Home>Finance>When Does Basis Risk Become A Problem In Hedging

Finance

When Does Basis Risk Become A Problem In Hedging

Published: January 15, 2024

Understanding when basis risk becomes a concern in hedging is crucial in finance. Learn how to mitigate risks effectively and optimize hedging strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance where risks and uncertainties run high. When it comes to hedging, managing risks is paramount. One of the risks that often comes into play is basis risk. But what exactly is basis risk and when does it become a problem in hedging?

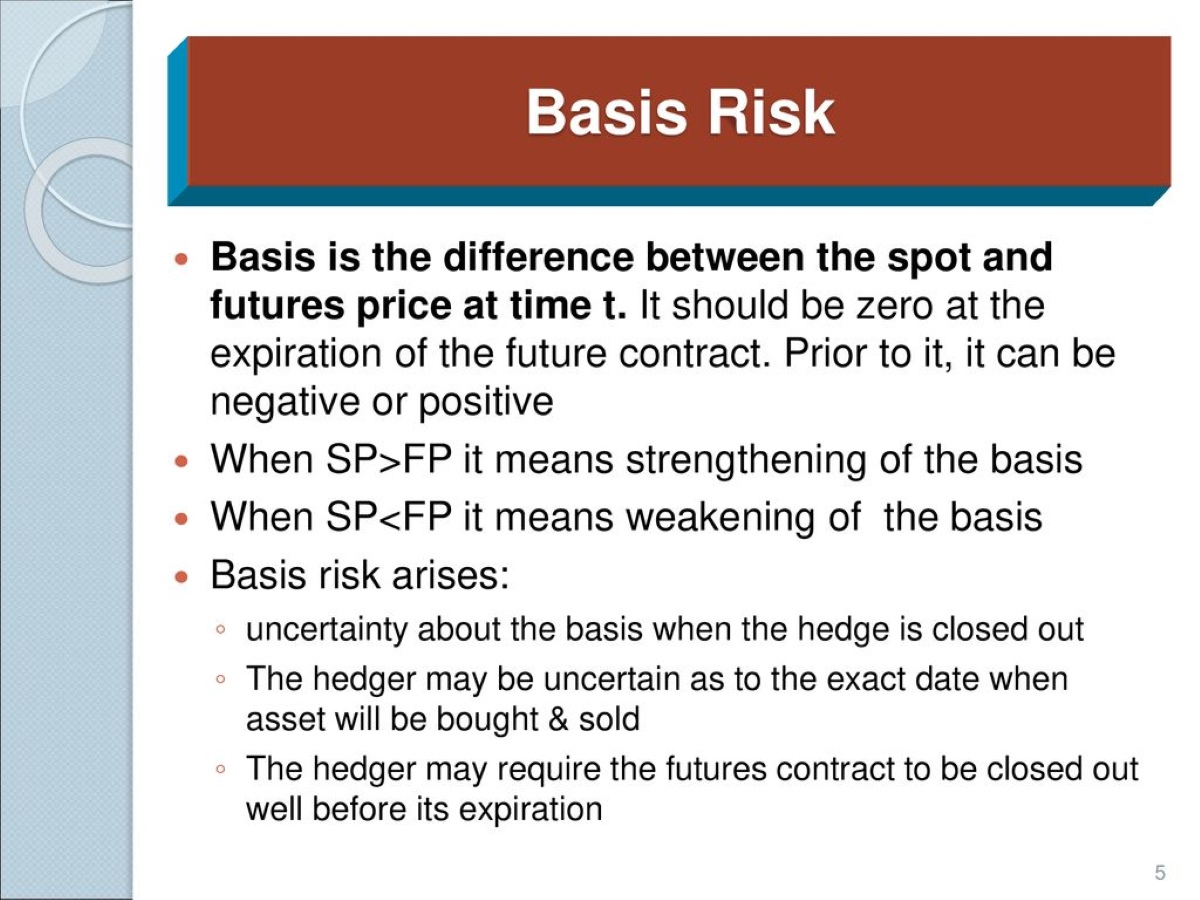

Basis risk refers to the potential loss that arises from the imperfect correlation between the hedging instrument and the asset being hedged. In simple terms, it is the risk associated with the difference in price movements between the hedging instrument and the underlying asset.

