Home>Finance>What Insurance Information Does A Pharmacy Need?

Finance

What Insurance Information Does A Pharmacy Need?

Published: November 12, 2023

Learn what insurance information a pharmacy needs for their financial needs. Discover how to manage finances and protect your pharmacy with the right insurance coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Patient Information

- Prescription Information

- Insurance Provider Information

- Coverage Details

- Copayment, Deductible, and Coinsurance Information

- Prior Authorization and Step Therapy Requirements

- Prescription Limitations and Exclusions

- Coordination of Benefits

- Claims Submission Process

- Reimbursement Policies

- Additional Insurance Requirements

- Conclusion

Introduction

Pharmacies play a crucial role in the healthcare industry, ensuring that patients receive the necessary medications to treat their conditions. In order to process prescriptions and provide patients with the best possible care, pharmacies need certain insurance information. This information not only helps pharmacies verify coverage but also ensures that patients receive the medications they need at an affordable cost.

In this article, we will explore the essential insurance information that pharmacies require for efficient prescription processing. By understanding the insurance details necessary for a smooth experience, patients can help facilitate the process and avoid any potential delays or complications.

Pharmacies serve as a vital link between healthcare providers, insurance companies, and patients. They must have accurate and up-to-date insurance information to bill the appropriate party for the cost of medications. By accurately capturing insurance-related information, pharmacies can streamline the prescription filling process, minimize billing errors, and help patients understand their coverage.

When visiting a pharmacy, patients will need to provide their insurance identification, prescription information, and specific details about their coverage. This data allows the pharmacy to communicate with the insurance provider and determine the patient’s eligibility and coverage for the prescribed medication. Additionally, pharmacies may need to understand the patient’s copayment, deductible, and coinsurance information to accurately calculate the patient’s financial responsibility.

Insurance information requirements can vary from one pharmacy to another, but certain common elements are typically necessary. These include patient information, prescription details, insurance provider information, coverage specifics, copayment, deductible, and coinsurance information, prior authorization and step therapy requirements, prescription limitations and exclusions, coordination of benefits, claims submission process, reimbursement policies, and any additional insurance requirements.

Understanding the importance of providing comprehensive insurance information to pharmacies allows patients to proactively participate in their healthcare management. By ensuring that pharmacies have the necessary details, patients can expedite the process of receiving their medications and help avoid any unnecessary delays or confusion.

In the subsequent sections, we will delve into each of these information requirements in greater detail, shedding light on their significance and helping patients navigate the insurance process smoothly.

Patient Information

When visiting a pharmacy, providing accurate and complete patient information is essential for a seamless prescription filling process. Patient information typically includes the following details:

1. Full Name: The patient’s legal first and last name are crucial for identification and documentation purposes. It is important to ensure that the name provided matches the information on the insurance card.

2. Date of Birth: The patient’s date of birth is necessary to verify their age and eligibility for certain medications. It helps pharmacies determine if there are any age restrictions or medication dosage adjustments required.

3. Address: The patient’s current residential address is vital for communication purposes, especially if any additional documentation or paperwork needs to be mailed.

4. Contact Information: Providing a valid phone number and email address allows pharmacies to communicate with patients regarding their prescriptions, insurance coverage, and any potential issues that may arise.

5. Insurance Identification: Patients should provide their insurance identification number. This unique identifier connects the patient’s insurance coverage to their healthcare records and ensures that prescriptions are appropriately billed and processed through the insurance provider.

6. Primary Care Physician (PCP): Sharing the name and contact information of the patient’s primary care physician is helpful for pharmacies to communicate regarding any necessary clarifications or consultations related to the prescribed medication.

7. Allergies and Medical Conditions: Patients should inform pharmacies about any known allergies or medical conditions that may impact their ability to take certain medications. This information is crucial for medication safety and helps pharmacies flag any potential drug interactions or allergies.

Providing accurate patient information helps pharmacies ensure that prescriptions are processed correctly and efficiently. It also helps prevent any confusion or delays in the prescription filling process. Patients should always double-check the accuracy of the information provided, as incorrect information can lead to issues such as insurance claim rejections or medication errors.

