Home>Finance>How To Change A Beneficiary On A Life Insurance Policy

Finance

How To Change A Beneficiary On A Life Insurance Policy

Modified: February 21, 2024

Learn how to change a beneficiary on a life insurance policy and ensure your financial plans are up to date. Explore our comprehensive finance guide today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Changing a Beneficiary

- Reviewing Your Existing Life Insurance Policy

- Gathering Necessary Documents and Information

- Notifying the Insurance Company

- Completing the Beneficiary Change Form

- Submitting the Form and Required Documentation

- Confirming the Beneficiary Change

- Updating Your Records and Keeping Copies

- Conclusion

Introduction

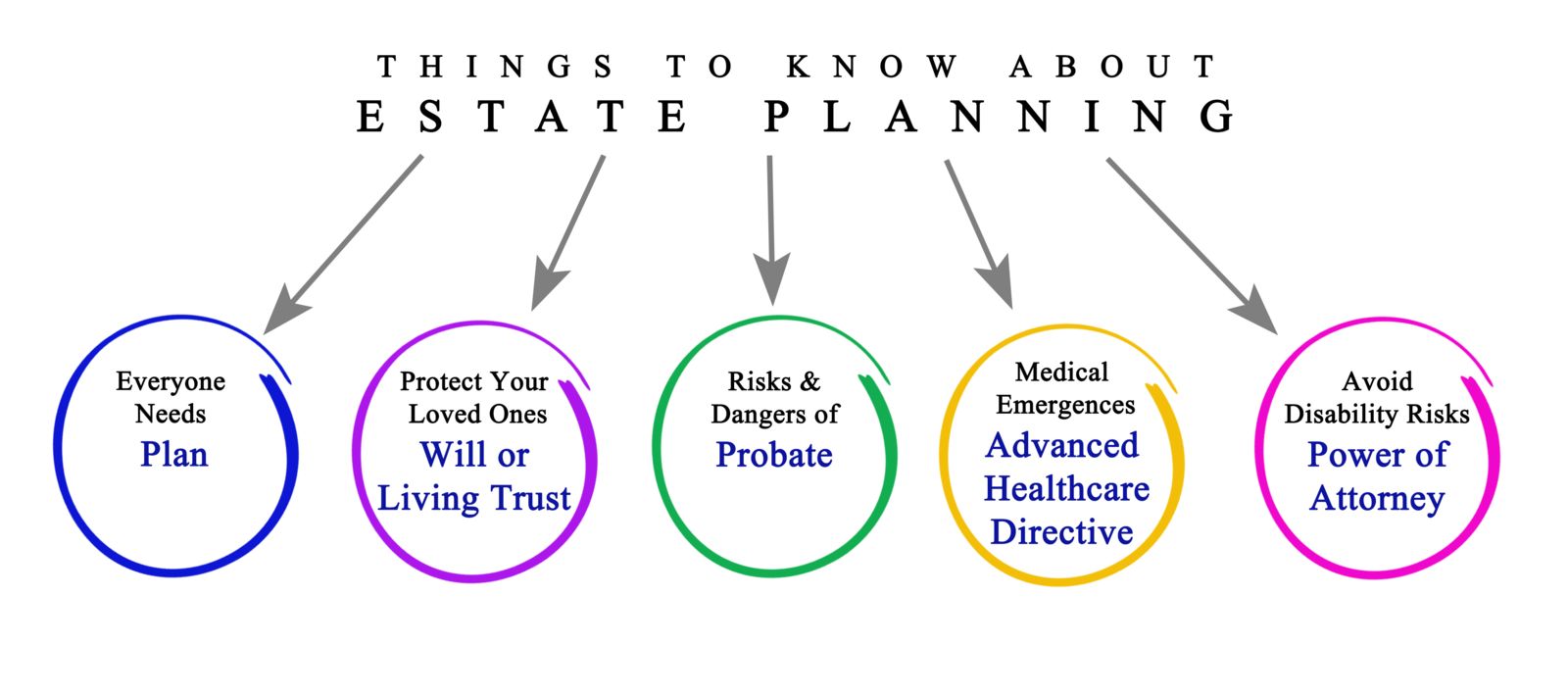

Changing a beneficiary on a life insurance policy is an important and often necessary step to ensure that your loved ones are protected and your wishes are honored. Life circumstances can change, and as a result, your chosen beneficiary may need to be updated. Whether you’ve experienced a major life event, such as marriage, divorce, or the birth of a child, or simply want to make a change for personal reasons, understanding the process of changing a beneficiary is essential.

