Home>Finance>How Much Higher Will Stock Market Prices Achieve In 2017?

Finance

How Much Higher Will Stock Market Prices Achieve In 2017?

Published: November 3, 2023

Discover the potential for higher stock market prices in 2017 with our expert finance analysis. Gain insights and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors Driving Stock Market Prices in 2017

- Historical Performance of Stock Market

- Current Economic and Political Landscape

- Investor Sentiment and Market Psychology

- Earnings Growth and Corporate Performance

- Interest Rates and Monetary Policy

- Global Market Conditions

- Technological Advancements and Innovation

- Conclusion

Introduction

The stock market is a dynamic and ever-changing landscape that has the power to captivate the attention of investors and economists alike. As we move into 2017, the question on everyone’s mind is: how much higher will stock market prices achieve this year? While we cannot predict the future with certainty, we can analyze various factors that impact stock market performance to gain insight into the potential direction of prices.

Stock market prices are influenced by a myriad of factors, including economic conditions, corporate performance, investor sentiment, interest rates, and global market conditions. These factors, coupled with technological advancements and political events, shape the outlook for stock market performance in any given year.

In this article, we will delve into the key factors driving stock market prices in 2017 and explore the historical performance of the market. We will also examine the current economic and political landscape, investor sentiment, earnings growth, interest rates, global market conditions, and technological advancements to provide a comprehensive picture of what the future may hold for stock market prices.

While it is important to note that past performance does not guarantee future results, analyzing historical trends can provide valuable insights into market behavior. By understanding how the market has performed under similar circumstances in the past, we can gain a better understanding of the potential outcomes in the present.

It is important to recognize that the stock market is inherently unpredictable, and there are always numerous variables at play that can influence prices. Therefore, this article aims to provide an informed analysis of the factors driving stock market performance in 2017, rather than an absolute prediction.

Investors should always exercise caution, conduct thorough research, and consult with financial advisors before making investment decisions. With that in mind, let us delve into the factors driving stock market prices in 2017.

Factors Driving Stock Market Prices in 2017

The performance of the stock market in 2017 will be influenced by a multitude of factors. These factors include economic conditions, corporate performance, investor sentiment, interest rates, global market conditions, and technological advancements.

Economic conditions play a vital role in shaping stock market prices. Factors such as GDP growth, employment rates, inflation, and consumer spending all impact investor confidence and sentiment. If the economy shows signs of strength and stability, it typically leads to positive market performance. Conversely, if there are concerns about economic growth or stability, it can weigh on the market and lead to price declines.

Corporate performance is another crucial driver of stock market prices. The financial health and profitability of companies impact investor sentiment and their willingness to invest in stocks. Strong earnings growth, robust revenue streams, and effective management contribute to higher stock prices as investors anticipate future growth and profitability.

Investor sentiment plays a pivotal role in stock market performance. Market psychology, behavioral biases, and emotions can influence buying and selling decisions. When investors are optimistic and confident, they tend to invest more in stocks, driving prices higher. Conversely, when fear and uncertainty prevail, investors may sell their holdings, leading to market declines.

Interest rates and monetary policy decisions also impact stock market performance. Lower interest rates make stocks more attractive compared to other investment options, as they provide potential for higher returns. Conversely, higher interest rates can lead to a shift in investor preferences, causing them to move towards fixed-income assets and away from stocks.

Global market conditions play an increasingly significant role in stock market performance. Global economic trends, geopolitical events, and international trade policies can impact investor sentiment and market performance. With the increased interconnectedness of global markets, developments in one country can have ripple effects on stock markets around the world.

Technological advancements and innovation have the potential to disrupt industries, create new opportunities, and shape market performance. Technologies such as artificial intelligence, blockchain, and renewable energy are transforming various sectors, and companies involved in these industries may experience significant stock price growth.

It is important to note that these factors do not operate in isolation, but rather interact and influence one another. For example, positive economic conditions can enhance corporate performance and boost investor sentiment. Likewise, an increase in interest rates may result from stronger economic growth, which can impact investor behavior and stock market performance.

