Finance

What Stocks To Invest In 2017

Published: January 19, 2024

Looking for the best stocks to invest in 2017? Discover expert financial advice and recommendations on Finance to maximize your returns in the stock market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

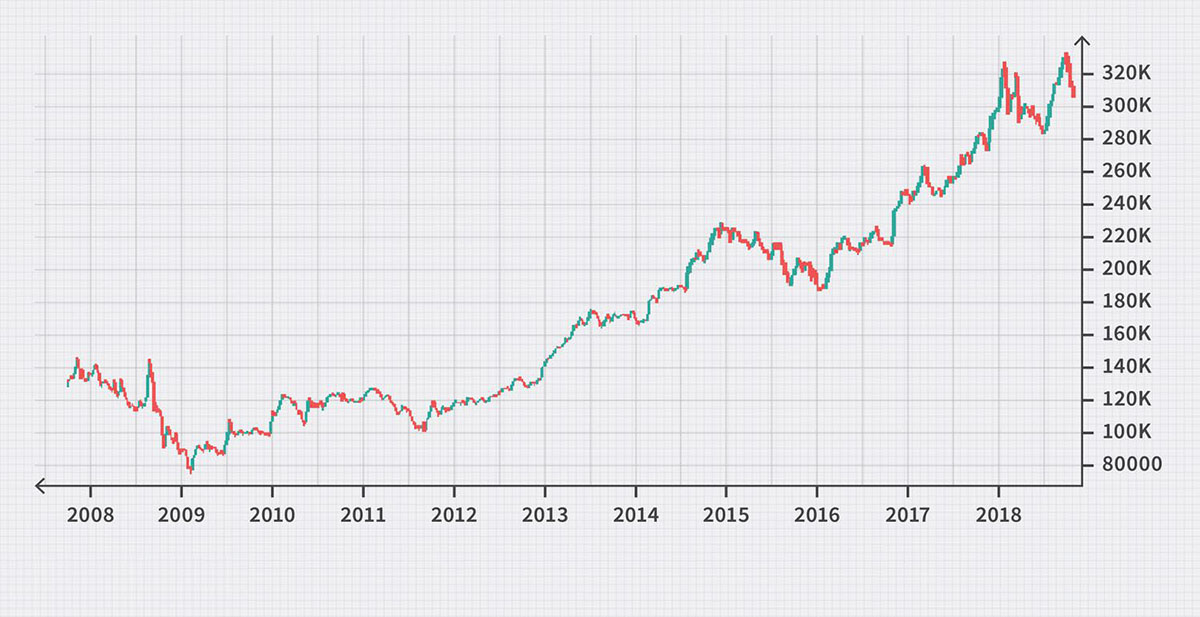

Welcome to the exciting world of stock investing! As we enter into the year 2017, it’s crucial to have a clear understanding of which stocks have the potential to outperform the market. Investing in the right stocks can result in significant returns, but it requires thorough research and analysis. In this article, we will explore some of the top stock sectors to consider for investment in 2017.

Before delving into individual sectors, it’s important to keep in mind that the stock market is inherently unpredictable. Therefore, it’s essential to conduct your due diligence and carefully assess the risk and potential reward associated with each investment. It’s also wise to consult with a financial advisor or conduct your own research to make informed investment decisions.

In the following sections, we will discuss various sectors and their individual investment prospects. It’s crucial to evaluate each sector based on market trends, competitive landscape, regulations, and other macroeconomic factors. By understanding how these factors can impact a sector’s performance, you’ll be better equipped to make wise investment choices.

It’s essential to keep in mind that past performance does not guarantee future success. Therefore, it’s crucial to analyze each sector based on its potential for growth, current market conditions, and any upcoming events, such as elections or policy changes, that could influence market dynamics.

Now, let’s explore some of the key sectors that show promise for investors in 2017. Whether you’re a seasoned investor or just starting on your investment journey, these sectors provide a starting point for your research and analysis. Remember, diversified portfolios tend to perform better in the long run, so consider spreading your investments across multiple sectors to manage risk effectively.

Factors to Consider Before Investing

Before jumping into the world of investing, it’s crucial to understand the key factors that should be considered. These factors will help you make informed decisions and mitigate risks associated with your investments. Here are some important factors to keep in mind before investing in any stock:

- Financial Goals: Clearly define your financial goals, whether it’s long-term wealth accumulation, retirement planning, or funding a specific milestone. Your goals will determine the investment horizon and risk tolerance.

- Risk Tolerance: Assess your risk tolerance level, which defines how comfortable you are with fluctuations in your portfolio value. Determine whether you are a conservative, moderate, or aggressive investor, and align your investment choices accordingly.