To understand basis risk, let’s consider an example. Suppose you are a farmer and want to protect yourself against a decline in crop prices. You decide to use futures contracts to hedge your risk. Here, the basis is the difference between the cash price of the crop and the futures price. If the basis remains relatively stable or converges, your hedge will be effective. However, if the basis widens or becomes volatile, it creates basis risk.

Factors such as supply and demand dynamics, market liquidity, pricing mechanisms, and market disruptions can contribute to basis risk. These factors introduce uncertainty and make it challenging to accurately predict and hedge against price movements.

While basis risk is an inherent part of hedging, it becomes a problem when it undermines the effectiveness of the hedging strategy. The magnitude of basis risk that can be tolerated without causing significant deviations from the desired risk management objectives varies depending on the nature of the underlying asset, market conditions, and the hedging instrument being used.

Understanding when basis risk becomes a problem is crucial for risk management professionals, traders, and investors alike. It allows them to evaluate the effectiveness of their hedging strategies and take appropriate measures to mitigate the impact of basis risk.

In the next sections, we will delve deeper into the factors contributing to basis risk, how to determine when it becomes a problem, its impact on hedging effectiveness, and strategies to mitigate basis risk.

Understanding Basis Risk

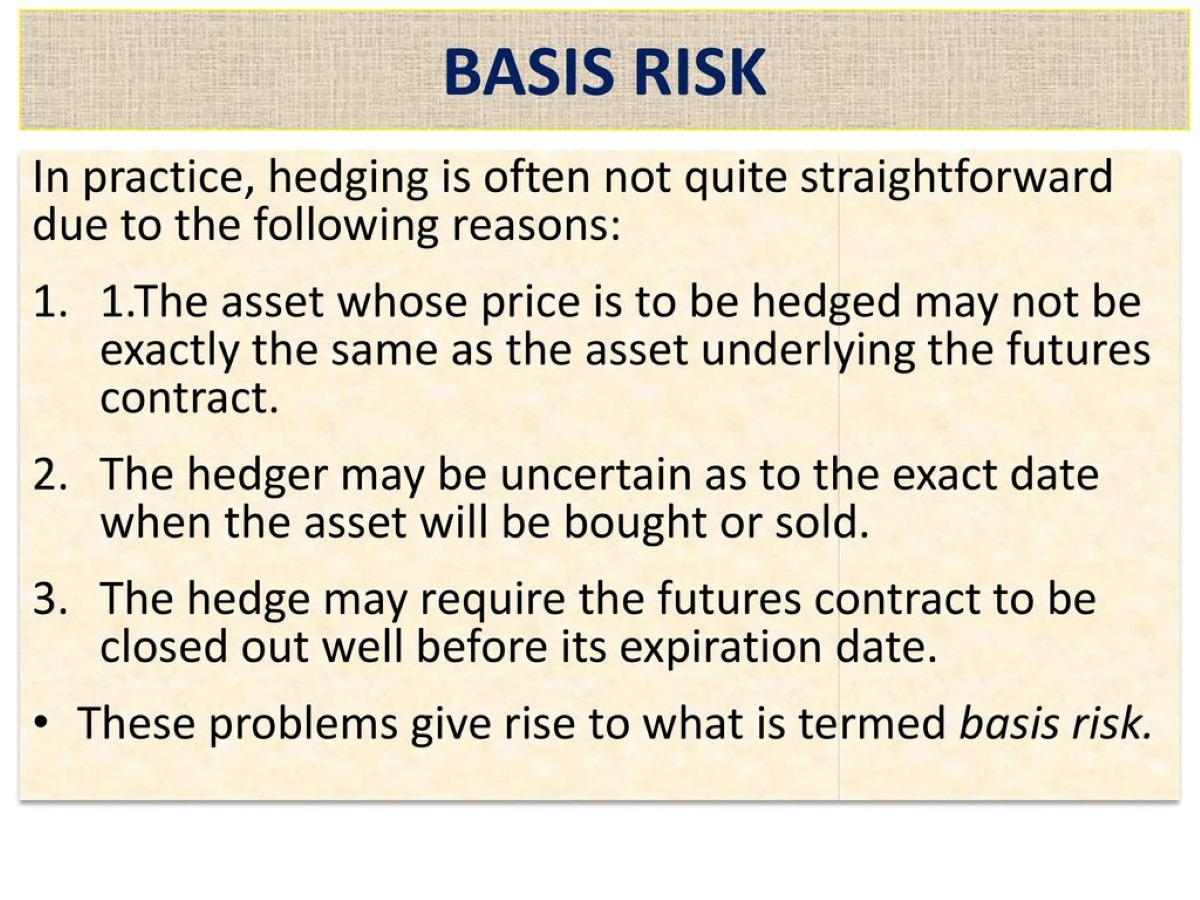

To effectively manage basis risk, it is important to have a clear understanding of what it entails. Basis risk arises from the discrepancy between the hedging instrument and the underlying asset being hedged. This discrepancy can be attributed to various factors, including differences in contract specifications, timing mismatches, and market forces.

One common form of basis risk arises from a difference in maturity dates between the hedging instrument and the underlying asset. For example, if you are hedging a commodity with a futures contract that has a different expiration date, the difference in price movements between the two can lead to basis risk. This is known as calendar spread basis risk.

Another type of basis risk is the quality or grade basis risk. This occurs when the quality or grade of the hedging instrument and the underlying asset do not match. For instance, if you are hedging a specific grade of oil with a futures contract that represents a different grade, the difference in price movements between the two can introduce basis risk.

Additionally, basis risk can arise due to location basis, which occurs when the hedging instrument and the underlying asset are located in different markets or regions. Variations in transportation costs, storage facilities, and supply and demand dynamics can contribute to differences in prices, leading to basis risk.