By providing complete and accurate patient information, individuals can help pharmacies streamline the prescription filling process and receive the necessary medications in a timely manner. This proactive approach not only ensures smoother operations but also contributes to a patient’s overall healthcare experience.

Prescription Information

Prescription information is a critical component of the insurance details that pharmacies require to process medications accurately and efficiently. When presenting a prescription at a pharmacy, patients should provide the following information:

1. Prescriber’s Name: The name of the healthcare provider who wrote the prescription is essential for pharmacies to verify the legitimacy of the prescription. This helps ensure that the medication is prescribed by a licensed professional and meets the patient’s healthcare needs.

2. Medication Name: Patients should clearly communicate the name of the prescribed medication. Including the dosage strength and form (tablet, capsule, liquid, etc.) is helpful for pharmacies to dispense the correct medication as prescribed.

3. Quantity: The prescribed quantity of the medication indicates how many units or dosage forms should be dispensed to the patient. This information helps pharmacies calculate the appropriate supply and ensures that patients receive an adequate amount of medication.

4. Instructions for Use: The prescriber’s instructions for how to take the medication are crucial for patient safety and compliance. Patients should relay this information accurately to the pharmacy to ensure that the medication is dispensed with the appropriate directions for use.

5. Refill Information: If the prescription includes refills, patients should inform the pharmacy about the number of authorized refills. This information helps pharmacies monitor the prescription’s validity and ensures that patients receive their medications without interruption.

6. Medication Strength: If the prescribed medication is available in multiple strengths, patients should provide the specific strength mentioned by the prescriber. This helps pharmacies dispense the correct medication variant as per the prescription’s instructions.

7. Medication Formulation: In some cases, prescribers may specify a specific brand name or generic version of a medication. Patients should share this information with the pharmacy to ensure that the correct formulation is dispensed as intended.

8. Date of Prescription: Patients should communicate the date when the prescription was issued by their healthcare provider. This information helps pharmacies determine the prescription’s validity within the authorized time frame.

By providing accurate prescription information to pharmacies, patients can ensure that the correct medication is dispensed and avoid any potential errors or confusion. It is important for patients to verify the details on their prescription before presenting it to the pharmacy and to communicate any specific instructions or concerns they may have.

Accurate prescription information is crucial for pharmacies to process medications efficiently and safely. Patients play a key role in facilitating this process by providing the necessary details and communicating clearly with their pharmacy team. By doing so, patients can contribute to positive health outcomes and a seamless medication experience.

