Home>Finance>When Does A Fingerhut FreshStart Account Become A Revolving Credit Account?

Finance

When Does A Fingerhut FreshStart Account Become A Revolving Credit Account?

Published: February 29, 2024

Learn how Fingerhut FreshStart accounts transition into revolving credit accounts and manage your finances effectively. Discover the process and benefits now.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

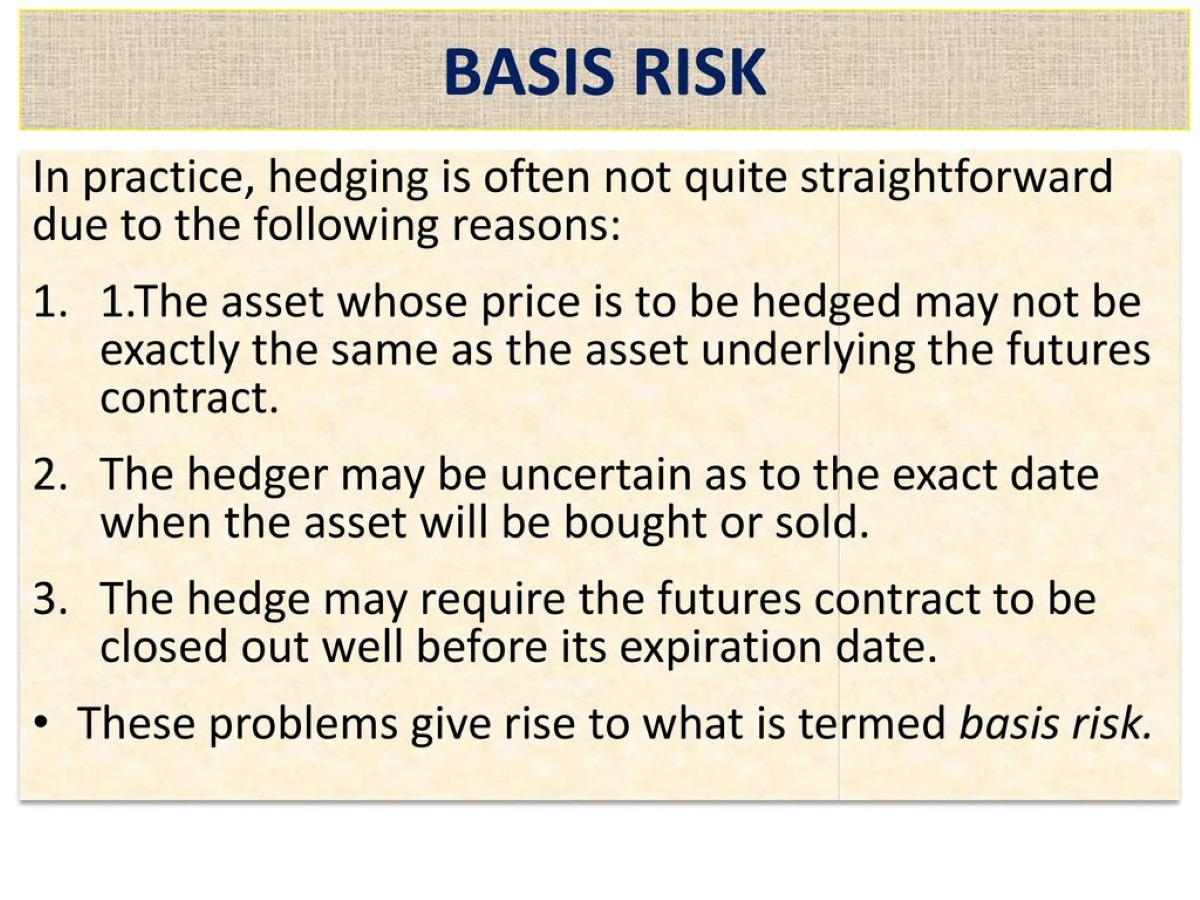

Fingerhut FreshStart accounts are a popular option for individuals aiming to build or rebuild their credit. These accounts offer a unique opportunity to make purchases and establish a positive credit history, even for those with less-than-perfect credit scores. However, it's essential to understand the transition from a Fingerhut FreshStart account to a revolving credit account, as this shift marks a significant milestone in the credit-building journey.

Navigating the nuances of credit accounts can be daunting, especially for individuals who are new to the world of credit or are working to improve their financial standing. This article aims to demystify the process and provide valuable insights into the transition from a Fingerhut FreshStart account to a revolving credit account. By understanding the intricacies of this progression, individuals can take proactive steps to manage their credit responsibly and maximize the benefits of their Fingerhut FreshStart account.