It is crucial to note that basis risk is not necessarily a negative factor in all situations. There are instances when basis risk can work in favor of hedgers. For example, if the cash price of the underlying asset increases more than the futures price, the positive basis can result in additional profits for the hedger.

However, in most cases, basis risk is seen as a potential source of hedging inefficiency as it introduces uncertainty and can undermine the desired risk management objectives. Ineffective hedging due to basis risk can lead to financial losses, especially when the hedged position and underlying asset are highly correlated.

By understanding the different forms of basis risk and how they can impact hedging effectiveness, risk management professionals can make informed decisions about hedging strategies and implement measures to mitigate this risk. In the following sections, we will explore the factors contributing to basis risk and how to determine when it becomes a problem.

Factors Contributing to Basis Risk

Basis risk occurs due to a variety of factors that introduce discrepancies between the hedging instrument and the underlying asset being hedged. These factors can significantly impact the effectiveness of a hedging strategy and increase the vulnerability to basis risk. Let’s explore some key factors contributing to basis risk:

- Market Forces: Changes in supply and demand dynamics, market liquidity, and economic conditions can create basis risk. Market forces can cause price discrepancies between the hedging instrument and the underlying asset, leading to an imperfect correlation.

- Timing Mismatches: Hedging instruments and the underlying assets may have different expiration or delivery dates, resulting in basis risk. The difference in price movements between the two can cause the basis to become volatile or widen, diminishing the effectiveness of the hedge.

- Contract Specifications: Differences in contract specifications between the hedging instrument and the underlying asset can contribute to basis risk. Variances in terms such as contract size, margin requirements, and settlement procedures can introduce discrepancies in price movements.

- Transportation and Location Differences: Location basis risk arises when the hedging instrument and the underlying asset are in different regions or markets. Variations in transportation costs, storage facilities, and regional supply and demand dynamics can lead to differences in prices, contributing to basis risk.

- Quality or Grade Discrepancies: Quality basis risk occurs when the hedging instrument and the underlying asset have different qualities or grades. Commodities such as oil, natural gas, or agricultural products may have varying grades, which can result in price discrepancies and basis risk.

