Home>Finance>Why Is There A Minimum Payment Due When There Is 0% Interest

Finance

Why Is There A Minimum Payment Due When There Is 0% Interest

Published: February 26, 2024

Learn why there is a minimum payment due even with 0% interest. Understand the impact on your finances and how to manage it effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing credit card debt, understanding the concept of minimum payments is crucial. Many individuals wonder why there is a minimum payment due, especially when the credit card carries a 0% interest rate. This seemingly contradictory scenario prompts questions about the purpose and impact of minimum payments in such circumstances. Exploring the rationale behind minimum payments and their relationship with 0% interest can shed light on this financial enigma.

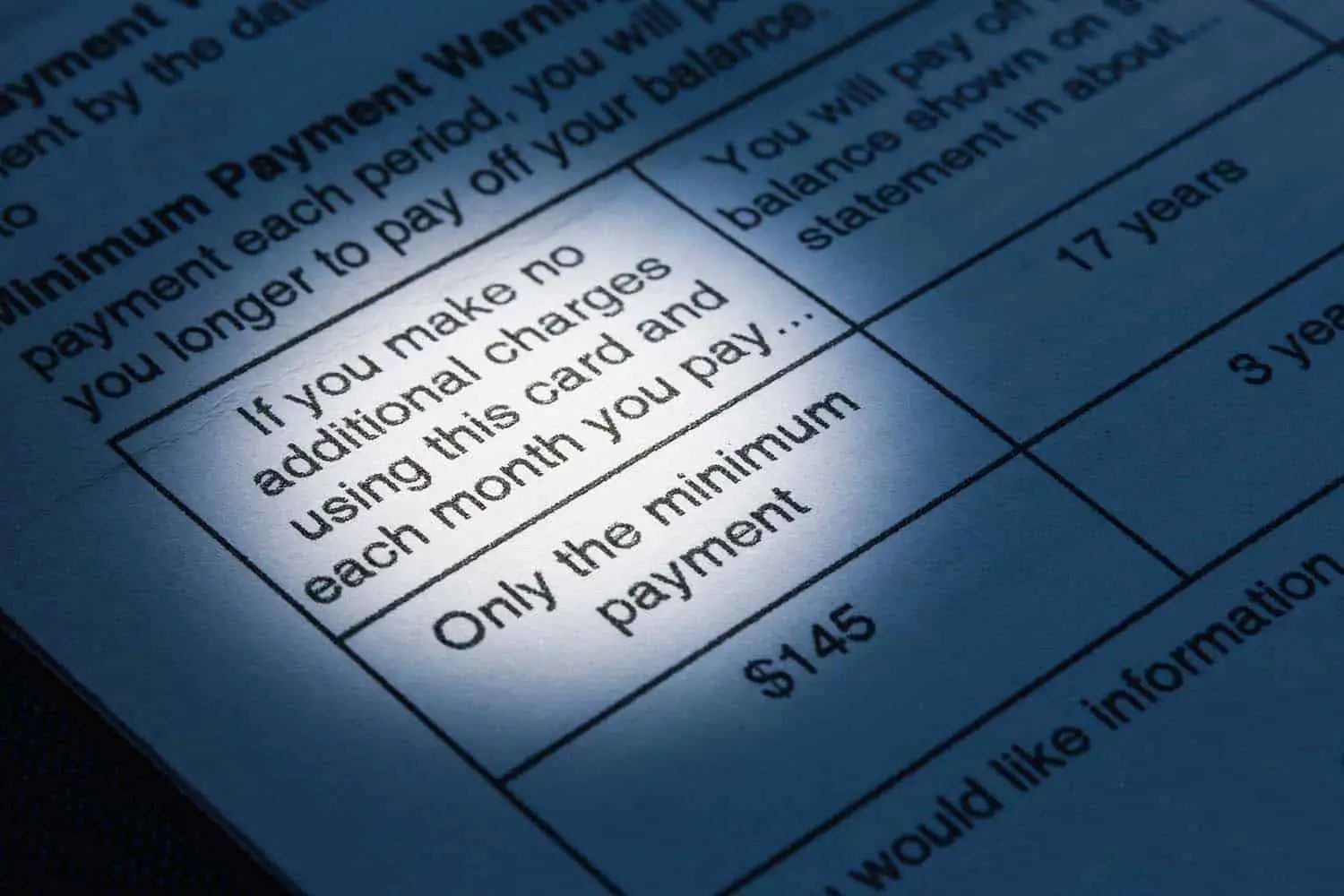

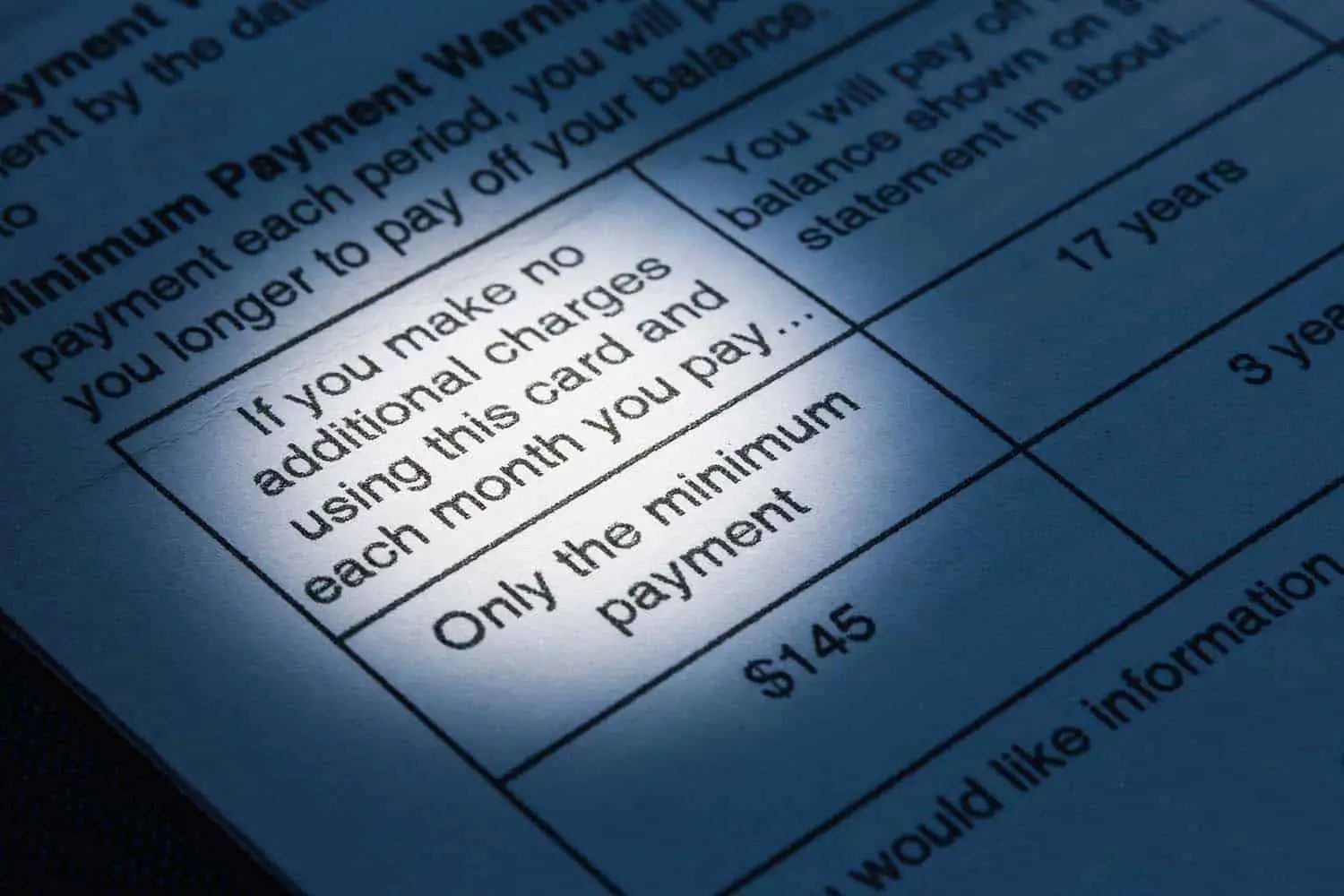

Credit card users often encounter the term "minimum payment due" on their monthly statements. This mandatory amount, typically a small percentage of the total balance, represents the minimum sum that cardholders must pay by a specified due date to keep their accounts in good standing. However, the presence of a minimum payment requirement, even when the card's interest rate is 0%, may seem perplexing at first glance.

