Home>Finance>What Type Of Information Is Not Included In A Certificate Of Insurance?

Finance

What Type Of Information Is Not Included In A Certificate Of Insurance?

Published: November 19, 2023

Discover what type of information is not included in a certificate of insurance. Find out how this affects your finances and risk management strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Certificate of Insurance

- Purpose of a Certificate of Insurance

- Types of Information Included in a Certificate of Insurance

- Limitations of a Certificate of Insurance

- Information Not Included in a Certificate of Insurance

- Exclusions and Limitations

- Importance of Reading the Insurance Policy

- Conclusion

Introduction

When it comes to managing risk and protecting your business, having adequate insurance coverage is crucial. A Certificate of Insurance (COI) is a document that is commonly used to provide proof of insurance coverage. It serves as a snapshot of your insurance policies and can be requested by clients, vendors, or other entities with whom you do business.

A Certificate of Insurance is not an insurance policy itself, but rather a summary of the key details of your insurance coverage. It typically includes information such as the types of coverage, policy limits, effective dates, and the name of the insurer. It is important to note that while a COI provides a quick overview of your insurance coverage, it should not be used as a substitute for reading the actual insurance policy.

The purpose of this article is to provide an understanding of the information typically included in a Certificate of Insurance, as well as the limitations and exclusions that the document may have. By knowing what is and what is not covered, you can have a clearer picture of your insurance protection and make more informed decisions.

