Home>Finance>When Do You Find Out Your Next Minimum Payment Due After Making A Payment

Finance

When Do You Find Out Your Next Minimum Payment Due After Making A Payment

Published: February 25, 2024

Learn about your next minimum payment due date after making a payment in finance. Understand the timeline and process for receiving payment notifications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the intricacies of credit card billing cycles and payment due dates is essential for managing your finances effectively. When you make a payment on your credit card, it's natural to wonder when your next minimum payment due date will be updated. This article delves into the nuances of credit card billing cycles, payment processing, and the timeline for the next minimum payment due date. By gaining insight into these processes, you can navigate your credit card payments with confidence and ensure that you stay on top of your financial responsibilities.

Navigating the world of credit card payments can be complex, and it's common to have questions about when your next minimum payment due date will be reflected after making a payment. This article aims to provide clarity on this matter, empowering you to make informed decisions about managing your credit card payments. Whether you're new to credit card ownership or seeking to deepen your understanding of payment cycles, this article will equip you with the knowledge you need to navigate the world of credit card payments effectively.

Understanding Credit Card Billing Cycles

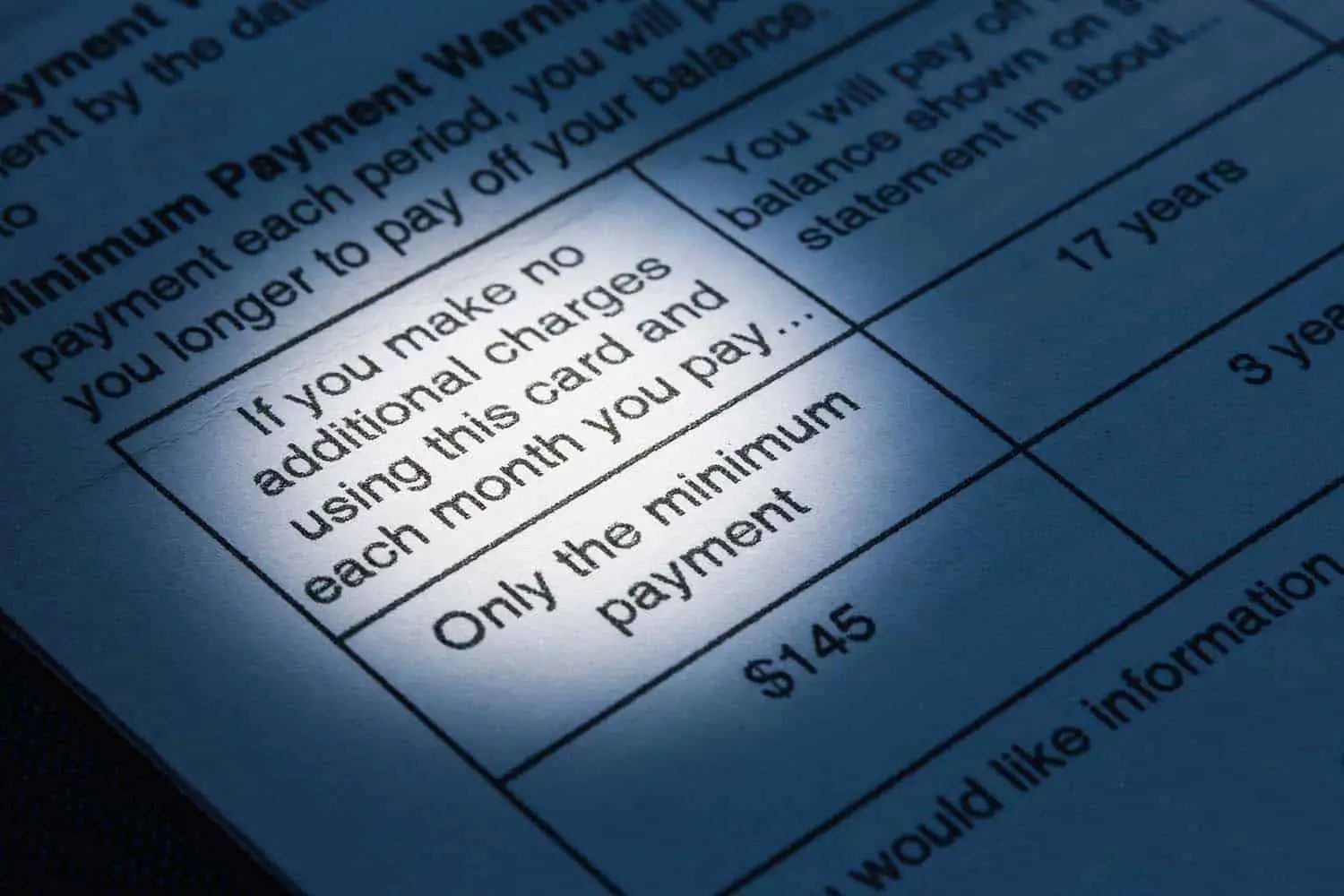

Before delving into the timing of minimum payment due date updates, it’s crucial to grasp the concept of credit card billing cycles. A billing cycle, also known as a statement period, typically spans around 30 days. During this period, your credit card transactions are recorded, and at the end of the cycle, a statement is generated detailing your charges, payments, and the minimum amount due. Understanding your billing cycle is vital, as it dictates when your minimum payment due date will fall.

It’s important to note that the billing cycle isn’t necessarily aligned with the calendar month. For instance, your billing cycle might run from the 12th of one month to the 11th of the next. This distinction is crucial, as it influences the timing of your minimum payment due date updates. Moreover, your billing cycle may vary based on the terms and conditions set by your credit card issuer, so it’s advisable to familiarize yourself with the specifics of your individual billing cycle.

During the billing cycle, any purchases, balance transfers, or cash advances you make with your credit card are tallied. Additionally, any payments you make during this period contribute to reducing the outstanding balance on your card. This interplay between transactions and payments forms the crux of the billing cycle, ultimately shaping the amount due and the due date for your next payment.

Making a Payment on Your Credit Card

When you make a payment on your credit card, whether it’s the minimum amount due, the full balance, or a custom amount, the payment is typically reflected in your account within a few business days. It’s important to be mindful of the timing when submitting your payment to ensure it is credited promptly. Many credit card issuers offer online payment options, enabling you to make payments conveniently and efficiently. Additionally, setting up automatic payments can help streamline the process and prevent missed payments.