While these factors provide insight into what may drive stock market prices in 2017, it is important to remember that the market is inherently unpredictable. It is advisable for investors to remain vigilant, diversify their portfolios, and continually monitor market conditions. By staying informed and adapting to changing circumstances, investors can navigate the stock market with greater confidence.

Historical Performance of Stock Market

Examining the historical performance of the stock market can provide valuable insights into its long-term trends and patterns. However, it is important to note that past performance does not guarantee future results, and the stock market can be highly volatile and unpredictable.

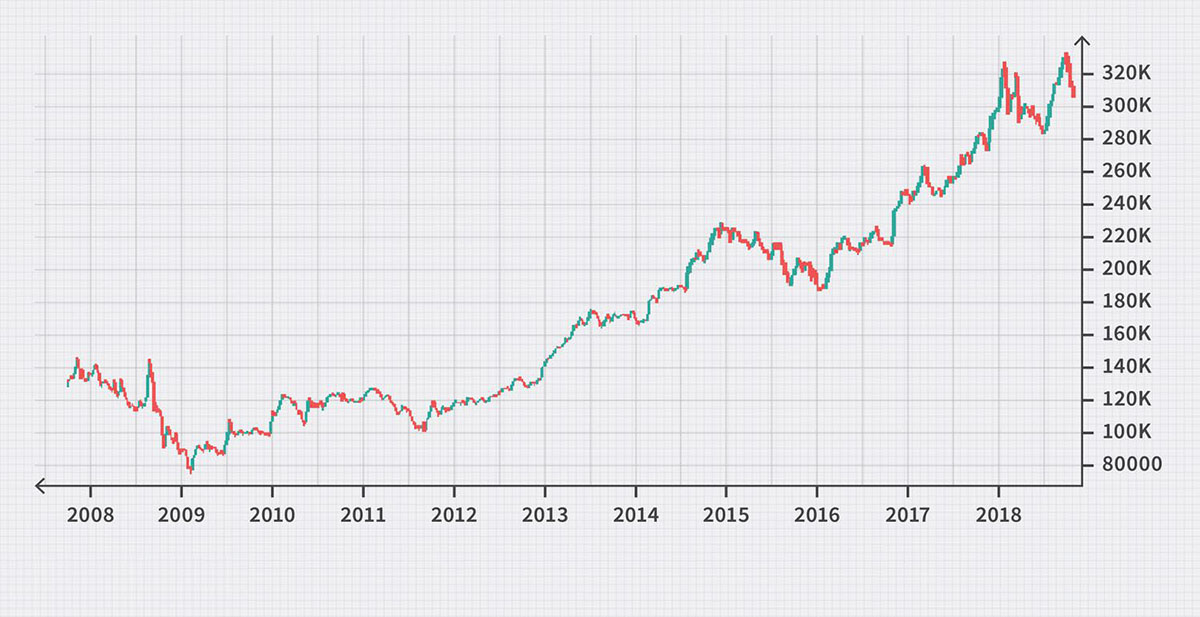

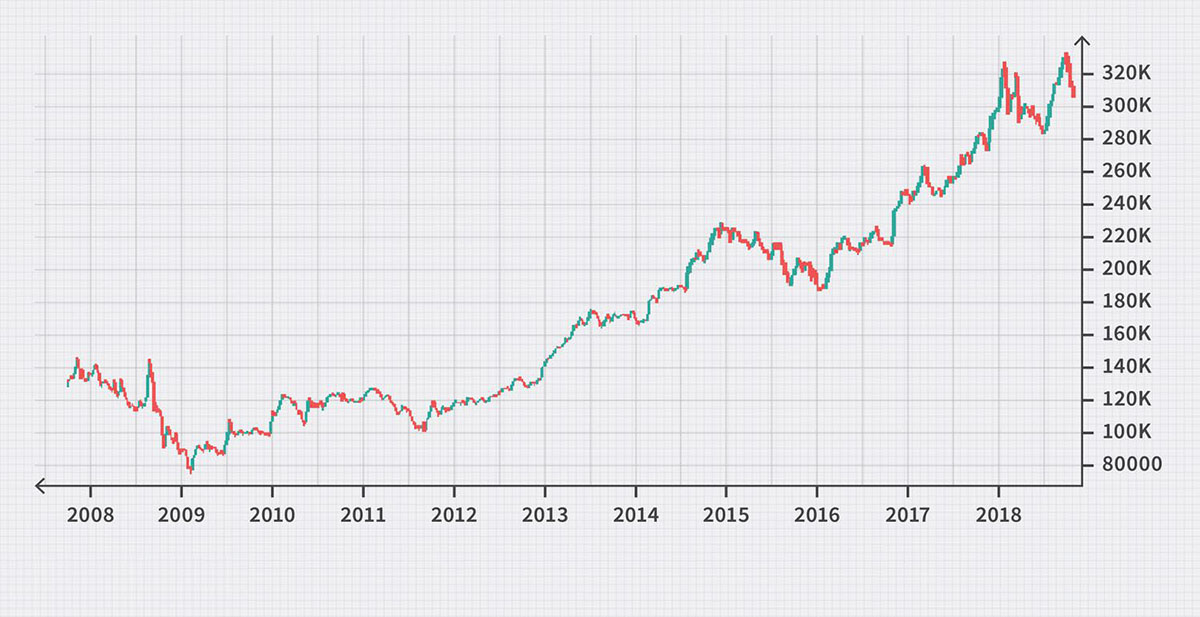

Over the years, the stock market has shown a general upward trajectory, with periods of growth and occasional downturns. Despite short-term fluctuations, the long-term trend has been positive, generating wealth for investors over time.

One of the most significant periods in the history of the stock market was the bull market of the 1990s. During this time, stock prices soared, driven by strong economic growth, technological advancements, and investor optimism. The dot-com boom resulted in a surge of internet-related companies going public, leading to skyrocketing stock prices. However, the bull market came to an abrupt end in 2000 with the burst of the dot-com bubble, causing a significant correction in stock prices.

The early 2000s also witnessed the aftermath of the September 11th terrorist attacks and the global financial crisis of 2008. These events led to market downturns and investor panic, resulting in a sharp decline in stock prices. However, the stock market eventually recovered from these downturns, highlighting its resilience and potential for long-term growth.

