Home>Finance>When Can I Use My Credit Card Again After Paying It Off

Finance

When Can I Use My Credit Card Again After Paying It Off

Modified: December 29, 2023

Discover when you can start using your credit card again after paying it off and managing your finances wisely. Gain insights on credit card usage and financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Using a credit card can be a convenient and flexible way to manage your finances. However, if you find yourself accumulating too much credit card debt, you may need to take steps to pay it off and regain financial stability. Paying off your credit card debt is a significant accomplishment, but you may be wondering when you can start using your credit card again.

While the decision to use your credit card again ultimately depends on your financial goals and circumstances, there are several factors to consider. It’s important to understand the impact of paying off your credit card debt, rebuilding your credit, monitoring your credit score, and applying for credit again. By taking a thoughtful and strategic approach, you can make informed decisions about when to start using your credit card again.

In this article, we will delve into these factors and provide you with guidance on when you can use your credit card again after paying off your debt. So, let’s explore the steps you need to take to regain financial stability and make smart choices about credit card usage.

Factors to Consider

Before deciding when to start using your credit card again after paying off your debt, there are several important factors to consider. These factors will help you evaluate your financial situation and make an informed decision that aligns with your goals.

- Current Financial Position: Assess your current financial position to determine if you have the means to responsibly use a credit card again. Consider your income, expenses, savings, and any other outstanding debts you may have. Ensure that you have a solid financial plan in place to avoid falling back into debt.

- Debt Management Skills: Reflect on your debt management skills and habits. Are you now more disciplined and have a better understanding of budgeting and spending? Recognize any factors that contributed to your previous credit card debt and focus on developing healthy financial habits moving forward.

- Rebuilding Credit: Paying off your credit card debt is a significant step towards rebuilding your credit. However, it’s essential to give yourself time to demonstrate responsible credit behavior and allow your credit score to improve. This can take several months or even years, depending on the severity of your previous debt.

- Financial Goals: Consider your financial goals and priorities. Maybe you want to save for a down payment on a house, start an emergency fund, or invest for retirement. Assess if using a credit card aligns with your current financial goals or if there are alternative methods to achieve them.

- Rewards and Benefits: Evaluate the rewards and benefits that come with using a credit card. If your credit card offers valuable perks, such as cashback, travel rewards, or purchase protection, it may be worth using it for certain expenses. However, ensure that you can pay off the balance in full each month to avoid accruing interest charges.

It’s crucial to carefully consider these factors before deciding when it’s appropriate to start using your credit card again. By taking the time to evaluate your financial situation and goals, you can make decisions that support your long-term financial well-being.

Paying Off Credit Card Debt

Paying off your credit card debt is a significant milestone on your journey to financial freedom. It allows you to regain control of your finances and start fresh. Before you can determine when to use your credit card again, it’s crucial to focus on paying off your existing debt.

There are several strategies you can employ to effectively pay off your credit card debt:

- Snowball Method: This method involves paying off your smallest debt balances first while making minimum payments on larger debts. As you pay off each debt, you can allocate the freed-up money towards tackling the next debt. The snowball method provides a psychological boost as you see progress more quickly.

- Avalanche Method: The avalanche method focuses on paying off your highest-interest debts first while making minimum payments on other debts. By targeting the debts with the highest interest rates, you’ll save more on interest payments in the long run.

- Consolidation Loan: If you have multiple credit cards with high-interest rates, you may consider consolidating your debt with a consolidation loan. This allows you to combine your debts into a single loan with a lower interest rate, providing more manageable monthly payments.

- Budgeting and Cutting Expenses: Take a close look at your budget and identify areas where you can reduce expenses. By cutting back on non-essential spending, you can allocate more money towards paying off your credit card debt.

- Increased Income: Consider ways to increase your income, such as taking on a side job or freelance work. The additional income can be used to accelerate your debt payments and shorten the time it takes to become debt-free.

Remember, paying off credit card debt requires discipline and commitment. Choose the strategy that works best for you and stay focused on your goal of becoming debt-free. Once you’ve paid off your debt, you can then start rebuilding your credit and decide when to use your credit card again.

Rebuilding Credit

After paying off your credit card debt, rebuilding your credit should be a top priority. Your credit score plays a crucial role in your financial life, impacting your ability to borrow money, secure favorable interest rates, and even access certain services or rental opportunities.

Here are some steps you can take to rebuild your credit:

- Check Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and review it for any errors or inaccuracies. Dispute any incorrect information to ensure your credit report is an accurate reflection of your financial history.

