure decisions of a company are influenced by various factors that need to be taken into consideration. These factors can vary from one company to another and can have a significant impact on the optimal mix of debt and equity. Let’s explore some of the key factors that affect capital structure:

1. Business Risk: The nature and level of business risk associated with a company’s industry and operations play a crucial role in determining its capital structure. Companies operating in high-risk industries, such as technology or mining, may opt for a lower proportion of debt to mitigate the potential financial risks. On the other hand, companies in stable and cash-rich industries may be more inclined to utilize debt financing due to the lower risk profile.

2. Financial Flexibility: The financial flexibility of a company, including its ability to generate internal cash flows and access external financing, affects its capital structure decisions. Companies with higher cash flows and strong access to capital markets may prefer to use more equity financing to maintain flexibility and reduce the financial risk associated with debt obligations.

3. Company Size and Growth Opportunities: The size and growth prospects of a company also influence its capital structure decisions. Smaller companies with limited access to capital markets may rely more on debt financing compared to larger companies. Additionally, companies with significant growth opportunities may prefer equity financing to fund future expansion and investment plans.

4. Tax Considerations: The tax environment in which a company operates can have a significant impact on its capital structure. Debt financing offers tax advantages as the interest payments can be tax-deductible, lowering the overall tax liability of the company. Therefore, companies operating in jurisdictions with favorable tax policies may be more inclined to use debt financing.

5. Cost of Capital: The cost of capital, which is influenced by the risk profile of the company and prevailing market conditions, impacts the capital structure decisions. Companies with lower borrowing costs may choose to utilize more debt financing to minimize their overall cost of capital. Conversely, companies with higher borrowing costs may rely more on equity financing.

6. Market Conditions: The prevailing market conditions, including the interest rate environment and investor sentiment, can also affect capital structure decisions. In times of low interest rates, companies may be more inclined to use debt financing due to its cost advantages. Conversely, during periods of economic uncertainty or market volatility, companies may opt for more equity financing to reduce financial risk.

7. Regulatory Environment: The regulatory environment in which a company operates can also impact its capital structure decisions. Regulatory restrictions on debt levels, interest rate caps, or specific requirements for equity financing can influence the choice of capital structure.

It is important to note that these factors are not mutually exclusive and should be considered collectively when determining the optimal capital structure for a company. Striking the right balance is a complex decision that requires in-depth analysis, financial expertise, and a thorough understanding of the company’s specific circumstances and objectives.

Next, let’s explore the different types of capital structures that companies commonly employ.

Types of Capital Structure

Companies have the flexibility to choose from various types of capital structures based on their financing needs, risk tolerance, and market conditions. Each type of capital structure represents a different mix of debt and equity financing. Let’s explore some of the common types of capital structures:

1. Debt-Focused Capital Structure: In a debt-focused capital structure, the majority of the financing is sourced through debt. Companies may have a higher proportion of long-term debt, such as bonds or bank loans, as compared to equity. This type of capital structure can be advantageous in terms of tax benefits and lower borrowing costs, but it also carries a higher financial risk due to the presence of fixed debt obligations and interest payments.

2. Equity-Focused Capital Structure: An equity-focused capital structure relies more heavily on equity financing. This means that a larger portion of the company’s funding is derived from issuing shares to investors. Equity financing allows companies to raise capital without incurring debt obligations or interest payments. However, it may dilute ownership and control rights and can be more expensive compared to debt financing in terms of the cost of equity.

3. Balanced Capital Structure: A balanced capital structure is characterized by a nearly equal mix of debt and equity financing. This type of capital structure aims to strike a balance between the advantages of debt and equity, offering the benefits of tax deductions, lower borrowing costs, while also maintaining financial flexibility and reducing the risk associated with excessive debt. It provides a more diversified funding base for the company.

4. Conservative Capital Structure: A conservative capital structure consists of a higher proportion of equity financing and a lower level of debt. This type of capital structure is typically preferred by companies aiming to minimize financial risk and maintain a high level of financial stability. Companies with steady cash flows, stable business models, or risk-averse management may opt for a conservative capital structure to protect against potential financial volatility.

5. Aggressive Capital Structure: An aggressive capital structure involves a higher level of debt financing compared to equity. It is often utilized by companies seeking to leverage their operations and maximize returns on equity. This type of capital structure can amplify profitability during favorable market conditions but also increases the financial risk if the company faces challenges in meeting its debt obligations.