Life insurance provides financial security for your loved ones in the event of your passing. It is designed to provide a lump sum payment, known as the death benefit, to your designated beneficiary. The beneficiary can use these funds for various purposes, such as covering funeral expenses, paying off debts, or maintaining their standard of living.

There are several reasons why you may need to change a beneficiary on your life insurance policy. For example, if you recently got married, you may want to update your policy to include your spouse as the primary beneficiary. On the other hand, if you have gone through a divorce, you may want to remove your former spouse as a beneficiary. Additionally, the birth or adoption of a child may prompt you to add them as a beneficiary.

To change a beneficiary on your life insurance policy, you will need to follow a series of steps. These steps typically involve reviewing your existing policy, gathering the necessary documents and information, notifying the insurance company, completing a beneficiary change form, submitting the form and required documentation, confirming the beneficiary change, and updating your records.

This comprehensive guide will walk you through each of these steps in detail, ensuring that you have the knowledge and confidence to change a beneficiary on your life insurance policy effectively. By staying informed and taking the necessary steps, you can ensure that your loved ones are protected and your wishes are fulfilled.

Reasons for Changing a Beneficiary

There are various life events and personal circumstances that may prompt you to change the beneficiary on your life insurance policy. It is important to regularly review and update your beneficiary designation to ensure that your policy aligns with your current wishes and circumstances. Here are some common reasons why you might consider changing a beneficiary:

- Marriage or Divorce: If you recently got married or divorced, you may want to change your beneficiary designation to reflect the changes in your marital status. It is essential to update your policy to include or remove your spouse accordingly.

- Birth or Adoption of a Child: The addition of a new child to your family is a significant life event that often prompts a change in beneficiary. You may want to ensure that your child is included as a beneficiary to secure their financial future.

- Change in Relationship Dynamics: Over time, relationships can change, and you may want to update your beneficiary designation to reflect those changes. This could include adding or removing a close friend, relative, or partner as a beneficiary.

- Death of a Beneficiary: If your designated beneficiary passes away before you do, it is crucial to update your beneficiary to ensure the funds go to the intended recipients.

- Reevaluation of Estate Planning: If you have recently reviewed your overall estate plan, including wills and trusts, you may need to update your life insurance beneficiary designation to align with your updated plan.

- Change in Financial Situation: If there has been a significant change in your financial circumstances, such as receiving a large inheritance, you may want to reconsider the allocation of your life insurance benefits.

- Conflict or Estrangement: In some cases, a falling out or estrangement with a previously designated beneficiary may require you to change your beneficiary to ensure that your wishes are respected.

It is crucial to review your life insurance policy regularly and reassess your beneficiary designation in light of any significant life events or changes. By keeping your policy up to date, you can ensure that your loved ones are protected and that your wishes are fulfilled.

Reviewing Your Existing Life Insurance Policy

Before proceeding with changing the beneficiary on your life insurance policy, it is essential to thoroughly review your existing policy. This step will help you understand the current beneficiary designation, coverage amount, and any specific requirements or restrictions associated with making changes.

Start by locating a copy of your life insurance policy. This can typically be found in your insurance paperwork or online if you have access to an online account. Take the time to carefully read through the policy, paying close attention to the section that outlines beneficiary designation.

Identify the current primary and contingent beneficiaries listed on the policy. Make note of their full names, relationship to you, and any other relevant information. It is essential to have this information on hand when completing the beneficiary change form.

Additionally, review the coverage amount specified in your policy. Ensure that the amount is still suitable for your needs and consider if any adjustments are necessary. Life circumstances and financial situations can change, so it is essential to update your coverage accordingly.