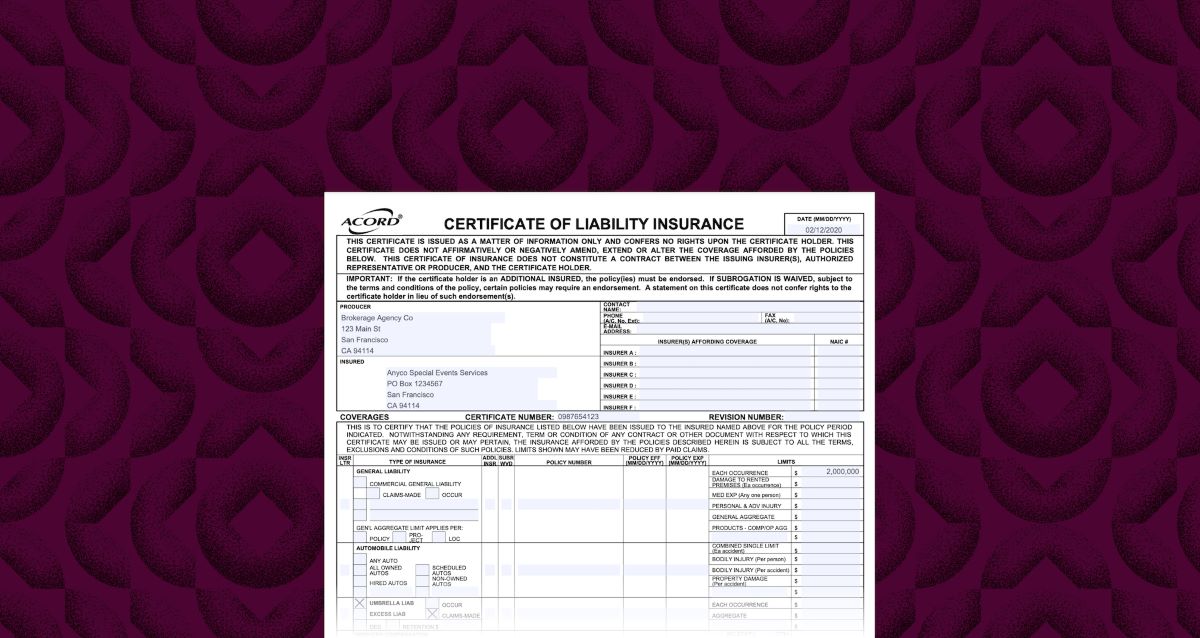

Insurance Provider Information

When filling a prescription, pharmacies require specific information about the patient’s insurance provider to ensure accurate billing and claims processing. Patients should provide the following insurance provider information:

1. Insurance Company Name: Patients should inform the pharmacy of the name of their insurance company. This allows pharmacies to identify and communicate with the correct insurance provider for the prescription.

2. Insurance ID Number: The insurance identification (ID) number is a unique identifier assigned to each individual covered by the insurance plan. Patients should provide this number as it is used to link the prescription to the patient’s insurance coverage.

3. Group/Policy Number: Some insurance plans have an additional group or policy number associated with them. Patients should share this information if applicable, as it helps pharmacies ensure that the prescription is processed under the correct insurance plan.

4. Pharmacy Benefit Manager (PBM): In some cases, the insurance provider may have contracted with a pharmacy benefit manager (PBM) to handle prescription benefits and claims processing. Knowing the name of the PBM can assist the pharmacy in submitting claims to the correct party.

5. Pharmacy Network: Patients should verify if their insurance plan has a preferred pharmacy network. This information helps determine if the pharmacy is in-network, which can impact coverage and copayment amounts.

6. Prior Authorization: Some medications require prior authorization from the insurance provider before they can be dispensed. Patients should inform the pharmacy if their medication requires prior authorization, as the pharmacy will need to communicate with the insurance company to obtain the necessary approval.

7. Step Therapy: Step therapy is a process in which the insurance provider requires the patient to try lower-cost or preferred medications first before approving coverage for more expensive options. Patients should notify the pharmacy if their insurance plan has step therapy requirements, as it may impact the dispensing process.

By providing accurate insurance provider information, patients help ensure that pharmacies can bill the correct party for the prescription and obtain the necessary authorization if required. This reduces the risk of claim denials, delays in prescription processing, and out-of-pocket expenses for the patient.

Understanding the importance of providing accurate insurance provider information allows patients to actively participate in their healthcare expenses and ensure that their insurance coverage is utilized effectively. Open communication between patients and pharmacies regarding insurance details helps facilitate a smoother prescription filling process and ensures that patients receive the medications they need in a timely manner.

Coverage Details

Understanding the coverage details of your insurance plan is crucial when filling a prescription at a pharmacy. The coverage details determine how much of the medication’s cost will be covered by the insurance provider. Patients should be aware of the following information regarding their coverage:

1. Formulary: The formulary is a list of medications that are covered by the insurance plan. It categorizes medications into different tiers or levels, with varying copayment or coinsurance amounts. Patients should inquire about their insurance plan’s formulary to understand which medications are covered and their corresponding costs.

2. Medication Tier: Insurance plans often assign medications to different tiers based on their cost and therapeutic value. Lower-tier medications usually have lower copayment amounts, while higher-tier medications may require higher out-of-pocket costs. Patients should know the specific tier of their prescribed medication to estimate their financial responsibility accurately.

3. Specialty Medications: Some insurance plans have a separate category for specialty medications, which are typically used to treat complex or chronic conditions. These medications can have higher copayments or coinsurance amounts. Patients should verify if their prescription falls into the specialty medication category to understand the potential financial impact.

4. Preferred vs. Non-Preferred Medications: Insurance plans may designate certain medications as preferred or non-preferred based on their cost or utilization. Preferred medications usually have lower copayment or coinsurance amounts, while non-preferred medications may require higher out-of-pocket expenses. Patients should check if their prescribed medication is considered a preferred or non-preferred option under their plan.