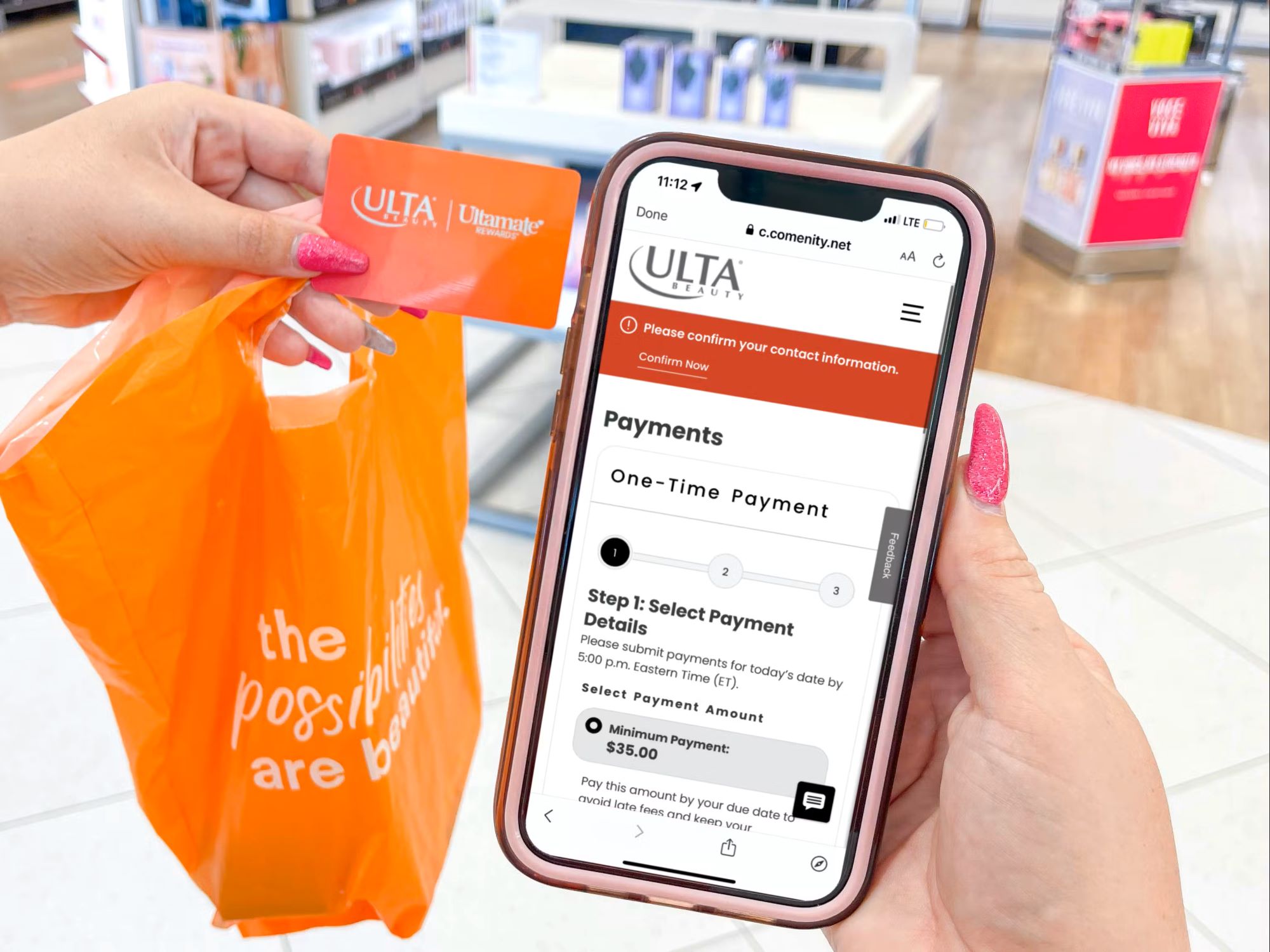

- Establish a Positive Payment History: Timely payments are crucial for rebuilding your credit. Consider using a credit rebuilding tool such as a secured credit card or a credit builder loan. Make small, regular purchases and pay off the balance in full and on time each month to demonstrate responsible credit usage.

- Keep Credit Utilization Low: Credit utilization refers to the amount of available credit you are using. Aim to keep your credit utilization below 30% of your available credit limit. High credit utilization can negatively impact your credit score.

- Monitor Your Credit: Stay vigilant and regularly monitor your credit to ensure there are no unauthorized accounts or suspicious activities. Consider signing up for a credit monitoring service to receive alerts about changes to your credit report.

- Apply for Secured Credit Cards: Secured credit cards require a cash deposit as collateral. They are designed to help individuals with poor credit or no credit history rebuild their credit. Make small, regular purchases and diligently make payments to show responsible credit behavior.

Rebuilding credit takes time and patience. It’s important to consistently practice good credit habits and make payments on time to gradually improve your creditworthiness. As your credit score improves, you can start considering when it’s appropriate to use your credit card again.

Remember, rebuilding your credit is a journey, and it’s important to focus on long-term financial health rather than rushing back into credit card usage.