Definition of a Certificate of Insurance

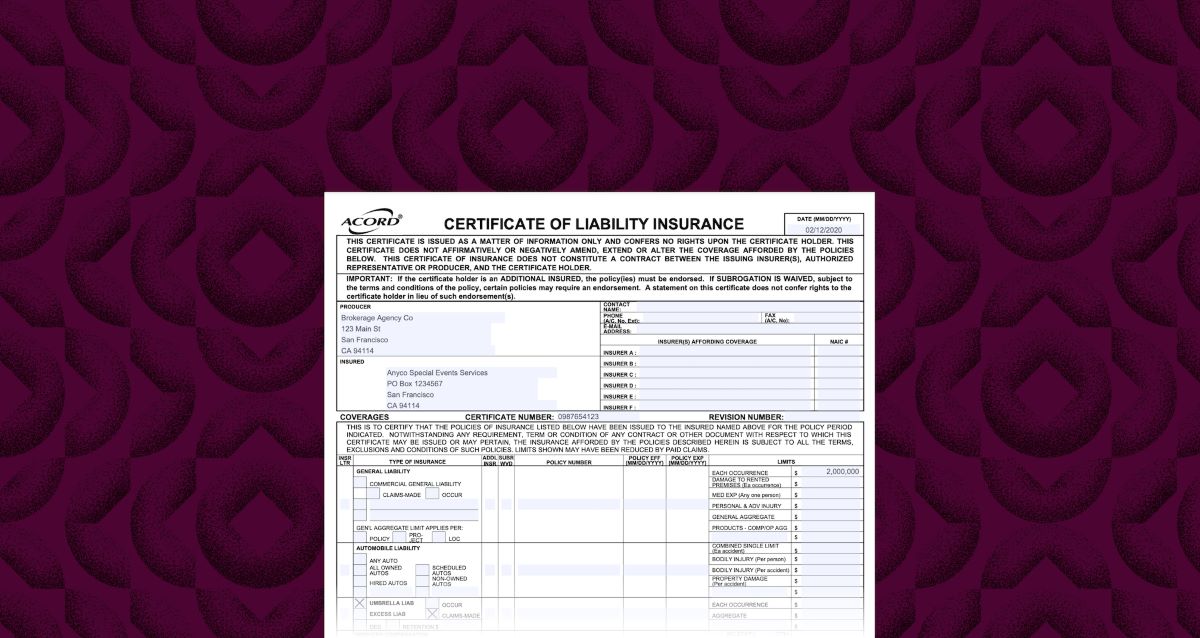

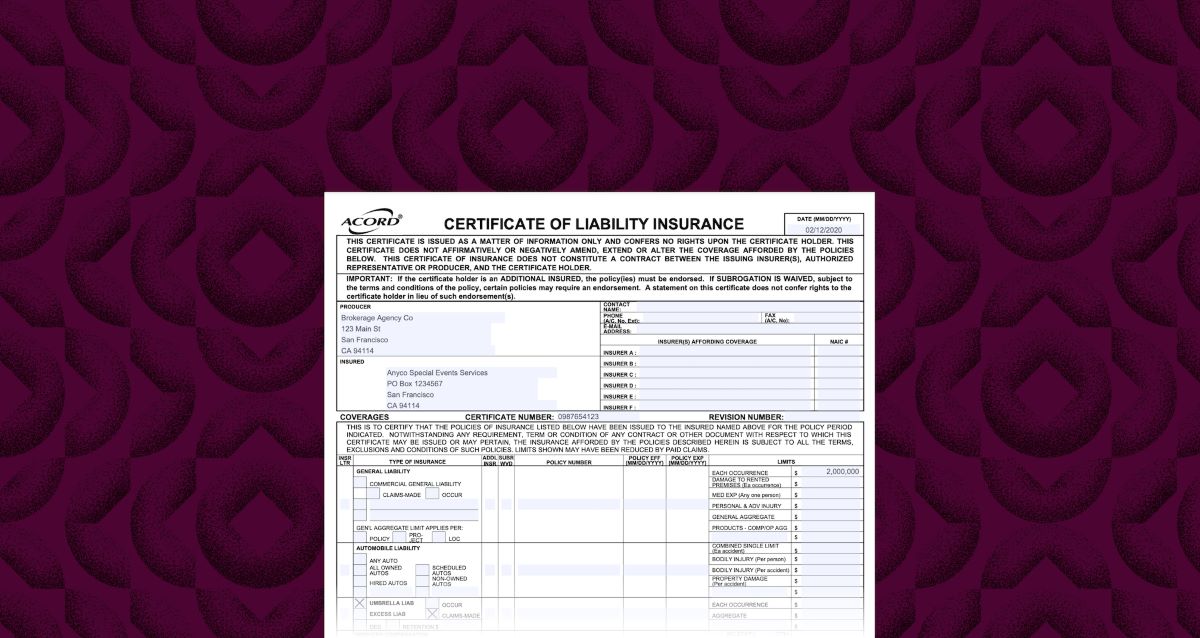

A Certificate of Insurance (COI) is a document issued by an insurance company or broker that provides a summary of the insurance policies held by an individual or business.

The COI serves as proof that insurance coverage is in place and provides information about the types and amounts of coverage, as well as the effective dates of the policies. It may include details about general liability, property, workers’ compensation, professional liability, or any other relevant insurance policies.

The purpose of a COI is to provide a concise summary of insurance coverage to third parties who may require proof of insurance. For example, if you are a contractor working on a client’s property, the client may request a COI to ensure that you have liability insurance in case of accidents or damage. Similarly, a landlord may ask tenants for a COI to ensure they have appropriate renters’ insurance coverage. In these cases, the COI serves as a way to quickly confirm that the necessary insurance is in place.

It’s important to note that a COI is not a legally binding contract or policy document. Instead, it acts as evidence that insurance coverage exists and provides a snapshot of the policy details. The terms and conditions of coverage are outlined in the actual insurance policy, which should be read and understood by the policyholder.

In summary, a Certificate of Insurance is a document that summarizes an individual or business’s insurance coverage. It serves as proof of insurance and provides important information to third parties who require evidence of coverage. However, it should be viewed as a summary document and not a substitute for reading the full insurance policy.

Purpose of a Certificate of Insurance

The primary purpose of a Certificate of Insurance (COI) is to provide proof of insurance coverage to third parties. Whether you’re a business owner, contractor, or tenant, you may be required to provide a COI to demonstrate that you have adequate insurance protection in place.

Here are some key purposes of a COI:

- Verification of Coverage: By presenting a COI, you can verify to clients, vendors, or other parties that you have the necessary insurance coverage. This can help instill confidence in your ability to fulfill contractual obligations and mitigate potential risks.