6. Optimal Capital Structure: The optimal capital structure is the ideal mix of debt and equity that maximizes the value of the company. It may vary depending on factors such as industry dynamics, company size, growth prospects, and market conditions. Achieving an optimal capital structure requires a careful evaluation of various factors, including the cost of capital, risk tolerance, and financial goals of the company.

It’s important to note that the choice of capital structure depends on the specific circumstances and objectives of each company. Different industries and businesses may have unique capital structure requirements based on their risk profile, growth potential, and access to different sources of financing.

Next, let’s explore how companies determine their optimal capital structure.

Optimal Capital Structure

The optimal capital structure refers to the ideal mix of debt and equity financing that allows a company to maximize its value and achieve its financial goals. It is the balance between the risks and benefits associated with different types of funding that is most conducive to the long-term success of the company.

Determining the optimal capital structure is a crucial decision for companies, as it directly impacts their cost of capital, profitability, risk management, and overall financial performance. While there is no one-size-fits-all approach to determining the optimal capital structure, there are several factors that need to be considered:

1. Cost of Capital: The cost of capital is a critical metric in determining the optimal capital structure. It is the minimum return that a company must generate to satisfy its investors. By finding the right balance between debt and equity, companies can minimize their cost of capital and improve their bottom line.

2. Industry and Market Factors: Industries and markets have different risk profiles and expectations regarding capital structure. Understanding industry norms and market conditions is crucial in determining the optimal capital structure. For example, industries with stable cash flows and low capital requirements may have higher debt-to-equity ratios, while capital-intensive industries may rely more on equity financing.

3. Risk Tolerance: Every company has a unique risk tolerance level based on its operating environment, business model, and management’s risk appetite. Conservative companies may prefer a lower level of debt to minimize financial risk, while more aggressive companies may be comfortable with higher leverage to maximize returns on equity. The optimal capital structure should align with the company’s risk tolerance.

4. Growth Opportunities: A company’s growth prospects and investment plans play a crucial role in determining its optimal capital structure. If a company has significant expansion opportunities, it may require additional funding to finance its growth initiatives. This could influence the capital structure by leaning towards more equity financing to maintain financial flexibility.

5. Financial Flexibility: Financial flexibility is the ability of a company to meet its financial obligations and adapt to changing market conditions. An optimal capital structure should ensure that the company has enough flexibility to navigate through economic downturns, invest in new projects, and manage unforeseen financial challenges.

6. Company Life Cycle: The stage of a company’s life cycle can influence its optimal capital structure. Start-ups and early-stage companies may rely more on equity financing to attract investors and fund their initial growth. As companies mature and generate stable cash flows, they may gradually increase their proportion of debt financing to optimize their capital structure.

7. Management’s Strategy and Goals: The management’s strategy and long-term goals also influence the optimal capital structure. Some companies prioritize growth and market dominance, while others focus on profitability and dividend payouts. The capital structure should align with the company’s strategic objectives and create value for its shareholders.

It is essential to note that the optimal capital structure is not a static concept and may change over time due to various internal and external factors. Regular evaluation and adjustments are necessary to ensure that the chosen capital structure remains aligned with the company’s evolving needs and objectives.

Next, let’s explore the process of determining the capital structure for a company.

Determining the Capital Structure

Determining the capital structure of a company is a critical decision that requires careful analysis, financial expertise, and a thorough understanding of the company’s financial goals and risk tolerance. While there is no one-size-fits-all approach, there are several steps companies can take to determine their optimal capital structure:

1. Assess Financial Goals: Companies need to identify and prioritize their financial goals, whether it is maximizing profitability, minimizing risk, achieving sustainable growth, or enhancing shareholder value. By clarifying these objectives, companies can align their capital structure decisions with their desired outcomes.

2. Evaluate Risk Tolerance: Companies must assess their risk tolerance by considering factors such as industry dynamics, market conditions, and the company’s ability to generate stable cash flows. This analysis will help determine the right mix of debt and equity financing that strikes a balance between risk and reward.

3. Analyze Cost of Capital: Evaluating the cost of capital is crucial in determining the capital structure. Companies need to consider the different costs associated with debt and equity financing, including interest rates, dividend expectations, and return expectations of investors. By comparing these costs, companies can determine which type of financing is more cost-effective.