The most recent historical example is the bull market that began in 2009 following the global financial crisis. Central bank intervention and stimulus measures contributed to a significant rise in stock prices. This extended period of growth, characterized by low-interest rates and increasing corporate profits, continued for almost a decade.

During periods of economic expansion, stock market prices tend to rise as companies experience increased revenue and profitability. In contrast, economic recessions typically lead to market declines as companies face financial challenges and consumer spending contracts.

It is important to note that shorter-term market fluctuations, such as market corrections and bear markets, are a natural part of market cycles. These periods of decline can provide opportunities for long-term investors to enter the market at lower prices.

While historical performance provides insights into the stock market’s behavior, it is crucial to remember that the future is inherently uncertain. The stock market is influenced by numerous factors, both domestically and internationally, which can impact performance and create volatility. It is essential for investors to remain diversified, disciplined, and focused on their long-term investment goals regardless of short-term market fluctuations.

By being aware of historical patterns and understanding market dynamics, investors can make informed decisions and manage their portfolios effectively.

Current Economic and Political Landscape

The current economic and political landscape can have a significant impact on stock market performance in 2017. Economic indicators and political developments play a crucial role in shaping investor sentiment and market behavior.

One key economic indicator to consider is GDP growth. Economic growth provides a favorable environment for businesses to thrive and expand, which can drive stock market prices higher. Improvements in employment rates and consumer spending can also contribute to a positive economic outlook, as they signify a healthy and robust economy.