- Contractual Requirement: Many contracts, especially in commercial and construction industries, stipulate that the parties involved must provide proof of insurance coverage. A COI serves as a straightforward way to meet these contract requirements and ensure compliance.

- Risk Management: For businesses and individuals, a COI can act as a risk management tool. It demonstrates that you have taken steps to protect yourself and others against potential liabilities and losses. By presenting a COI, you can showcase your commitment to responsible risk management practices.

- Compliance with Legal and Regulatory Obligations: Some industries have specific legal or regulatory requirements for insurance coverage. For example, certain professionals such as doctors or lawyers may need to carry professional liability insurance. A COI helps demonstrate compliance with these obligations.

- Credentialing and Licensing: Professionals and businesses in certain fields may need to obtain licenses or credentials. In many cases, providing a COI is part of the application or renewal process. It demonstrates that you meet the insurance requirements necessary for obtaining or maintaining these credentials.

Overall, the purpose of a Certificate of Insurance is to provide evidence of insurance coverage, meet contractual obligations, manage risks, comply with legal requirements, and demonstrate professionalism. It acts as a convenient summary of insurance details that helps establish trust and confidence with third parties.

Types of Information Included in a Certificate of Insurance

A Certificate of Insurance (COI) provides a summarized overview of an individual or business’s insurance coverage. It contains various types of information that are important for understanding the scope and limits of the policies. Here are the key details typically found in a COI:

- Policyholder Information: The COI will include the name and contact information of the policyholder. This could be an individual or a business entity.

- Insurance Company Information: The COI will provide the name and contact information of the insurance company or broker issuing the certificate.

- Policy Types: The COI will specify the types of insurance coverage held by the policyholder. This may include general liability, property, workers’ compensation, professional liability, commercial auto, or other relevant policies.

- Policy Limits: The COI will outline the policy limits for each coverage type. This refers to the maximum amount the insurer will pay in the event of a claim. For example, it may state a liability limit of $1 million per occurrence or a property limit of $500,000.

- Effective Dates: The COI will indicate the start and end dates of the insurance policies. It is essential to ensure that the coverage is in force during the period for which the COI is provided.

- Additional Insured: The COI may list any additional parties who are granted coverage under the policy. This is common when subcontractors need to be covered under the general liability policy of a primary contractor, for example.

- Cancellation and Modification Notices: The COI will state whether there are any provisions for the policyholder to receive notice of cancellation or modification of the policies. It is important to be aware of these provisions in case changes occur during the coverage period.

- Special Endorsements: The COI may include any special endorsements or riders that modify or extend the standard policy provisions. These add-ons provide additional coverage for specific risks or situations not covered in the base policy.

It is important to review the COI carefully to ensure that it accurately reflects the desired coverage and policy limits. If there are any discrepancies or questions, it is crucial to contact the insurance company or broker to seek clarification and make any necessary adjustments.

Remember that while the COI provides a condensed summary of the policy details, it is not a substitute for reading and understanding the actual insurance policy. The full policy will contain more comprehensive information, including exclusions, conditions, and other terms and conditions.

Limitations of a Certificate of Insurance

While a Certificate of Insurance (COI) is a valuable document that provides a snapshot of an individual or business’s insurance coverage, it is important to understand its limitations. Here are some key limitations to keep in mind:

- Summary Document: A COI is a summary document that provides abbreviated information about insurance coverage. It does not provide the detailed terms, conditions, or exclusions of the policies. To fully understand the extent of coverage, it is essential to refer to the actual insurance policies.

- Validity Period: A COI is valid only for a specific period. It reflects the insurance coverage in effect at the time of issuance. If any changes occur to the policies during the coverage period, a new COI may need to be requested to ensure accurate documentation.

- Policy Amendments: A COI does not automatically reflect any subsequent changes or amendments made to the insurance policies. If modifications are made to the policies after the COI is issued, the parties involved should be notified separately.

- Modifications and Cancellations: A COI typically states whether the policyholder will receive notice of any modification or cancellation of the insurance coverage. It is important to be aware of these provisions and promptly notify the relevant parties if adjustments or cancellations occur.