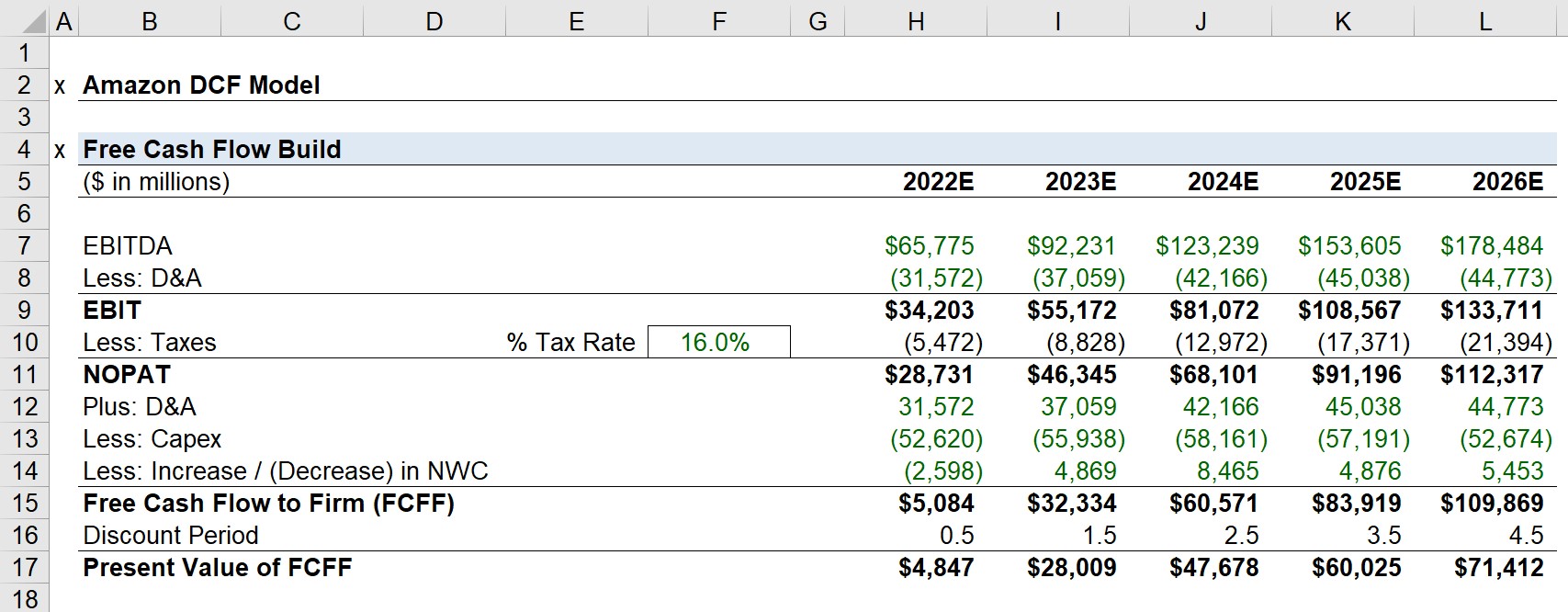

4. Conduct Financial Modeling: Companies should utilize financial modeling techniques to simulate different capital structure scenarios. This involves analyzing the impact of various debt-to-equity ratios, interest rates, and other financial variables on the company’s financial performance, profitability, and cash flows. Financial modeling helps identify the capital structure that maximizes value creation.

5. Consider Regulatory and Tax Factors: Companies need to consider the regulatory environment and tax implications when determining their capital structure. Different jurisdictions may have specific regulations on debt levels, interest deductibility, or equity requirements. Companies must ensure compliance with relevant regulations and take advantage of any tax benefits offered by particular financing options.

6. Assess Market Conditions: Market conditions, including interest rate levels, investor sentiment, and the availability of financing options, can impact the capital structure decisions. Companies need to consider these external factors when determining their capital structure to take advantage of favorable conditions and minimize financial risk.

7. Seek Professional Advice: Obtaining professional advice from financial experts, such as investment bankers, financial consultants, or corporate finance professionals, can provide valuable insights and expertise in determining the capital structure. These professionals can help conduct thorough analyses, provide industry benchmarks, and recommend the most suitable capital structure based on the company’s unique circumstances.