- Market Analysis: Conduct thorough market research and analysis to identify emerging trends and potential opportunities. Stay updated with economic indicators, market news, and company-specific information that may impact stock prices.

- Company Fundamentals: Evaluate the financial health, profitability, and growth prospects of the companies you are considering. Review their balance sheets, income statements, and cash flow statements to understand their financial performance.

- Valuation: Consider the valuation of the stock by analyzing the price-to-earnings ratio, price-to-sales ratio, and other relevant metrics. Determine whether the stock is overvalued or undervalued compared to its peers or industry averages.

- Diversification: Spread your investments across different sectors and asset classes to reduce the impact of volatility. Diversification can help mitigate risks and improve the overall performance of your portfolio.

- Management Team: Evaluate the management team’s track record, leadership skills, and strategic vision. A strong management team can drive the company’s success and shareholder value in the long run.

- Regulatory Environment: Understand the regulatory landscape and any potential regulatory changes that may impact the sector or specific companies you are considering. Regulatory changes can have a significant impact on stock prices and profitability.

- Long-Term Outlook: Consider the long-term prospects of the sector and companies you are investing in. Look for companies with sustainable business models, competitive advantages, and potential for growth in the years ahead.

- Exit Strategy: Have a clear exit strategy in place, whether it’s based on achieving specific profit targets or minimizing losses. Regularly review and reassess your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

By considering these factors before investing, you can make well-informed decisions that align with your financial goals and risk tolerance. Remember, investing in the stock market involves risks, and it’s important to stay vigilant, adapt to changing market conditions, and regularly review your portfolio to ensure it remains in line with your investment objectives.

Technology Stocks

The technology sector has been a hotbed for innovation and growth in recent years, and it continues to offer promising investment opportunities in 2017. Technology companies are at the forefront of advancements in artificial intelligence, cloud computing, e-commerce, and other disruptive technologies. Here are some key factors to consider when investing in technology stocks:

- Growth Potential: The technology sector is known for its potential for rapid growth. Look for companies that are developing groundbreaking technologies or have a strong presence in emerging markets.

- Financial Health: Evaluate the financial stability and cash flow of technology companies. Consider factors such as revenue growth, earnings per share, and debt levels.

- Competitive Landscape: Assess the competitive advantage of technology companies in their respective markets. Look for companies with strong intellectual property rights, strong brand recognition, and a solid customer base.

- Innovation and Research: Research and development are critical in the technology sector. Evaluate the company’s investment in research and its ability to introduce new products or services to market.

- Industry Trends: Stay informed about the latest trends in technology, such as artificial intelligence, Internet of Things (IoT), and cybersecurity. Companies that are at the forefront of these trends may present attractive investment opportunities.

- Management Team: Assess the qualifications and track record of the management team. Look for companies with experienced leaders who have a clear vision for the future and a history of successfully executing strategies.

- Valuation: Analyze the valuation of technology stocks to ensure they are not overpriced. Compare valuation metrics such as price-to-earnings ratio and price-to-sales ratio with industry averages.

- Risk Factors: Consider the risks associated with investing in technology stocks, such as rapid technological advancements, regulatory changes, and intense competition.

- Diversification: Diversify your technology investments across different sub-sectors, such as software, hardware, semiconductors, and internet services, to manage risks effectively.

- Long-Term Outlook: Evaluate the long-term growth potential of technology companies. Look for companies that have a sustainable business model and demonstrate the ability to adapt to changing market dynamics.

Some notable technology companies to consider in 2017 include established giants like Apple, Microsoft, and Alphabet (Google), as well as innovative disruptors like Amazon, Tesla, and NVIDIA. However, it’s important to conduct thorough research and analysis before investing in any individual technology stock to ensure it aligns with your investment goals and risk appetite.

Financial Stocks

Financial stocks offer investors the opportunity to capitalize on the performance of the banking, insurance, and investment industries. These stocks can provide steady income through dividends and have the potential for long-term growth. When considering financial stocks for investment in 2017, here are some key factors to keep in mind:

- Regulatory Environment: The financial sector is heavily regulated, and changes in regulations can have a significant impact on stock prices. Stay informed about any anticipated regulatory changes that could affect the industry.

- Interest Rates: Interest rates have a profound influence on financial stocks. Higher interest rates generally benefit banks and insurance companies, as they can charge more for loans and investment products.

- Financial Performance: Evaluate the financial health and profitability of financial institutions. Consider metrics such as return on equity (ROE), net interest margin (NIM), and the efficiency ratio.