Throughout this article, we will explore the fundamental aspects of Fingerhut FreshStart accounts, delve into the pivotal moment when these accounts evolve into revolving credit accounts, examine the factors that influence this transition, and offer practical tips for effectively managing a Fingerhut FreshStart revolving credit account. Whether you're considering opening a Fingerhut FreshStart account or are already on the path toward establishing a stronger credit profile, this comprehensive guide will equip you with the knowledge and strategies needed to navigate this financial landscape with confidence.

Understanding Fingerhut FreshStart Accounts

Fingerhut FreshStart accounts serve as a valuable entry point for individuals looking to initiate or enhance their credit history. These accounts are designed to provide a pathway for individuals with limited or damaged credit to access a line of credit and make purchases through the Fingerhut online store. What sets the Fingerhut FreshStart account apart is its accessibility, as it extends the opportunity for individuals with imperfect credit to obtain the products they need while simultaneously working to improve their creditworthiness.

When individuals apply for a Fingerhut FreshStart account, they are typically granted an initial credit line to use for purchasing items from the Fingerhut catalog. This initial credit line is often modest, reflecting the cautious approach taken to assess the individual’s credit management capabilities. As individuals make timely payments and demonstrate responsible credit usage, they may become eligible for a transition to a revolving credit account, marking a pivotal step in their credit-building journey.

Moreover, Fingerhut FreshStart accounts offer a structured repayment plan, allowing individuals to make an initial down payment on their purchase, followed by a series of manageable installment payments. This approach empowers individuals to acquire essential items while establishing a positive payment history, thereby contributing to the gradual improvement of their credit standing.

By understanding the fundamental principles of Fingerhut FreshStart accounts, individuals can leverage this financial tool to not only access necessary products but also embark on a journey toward enhanced credit health. The next section will delve into the transition from a Fingerhut FreshStart account to a revolving credit account, shedding light on the factors that influence this progression and the implications it holds for individuals seeking to fortify their financial foundation.

Transition to Revolving Credit

The transition from a Fingerhut FreshStart account to a revolving credit account represents a significant milestone in an individual’s credit-building endeavor. This evolution signifies a shift from a restricted credit line with structured repayment terms to a more flexible and dynamic credit arrangement. When a Fingerhut FreshStart account transitions to a revolving credit account, individuals gain access to a broader credit line, providing them with increased purchasing power and greater financial flexibility.

Typically, the transition to a revolving credit account occurs when individuals demonstrate responsible credit management and a consistent repayment history. Fingerhut evaluates various factors, including payment history, credit utilization, and overall financial behavior, to determine whether an individual qualifies for the transition. By showcasing prudent financial habits and a commitment to timely payments, individuals can position themselves for this pivotal progression in their credit journey.

Upon the transition to a revolving credit account, individuals may experience an expansion of their credit line, enabling them to make larger purchases and manage their expenses more effectively. This newfound flexibility empowers individuals to navigate their financial obligations with greater ease while continuing to strengthen their credit profile through diligent credit management.

It’s important to note that the transition to a revolving credit account signifies a vote of confidence from Fingerhut, acknowledging an individual’s progress in building and managing credit responsibly. This transition also aligns with the overarching goal of empowering individuals to achieve financial stability and cultivate a positive credit history.

As individuals navigate this transition, they should remain mindful of the responsibilities that accompany a revolving credit account. Diligent financial management, prudent spending, and timely payments are essential for harnessing the benefits of a revolving credit account while safeguarding one’s credit standing. The subsequent section will delve into the factors that influence the transition from a Fingerhut FreshStart account to a revolving credit account, providing valuable insights for individuals seeking to optimize their credit-building journey.

Factors Influencing the Transition

Several key factors influence the transition from a Fingerhut FreshStart account to a revolving credit account, reflecting Fingerhut’s assessment of an individual’s creditworthiness and financial responsibility. Understanding these factors can provide valuable insights for individuals aiming to navigate this transition successfully and maximize the benefits of a revolving credit account.

Payment History: A consistent history of on-time payments is a pivotal factor considered during the transition to a revolving credit account. Individuals who demonstrate a pattern of timely payments on their Fingerhut FreshStart account showcase their commitment to responsible credit management, thereby strengthening their candidacy for a transition to a revolving credit account.

Credit Utilization: Responsible utilization of the available credit plays a significant role in the transition process. Individuals who effectively manage their credit utilization, maintaining a healthy balance between their credit limit and actual spending, exhibit prudent financial behavior that aligns with the principles of responsible credit management.

Financial Behavior: Fingerhut may evaluate an individual’s overall financial behavior, taking into account factors such as income stability, employment status, and debt-to-income ratio. A holistic assessment of an individual’s financial conduct provides a comprehensive understanding of their capacity to manage a revolving credit account effectively.

