Finance

Where Can You Cash An IRS Check?

Modified: March 1, 2024

Looking to cash an IRS check? Discover the best places to get your refund money, find finance options and cash locations today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

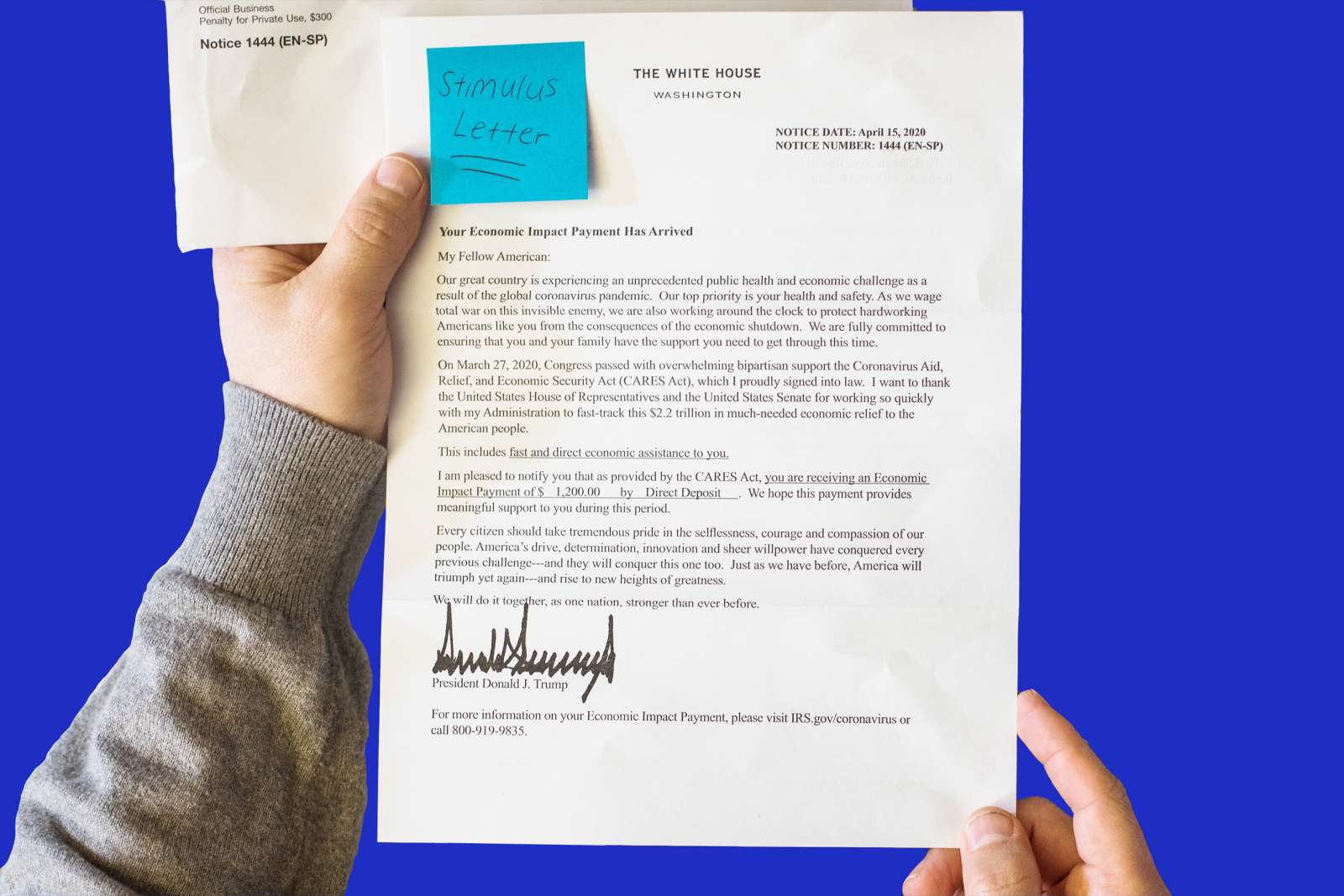

Receiving a check from the Internal Revenue Service (IRS) can be an exciting moment. Whether it’s a tax refund, a stimulus payment, or any other type of payment issued by the IRS, the next step is to find a convenient and reliable place to cash it. While many options are available, it is important to choose the right one that suits your needs.

In this article, we will explore various places where you can cash an IRS check, ranging from traditional banks to online platforms. Each option has its own pros and cons, so it’s essential to consider factors like location, fees, and convenience.

Before deciding where to cash your IRS check, it’s crucial to understand that some financial institutions or stores may have different policies or criteria for accepting these types of checks. Additionally, it’s important to have proper identification and any necessary documentation when cashing your check to avoid any potential complications. Now, let’s delve into the different options available for cashing an IRS check.

Banks

One of the most common places to cash an IRS check is at a traditional bank. Banks are known for their financial services, including cashing checks for their account holders. If you already have an account with a bank, this can be a convenient and hassle-free option.