During this review process, it is also a good idea to consider any specific requirements or restrictions outlined in your policy regarding beneficiary changes. Some policies may have specific forms or procedures that need to be followed, so be sure to familiarize yourself with these requirements to avoid any delays or complications.

If you have any questions or concerns about your policy, do not hesitate to reach out to your insurance provider or agent. They will be able to provide you with the necessary guidance and clarification to ensure a smooth transition when changing your beneficiary.

By thoroughly reviewing your existing life insurance policy, you can gain a clear understanding of your current beneficiary designation and make any necessary updates with confidence.

Gathering Necessary Documents and Information

Before proceeding with changing the beneficiary on your life insurance policy, it’s important to gather the necessary documents and information to facilitate a smooth and efficient process. By having everything ready, you can ensure that you provide accurate and complete information when making the beneficiary change request.

Here are the key documents and information you’ll need:

- Life Insurance Policy: Retrieve a copy of your current life insurance policy. This document contains important details such as the policy number, coverage amount, and beneficiary designation.

- Beneficiary Change Form: Check with your insurance provider to obtain the official beneficiary change form. You may be able to find this form on their website or by contacting their customer service department.

- Personal Identification: Ensure you have a valid form of identification, such as a driver’s license or passport, to verify your identity when submitting the beneficiary change request. Some insurance companies may require a notarized signature as well.

- Beneficiary Information: Collect the necessary information about the new beneficiary(s), including their full name, contact information, social security number or date of birth, and their relationship to you.

- Supporting Documents: Depending on the circumstances surrounding the beneficiary change, you may need to provide additional supporting documentation. For example, if you are changing the beneficiary due to marriage, you might need to provide a copy of your marriage certificate.

- Existing Will or Trust Documents: If you have an existing will or trust that designates beneficiaries, it is helpful to have these documents on hand to ensure consistency with your life insurance policy.

By gathering these documents and information in advance, you’ll be prepared to complete the beneficiary change process efficiently. It’s always a good idea to double-check with your insurance provider if there are any specific documents or information they require to ensure a smooth transition.

Remember to keep copies of all documents for your records and to facilitate future reference. Safeguarding these important documents will help you stay organized and provide peace of mind.

Notifying the Insurance Company

Once you have reviewed your existing life insurance policy and gathered the necessary documents and information, the next step in changing the beneficiary is to notify the insurance company. Notifying the insurance company ensures that they are aware of your intent to make a beneficiary change and allows them to guide you through the process.

To notify the insurance company, follow these steps:

- Contact the Insurance Provider: Reach out to your insurance provider’s customer service department or your insurance agent. They will be able to provide you with the necessary instructions and inform you about their specific process for changing beneficiaries.

- Provide Policy Details: When contacting the insurance company, provide them with your policy number and any other identifying information they may need to access your account. This will help expedite the process and ensure accurate communication.

- Explain the Change: Clearly communicate that you wish to change the beneficiary on your life insurance policy. Mention the reason for the change, such as marriage, divorce, or the birth of a child. This will help the insurance company understand the context and assist you accordingly.

- Follow Their Guidance: The insurance company will guide you on the specific steps you need to take to change the beneficiary. They may provide you with specific forms to complete, request additional documentation, or direct you to an online portal to make the changes.

- Ask for Confirmation: Before ending the conversation, ask the insurance company for written confirmation of your beneficiary change request. This can be sent via email or regular mail and serves as proof that your request was received and acknowledged.

Remember to keep a record of any communication with the insurance company, including the date and time of the conversation, the name of the representative you spoke with, and any reference numbers provided. This will be useful in case any issues or discrepancies arise during the beneficiary change process.

Notifying the insurance company promptly and following their guidance will help ensure a smooth transition and minimize any potential delays or misunderstandings.

Completing the Beneficiary Change Form

Once you have notified the insurance company of your intention to change the beneficiary on your life insurance policy, they will typically provide you with a beneficiary change form. This form is a crucial document that allows you to officially update the beneficiary designation. Completing the form accurately and thoroughly is important to ensure that your desired changes are properly recorded.

Follow these steps to complete the beneficiary change form:

- Read the Instructions: Start by carefully reading the instructions provided with the beneficiary change form. Familiarize yourself with the requirements and guidelines outlined by the insurance company.