5. Coverage Limits: Some insurance plans impose coverage limits on certain medications. This could include quantity limits, duration limits, or annual maximums. Patients should be aware of any coverage limits associated with their prescription to ensure that they receive the appropriate amount of medication within their plan’s guidelines.

Understanding these coverage details allows patients to estimate their out-of-pocket costs and plan their budget accordingly. Patients can consult their insurance provider’s website, contact their insurance company, or review their plan documents to gather information regarding their specific coverage details.

By having a clear understanding of their insurance plan’s coverage details, patients can make informed decisions about their healthcare expenses and navigate the prescription filling process more efficiently. This knowledge helps patients collaborate effectively with their healthcare providers and pharmacy team to ensure that they receive the necessary medications without any surprises in terms of costs or coverage.

Copayment, Deductible, and Coinsurance Information

When filling a prescription at a pharmacy, patients should have a clear understanding of their copayment, deductible, and coinsurance information. These aspects determine the financial responsibility the patient bears for their medications. It is important to be aware of the following details:

1. Copayment: A copayment, or copay, is a fixed amount that patients are required to pay for each prescription or healthcare service. It is typically a set dollar amount, such as $10 or $20 per prescription. Copayments can vary depending on the medication’s tier or class and the terms of the insurance plan. Patients should know their copayment amount for their prescribed medication to be prepared for the out-of-pocket expense at the pharmacy.

2. Deductible: A deductible is the amount patients must pay out-of-pocket for medical expenses before their insurance coverage kicks in. Prescription costs typically count towards the deductible. Patients should be aware of their deductible amount and whether it has been met, as it can impact the cost they have to pay at the pharmacy. High-deductible plans often require patients to bear a larger portion of the prescription cost until the deductible is fulfilled.

3. Coinsurance: Coinsurance is the percentage of the medication’s cost that patients are responsible for after meeting their deductible. For example, if the insurance plan has a 20% coinsurance, the patient would pay 20% of the prescription’s cost while the insurance covers the remaining 80%. Patients should know their coinsurance percentage to estimate their financial responsibility accurately.

It is important to note that copayments, deductibles, and coinsurance amounts can vary depending on factors such as the insurance plan, medication tier, and network agreements. Patients should review their insurance plan documents, consult their insurance provider or employer, or contact their pharmacy to obtain the specific copayment, deductible, and coinsurance information relevant to their coverage.

Understanding copayment, deductible, and coinsurance information allows patients to plan their healthcare expenses and budget accordingly. It helps avoid any surprises at the pharmacy counter and facilitates a smoother prescription filling process.

By being knowledgeable about their copayment, deductible, and coinsurance information, patients can take an active role in managing their healthcare costs. This understanding empowers them to make informed decisions about their prescriptions and navigate the financial aspect of their healthcare with confidence.

Prior Authorization and Step Therapy Requirements

In certain instances, insurance providers may have prior authorization or step therapy requirements for specific medications. These requirements are put in place to ensure appropriate and cost-effective use of medications. Patients should be aware of the following details regarding prior authorization and step therapy:

1. Prior Authorization: Prior authorization is a process where insurance providers require prescribers to obtain approval before certain medications can be dispensed. This requirement helps ensure that the prescribed medication meets the necessary medical criteria and is deemed appropriate by the insurance provider. Patients should consult with their healthcare provider to determine if their prescription requires prior authorization and work together to obtain the necessary approval.

2. Step Therapy: Step therapy is a process where insurance plans require patients to try and demonstrate the failure of lower-cost or preferred medications before approving coverage for more expensive or alternative options. Patients must follow specific sequences of medications, starting with the lower-cost options, and only move to the next step if the initial medication is unsuccessful. If a medication is not covered initially due to step therapy, patients should speak with their healthcare provider about starting with the appropriate step therapy medication and progressing as needed.

It is important for patients and healthcare providers to adhere to prior authorization and step therapy requirements to avoid coverage denials or delays in receiving necessary medications. Healthcare providers play a crucial role in coordinating with insurance companies and submitting the required documentation for prior authorization. Patients should communicate openly with their healthcare provider about any required processes to ensure a seamless prescription filling experience.