Interest rates are another critical factor to monitor. The Federal Reserve’s decisions on monetary policy have a direct influence on stock market performance. If the Fed raises interest rates, it can lead to a shift in investor preferences and potentially dampen stock market returns. Conversely, a dovish monetary policy, with low-interest rates, can boost stock market performance.

Furthermore, political developments can have a significant impact on the stock market. Policy changes, such as tax reforms, trade agreements, and regulatory adjustments, can directly affect companies’ profitability and investor sentiment. For example, corporate tax cuts can stimulate economic growth and lead to higher stock prices, while trade tensions and protectionist measures can create market volatility and uncertainty.

The current global economic landscape is also essential to consider. Economic conditions in major economies, such as the United States, China, and Europe, can influence global market sentiment. Trade relations, geopolitical events, and currency fluctuations can significantly impact stock market performance, particularly for multinational companies with international exposure.

Given the unprecedented disruption caused by the COVID-19 pandemic in 2020, the global economy and financial markets continue to face uncertainties in 2021. The recovery from the pandemic-induced recession, the effectiveness of vaccination campaigns, and ongoing government stimulus measures will play a vital role in determining the trajectory of economic growth and its impact on the stock market.

Political stability is also essential for a favorable investment climate. Political events, such as elections, policy changes, and geopolitical tensions, can create uncertainties in the market. Investors often seek political stability, as it provides a more predictable environment for businesses to operate and thrive.

Monitoring and analyzing the current economic and political landscape is crucial for financial investors. By staying informed about economic indicators, policy decisions, and political developments, investors can anticipate potential opportunities and risks in the stock market. It is important to stay nimble and adapt investment strategies accordingly to navigate the ever-changing economic and political landscape.

Investor Sentiment and Market Psychology

Investor sentiment and market psychology play a crucial role in determining stock market prices. The attitudes, emotions, and biases of investors can significantly influence their investment decisions, leading to buying or selling pressure in the market.

Investor sentiment refers to the overall outlook and perception of market participants regarding the future direction of stock prices. When investors are optimistic and confident about the market, they tend to be bullish, leading to increased buying activity and upward pressure on stock prices. Conversely, when investors are pessimistic and fearful, they may become bearish and sell their holdings, driving prices downward.

Market psychology, on the other hand, encompasses the behavioral biases and emotional responses that investors exhibit. Greed and fear are two predominant emotions that can drive investor decision-making. Greed can lead to irrational exuberance and excessive risk-taking, pushing stock prices to unsustainable levels. Fear, on the other hand, can result in panic selling and market downturns.

Behavioral biases, such as confirmation bias, recency bias, and herd mentality, also influence investor sentiment. Confirmation bias occurs when investors seek information that confirms their pre-existing beliefs and ignore contradictory data. Recency bias refers to the tendency to give more weight to recent events and experiences when making investment decisions. Herd mentality refers to the tendency of investors to follow the crowd and make decisions based on what others are doing, rather than conducting independent analysis.

Understanding investor sentiment and market psychology is crucial because they can create feedback loops that amplify market movements. In a bull market, positive investor sentiment can lead to a self-perpetuating cycle of rising prices, as more investors enter the market, pushing prices further. However, in a bear market, negative sentiment can exacerbate selling pressure, leading to further declines.

Investor sentiment and market psychology are influenced by a variety of factors, including economic indicators, corporate earnings, news events, and geopolitical developments. Positive economic data, strong corporate earnings, and favorable news can boost investor confidence and drive market optimism. Conversely, negative economic indicators, disappointing earnings reports, and geopolitical tensions can erode investor sentiment and lead to market declines.

It is important to note that investor sentiment and market psychology do not always align perfectly with underlying fundamentals. There can be periods of irrational exuberance or extreme pessimism that drive stock prices away from their intrinsic value. This creates opportunities for astute investors who can identify mispriced assets based on a rational evaluation of underlying economic and corporate conditions.