- Exclusions and Limitations: The COI may not explicitly list all exclusions and limitations of the insurance policies. These details are typically outlined in the actual insurance policies. It is crucial to review the policy documents to understand the full scope of coverage and any restrictions that may apply.

- Verification of Coverage: While a COI can serve as proof of insurance coverage, it does not guarantee that the policies are still in effect at the time of verification. It is necessary to validate the coverage directly with the insurance company or broker to ensure its current status.

- Liability Transfer: A COI does not transfer any liability from the insurance company to the party requesting the document. It only provides evidence of insurance coverage and does not confer any rights or obligations to third parties.

It is crucial to read and understand the complete insurance policies to fully grasp the coverage, exclusions, and limitations. The COI provides a helpful summary, but it is necessary to refer to the actual policy documents for comprehensive knowledge of the insurance protection.

Information Not Included in a Certificate of Insurance

While a Certificate of Insurance (COI) provides a summary of an individual or business’s insurance coverage, there are certain types of information that are typically not included in this document. It’s important to be aware of what is not covered to ensure a complete understanding of your insurance policies. Here are some examples of information that is typically not found in a COI:

- Policy Details: A COI does not provide the full details of the insurance policies. It typically includes a brief description of the coverage types, policy limits, and effective dates. However, it does not provide the comprehensive terms, conditions, or exclusions of the policies.

- Specific Endorsements: A COI may not include information about specific endorsements or riders that modify or extend coverage beyond the base policy. These additional endorsements may offer specialized coverage for specific risks or situations that are not covered by the standard policy.

- Premium Amount: The COI generally does not disclose the premium amount paid for the insurance policies. It solely focuses on providing summary information about the coverage types, limits, and effective dates.

- Claims History: Information about the policyholder’s claims history is typically not included in a COI. This information is typically confidential and not shared in a summary document. Claims history may impact future premiums and coverage options, but it is not mentioned in a COI.

- Sub-Limits: Sub-limits, which are specific limits within a broader coverage type, are often not detailed in a COI. For example, a general liability policy may have sub-limits for certain types of claims, such as those related to advertising or personal injury. These specific limits are typically not included in the COI.

- Policy Exclusions: A COI does not provide an exhaustive list of all the policy exclusions. Exclusions specify the types of incidents or situations that are not covered by the policy. These details are found within the insurance policy itself.

- Additional Insured Coverage: While a COI may list additional insured parties, it may not specify the extent or limitations of the additional insured coverage. The full policy would provide the specific details and conditions of the additional insured coverage.

It is essential to thoroughly review the actual insurance policies to understand all the details, terms, conditions, exclusions, and endorsements of the coverage. The COI serves as a summary document but should not be relied upon as the sole source of information about the insurance policies.

Exclusions and Limitations

Every insurance policy has its own set of exclusions and limitations that define the scope and limitations of coverage. These exclusions and limitations outline the specific situations or types of claims that will not be covered by the policy. It is important to understand these provisions to avoid any surprises or misunderstandings in the event of a claim. Here are some common examples of exclusions and limitations found in insurance policies:

- Natural Disasters: Many insurance policies exclude coverage for damages caused by natural disasters such as earthquakes, floods, hurricanes, or wildfires. Separate policies or endorsements may be required to cover these types of events.

- Intentional Acts: Insurance policies typically do not cover losses or damages caused intentionally by the policyholder or anyone acting on their behalf. This exclusion is in place to deter fraudulent or malicious activities.

- War or Terrorism: Damage or loss resulting from acts of war or terrorism is often excluded from standard insurance policies. Specialized insurance coverage may be required to protect against these risks.

- Wear and Tear: Insurance policies generally do not cover damage due to normal wear and tear or gradual deterioration of property. Such damages are considered to be part of regular maintenance and are not insurable events.

- Professional Errors and Omissions: Professional liability policies may have exclusions for certain types of errors, omissions, or professional negligence. Policyholders in professional fields should carefully review their policies and consider additional coverage, such as specialized malpractice insurance.

- Criminal or Illegal Activities: Insurance policies typically exclude coverage for losses arising from criminal or illegal activities. Claims resulting from illegal or fraudulent acts are generally not covered by insurance.