It is also important for patients to understand that prior authorization and step therapy requirements can differ among insurance plans and may apply to specific medications or therapeutic classes. Patients should consult their insurance plan documents or speak with their insurance provider to ascertain if their prescribed medication falls under these requirements.

By being aware of prior authorization and step therapy requirements, patients can proactively work with their healthcare providers and insurance companies to navigate the necessary processes. Open communication and proactive management of these requirements help ensure that patients receive the appropriate medications without unnecessary delays or complications.

Prescription Limitations and Exclusions

Patient insurance plans may have specific limitations and exclusions regarding certain prescriptions. These limitations and exclusions can impact the coverage and availability of certain medications. Patients should be familiar with the following aspects:

1. Quantity Limits: Insurance plans may place restrictions on the quantity of medication that can be dispensed within a certain timeframe. These limits are often imposed to prevent overuse or misuse of medications. Patients should be aware of any quantity limits associated with their prescription to ensure they receive the appropriate amount according to their insurance plan’s guidelines.

2. Duration Limits: Some insurance plans may have limitations on the duration of certain medications. This means that the plan may only cover a specific duration of therapy, and additional authorization may be required to continue the medication beyond that timeframe. Patients should understand the duration limits for their prescription and consult with their healthcare provider as necessary.

3. Exclusion of Certain Medications: Insurance plans may exclude coverage for specific medications or therapeutic classes. This means that patients are responsible for the full cost of these excluded medications. It is important for patients to review their insurance plan documents or contact their insurance provider to determine if their prescriptions fall under any exclusions.

Patients should engage in open communication with their healthcare provider regarding any limitations or exclusions associated with their insurance plan. Healthcare providers can work with patients to explore alternative medication options that are covered or assist in requesting exceptions or appeals for coverage.

Understanding prescription limitations and exclusions allows patients to make informed decisions about their healthcare options. Being aware of any restrictions or coverage gaps helps patients collaborate effectively with healthcare providers and insurance companies to find suitable alternatives or explore other avenues for obtaining necessary medications when needed.

By staying informed about prescription limitations and exclusions, patients can actively participate in their healthcare decision-making process. They can work with their healthcare providers and insurance companies to identify suitable alternatives and access the medications they need to manage their health effectively.

Coordination of Benefits

Coordination of benefits (COB) is a process that occurs when a patient has multiple insurance policies that could potentially provide coverage for their prescription medications. COB helps determine which insurance plan is primarily responsible for paying the claims.

When a patient has multiple insurance policies, such as through their own coverage and a spouse’s plan, the primary insurance plan is typically responsible for paying the majority of the costs, while the secondary plan may cover the remaining balance. Patients should be aware of the following aspects regarding coordination of benefits:

1. Primary and Secondary Insurance: Patients should determine which insurance plan is their primary coverage and which is secondary. The primary plan is usually based on factors such as the individual’s employment status or relationship to the policyholder. It is important to provide accurate and up-to-date information about both primary and secondary insurance plans to the pharmacy.

2. Explanation of Benefits (EOB): The primary insurance plan will issue an Explanation of Benefits (EOB) statement after processing a claim. This statement outlines the services or medications covered, how much was paid, and any amounts the patient may owe. Patients should review their EOB statements and promptly provide them to the secondary insurance plan if applicable.

3. COB Claim Submission: Pharmacies will prioritize the submission of claims to the primary insurance plan. Once the primary plan has processed the claim, the patient can provide the secondary insurance information for any remaining balance. It is important to communicate the correct order of insurance coverage to the pharmacy to ensure accurate and timely claims processing.

4. Reimbursement Processes: Depending on the coordination of benefits process, patients may need to submit a claim or receipt to their secondary insurance company for reimbursement of the remaining balance. Patients should familiarize themselves with the specific reimbursement requirements of their secondary insurance plan.

Understanding the coordination of benefits process allows patients to effectively navigate multiple insurance coverages and ensure accurate billing. Patients should communicate openly with their insurance companies and pharmacy to provide the necessary information and documentation for successful coordination of benefits.