- Provide Policy Details: Fill in the relevant policy information such as your name, policy number, and any other identifying information requested on the form. This ensures that the beneficiary change is applied to the correct policy.

- Identify Current Beneficiary: Indicate the name of the current beneficiary or beneficiaries as listed on your policy. This helps the insurance company cross-reference the existing beneficiary information.

- Add New Beneficiary: Fill in the details of the new beneficiary or beneficiaries on the form. This includes their full name, contact information, social security number or date of birth, and their relationship to you.

- Specify Percentage Allocation (if applicable): If you are assigning different percentages of the death benefit to multiple beneficiaries, indicate the specific percentages for each person. Ensure that the total percentage adds up to 100%.

- Sign and Date: Read the declaration section of the form carefully, and sign and date the form in the designated area. Some insurance companies may require a notarized signature, so be sure to verify this requirement.

- Attach Supporting Documents (if required): If the insurance company has requested any additional documents to support the beneficiary change, make sure to include them with the completed form.

Take the time to review the completed beneficiary change form for accuracy and completeness before submitting it. Double-check all the information, including names, contact details, and beneficiary percentages (if applicable), to avoid any potential errors or delays in processing.

Keep a copy of the completed form for your records and submit the original form and any supporting documents as instructed by the insurance company. It is recommended to send the documents using a trackable method to ensure their safe delivery.

By carefully completing the beneficiary change form, you can ensure that your new beneficiary designation is accurately recorded and documented by the insurance company.

Submitting the Form and Required Documentation

Once you have completed the beneficiary change form and gathered any required supporting documents, it is time to submit them to the insurance company. Submitting the form and documentation promptly and accurately will help ensure a smooth processing of your beneficiary change request.

Follow these steps to submit the form and required documentation:

- Contact the Insurance Company: Reach out to the insurance company to confirm the preferred method of submission for the beneficiary change form and any supporting documents. They may provide you with specific instructions, such as an online portal, mailing address, or email address.

- Review the Submission Requirements: Carefully review the submission requirements provided by the insurance company. This may include instructions on how to format and label the documents, any specific forms of identification required, or any fees associated with the beneficiary change.

- Make Copies: Prior to submitting the original form and documentation, make copies of everything for your own records. This allows you to have a record of the submission and to refer back to it if needed.

- Organize the Documents: Ensure that all the required documents are properly organized and packaged. If mailing the documents, use a secure envelope and consider using a trackable mailing service to ensure safe delivery.

- Send the Form and Documentation: Submit the completed beneficiary change form and any required documentation as instructed by the insurance company. If submitting online, ensure that you have properly uploaded all the required files. If mailing or emailing, double-check the address to ensure accuracy.

- Confirm Receipt: After submitting the form and documentation, it is a good practice to follow up with the insurance company to confirm receipt of your submission. This will provide peace of mind knowing that your request has been received and is being processed.

Once the insurance company has received your beneficiary change form and supporting documentation, they will review and process your request. This may take some time, so it is important to be patient. If you have not received confirmation or an update from the insurance company within a reasonable timeframe, don’t hesitate to reach out and inquire about the status of your request.

By adhering to the submission requirements and following up with the insurance company, you can ensure that your beneficiary change request is properly processed and documented.

Confirming the Beneficiary Change

After submitting the beneficiary change form and required documentation to the insurance company, it is important to confirm that the beneficiary change has been successfully processed. Confirming the beneficiary change ensures that your desired changes are implemented and that the correct individuals will receive the death benefit in the event of your passing.

Follow these steps to confirm the beneficiary change:

- Keep Communication Records: Maintain a record of all communication with the insurance company regarding the beneficiary change. This includes keeping copies of any emails, letters, or other forms of communication exchanged throughout the process.

- Follow up with the Insurance Company: After a reasonable amount of time has passed since submitting the beneficiary change request, reach out to the insurance company to inquire about the status of your request. This can be done through a phone call, email, or online portal, depending on the preferred method of communication established with the company.