It is important to note that the impact of these factors on basis risk can vary depending on the specific circumstances and asset being hedged. Factors such as market volatility, correlation between the hedging instrument and the underlying asset, and the timing of market events can amplify or mitigate the impact of basis risk.

Understanding the underlying factors contributing to basis risk allows risk management professionals to assess the level of risk exposure and implement strategies to mitigate its impact. In the next section, we will explore how to determine when basis risk becomes a problem in hedging.

Determining When Basis Risk Becomes a Problem

While basis risk is an inherent part of hedging, it becomes a problem when it undermines the effectiveness of the hedging strategy. Determining when basis risk becomes a problem requires an assessment of various factors and a thorough analysis of the impact on hedging objectives. Here are some key considerations:

- Deviation from Hedging Objectives: The first step in determining if basis risk is a problem is to evaluate whether the hedging strategy is deviating significantly from the intended risk management objectives. If the basis widens or becomes volatile to the extent that it negates the purpose of hedging, then basis risk can be considered a problem.

- Impact on Financial Performance: Basis risk can have a direct impact on financial performance. If the fluctuations in the basis result in significant losses or reduced profits, then it indicates that basis risk has become a problem. Monitoring the financial outcomes of hedging activities can help assess the extent to which basis risk is affecting the overall performance.

- Historical Analysis: Looking at historical data and analyzing the patterns of basis risk can provide insights into when it becomes problematic. By identifying periods of significant basis risk and its impact on hedging effectiveness in the past, risk management professionals can gain a better understanding of when basis risk is likely to become problematic in the future.

- Correlation and Volatility: Evaluating the correlation between the hedging instrument and the underlying asset, as well as the volatility of the basis, is essential in determining when basis risk becomes problematic. If the correlation weakens or the basis becomes increasingly volatile, it indicates a higher level of basis risk that can hinder hedging effectiveness.

- Monitoring Market Conditions: Keeping a close eye on market conditions and factors that contribute to basis risk is crucial in determining when it becomes problematic. Market disruptions, changes in supply and demand dynamics, or shifts in contract specifications can all impact basis risk. Regular monitoring allows for timely adjustments in hedging strategies to mitigate the impact of unfavorable basis risk conditions.

It is important to note that the level at which basis risk becomes problematic depends on the specific circumstances, market conditions, and the risk tolerance of the hedger. What may be considered problematic for one entity may be tolerable for another.

By considering these factors and conducting a thorough analysis, risk management professionals can determine when basis risk becomes a problem and take appropriate actions to adjust their hedging strategies. In the next section, we will explore the impact of basis risk on hedging effectiveness.

Impact of Basis Risk on Hedging Effectiveness

Basis risk can have a significant impact on the effectiveness of hedging strategies. When the basis widens or becomes volatile, it introduces uncertainty and undermines the desired risk management objectives. Here are some key ways in which basis risk can impact hedging effectiveness:

- Reduced Hedge Effectiveness: One of the main objectives of hedging is to offset price movements in the underlying asset. However, when the basis risk is high, the hedging instrument may not closely track the price movements of the asset, reducing the effectiveness of the hedge. This can leave the hedger exposed to potential losses.

- Inaccurate Price Protection: Hedging is often used to protect against adverse price movements. However, if the basis risk is significant, the hedger may not be fully protected. For example, if the cash price of the underlying asset decreases, but the futures price does not reflect this downward movement due to a widening basis, the hedger may not fully benefit from the hedge.

- Increased Costs: Basis risk can lead to increased costs, especially in situations where the hedging instrument and the underlying asset have different specifications or are located in different markets. The need to adjust positions or roll over contracts to manage basis risk can result in additional transaction costs for the hedger.

- Potential Losses: In extreme cases, basis risk can result in financial losses for the hedger. If the basis becomes highly volatile or widens significantly, it can create a mismatch between the hedging instrument and the underlying asset. This mismatch can result in losses, particularly if the hedger is unable to adjust their positions in a timely or effective manner.

- Diminished Risk Management Objectives: Basis risk can compromise the overall risk management objectives of a hedging strategy. The hedger may not be able to achieve the desired level of risk reduction or may be exposed to unexpected risks due to basis variations. This can result in increased uncertainty and difficulty in effectively managing the portfolio or business risks.