By actively participating in the coordination of benefits process, patients can potentially reduce their out-of-pocket expenses and ensure that their prescription medications are appropriately covered by their insurance plans. It is essential to understand the intricacies of coordination of benefits and maintain open communication with all involved parties to facilitate a seamless claims process.

Claims Submission Process

The claims submission process is a crucial step in ensuring that pharmacies receive reimbursement from insurance companies for dispensed medications. Patients should be familiar with the following aspects of the claims submission process:

1. Pharmacy Claims Submission: After filling a prescription, pharmacies electronically submit claims to the patient’s insurance company for reimbursement. This includes transmitting information about the patient, medication, prescriber, and insurance coverage. Patients do not have to submit claims themselves, as this process is handled by the pharmacy.

2. Real-Time Adjudication: Many pharmacies have real-time adjudication systems that instantly verify the patient’s insurance coverage, copayment amount, and other pertinent details during the claims submission process. This allows patients to receive immediate feedback about their prescription cost and any coverage limitations.

3. Pharmacy Benefit Manager (PBM): In some cases, pharmacies may submit claims to a pharmacy benefit manager (PBM), which serves as an intermediary between the pharmacy and the insurance company. PBMs help facilitate the claims processing and reimbursement activities, ensuring that the pharmacy receives payment for the dispensed medications.

4. Reimbursement and Patient Responsibility: After the claims submission process, the insurance company or PBM determines the reimbursement amount based on the patient’s coverage and the terms of the insurance plan. The patient’s copayment, coinsurance, and deductible amounts, if applicable, are also calculated. Any remaining balance that the patient is responsible for will be communicated to them by the pharmacy or insurance company.

5. Explanation of Benefits (EOB): Following the claims submission and reimbursement process, the insurance company provides an Explanation of Benefits (EOB) to the patient, detailing the coverage determination, payments made, and any remaining patient responsibilities. Patients should review the EOB to ensure the accuracy of the information and address any discrepancies with their insurance company or pharmacy.

It is important for patients to provide accurate and up-to-date insurance information to the pharmacy during the claims submission process. This includes verifying insurance identification numbers, group or policy numbers, and any required prior authorization or step therapy documentation.

Understanding the claims submission process empowers patients to be actively involved in their healthcare financials. By staying informed and reviewing the Explanation of Benefits, patients can ensure that they are billed accurately and identify any potential issues with their insurance coverage or payments.

Reimbursement Policies

Reimbursement policies govern how pharmacies receive payment for dispensed medications from insurance companies. Understanding these policies is essential for patients to comprehend the financial aspect of their prescription medication purchases. Patients should be aware of the following aspects of reimbursement policies:

1. Payment Methods: Insurance companies typically reimburse pharmacies through electronic funds transfer (EFT) or paper check payments. EFT payments are more common and allow for quicker reimbursement, while paper checks may take longer to process and receive.

2. Claim Adjudication: Insurance companies review each pharmacy claim to determine the reimbursement amount based on the patient’s coverage and pharmacy contract terms. Adjudication involves assessing the patient’s eligibility, the medication’s coverage, copayment, deductible, and coinsurance amounts.

3. Pharmacy Contract Agreements: Pharmacies enter into contracts with insurance companies and pharmacy benefit managers (PBMs). These contracts outline the reimbursement rates and terms negotiated between the pharmacy and the insurer. Patients should understand that reimbursement rates can vary for different pharmacies based on these contractual agreements.

4. Generic Substitution: Reimbursement policies often encourage the use of generic medications when available, as they tend to be less expensive. When a generic equivalent is available for a prescribed brand-name medication, insurance plans may reimburse at a higher rate for the generic option, or they may require patients to pay the difference in cost if they opt for the brand-name medication.

5. Timely Filing Deadlines: Insurance companies typically require pharmacies to submit claims within a specific timeframe from the date of service, known as a timely filing deadline. If the claim is not submitted within this timeframe, the pharmacy may not be eligible for reimbursement, and the patient may be responsible for the full cost of the medication.

Patients should note that reimbursement policies may vary depending on the insurance plan, pharmacy contract terms, and specific coverage details. It is essential for patients to review their insurance plan documents, communicate with their pharmacy, and consult with their insurance provider to understand the reimbursement policies applicable to their specific situation.