Credit Score Improvement: As individuals make progress in their credit journey and work towards enhancing their credit score, they create a compelling case for transitioning to a revolving credit account. A demonstrable improvement in creditworthiness signals a proactive approach to financial management and can bolster an individual’s eligibility for a transition.

Engagement with Credit Education Resources: Individuals who actively engage with credit education resources provided by Fingerhut demonstrate a commitment to enhancing their financial literacy and credit management skills. This proactive approach can positively influence the transition to a revolving credit account, as it reflects a willingness to learn and implement sound financial practices.

By understanding these influential factors, individuals can proactively address key aspects of their credit management to strengthen their candidacy for transitioning to a revolving credit account. The subsequent section will offer practical insights into effectively managing a Fingerhut FreshStart revolving credit account, empowering individuals to navigate this transition with confidence and prudence.

Managing a Fingerhut FreshStart Revolving Credit Account

Upon the transition to a Fingerhut FreshStart revolving credit account, individuals enter a phase of increased financial flexibility and responsibility. Effectively managing this revolving credit account is crucial for optimizing its benefits and fortifying one’s credit standing. By adhering to prudent financial practices and leveraging the features of the revolving credit account, individuals can navigate this new phase with confidence and foresight.

Timely Payments: Continuously prioritizing on-time payments is paramount for maintaining a positive credit standing and maximizing the advantages of a revolving credit account. By ensuring that payments are made by the due date, individuals demonstrate their commitment to responsible credit management, thereby fostering a favorable credit history.

Strategic Credit Utilization: Managing credit utilization is essential for harnessing the potential of a revolving credit account. Individuals should aim to maintain a healthy balance between their credit limit and actual spending, avoiding excessive utilization that could negatively impact their credit score. Strategic utilization reflects prudent financial behavior and contributes to a positive credit profile.

Budget-Conscious Spending: Practicing mindful and budget-conscious spending is instrumental in effectively managing a Fingerhut FreshStart revolving credit account. By aligning purchases with their financial means and avoiding unnecessary or impulsive spending, individuals can maintain control over their credit obligations and cultivate responsible financial habits.

Regular Credit Monitoring: Vigilant monitoring of the revolving credit account, including reviewing statements and tracking transactions, enables individuals to stay informed about their credit activity. This proactive approach empowers individuals to detect any irregularities or unauthorized charges promptly, contributing to enhanced financial security and peace of mind.

Engagement with Financial Resources: Leveraging the financial education and resources provided by Fingerhut can further enrich an individual’s credit management skills. Actively engaging with these resources, such as educational materials and financial tools, can enhance one’s financial literacy and empower informed decision-making regarding credit utilization and overall financial planning.

By incorporating these strategies into their credit management approach, individuals can effectively navigate the transition to a Fingerhut FreshStart revolving credit account and harness its potential for strengthening their credit profile. This proactive and conscientious approach sets the stage for sustained financial well-being and paves the way for continued progress in the realm of credit management.

Conclusion

The journey from a Fingerhut FreshStart account to a revolving credit account embodies a significant progression in an individual’s credit-building endeavor. By understanding the nuances of this transition and the factors that influence it, individuals can navigate this financial evolution with confidence and prudence, maximizing the benefits of their Fingerhut credit account.

Fingerhut FreshStart accounts offer a valuable opportunity for individuals to access credit and make essential purchases while working to fortify their credit standing. The transition to a revolving credit account signifies a vote of confidence from Fingerhut, acknowledging an individual’s progress in managing credit responsibly and fostering a positive payment history.

Crucial factors, including payment history, credit utilization, financial behavior, credit score improvement, and engagement with credit education resources, play pivotal roles in influencing the transition. By proactively addressing these factors and embracing sound financial practices, individuals can position themselves for a successful transition to a revolving credit account.

Upon transitioning to a Fingerhut FreshStart revolving credit account, individuals must embrace responsible credit management, including prioritizing timely payments, strategic credit utilization, budget-conscious spending, and vigilant credit monitoring. Engaging with financial resources and educational materials further equips individuals with the knowledge and skills needed to navigate their credit journey adeptly.

Ultimately, the transition to a revolving credit account marks a milestone in an individual’s pursuit of financial stability and credit health. By leveraging the opportunities presented by a Fingerhut FreshStart revolving credit account and embracing prudent credit management practices, individuals can continue to strengthen their credit profile, paving the way for enhanced financial well-being and expanded opportunities in the realm of credit and personal finance.

Armed with a deeper understanding of the transition process and equipped with practical insights for managing a Fingerhut FreshStart revolving credit account, individuals can embark on this next phase of their credit journey with confidence, resilience, and a clear vision for a stronger financial future.