It’s important to understand that determining the capital structure is not a one-time decision. It requires ongoing monitoring and adjustment based on changes in the business landscape, financing needs, and market conditions. Regular evaluation and refinements are necessary to ensure that the chosen capital structure remains optimal and aligned with the company’s long-term objectives.

Next, let’s explore two prominent theories that provide insights into capital structure decisions: the trade-off theory and the pecking order theory.

Trade-off Theory of Capital Structure

The trade-off theory of capital structure suggests that companies face a trade-off when determining their capital structure. This theory posits that there is an optimal level of debt that balances the benefits of tax advantages and lower costs of debt financing against the potential risks of financial distress and increased costs of borrowing.

According to the trade-off theory, the decision to take on debt is driven by the tax shield advantage it provides. Interest payments on debt are tax-deductible, reducing the overall tax liability of the company. This tax shield advantage can increase the after-tax cash flow and profitability of the company. Therefore, by using debt financing, companies can minimize their tax expenses and improve their return on equity.

However, the trade-off theory recognizes that there are costs associated with debt financing. Companies with higher levels of debt are exposed to the risk of financial distress, where they may struggle to meet their debt obligations. This can lead to higher borrowing costs, reduced access to credit, and potential bankruptcy. As a result, companies must balance their desire for the tax advantages of debt with the risks associated with higher leverage.

The optimal capital structure, according to the trade-off theory, is the point where the marginal benefit of the tax advantages of debt equals the marginal cost of financial distress. Companies need to find the right balance to maximize the benefits of debt financing while minimizing the risks associated with excessive debt.

Several factors influence the optimal capital structure under the trade-off theory:

- Tax Rates: Higher tax rates increase the value of the tax shield advantage, making debt financing more attractive.

- Business Risk: Companies with stable cash flows and lower levels of business risk can handle higher levels of debt without increasing the risk of financial distress.

- Growth Opportunities: Companies with significant growth prospects may choose to finance their expansion through debt to preserve equity rights and avoid dilution.

- Market Conditions: Favorable market conditions, such as low interest rates and easy access to credit, can make debt financing more appealing.

The trade-off theory provides valuable insights into capital structure decision-making by highlighting the delicate balance between the benefits and costs of debt financing. It emphasizes the need for companies to carefully evaluate the trade-offs and make informed decisions based on their unique circumstances and financial goals.

Next, let’s explore another prominent theory of capital structure: the pecking order theory.

Pecking Order Theory of Capital Structure

The pecking order theory of capital structure suggests that companies have a preferred hierarchy, or “pecking order,” when it comes to raising funds. According to this theory, companies prioritize internal financing, followed by debt financing, and then equity financing as a last resort.

The pecking order theory is based on the notion that companies have information asymmetry, meaning that management has more information about the company’s prospects and risks than external investors. As a result, companies prefer to rely on internal funds, such as retained earnings and cash flows, to finance their operations and investments. Internal financing avoids transaction costs and the need to disclose sensitive information to external investors.

If internal funds are insufficient, companies then turn to debt financing. Debt is considered less costly and less dilutive than equity financing. Debt does not require companies to give up ownership stakes or control rights, allowing them to maintain their independence and decision-making power.

The pecking order theory also suggests that companies view equity financing as a last resort. Issuing equity leads to dilution, potentially reducing existing shareholders’ ownership and control. Therefore, companies are more reluctant to issue equity, unless there is a compelling need for additional funds that cannot be met through internal funds or debt financing.

Under the pecking order theory, the capital structure is influenced by the following factors:

- Internal Funds: The availability and sufficiency of internal funds impact the company’s reliance on debt or equity financing.

- Financial Needs: The level of financing needs for operations, investments, and growth prospects can influence the priority of internal funds, debt, or equity financing.

- Information Asymmetry: The theory assumes that companies have better information about their own prospects and risks, leading them to prefer internal funds over external financing.

- Market Conditions: External market conditions, such as interest rates, investor sentiment, and the cost of debt, can influence the decision to rely on debt financing.

- Company Size: Smaller companies may rely more on internal funds or debt financing, while larger companies may have more access to equity markets.

The pecking order theory provides valuable insights into the capital structure decisions of companies, highlighting the preference for internal funds and debt financing over equity financing. It acknowledges the importance of maintaining control and minimizing disclosure requirements in financing decisions.