To demystify this financial puzzle, it's essential to delve into the underlying principles of minimum payments, their intended purpose, and the factors that influence their calculation. By gaining a comprehensive understanding of minimum payments and their interaction with 0% interest rates, individuals can make informed decisions about managing their credit card balances and optimizing their financial well-being.

Understanding Minimum Payments

Minimum payments represent the smallest amount that credit card holders must remit to their issuers each month. This obligatory sum serves as a commitment to the repayment of the outstanding balance, ensuring that the account remains in good standing. Typically, minimum payments are calculated as a percentage of the total balance, often ranging from 1% to 3%, or a fixed amount, whichever is higher. This fundamental aspect of credit card management aims to prevent delinquency and maintain a positive payment history.

Understanding the significance of minimum payments involves recognizing their role in sustaining the financial health of credit card accounts. By making at least the minimum payment by the due date, cardholders can avoid late fees, penalties, and adverse effects on their credit scores. Moreover, consistent adherence to minimum payment obligations demonstrates responsible financial behavior, which is essential for building and preserving a favorable credit profile.

While minimum payments contribute to account maintenance and responsible debt management, it is important to note that paying only the minimum amount can result in long-term interest accrual and prolonged debt repayment. This is particularly relevant when the credit card carries an interest-bearing balance. However, in the context of 0% interest credit cards, the implications of making only the minimum payment differ significantly, as the absence of interest charges alters the dynamics of debt repayment.

Purpose of Minimum Payments

The primary purpose of minimum payments is to ensure the continuous servicing of credit card debt, thereby preventing accounts from falling into delinquency. By stipulating a minimum amount that cardholders must pay each month, credit card issuers establish a framework for consistent debt repayment. This serves as a foundational element of responsible credit usage and helps individuals manage their financial obligations effectively.

Minimum payments also play a crucial role in sustaining the positive standing of credit accounts. When cardholders fulfill their minimum payment requirements punctually, they avoid incurring late fees and penalties, which can contribute to unnecessary financial strain. Moreover, adhering to minimum payments safeguards the cardholder’s credit score by preventing adverse notations resulting from missed or late payments. This, in turn, supports the maintenance of a healthy credit history, which is pivotal for various financial endeavors, such as obtaining loans, securing favorable interest rates, and accessing additional lines of credit.

Furthermore, minimum payments serve as a gateway to financial discipline and accountability. By committing to regular payments, individuals cultivate a habit of meeting their financial obligations, fostering a sense of fiscal responsibility and prudence. This aspect is particularly pertinent for those seeking to establish or rebuild their credit profiles, as consistent adherence to minimum payments showcases a commitment to sound financial management.

While the purpose of minimum payments is inherently linked to debt servicing and credit account maintenance, it is essential to recognize that making only the minimum payment, especially on interest-bearing balances, can lead to prolonged debt repayment and increased interest costs. However, the dynamics shift when considering 0% interest credit cards, as the absence of interest charges alters the implications of minimum payments on debt management.

Impact of 0% Interest on Minimum Payments

When credit cards offer a 0% interest rate, the impact on minimum payments is notably distinct from that associated with interest-bearing balances. In the context of 0% interest, minimum payments function in a manner that primarily addresses the principal balance, thereby expediting debt reduction without the burden of interest accrual. This unique characteristic of 0% interest cards amplifies the significance of minimum payments as a strategic tool for efficient debt management.

With 0% interest, minimum payments contribute directly to reducing the principal amount owed, enabling cardholders to make substantial progress in clearing their balances. Unlike interest-bearing scenarios where a significant portion of a payment addresses interest charges, 0% interest empowers minimum payments to directly chip away at the principal, accelerating the path to debt freedom.

Moreover, the impact of 0% interest on minimum payments extends to the cost savings and financial efficiency it affords to cardholders. By leveraging the absence of interest charges, individuals can allocate funds towards their minimum payments with the assurance that the entirety of the payment directly diminishes the principal balance. This not only expedites debt repayment but also mitigates the long-term interest costs that would typically accompany credit card balances.

Furthermore, the interplay between 0% interest and minimum payments fosters a conducive environment for proactive debt management. Cardholders can strategically leverage the absence of interest to channel additional funds towards their minimum payments, further hastening the reduction of their outstanding balances. This approach enables individuals to capitalize on the favorable terms of 0% interest, optimizing their financial resources to achieve accelerated debt reduction.