To gauge investor sentiment, analysts often rely on various indicators, such as surveys, market breadth, options activity, and volatility indices. These indicators provide insights into the prevailing sentiment and can help investors make informed decisions based on market dynamics.

Ultimately, investor sentiment and market psychology are integral components of the stock market. Understanding and analyzing these factors can provide valuable insights into market behavior and help investors navigate through periods of optimism and pessimism. By staying abreast of market sentiment and maintaining a rational investment approach, investors can make more informed decisions and potentially capitalize on market opportunities.

Earnings Growth and Corporate Performance

Earnings growth and corporate performance are fundamental drivers of stock market prices. The profitability and financial health of companies have a direct impact on investor sentiment and their willingness to invest in stocks.

Earnings growth refers to the increase in a company’s net income over time. When companies consistently report higher earnings, it signals to investors that the company is generating more profits and may continue to do so in the future. This, in turn, can drive stock prices higher as investors anticipate future growth and profitability.

Corporate performance encompasses a wide range of factors that contribute to a company’s overall financial health. Key metrics to evaluate corporate performance include revenue growth, profit margins, return on equity, and cash flow generation. Strong corporate performance indicates that a company is effectively managing its operations, generating sales, and delivering value to its stakeholders.

Investors look for companies that not only have a history of strong earnings growth but also exhibit consistent and sustainable performance. A company with a track record of generating stable and growing earnings is more likely to attract investor interest and potentially command higher stock prices.

The stock market’s reaction to earnings and corporate performance is often reflected in stock price movements around earnings announcements. If a company exceeds market expectations and reports better-than-expected earnings, it can lead to a positive market reaction, causing the stock price to increase. Conversely, if a company disappoints by reporting lower-than-expected earnings, it can result in a negative market reaction and a decline in stock price.

It is important to note that earnings growth and corporate performance can vary across different sectors and industries. Some sectors, such as technology and healthcare, may experience higher earnings growth due to innovation, market demand, or regulatory developments. Other sectors, such as utilities or mature industries, may have more stable but slower earnings growth.

Investors analyze various financial reports, such as quarterly earnings releases and annual reports, to assess the financial performance of companies. They also consider factors such as market share, competitive advantage, management team, and industry trends to evaluate the overall strength and potential of a company.

It is important to recognize that stock market prices are forward-looking, meaning they are influenced not only by current earnings but also by future earnings expectations. Analysts and investors often rely on earnings forecasts to estimate a company’s future profitability and growth potential. Positive earnings revisions or upgraded earnings forecasts can contribute to increased investor confidence and potentially drive stock prices higher.

In summary, earnings growth and corporate performance are essential factors that drive stock market prices. Companies that consistently deliver strong earnings growth and demonstrate robust corporate performance are more likely to attract investor attention and experience upward pressure on stock prices. Investors should carefully evaluate a company’s financial health, earnings track record, and growth potential when making investment decisions.

Interest Rates and Monetary Policy

Interest rates and monetary policy decisions are crucial factors that impact stock market performance. The actions of central banks, such as the Federal Reserve in the United States, can have profound effects on borrowing costs, investor behavior, and stock market prices.

Central banks use monetary policy tools, such as adjusting interest rates or implementing quantitative easing measures, to manage economic growth, inflation, and financial stability. The primary tool utilized by central banks is the benchmark interest rate, which influences borrowing costs for consumers, businesses, and investors.

When central banks lower interest rates, it reduces the cost of borrowing, making it more attractive for businesses to invest, expand, and hire employees. Lower interest rates also incentivize consumers to borrow and spend, stimulating economic activity. Consequently, this can lead to increased corporate profitability and positive market sentiment, potentially driving stock market prices higher.

Conversely, when central banks raise interest rates, borrowing costs increase, which can dampen economic activity. Higher interest rates can make it more expensive for businesses to access capital, which can slow down investment and expansion. It may also discourage consumers from taking on debt, which can impact consumer spending. As a result, higher interest rates can lead to a decline in corporate earnings and potentially affect stock market performance.