Monitoring Your Credit Score

Monitoring your credit score is an essential part of managing your credit and ensuring that you are on the right track towards financial stability. After paying off your credit card debt and rebuilding your credit, it’s vital to keep a close eye on your credit score to maintain your progress and make informed decisions about using your credit card again.

Here’s why monitoring your credit score is important:

- Identify Potential Issues: By regularly monitoring your credit score, you can quickly identify any significant drops or fluctuations. This can be a sign of a missed payment or other negative activity that could impact your creditworthiness.

- Prevent Identity Theft: Monitoring your credit can help detect any unauthorized activities or accounts that may indicate identity theft. Early detection allows you to take immediate action and minimize the potential damage to your credit.

- Track Credit Building Progress: Monitoring your credit score allows you to track your progress as you rebuild your credit. It’s gratifying to see your score improve over time as a result of your responsible credit behavior.

- Prepare for Future Credit Needs: By keeping a close watch on your credit score, you can gauge when it’s appropriate to apply for new credit or take advantage of better loan or credit card offers. A higher credit score often leads to more favorable terms and lower interest rates.

There are several ways to monitor your credit score:

- Free Credit Reports: Under federal law, you are entitled to a free copy of your credit report annually from each of the three major credit bureaus. Review your credit reports for accuracy and look for any areas that may require improvement.

- Credit Monitoring Services: Consider subscribing to a credit monitoring service that provides regular updates on changes to your credit report, alerts for potential fraud or identity theft, and access to your credit score.

- Online Tools and Apps: Many online tools and mobile apps allow you to monitor your credit score for free. These tools often provide insights into factors impacting your credit score.

Regularly monitoring your credit score empowers you to stay informed about your credit health and make responsible decisions when it comes to using your credit card again. Understanding your creditworthiness allows you to make strategic financial choices and continue on the path to financial success.

Applying for Credit Again

After paying off your credit card debt and rebuilding your credit, you may consider applying for new credit cards or loans. However, it’s crucial to approach this process thoughtfully and strategically to ensure you maintain your financial stability and continue to improve your credit profile.

Here are some things to consider when applying for credit again:

- Assess Your Financial Situation: Before applying for new credit, evaluate your current financial position. Consider your income, expenses, and any outstanding debts. Ensure that you have the means to handle additional credit responsibly and avoid falling back into debt.

- Research and Compare Options: Take the time to research and compare different credit card or loan options. Look for cards or loans that align with your financial goals and offer favorable terms, such as low interest rates, rewards programs, or flexible repayment options. Compare fees, credit limits, and any other relevant features.

- Pick the Right Time: Timing is essential when applying for credit. Apply when you have a positive credit history, a stable income, and a low level of existing debt. Avoid applying for multiple lines of credit simultaneously, as this can raise concerns for lenders and potentially lower your credit score.

- Manage Credit Utilization: When you start using a credit card again, be mindful of your credit utilization. Aim to keep your credit utilization ratio low by using only a small portion of your available credit. Using a higher percentage of your credit limit can negatively impact your credit score.

- Make Timely Payments: Once you have new credit, it’s crucial to make all payments on time. Timely payments demonstrate responsible credit behavior and contribute to a positive payment history, which is an important factor in your credit score calculation.

- Continue Monitoring Your Credit: Even after you’ve applied for new credit, it’s essential to keep monitoring your credit score and report. This allows you to stay informed about any changes and address any potential issues promptly.

By taking a cautious and deliberate approach to applying for credit again, you can make informed decisions that are in line with your financial goals. Remember, responsible credit usage and timely payments are key to maintaining and improving your credit score over time.

Conclusion

Deciding when to start using your credit card again after paying off your debt is a personal and strategic choice. It’s important to consider factors such as your current financial position, debt management skills, credit rebuilding efforts, financial goals, and the benefits of using credit. By evaluating these factors and making informed decisions, you can prevent falling back into debt and maintain long-term financial stability.

After paying off your credit card debt, take the time to rebuild your credit by establishing a positive payment history, keeping credit utilization low, and monitoring your credit score. Rebuilding your credit takes time and patience, but it’s essential for improving your creditworthiness and gaining access to better credit options in the future.

When you feel ready to start using your credit card again, take a thoughtful approach. Assess your financial situation, research credit card options, and make timely payments to maintain a positive credit history. Additionally, continue monitoring your credit to ensure that you stay informed about any changes and address potential issues promptly.

Remember, the goal is not just to use your credit card again, but to use it responsibly and in a way that supports your financial well-being. By taking a proactive and cautious approach, you can leverage credit cards to your advantage, earn rewards, and build a strong credit profile while avoiding the pitfalls of debt.

Ultimately, the decision of when to use your credit card again is yours to make. Take the time to assess your financial situation, understand the impact of your choices, and make decisions that align with your goals and priorities. With careful planning and responsible credit usage, you can maintain financial stability and make the most of your credit card benefits.