- Diversification: Diversify your financial stock investments across different sub-sectors, such as banks, insurance companies, and asset management firms. This diversification helps spread risk and potentially boosts returns.

- Macroeconomic Factors: Assess the broader economic environment and its potential impact on financial stocks. Factors like GDP growth, unemployment rates, and consumer sentiment can influence the performance of financial institutions.

- Valuation: Analyze the valuation of financial stocks by considering metrics such as price-to-earnings ratio (P/E ratio) and price-to-book ratio (P/B ratio). Compare the valuation of the stock to its historical averages and industry peers.

- Dividend Yield: Consider the dividend yield of financial stocks. Although not guaranteed, a consistent and growing dividend yield can be an attractive feature for income-focused investors.

- Risk Management: Assess the risk management practices of financial institutions, including their ability to navigate through economic downturns and manage credit risks.

- Leadership and Reputation: Evaluate the leadership team’s experience, strategic vision, and ability to adapt to changing market conditions. Take into account the reputation of the institution, as trust and credibility are crucial in the financial industry.

- Long-Term Prospects: Evaluate the long-term growth potential of financial stocks. Consider factors such as their exposure to emerging markets, adoption of technology, and ability to innovate in response to changes in consumer behavior.

Some notable financial stocks to consider in 2017 include industry leaders such as JPMorgan Chase, Bank of America, and Berkshire Hathaway. It’s important to conduct thorough research and analysis to ensure that a financial stock aligns with your investment goals and risk tolerance. Additionally, consulting with a financial advisor can provide valuable insights and guidance tailored to your individual investment needs.

Healthcare Stocks

The healthcare sector is known for its resilience and the constant demand for medical products and services. Investing in healthcare stocks can offer investors exposure to a wide range of opportunities, including pharmaceutical companies, biotechnology firms, healthcare providers, and medical device manufacturers. When considering healthcare stocks for investment in 2017, here are some key factors to consider:

- Demographic Trends: Analyze demographic trends, such as an aging population or an increase in chronic diseases, that may drive the demand for healthcare products and services.

- Drug Pipeline: Evaluate the pipeline of pharmaceutical and biotech companies to understand their potential for developing and commercializing new drugs and therapies.

- Regulatory Environment: Stay informed about regulatory changes that may impact the healthcare industry, such as drug pricing regulations or changes to healthcare policies.

- Medical Advances: Consider the latest medical advancements, such as precision medicine, gene therapy, and telemedicine, and evaluate how companies in the healthcare sector are leveraging these technologies.

- Financial Performance: Assess the financial performance of healthcare companies, including revenue growth, profit margins, and cash flow generation.

- Patent Protection: Consider the patent protection of drugs and medical devices, as it can provide a competitive advantage and revenue stability for companies in the healthcare sector.

- Competition: Evaluate the competitive landscape within the healthcare sector. Consider factors such as market share, pricing power, and the ability to differentiate products and services.

- Healthcare Policy: Stay informed about changes to healthcare policies and their potential impact on the sector. Changes in reimbursement rates or insurance coverage can significantly affect healthcare companies’ revenues and profits.

- Research and Development: Evaluate the investment in research and development by healthcare companies, as it is vital for future growth and innovation.

- Ethical Considerations: Consider any ethical considerations associated with investing in healthcare stocks. Some investors may have specific criteria regarding companies engaged in controversial practices, such as animal testing or controversial medication pricing.

Some notable healthcare stocks to consider in 2017 include well-established companies like Johnson & Johnson, Pfizer, and Merck. Additionally, there are opportunities in the biotechnology sector with companies like Amgen and Gilead Sciences. It’s important to conduct thorough research and analysis, considering both the risks and potential rewards of investing in healthcare stocks. Consulting with a financial advisor or healthcare industry expert can provide additional insights and guidance tailored to your specific investment goals and risk tolerance.

Energy Stocks

The energy sector plays a crucial role in powering the global economy, making it an interesting area for investors to consider. Investing in energy stocks can provide exposure to companies involved in oil, natural gas, renewable energy, and other energy sources. When considering energy stocks for investment in 2017, here are some key factors to keep in mind:

- Global Energy Demand: Analyze global energy demand trends and consider factors such as population growth, urbanization, and industrialization that may impact energy consumption.

- Oil and Gas Prices: Monitor oil and gas prices as they have a significant influence on the profitability of energy companies. Consider factors such as supply and demand dynamics, geopolitical tensions, and production costs.

- Renewable Energy Growth: Evaluate the growth potential of the renewable energy sector. Consider factors such as government policies, technological advancements, and the increasing focus on sustainability.

- Macro Factors: Assess macroeconomic factors that may impact the energy sector, such as economic growth rates, inflation, and currency exchange rates.