Understanding reimbursement policies provides patients with insights into the financial aspects of their prescription medications. By familiarizing themselves with the policies and collaborating with their pharmacy and insurance provider, patients can ensure a smoother reimbursement process and better manage their healthcare expenses.

Additional Insurance Requirements

In addition to the standard insurance information, there may be additional requirements that patients need to be aware of when filling a prescription. These requirements can vary depending on the insurance plan and pharmacy policies. Some common additional insurance requirements include:

1. Restricted Pharmacies: Certain insurance plans may restrict patients to using specific pharmacies within their network. Patients should confirm if their insurance plan has a preferred pharmacy network and ensure that the pharmacy they choose is within that network. Using an out-of-network pharmacy may result in higher out-of-pocket expenses or non-reimbursement.

2. Mail-Order Pharmacy: Some insurance plans encourage or require patients to use a mail-order pharmacy for certain medications. Patients should check if their plan offers this option and consult with their insurance provider to understand the process for obtaining medication through mail-order.

3. Preferred Medication List: Insurance plans may have a preferred medication list, also known as a formulary or drug list. These are medications that are deemed cost-effective and may have lower copayments or coinsurance. Patients should consult their insurance plan’s preferred medication list to identify medications that offer the most favorable coverage.

4. Specialty Pharmacy Requirements: For specialty medications used to treat complex or rare conditions, insurance plans may require patients to use a designated specialty pharmacy. These pharmacies specialize in dispensing and managing specialty medications. Patients should verify if their insurance plan has any requirements regarding specialty medications and consult with their healthcare provider for guidance.

5. Annual Medication Reviews: Some insurance plans require annual medication reviews to assess the continued medical necessity of certain prescriptions. Patients may be asked to provide documentation or undergo a review process to ensure that the prescribed medications are still appropriate.

6. Preferred Brand-Name Medications: Insurance plans may offer preferred brand-name medications that have lower costs or copayments compared to non-preferred brand-name medications. Patients should verify if their prescribed medication falls under the preferred brand-name category and consult with their healthcare provider or insurance company to explore cost-saving options.

It is vital for patients to understand and comply with any additional insurance requirements to ensure smooth prescription processing and reimbursement. Patients should review their insurance plan documents, contact their insurance provider, and communicate with their pharmacy to clarify any specific requirements applicable to their coverage.

Being aware of these additional insurance requirements allows patients to make informed decisions about their medications and comply with their insurance plans. By understanding and following the guidelines, patients can optimize their insurance coverage, minimize out-of-pocket costs, and receive their medications in a timely manner.

Conclusion

Providing the necessary insurance information to pharmacies is essential for a smooth prescription filling process. Understanding the insurance requirements enables patients to navigate the complexities of insurance coverage and ensure that they receive their medications in a timely and cost-effective manner.

Throughout this article, we have explored the critical insurance information that pharmacies need, including patient information, prescription details, insurance provider information, coverage specifics, copayment, deductible, and coinsurance information, prior authorization and step therapy requirements, prescription limitations and exclusions, coordination of benefits, claims submission process, reimbursement policies, and additional insurance requirements. By being aware of these requirements, patients can actively participate in their healthcare management and optimize their insurance benefits.

Patients should communicate accurately and openly with their healthcare providers, pharmacies, and insurance companies to provide complete and up-to-date insurance information. Understanding the coverage details, copayments, deductibles, and coinsurance associated with their insurance plans allows patients to make informed decisions regarding their healthcare expenses.

It is important for patients to review their insurance plan documents, consult with their insurance providers, and stay informed about any changes or updates to their coverage. Open communication with healthcare providers and pharmacies is essential to address any concerns, navigate prior authorization or step therapy requirements, and explore alternative medication options if necessary.

By actively engaging in the prescription filling process and understanding their insurance coverage, patients can contribute to a seamless experience while receiving the necessary medications to manage their health conditions effectively.

Remember, each insurance plan may have its own specific requirements, so it is crucial for patients to stay informed about their particular coverage. By being proactive and knowledgeable about the insurance information pharmacies need, patients can play an active role in their healthcare journey while ensuring that they receive the medications they need in a timely and affordable manner.