It is crucial for risk management professionals, traders, and investors to assess the impact of basis risk on hedging effectiveness. By monitoring and understanding the level of basis risk and its potential consequences, appropriate adjustments can be made to the hedging strategy to mitigate its impact. In the next section, we will explore strategies to help mitigate basis risk.

Strategies to Mitigate Basis Risk

While basis risk is unavoidable in hedging, there are several strategies that risk management professionals can employ to mitigate its impact. These strategies aim to minimize the discrepancy between the hedging instrument and the underlying asset, thereby improving the effectiveness of the hedge. Here are some key strategies to consider:

- Contract Selection: Careful selection of the hedging instrument is crucial in mitigating basis risk. Opt for contracts that closely match the underlying asset in terms of maturity dates, quality specifications, and location. This can help reduce basis risk by aligning the price movements between the hedging instrument and the asset being hedged.

- Rolling Contracts: Rolling contracts involves closing out existing positions and entering into new positions with updated maturity dates. This strategy helps manage basis risk by adjusting the hedging instrument to align with the changing market conditions and minimize potential discrepancies that may arise due to timing mismatches.

- Basis Trading: Basis trading involves taking positions in the spot market and hedging them with futures contracts or other derivative instruments. This strategy allows hedgers to capture and manage basis risk directly, potentially benefiting from a convergence or narrowing of the basis. However, basis trading requires careful analysis and monitoring of market conditions.

- Hedging Spreads: Hedging spreads involves using multiple hedging instruments with different maturities or contract specifications to offset basis risk. By employing this strategy, hedgers can diversify their positions and reduce reliance on a single instrument, diminishing the impact of basis risk.

- Monitoring and Adjusting: Regular monitoring of market conditions and basis risk is crucial in mitigating its impact. By staying informed about factors that contribute to basis risk and assessing its potential consequences on hedging effectiveness, risk management professionals can make necessary adjustments to their hedging strategies in a timely manner.

It is important to note that these strategies do not completely eliminate basis risk but rather help manage and minimize its impact. The choice of the most suitable strategy depends on the specific circumstances, the nature of the underlying asset, and the risk tolerance of the hedger.

By implementing these strategies and actively managing basis risk, risk management professionals can enhance the effectiveness of their hedging strategies and reduce the potential losses or inefficiencies associated with basis risk. In the final section, we will summarize the key points discussed in this article.

Conclusion

Basis risk is an inherent part of hedging in the world of finance. It refers to the potential loss that arises from the imperfect correlation between the hedging instrument and the underlying asset being hedged. While basis risk cannot be eliminated entirely, understanding when it becomes a problem is crucial for risk management professionals, traders, and investors.

In this article, we discussed the concept of basis risk and explored the factors that contribute to it. We also delved into the determinants of when basis risk becomes problematic and the impact it has on the effectiveness of hedging strategies.

We highlighted the importance of considering factors such as deviation from hedging objectives, financial performance, historical analysis, correlation, volatility, and market conditions in determining when basis risk becomes a problem. It is crucial to regularly monitor the basis risk and make appropriate adjustments to the hedging strategy to mitigate its impact.

We also discussed various strategies to mitigate basis risk, including careful contract selection, rolling contracts, basis trading, hedging spreads, and regular monitoring and adjustments. These strategies help minimize the discrepancy between the hedging instrument and the underlying asset, thereby improving the effectiveness of the hedge.

It is important for risk management professionals to strike a balance between reducing basis risk and achieving desired risk management objectives. The right approach depends on the specific circumstances, market conditions, and the risk tolerance of the hedger.

In conclusion, basis risk is a challenge that must be addressed in hedging activities. By understanding basis risk, identifying when it becomes problematic, and implementing appropriate strategies to mitigate its impact, risk management professionals can enhance the effectiveness of their hedging strategies and minimize potential losses.

Remember, while basis risk cannot be completely eliminated, proactive risk management and continuous monitoring can go a long way in managing its impact and ensuring the desired risk management objectives are achieved.