If you opt to make a payment via check or electronic transfer, it’s advisable to do so well in advance of the due date to allow for processing time. This proactive approach can help you avoid late fees and maintain a positive payment history. Furthermore, keeping track of your payment confirmation and ensuring that the funds are successfully debited from your account is crucial for maintaining financial control.

It’s worth noting that when you make a payment on your credit card, the amount you pay directly impacts your outstanding balance. This, in turn, influences the calculation of your next minimum payment due. By understanding the dynamics of credit card payments, you can effectively manage your financial obligations and maintain a healthy credit standing.

When Will Your Next Minimum Payment Due Date Be Updated?

After making a payment on your credit card, you might wonder when your next minimum payment due date will be updated. The timeline for this update depends on various factors, including your credit card issuer’s policies and the specific details of your billing cycle. Typically, the next minimum payment due date is adjusted after the payment you’ve made is processed and reflected in your account.

Once your payment is received and processed by your credit card issuer, the updated balance is calculated, taking into account the recent payment and any new transactions made since the last billing cycle. This updated balance influences the determination of your next minimum payment due date. The processing time for payments can vary, but in most cases, the next minimum payment due date is adjusted shortly after the payment is successfully processed.

It’s important to monitor your account closely after making a payment to verify that it has been applied correctly and to take note of any changes in your minimum payment due date. This vigilance allows you to stay informed about the status of your account and ensures that you are aware of when your next payment is due. Additionally, regularly reviewing your credit card statements and account activity can help you track the impact of your payments on your outstanding balance and due dates.

By staying attuned to the timing of minimum payment due date updates and understanding the factors that influence this timeline, you can effectively manage your credit card payments and maintain financial stability.

Conclusion

Managing credit card payments involves a nuanced understanding of billing cycles, payment processing, and the timeline for minimum payment due date updates. By gaining insight into these aspects, you can navigate your financial responsibilities with confidence and precision. Understanding your credit card billing cycle is pivotal, as it dictates when your minimum payment due date will fall and how your payments impact your outstanding balance.

When making a payment on your credit card, whether through online platforms, automatic payments, or traditional methods, it’s essential to consider the processing time to ensure that your payment is credited promptly. Monitoring your account after making a payment allows you to verify that it has been applied correctly and to stay informed about any changes in your minimum payment due date.

By staying attuned to the timing of minimum payment due date updates and actively managing your credit card payments, you can maintain a positive payment history, avoid late fees, and uphold a healthy credit standing. Regularly reviewing your credit card statements and account activity empowers you to track the impact of your payments on your outstanding balance and due dates, fostering financial stability and control.

Ultimately, a comprehensive understanding of credit card billing cycles and payment dynamics equips you to navigate the world of credit card payments effectively, ensuring that you fulfill your financial obligations in a timely and informed manner.