Home>Finance>When To Switch From A Secured Credit Card To An Unsecured Card?

Finance

When To Switch From A Secured Credit Card To An Unsecured Card?

Published: March 2, 2024

Learn when to transition from a secured credit card to an unsecured one and manage your finances effectively. Find expert advice on making the switch.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Secured credit cards are a valuable financial tool for individuals looking to build or rebuild their credit. They require a cash deposit as collateral, which serves as a safety net for the issuer in case the cardholder defaults on payments. While secured cards offer a pathway to improving credit scores, there comes a point when cardholders may consider transitioning to an unsecured credit card.

This transition represents a significant milestone in a person's financial journey. It signifies a level of trust and responsibility that financial institutions place in the cardholder, allowing them to access credit without the need for collateral. However, determining the right time to make this switch requires careful consideration of various factors, including credit score improvement, financial stability, and responsible credit usage.

In this article, we'll explore the nuances of secured and unsecured credit cards, delve into the signs that indicate it's time to transition from a secured to an unsecured card, and provide actionable steps to facilitate a smooth and successful transition. Understanding these aspects can empower individuals to make informed decisions about their credit journey and take the necessary steps towards achieving financial milestones.

**

Understanding Secured and Unsecured Credit Cards

Secured and unsecured credit cards represent two distinct paths in the realm of credit building and financial management. Understanding the differences between these two types of cards is crucial for individuals seeking to make informed decisions about their credit journey.

Secured Credit Cards

A secured credit card requires the cardholder to provide a cash deposit, typically equal to the credit limit of the card. This deposit serves as collateral and mitigates the risk for the card issuer, making secured cards accessible to individuals with limited or poor credit history. Responsible use of a secured card, such as making timely payments and keeping credit utilization low, can help individuals establish or rebuild their credit scores over time.

Unsecured Credit Cards

Unsecured credit cards, in contrast, do not require a cash deposit or collateral. These cards are extended based on the cardholder’s creditworthiness, as evaluated by the issuer. They offer a line of credit without the need for upfront funds, providing greater financial flexibility and convenience. Individuals with established credit history and improved credit scores may qualify for unsecured cards with favorable terms and rewards programs.

While both types of cards serve the purpose of facilitating transactions and building credit, the distinction lies in the level of risk assumed by the card issuer and the cardholder’s current financial standing. Secured cards offer a structured approach to credit building, while unsecured cards reflect a higher level of trust and financial responsibility extended to the cardholder.

Understanding the dynamics of secured and unsecured credit cards empowers individuals to navigate their credit journey strategically. By leveraging the benefits of each card type and transitioning mindfully between them, cardholders can optimize their credit utilization and work towards achieving their financial goals.

**

Signs It’s Time to Switch to an Unsecured Card

Recognizing the opportune moment to transition from a secured credit card to an unsecured card is a pivotal aspect of managing one’s credit journey. Several signs indicate that a cardholder may be ready to make this significant leap, signaling a positive evolution in their financial standing and credit management.

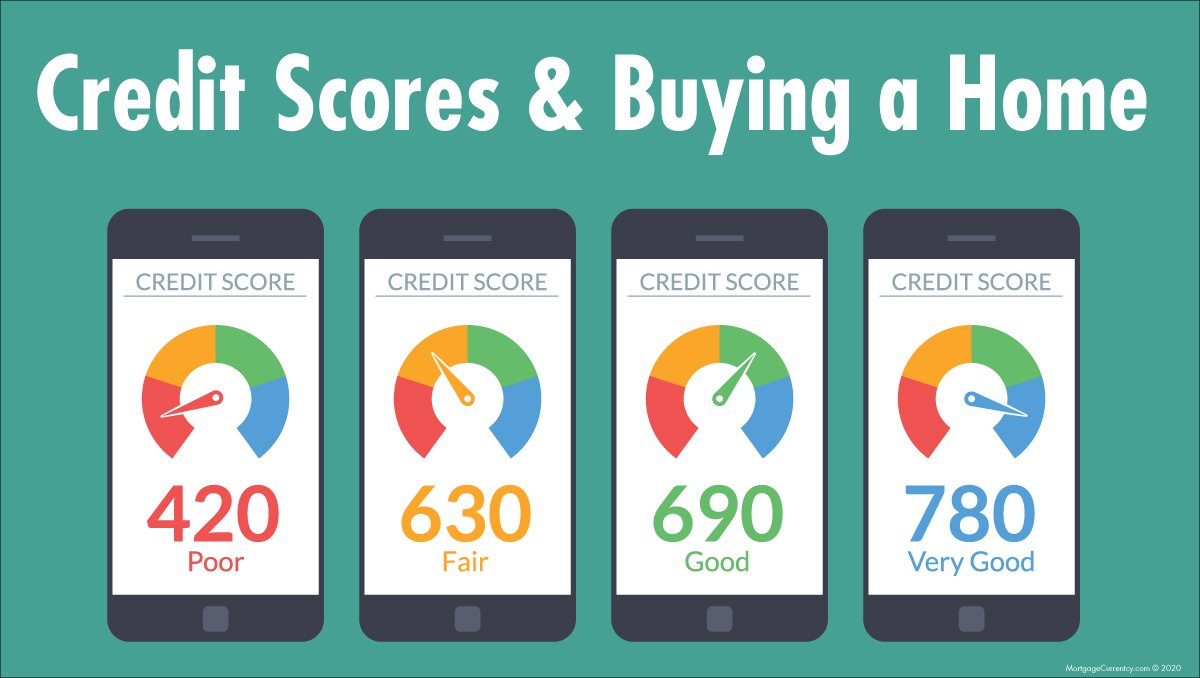

Improved Credit Score

One of the primary indicators that it may be time to switch to an unsecured card is a noticeable improvement in the cardholder’s credit score. As responsible credit habits, such as timely payments and prudent credit utilization, contribute to score enhancement, individuals may become eligible for unsecured cards with more favorable terms and lower fees.