Monetary policy decisions, such as interest rate changes or changes in the money supply, can also impact investor behavior and market sentiment. In periods of accommodative monetary policy, characterized by low-interest rates and stimulus measures, investors may be more willing to take on risk and invest in stocks, potentially leading to upward pressure on stock market prices.

Anticipating changes in interest rates and monetary policy is crucial for investors. Stock market participants closely monitor central bank communications, economic indicators, and inflation data to assess the likelihood of future interest rate changes. The stock market often reacts to central bank announcements and shifts in monetary policy, as they can signal a shift in market conditions and expectations.

It is important to note that interest rates and monetary policy decisions are influenced by a variety of factors, including economic conditions, inflationary pressures, and financial market stability. Central banks aim to strike a balance between stimulating economic growth and managing inflation to maintain financial stability.

Global interest rate differentials can also impact stock market performance. When interest rates in one country are higher relative to another, it can attract foreign investors seeking higher yields. This can lead to increased demand for stocks in the higher-yielding country, potentially driving up stock market prices.

Overall, interest rates and monetary policy decisions have a significant impact on stock market performance. Changes in interest rates affect borrowing costs, investor behavior, and market sentiment. Investors should carefully monitor central bank actions and their implications for the overall economy and financial markets when making investment decisions.

Global Market Conditions

Global market conditions play a crucial role in determining stock market performance. Economic trends, geopolitical events, trade relations, and currency fluctuations all influence investor sentiment and market dynamics.

Economic conditions in major economies around the world can have a significant impact on stock market performance. When major economies experience robust economic growth, it often leads to positive spillover effects on global markets. Stronger consumer spending, increased business investment, and overall economic expansion can drive stock prices higher.

On the other hand, economic downturns or recessions in key economies can have adverse effects on global markets. Negative economic indicators, such as declining GDP growth, rising unemployment rates, or slowing trade, can create uncertainties and dampen investor sentiment, leading to market declines.

Geopolitical events and developments can also create volatility and uncertainty in global markets. Political tensions, conflicts, and diplomatic disputes can have implications for trade relations and disrupt economic stability. Investors closely monitor geopolitical risks as they can influence market sentiment and result in heightened market volatility.

Trade relations and policies between countries are an essential aspect of global market conditions. Trade agreements, tariffs, and trade disputes can impact industries and specific companies, affecting their profitability and stock market performance. Changes in trade policies can create winners and losers within the market, and investors monitor these developments to assess potential opportunities and risks.

Currency fluctuations are another crucial aspect of global market conditions. Exchange rate movements impact the competitiveness of exporters, international trade flows, and global financial markets. Strengthening or weakening of currencies can affect companies’ revenues and profit margins, especially for multinational corporations. Investors who hold investments in foreign markets also need to consider currency risk and its potential impact on their returns.

Global market conditions are interconnected, and developments in one region can have ripple effects on other markets. Increased global interconnectedness and the rise of emerging markets have made it essential for investors to consider a global perspective when assessing stock market performance.

Investors often evaluate global market conditions through various indicators and reports, including global economic outlooks, international trade data, geopolitical analyses, and currency market trends. These sources of information help investors gauge the overall health and stability of global markets and make informed investment decisions.

It is important to recognize that global market conditions can be dynamic and subject to rapid changes. Factors such as political developments, economic indicators, and regional conflicts can all impact market sentiment and influence stock market performance. Investors should stay abreast of global market conditions, conduct thorough research, and consider diversifying their portfolios to mitigate risks associated with specific countries or regions.

By staying informed and understanding the broader global market environment, investors can position themselves to capitalize on potential opportunities and navigate the challenges presented by global market conditions.

Technological Advancements and Innovation

Technological advancements and innovation have a profound impact on stock market performance. Companies that embrace and successfully harness technology and innovation often experience significant growth, driving stock prices higher.