- Technological Advancements: Analyze the technological advancements in the energy sector and the potential impact on companies’ cost structures, efficiency, and competitiveness.

- Regulatory Environment: Stay informed about regulations and policies related to energy production and consumption. Changes in regulations can impact the profitability and growth prospects of energy companies.

- Geopolitical Risks: Consider geopolitical risks, such as conflicts or sanctions in major oil-producing regions, as they can disrupt the supply and prices of energy commodities.

- Financial Strength: Evaluate the financial health of energy companies by analyzing their debt levels, cash flow generation, and ability to fund capital expenditures.

- Dividend Potential: Consider energy companies that offer attractive dividend yields, as these can provide a steady income stream for investors.

- Environmental Concerns: Evaluate companies’ environmental track records and their commitment to sustainability. Increasing societal concerns about climate change and environmental sustainability may impact the long-term viability and reputation of energy companies.

Some notable energy stocks to consider in 2017 include integrated oil companies like ExxonMobil and Chevron, renewable energy companies like NextEra Energy and First Solar, and natural gas companies like Cheniere Energy and Dominion Energy. It’s important to conduct thorough research and analysis, taking into account the risks and opportunities associated with investing in the energy sector. Consulting with a financial advisor who specializes in energy investments can provide valuable insights and guidance tailored to your individual investment goals and risk tolerance.

Consumer Goods Stocks

Consumer goods stocks are associated with companies that produce and sell products that are in high demand by consumers. These stocks can offer investors the opportunity to benefit from stable revenue streams and brand loyalty. When considering consumer goods stocks for investment in 2017, here are some key factors to consider:

- Consumer Spending: Analyze consumer spending patterns and trends to understand the potential demand for consumer goods. Consider factors such as income levels, consumer confidence, and cultural shifts in purchasing habits.

- Brand Recognition: Evaluate the strength of the company’s brand and its reputation among consumers. Look for companies with well-established and recognized brands that can drive customer loyalty and repeat purchases.

- Product Innovation: Consider the company’s ability to innovate and introduce new products or variations to meet changing consumer preferences and market trends.

- Competitive Landscape: Assess the competitive landscape within the consumer goods sector. Consider factors such as market share, pricing power, and the ability to differentiate products from competitors.

- Financial Performance: Evaluate the financial health and profitability of consumer goods companies. Analyze factors such as revenue growth, profit margins, and return on investment.

- Global Expansion: Assess the company’s potential for global expansion and its ability to capitalize on emerging markets and changing consumer dynamics in different regions.

- Consumer Trends: Stay informed about consumer trends and changes in preferences, such as the growing demand for sustainable and ethical products.

- Supply Chain: Analyze the company’s supply chain and distribution networks to ensure efficiency and cost-effectiveness.

- Price-to-Earnings Ratio: Consider the valuation of consumer goods stocks by analyzing the price-to-earnings ratio (P/E ratio) in comparison to industry peers and historical averages.

- E-commerce Potential: Evaluate the company’s online presence and ability to leverage e-commerce to reach a broader customer base.

Some notable consumer goods stocks to consider in 2017 include well-established companies such as Coca-Cola, Procter & Gamble, and Unilever. Additionally, there are opportunities in emerging consumer trends, such as plant-based foods, organic products, and health and wellness. It’s important to conduct thorough research and analysis, considering both the risks and potential rewards of investing in consumer goods stocks. Consulting with a financial advisor or consumer goods industry expert can provide additional insights and guidance tailored to your specific investment goals and risk tolerance.

Real Estate Stocks

Real estate stocks provide investors with the opportunity to participate in the performance of the real estate market without the need for direct property ownership. These stocks can offer both income and potential capital appreciation. When considering real estate stocks for investment in 2017, here are some key factors to consider:

- Market Conditions: Analyze the current state of the real estate market, including factors such as supply and demand, vacancy rates, and rental yields. Consider both residential and commercial real estate segments.

- Location: Evaluate the location of the real estate assets owned by the company. Look for properties in desirable and growing areas with potential for appreciation in value.

- Property Types: Consider the types of properties in the company’s portfolio, such as residential, retail, office, or industrial. Diversification across property types can help manage risks and capture various income streams.

- Rent Roll: Assess the stability and growth potential of rental income generated by the real estate assets. Look for companies with high occupancy rates, long-term leases, and rental escalations.

- Development Projects: Evaluate real estate companies involved in development projects. Consider factors such as the track record of successful project completions and the potential for value creation through development activities.

- Financing Structure: Analyze the company’s financing structure and debt levels. Consider the cost of debt and the ability to refinance debt in a changing interest rate environment.