It is important to note that the pecking order theory is not universally applicable and may vary depending on the specific circumstances and objectives of each company. Some companies may choose to deviate from the pecking order based on their unique needs, industry dynamics, and growth prospects.

Next, let’s explore the relationship between capital structure and firm performance.

Capital Structure and Firm Performance

The relationship between capital structure and firm performance is a significant topic of interest for researchers and practitioners. Understanding how a company’s capital structure influences its financial performance is crucial for making informed financial decisions and enhancing shareholder value. While the impact of capital structure on firm performance may vary across industries and companies, there are some common factors to consider:

1. Cost of Capital: The capital structure directly affects a company’s cost of capital, which is the minimum return required by investors. By optimizing the mix of debt and equity, companies can reduce their cost of capital and improve their profitability. An efficient capital structure allows a company to generate higher returns on its investments and enhance its overall financial performance.

2. Financial Risk: The capital structure influences a company’s financial risk, which refers to the potential for financial distress or the inability to meet financial obligations. Companies with a high proportion of debt may have higher financial risk due to the presence of fixed debt payments and interest expenses. On the other hand, companies with lower levels of debt may have lower financial risk but could miss out on potential tax advantages or growth opportunities.

3. Flexibility and Investment Opportunities: A well-structured capital mix provides companies with financial flexibility to seize investment opportunities and fund future growth. By maintaining a balanced capital structure, companies can access both debt and equity financing options, allowing them to execute expansion plans, acquire new technologies, or invest in research and development. This flexibility enhances a company’s performance by positioning it to take advantage of favorable market conditions.

4. Industry and Market Factors: The relationship between capital structure and firm performance can also vary across industries and market conditions. Different sectors have unique capital structure norms based on their risk profiles, growth prospects, and regulatory environments. Understanding industry dynamics and market factors is essential in evaluating the impact of capital structure on firm performance within a specific context.

5. Alignment of Financial Goals: The capital structure should align with a company’s financial goals and strategic objectives. For example, a company aiming for aggressive growth may require higher debt to fund expansion initiatives. On the other hand, a company focused on stability and consistent dividends may prefer a more conservative capital structure with a lower level of debt and more reliance on equity.

It is crucial to note that the impact of capital structure on firm performance is complex and multidimensional, and a clear causal relationship is challenging to establish. Various internal and external factors, such as management’s capabilities, industry dynamics, economic cycles, and competitive forces, interact with capital structure decisions to shape firm performance.

Practitioners and academics continue to explore the relationship between capital structure and firm performance, seeking to understand the nuanced factors that drive this relationship. By considering the specific circumstances and objectives of a company, conducting rigorous analysis, and staying informed about industry trends, companies can make informed decisions regarding their capital structure and enhance their overall firm performance.

Finally, let’s summarize the key points discussed in this article.

Conclusion

In conclusion, capital structure plays a crucial role in shaping the financial landscape of a company. Determining the optimal mix of debt and equity financing is essential for maximizing shareholder value, managing risk, and achieving long-term financial success.

In this article, we explored the definition of capital structure and its importance in financial management. We discussed the factors that influence capital structure decisions, including business risk, financial flexibility, tax implications, and market conditions. We also examined the different types of capital structures that companies commonly employ, such as debt-focused, equity-focused, balanced, conservative, and aggressive structures.

Furthermore, we discussed the trade-off theory and pecking order theory, providing valuable insights into the decision-making process behind capital structure. We highlighted the trade-offs between the tax advantages of debt and the risks of financial distress, as well as the preference for internal financing and debt before equity under the pecking order theory.

We also emphasized the relationship between capital structure and firm performance, noting that the cost of capital, financial risk, flexibility, and alignment of financial goals all play a role in determining a company’s financial success.

Overall, it is important for companies to regularly evaluate and adjust their capital structure to align with their changing financial needs, market dynamics, and strategic objectives. By understanding the factors influencing capital structure decisions and considering the various theories, companies can make informed choices that enhance their financial performance and create value for their stakeholders.

Capital structure management is a complex and ongoing process that requires a deep understanding of finance principles, market dynamics, and industry trends. Seeking professional advice and staying informed about best practices in capital structure management can greatly assist companies in navigating the financial landscape and positioning themselves for long-term success.

By carefully managing their capital structure, companies can leverage their financial resources, optimize their cost of capital, and maximize their profitability, ultimately enhancing their competitiveness and achieving sustainable growth in an ever-changing business environment.