Technological advancements can disrupt industries, create new market opportunities, and enhance productivity. Companies that develop innovative products or incorporate innovative technologies into their operations gain a competitive edge, positioning themselves for potential stock market outperformance.

One example of technological advancement is the rise of the digital economy. Companies that leverage digital technologies, such as e-commerce, cloud computing, and data analytics, have transformed industries and experienced rapid growth. These companies often attract investor interest and command high stock market valuations.

Moreover, breakthrough innovations in areas such as artificial intelligence, robotics, biotechnology, and renewable energy drive investor excitement and can lead to significant stock price appreciation. Investors seek opportunities in companies at the forefront of technological breakthroughs, as they have the potential to disrupt existing markets and create new avenues for growth.

Technology-driven sectors, such as information technology, telecommunication, and healthcare, are particularly influenced by technological advancements. These sectors can experience rapid growth and strong stock market performance as they benefit from innovations that improve efficiency, reduce costs, and drive revenue growth.

Investors follow technological trends and innovations closely, keeping an eye on companies that are leading the way in developing groundbreaking technologies. Start-ups and tech companies with disruptive business models often receive significant attention from investors, and successful initial public offerings (IPOs) can generate significant interest and drive stock market gains.

However, it is important to note that not all technological advancements lead to successful stock market performance. Investors need to carefully evaluate a company’s business model, long-term viability, competitive advantages, and ability to monetize their technology. Companies that fail to effectively commercialize their innovations or face intense competition may struggle to deliver sustained stock market outperformance.

Market participants should also be aware of regulatory risks and potential ethical concerns associated with certain technologies. Regulatory changes or public backlash against technology companies can impact market sentiment and stock prices, as seen in the case of controversies surrounding data privacy or antitrust issues.

Investors looking to capitalize on technological advancements and innovation should conduct thorough research and due diligence. Staying informed about emerging technologies, industry trends, and breakthrough innovations can help investors identify companies with growth potential and position themselves for potential stock market gains.

Overall, technological advancements and innovation have a transformative impact on stock market performance. Companies that excel in incorporating technology and driving innovation are positioned for growth and have the potential to deliver strong stock market returns. By actively monitoring and identifying opportunities in the evolving technological landscape, investors can participate in the potential upside offered by these advancements.

Conclusion

As we look ahead to stock market performance in 2017, it is important to consider the various factors that drive prices and shape investor sentiment. From analyzing the historical performance of the stock market to assessing current economic and political landscapes, understanding the dynamics of the market is paramount.

Economic conditions, corporate performance, investor sentiment, interest rates, global market conditions, and technological advancements all play integral roles in influencing stock market prices. Positive economic indicators, strong corporate earnings, and favorable investor sentiment typically contribute to upward pressure on stock prices. Conversely, economic downturns, negative earnings surprises, and investor pessimism can lead to market declines.

Interest rates and monetary policy decisions are crucial aspects to monitor. Changes in interest rates initiated by central banks can have significant effects on borrowing costs, investor behavior, and overall market sentiment. Additionally, global market conditions, geopolitical events, trade relations, and currency fluctuations all interact and influence stock market performance.

Furthermore, technological advancements and innovation can reshape industries, create new opportunities, and impact stock market performance. Companies that embrace technology and successfully innovate are well-positioned for growth and can attract investor attention.

While analyzing these factors and historical trends provide useful insights, it is important to recognize that the stock market is inherently unpredictable. Investors should exercise caution, conduct thorough research, and seek expert advice when making investment decisions.

Ultimately, a diversified portfolio and long-term investment strategy are recommended to mitigate risks and take advantage of potential opportunities. By staying informed and actively monitoring the ever-changing market conditions, investors can navigate the stock market with greater confidence and potentially achieve their financial goals.

While our exploration of the factors driving stock market prices in 2017 provides a comprehensive overview, it is essential to continuously assess new developments and adapt strategies accordingly. The stock market is a dynamic and evolving landscape, and success lies in staying informed, being adaptable, and maintaining a disciplined approach in the face of changing market conditions.