Understanding the impact of 0% interest on minimum payments empowers individuals to make informed decisions regarding debt repayment strategies. By recognizing the unique advantages conferred by 0% interest, cardholders can harness the potential of minimum payments as a catalyst for efficient debt reduction, ultimately advancing their journey towards financial freedom.

Factors Influencing Minimum Payments

The calculation of minimum payments is influenced by various factors that collectively determine the amount cardholders are required to remit each month. Understanding these factors is essential for individuals seeking to manage their credit card balances effectively and navigate the intricacies of minimum payment obligations.

1. Total Balance: The total outstanding balance on a credit card is a primary determinant of the minimum payment amount. Typically, minimum payments are calculated as a percentage of the total balance, ensuring that a proportionate amount is allocated towards debt repayment. This factor underscores the direct relationship between the balance owed and the minimum payment due, highlighting the impact of balance management on minimum payment obligations.

2. Interest Rate: In scenarios where credit cards carry an interest-bearing balance, the interest rate significantly influences the minimum payment calculation. Higher interest rates necessitate larger minimum payments to address both the principal balance and interest charges. Conversely, 0% interest rates alleviate the burden of interest accrual, allowing minimum payments to focus exclusively on reducing the principal amount owed.

3. Issuer’s Policies: Credit card issuers may establish specific policies and guidelines for determining minimum payments. These policies can vary across different issuers and may encompass factors such as the card’s terms and conditions, regulatory requirements, and proprietary algorithms for minimum payment computation. Understanding the issuer’s policies is crucial for navigating minimum payment obligations effectively.

4. Regulatory Standards: Regulatory bodies and financial authorities may stipulate minimum payment requirements to ensure responsible lending practices and consumer protection. These standards aim to establish a baseline for minimum payments, safeguarding consumers from excessively low payment obligations that could perpetuate debt cycles. Compliance with regulatory standards shapes the formulation of minimum payment calculations.

5. Account Status: The status of a cardholder’s account, including factors such as payment history, delinquency, and credit utilization, can influence minimum payment obligations. Accounts with adverse payment histories or delinquencies may be subject to heightened minimum payment requirements as issuers seek to mitigate risk and encourage accelerated debt repayment.

By considering these influential factors, individuals can gain insight into the dynamics of minimum payments and make informed decisions regarding their credit card management strategies. Understanding the interplay of these factors empowers cardholders to navigate minimum payment obligations effectively, optimizing their approach to debt repayment and financial well-being.

Conclusion

Understanding the dynamics of minimum payments and their interaction with 0% interest credit cards is pivotal for individuals seeking to navigate the realm of credit card debt management. Minimum payments serve as a foundational component of responsible credit usage, ensuring the continuous servicing of outstanding balances and the maintenance of positive account standing. While the presence of minimum payments may initially appear incongruous with 0% interest rates, delving into their purpose and impact reveals their significance as strategic tools for debt reduction and financial efficiency.

The purpose of minimum payments extends beyond mere debt servicing, encompassing the preservation of credit standing, the cultivation of financial discipline, and the prevention of unnecessary fees and penalties. When considering 0% interest credit cards, the impact of minimum payments is amplified, as they directly contribute to principal reduction and cost savings, empowering cardholders to expedite debt repayment without the encumbrance of interest charges.

Factors such as the total balance, interest rate, issuer policies, regulatory standards, and account status collectively influence the calculation of minimum payments, shaping the obligations that cardholders must fulfill each month. By comprehending these influential factors, individuals can navigate minimum payment requirements effectively, optimizing their approach to debt management and financial responsibility.

In essence, the interplay between minimum payments and 0% interest credit cards underscores the strategic potential of minimum payments as catalysts for efficient debt reduction and financial empowerment. By leveraging the unique advantages conferred by 0% interest, individuals can harness minimum payments as proactive tools for accelerating the path to debt freedom and optimizing their financial well-being.

Ultimately, a comprehensive understanding of minimum payments and their relationship with 0% interest rates equips individuals with the knowledge and insight to make informed decisions about credit card management, fostering financial resilience and empowering them to embark on a journey towards sustainable debt management and long-term financial stability.