Credit Limit Increase

Secured credit cards often have lower credit limits initially, reflecting the collateralized nature of the account. When a cardholder’s financial stability and creditworthiness improve, they may find themselves in a position to access higher credit limits through unsecured cards, providing greater purchasing power and flexibility.

Desire for Rewards and Benefits

Unsecured credit cards frequently offer rewards programs, cashback incentives, and other benefits that may not be available with secured cards. As individuals progress in their credit journey, they may seek these additional perks and aspire to leverage the advantages that come with unsecured card offerings.

Financial Stability

Stability in income, employment, and overall financial health can serve as a compelling reason to transition to an unsecured card. When individuals feel confident in their ability to manage credit responsibly and meet payment obligations, the transition to an unsecured card aligns with their strengthened financial position.

Prequalification Offers

Receiving prequalification offers for unsecured credit cards from reputable issuers signifies that financial institutions recognize the cardholder’s credit progress and consider them eligible for unsecured card products. This external validation often signals that the time may be ripe to make the switch.

Recognizing these signs empowers individuals to make informed decisions about transitioning from a secured to an unsecured credit card, aligning their credit products with their evolving financial needs and goals.

**

Steps to Transition from a Secured to an Unsecured Card

Transitioning from a secured credit card to an unsecured card involves a deliberate and strategic approach to ensure a smooth and successful shift. By following these essential steps, individuals can navigate the transition process with confidence and maximize the benefits of unsecured credit cards.

Monitor Credit Score and Financial Health

Prior to initiating the transition, it’s crucial to monitor one’s credit score and overall financial health. A steady improvement in credit score, responsible credit behavior, and a stable financial position are key indicators that the time may be right to explore unsecured card options.

Contact the Current Card Issuer

Reach out to the current secured card issuer to inquire about the possibility of transitioning to an unsecured card. Some issuers may offer a pathway to upgrade existing secured accounts to unsecured cards based on the cardholder’s credit progress and payment history.

Explore Unsecured Card Options

Research unsecured credit card offers from various issuers to identify products that align with individual financial goals and credit needs. Compare features, such as interest rates, annual fees, rewards programs, and credit limits, to make an informed decision about the most suitable unsecured card.

Submit an Application for an Unsecured Card

Once a favorable unsecured card option is identified, submit an application to the chosen issuer. Provide accurate and updated financial information, employment details, and personal data to support the application process.

Consider a Gradual Transition

Some individuals may opt for a gradual transition by maintaining the secured card while also utilizing the benefits of an unsecured card. This approach allows for a seamless shift while leveraging the credit-building advantages of both card types.

Manage Credit Responsibly

Upon approval and receipt of the unsecured card, continue to manage credit responsibly by making timely payments, keeping credit utilization low, and staying informed about the card’s terms and conditions. Responsible credit management is essential for sustaining and enhancing the benefits of the unsecured card.

Evaluate the Secured Card Closure

Once the transition is complete, evaluate the option of closing the secured card account. Consider the impact on credit utilization and overall credit profile before deciding whether to keep the secured card open or close it.

By following these steps, individuals can navigate the transition from a secured to an unsecured credit card effectively, leveraging the opportunities presented by unsecured card products and optimizing their credit journey.

**

Conclusion

The transition from a secured credit card to an unsecured card represents a significant milestone in an individual’s credit journey. It signifies progress in credit building, financial stability, and responsible credit management. Recognizing the signs that indicate the opportune moment for this transition is essential for maximizing the benefits of unsecured credit cards and aligning credit products with evolving financial needs.

As individuals experience improvements in credit score, financial stability, and creditworthiness, the desire to access unsecured cards with higher credit limits, rewards programs, and additional benefits becomes increasingly compelling. This transition reflects a shift in trust and responsibility from the card issuer, acknowledging the cardholder’s progress and potential for continued financial growth.

By following a strategic approach to transitioning, including monitoring credit health, exploring unsecured card options, and managing credit responsibly, individuals can navigate this shift seamlessly and position themselves for long-term credit success. Whether opting for a gradual transition or pursuing a direct switch to an unsecured card, the key lies in informed decision-making and a commitment to prudent credit management.

Ultimately, the transition from a secured to an unsecured credit card empowers individuals to access a broader range of financial opportunities, enhance their purchasing power, and continue building a positive credit history. It represents a pivotal step towards achieving financial goals and realizing the potential for long-term financial well-being.

By embracing this transition with careful consideration and a proactive approach, individuals can leverage the advantages of unsecured credit cards to further their financial journey and unlock new possibilities for credit utilization and financial growth.