- Pre-Existing Conditions: Health insurance policies often have exclusions for pre-existing medical conditions, meaning that treatment or expenses related to those conditions may not be covered. However, regulations regarding pre-existing conditions may vary based on region and specific insurance policies.

- Policy Limits: Insurance policies have predefined limits on the maximum amount that will be paid for a covered claim. It is important to understand these limits and ensure they are sufficient for potential losses or damages.

These are just a few examples of common exclusions and limitations that can vary depending on the type of insurance and the specific policy. It is essential to carefully review the policy documents to understand the exclusions, limitations, and specific terms and conditions of coverage. Additionally, consulting with an insurance professional can help clarify any questions or concerns regarding the exclusions and limitations of your insurance policies.

Importance of Reading the Insurance Policy

Reading and understanding your insurance policy is essential for ensuring that you have the appropriate coverage and that you are aware of any exclusions, limitations, and conditions that may impact your claims. Here are some key reasons why reading the insurance policy is crucial:

- Understanding Coverage: By reading the insurance policy, you gain a comprehensive understanding of the types of risks and incidents that are covered. This knowledge allows you to make informed decisions about your insurance needs and assess whether the coverage aligns with your requirements.

- Exclusions and Limitations: The insurance policy outlines any exclusions and limitations that may restrict coverage. This information is crucial in managing expectations and avoiding surprises when filing a claim. Understanding these provisions can help you take appropriate steps to mitigate risks not covered by the policy.

- Claims Process: The policy document provides information on the claims process, including requirements, documentation, and timelines. Understanding this process ahead of time can streamline the claims process and help you navigate it more efficiently.

- Policy Conditions: Insurance policies often include specific conditions that policyholders must fulfill to maintain coverage. Examples may include carrying out regular maintenance, implementing safety measures, or providing prompt notice of incidents. Failing to meet these conditions can result in coverage denials, so it is crucial to be aware of and comply with them.

- Policy Changes: Insurance policies may be subject to changes over time, such as updates in coverage, premiums, or terms. By reading the policy, you can stay informed about any modifications and take appropriate action if necessary. Failure to review policy changes could result in unintended coverage gaps or missed opportunities for accessing additional coverage options.

- Reviewing Insured Items: Insurance policies often require policyholders to provide accurate information about the items or risks being insured. It is important to review this information carefully to ensure its accuracy. If any discrepancies are found, they should be addressed immediately to prevent potential coverage issues.

Reading the insurance policy allows you to be an informed policyholder, enabling you to make well-informed decisions about your coverage needs, understand the extent of your protection, and navigate the claims process efficiently. If you have any questions or uncertainties about the policy, it is advisable to consult with an insurance professional who can guide you through the document and provide clarification on any aspects that may require further explanation.

Conclusion

A Certificate of Insurance (COI) serves as proof of insurance coverage and provides a summarized overview of an individual or business’s insurance policies. While a COI is a valuable document for demonstrating insurance coverage to third parties, it is important to recognize its limitations.

A COI is not a substitute for reading and understanding the actual insurance policy. The policy itself contains the comprehensive details, terms, conditions, exclusions, and limitations that define the scope of coverage.

By thoroughly reviewing the insurance policy, you gain a deeper understanding of the coverage types, policy limits, exclusions, and conditions. This knowledge helps you make informed decisions, manage risks effectively, and avoid surprises when filing a claim.

Remember to pay attention to exclusions and limitations that may impact your coverage. It is crucial to be aware of any specific endorsements, sub-limits, or additional insured parties that may be crucial to your insurance protection.

Reading the policy also allows you to understand the claims process and comply with any policy conditions. It ensures that you meet the requirements necessary to maintain coverage and receive prompt and fair claim settlements.

Lastly, consult with an insurance professional if you have any questions or need clarification on any aspects of your policy. They can provide valuable guidance and help you navigate the intricacies of your insurance coverage.

In conclusion, while a Certificate of Insurance is a useful summary document, it should not replace the importance of reading and understanding your insurance policy. By being proactive in reviewing and comprehending your policy, you can make informed decisions, effectively manage risks, and ensure that your insurance coverage aligns with your needs and expectations.