- Management Team: Assess the qualifications and experience of the management team. Look for companies with a track record of successfully executing real estate strategies and creating value for shareholders.

- Regulatory Environment: Stay informed about regulations and policies that may impact the real estate market. Consider factors such as zoning laws, building codes, and rent control measures.

- Dividend Yield: Evaluate the dividend yield offered by real estate stocks. Companies with a history of consistent and growing dividends may be attractive to income-focused investors.

- Economic Outlook: Consider the overall economic outlook and its potential impact on the real estate market. Factors such as GDP growth, employment rates, and population growth can influence demand for real estate.

Some notable real estate stocks to consider in 2017 include Real Estate Investment Trusts (REITs) such as Simon Property Group, Prologis, and Equity Residential. Additionally, there are opportunities in companies involved in real estate development, property management, and real estate services. It’s important to conduct thorough research and analysis, considering both the risks and potential rewards of investing in real estate stocks. Consulting with a financial advisor or real estate industry expert can provide additional insights and guidance tailored to your specific investment goals and risk tolerance.

Utilities Stocks

Utilities stocks can offer investors stability and consistent income through dividends as they belong to companies that provide essential services such as electricity, natural gas, and water. When considering utilities stocks for investment in 2017, here are some key factors to consider:

- Regulated Environment: Utilities typically operate in a regulated environment, with government agencies setting rates and ensuring fair competition. Evaluate the regulatory framework in the jurisdictions where the company operates.

- Revenue Stability: Utilities provide essential services, leading to stable and predictable revenues. Analyze the demand for these services and consider factors such as population growth and economic stability.

- Infrastructure Investment: Assess the company’s investment in maintaining and upgrading its infrastructure. Look for utilities that prioritize investments in grid modernization, renewable energy, and sustainability initiatives.

- Financial Health: Evaluate the financial stability and profitability of utilities. Consider factors such as revenue growth, cash flow generation, and debt levels.

- Dividend Yield: Consider the dividend yield of utilities stocks. Utilities are known for their ability to pay consistent dividends, making them attractive to income-focused investors.

- Expansion Opportunities: Evaluate the potential for geographic expansion or diversification into other utility sectors, such as renewable energy or water treatment. Look for companies with a well-defined growth strategy.

- Operating Efficiency: Assess the company’s operational efficiency and cost management. Efficient utilities can better handle challenges and maintain profitability.

- Sustainability Initiatives: Consider utilities that prioritize environmental sustainability and clean energy. Utilities that transition to renewable energy and reduce greenhouse gas emissions may be well-positioned for long-term growth.

- Energy Transition: Evaluate the company’s readiness to adapt to the evolving energy landscape. Consider factors such as the integration of renewable energy, smart grids, and energy storage solutions.

- Government Policies: Stay informed about energy policies and government incentives that may affect the utilities sector. Changes in regulations or shifts in government priorities can impact the industry.

Some notable utilities stocks to consider in 2017 include companies like NextEra Energy, Dominion Energy, and Duke Energy. Additionally, there are opportunities in companies involved in renewable energy generation and distribution. It’s important to conduct thorough research and analysis, considering both the risks and potential rewards of investing in utilities stocks. Consulting with a financial advisor or utilities industry expert can provide additional insights and guidance tailored to your specific investment goals and risk tolerance.

Conclusion

As we conclude our exploration of potential stocks to invest in for the year 2017, it is important to approach investing with careful consideration and due diligence. Each sector – technology, financials, healthcare, energy, consumer goods, real estate, and utilities – presents unique opportunities and risks that investors should evaluate based on their individual financial goals and risk tolerance.

While no investment is guaranteed to be successful, conducting thorough research and analysis can help mitigate risks and increase the potential for rewarding returns. Factors such as market conditions, financial performance, regulatory environment, and long-term prospects should be carefully assessed when making investment decisions.

Diversification is a key strategy that helps spread risk across different sectors and asset classes. By diversifying one’s investment portfolio, investors can take advantage of the growth opportunities presented by various sectors while minimizing exposure to any single sector’s potential downside.

Furthermore, seeking professional guidance from a financial advisor can provide valuable insights and help investors navigate the complexities of the stock market. A financial advisor can assist in creating an investment strategy that aligns with individual goals and risk tolerance, as well as provide ongoing portfolio management and guidance.

Overall, investing requires patience, persistence, and a long-term perspective. It is essential to continually monitor investments and adapt to changing market conditions. By staying informed, conducting thorough research, and making informed investment decisions, investors can position themselves for success in the ever-evolving world of stocks.