- Ask for Confirmation: When contacting the insurance company, specifically ask for written confirmation that the beneficiary change has been processed. This confirmation can be in the form of an email, letter, or official document from the company.

- Review Confirmation Details: Carefully review the confirmation provided by the insurance company, making sure that the new beneficiary is accurately listed and that all details match your intended changes.

- Address Any Discrepancies: If the confirmation contains any discrepancies or inaccuracies, immediately bring them to the attention of the insurance company. This will allow them to rectify any errors promptly and ensure that your beneficiary change is correctly recorded.

- Keep a Copy of the Confirmation: Once you have received the confirmation of the beneficiary change, keep a copy of it with your important documents. This serves as proof of the updated beneficiary designation and can be referenced in the future if needed.

Confirming the beneficiary change is a crucial step in the process to ensure that your desired changes are accurately recorded and implemented by the insurance company. By maintaining communication and obtaining written confirmation, you can have peace of mind knowing that your beneficiary change request has been successfully processed.

Updating Your Records and Keeping Copies

After successfully changing the beneficiary on your life insurance policy, it is essential to update your records and keep copies of all relevant documents. This step ensures that you have accurate documentation of the beneficiary change and provides a reference for future needs or inquiries.

Follow these steps to update your records and keep copies:

- Update Personal Records: Make sure to update your personal records, such as your will, trust documents, and any other estate planning documents, to reflect the new beneficiary designation. This ensures consistency across all your legal and financial documents.

- Inform Relevant Parties: Notify any other involved parties about the beneficiary change, such as your attorney or financial advisor. This helps them stay informed and ensures that your wishes are accurately reflected in their records.

- Keep a Digital Copy: Scan all the relevant documents related to the beneficiary change and store them in a secure digital location, such as a password-protected folder or a cloud storage service. This provides an easily accessible backup and allows for quick retrieval if needed.

- Secure Hard Copies: Safely store hard copies of all the documents in a secure location, such as a locked filing cabinet or a safe deposit box. Organize them in a way that makes it easy to find and access when necessary.

- Maintain a List: Create a list or spreadsheet that includes all the important information regarding your life insurance policy and beneficiary change. Include details such as the policy number, coverage amount, effective date of the beneficiary change, and any pertinent contact information.

- Periodically Review and Update: Regularly review your records to ensure that they remain up to date. Life circumstances can change, and it is important to ensure that your beneficiary designation reflects your current wishes and situation.

Updating your records and keeping copies of all relevant documents helps provide clarity and prevent any misunderstandings or disputes in the future. It also makes it easier for your loved ones to navigate the process should the life insurance policy come into effect.

Remember to periodically review your records and beneficiary designation as needed, especially after important life events or changes in your relationships. By staying proactive and organized, you can ensure that your beneficiary designation is always up to date and aligned with your wishes.

Conclusion

Changing the beneficiary on your life insurance policy is a crucial step to ensure that your loved ones are protected and your wishes are honored. Life circumstances can change, and it is important to review and update your beneficiary designation to reflect these changes. By following the necessary steps and understanding the process, you can successfully change the beneficiary on your life insurance policy.

Throughout the process, it is crucial to review your existing policy, gather the necessary documents and information, notify the insurance company, complete the beneficiary change form accurately, and submit the form and required documentation. Confirming the beneficiary change with the insurance company is essential to ensure that your changes have been properly processed.

Additionally, it is important to update your personal records, inform relevant parties, and keep copies of all relevant documents. This ensures that you have accurate records of the beneficiary change and can easily access the information if needed.

Remember to periodically review and update your beneficiary designation as life events unfold and circumstances change. Regularly reviewing your policy and beneficiary designation will help ensure that your loved ones are protected and that your wishes are fulfilled.

By understanding the process and taking the necessary steps, you can navigate the beneficiary change process with confidence. It is always a good idea to consult with your insurance provider or seek guidance from an insurance professional to ensure that you are making informed decisions that align with your specific needs and priorities.

Changing a beneficiary on a life insurance policy is an important responsibility that allows you to maintain control over the distribution of funds in the event of your passing. By staying informed and proactive, you can ensure that your loved ones are financially supported during difficult times.