When cashing an IRS check at a bank, you will typically need to provide proper identification, such as a government-issued ID, and endorse the check by signing the back. Some banks may require you to have an account with them to cash the check, while others may accept non-account holders for a fee.

One advantage of cashing your IRS check at a bank is the security and reliability it offers. Banks are regulated financial institutions that follow strict protocols, ensuring the legitimacy of the check and protecting against fraud. Additionally, if you have an account with the bank, you can conveniently deposit the funds or withdraw cash directly.

However, it’s important to note that not all banks may cash IRS checks. Some smaller banks or local branches may have restrictions or limitations, so it’s advisable to check with your specific bank beforehand.

Another consideration when cashing an IRS check at a bank is the possibility of fees. While some banks may cash the check for free, others may charge a nominal fee, especially if you are not an account holder. It’s wise to inquire about any potential fees before proceeding with the transaction to avoid any surprises.

Overall, cashing an IRS check at a bank can be a reliable and convenient option, especially if you already have an account. Just ensure that the bank you choose accepts IRS checks and inquire about any associated fees or requirements.

Credit Unions

Credit unions are another viable option for cashing an IRS check. Similar to banks, credit unions are financial institutions that offer various services, including check cashing.

Credit unions are member-owned, not-for-profit organizations that cater to the financial needs of their members. If you are a member of a credit union, you may have the advantage of lower fees and more personalized service when cashing your IRS check.

When cashing an IRS check at a credit union, you will typically need to present proper identification and endorse the check. Some credit unions may require you to be an account holder to cash the check, while others may have different policies for non-members.

One of the benefits of cashing an IRS check at a credit union is the potential for lower fees compared to other financial institutions. Since credit unions are owned by the members, they prioritize providing affordable services. Additionally, credit unions may offer competitive interest rates on savings or checking accounts, giving you the option to deposit the funds from your IRS check.

It’s important to note that credit unions have eligibility requirements, and not everyone may be eligible for membership. However, many credit unions have broad membership criteria, including specific professions, geographical location, or membership in certain organizations. It’s worth exploring credit unions in your area to see if you meet their membership criteria.

Overall, if you are a member of a credit union, cashing an IRS check at your credit union can be a cost-effective and convenient option. Credit unions typically offer personalized service and competitive fees, making them worth considering when deciding where to cash your IRS check.

Retail Stores

Another option for cashing an IRS check is retail stores. Many large retail chains, such as Walmart, Kroger, and 7-Eleven, offer check cashing services to their customers.

When choosing a retail store to cash your IRS check, it’s important to consider factors such as the store’s check cashing policy, fees, and location. Some retail stores may have specific requirements, such as being a customer or purchasing a store product, while others may offer check cashing services to anyone, regardless of whether they have a relationship with the store.

One advantage of cashing an IRS check at a retail store is the extended operating hours. Unlike banks or credit unions, retail stores often have longer business hours, with some locations open 24/7. This can be beneficial if you need to cash your check outside of traditional banking hours.

In terms of fees, retail stores may charge a flat fee or a percentage of the check amount. It’s important to inquire about the fee structure and compare it with other options to ensure you’re getting the best deal. Some retail stores may offer lower fees for their store customers or loyalty program members.

While cashing your IRS check at a retail store can be convenient, it’s crucial to exercise caution and choose reputable establishments. Stick to well-known retail chains with established check cashing services to minimize the risk of fraud or issues with the transaction.

Overall, cashing an IRS check at a retail store can be a convenient option, especially if you have limited access to banks or credit unions. Just make sure to familiarize yourself with the store’s policies, fees, and reputation before proceeding with the check cashing transaction.

Check Cashing Outlets

If you’re looking for a dedicated place to cash your IRS check, check cashing outlets are another option to consider. These establishments specialize in cashing various types of checks, including IRS checks.

Check cashing outlets are typically found in urban areas and offer services to individuals who do not have traditional bank accounts or prefer not to use banks. They provide a convenient alternative for cashing checks, including IRS checks, without the need for a bank account.

When using a check cashing outlet, you will need to provide proper identification and endorse the check. Some check cashing outlets may require additional documentation or may have specific requirements for cashing IRS checks due to their higher value.

One advantage of using a check cashing outlet is the accessibility. These outlets are often located in areas with high foot traffic and have extended operating hours, making it convenient for individuals who work unconventional schedules or require immediate access to their funds.

However, it’s important to note that check cashing outlets typically charge higher fees compared to other options. These fees can vary based on the check amount and the specific policies of the outlet. It’s essential to inquire about the fee structure and compare it with other alternatives to ensure you’re comfortable with the cost.

While check cashing outlets provide a valuable service for cashing IRS checks, it’s important to exercise caution and choose reputable establishments. Research the outlet’s reputation, read reviews, and verify their credentials to minimize the risk of fraud or potential issues.

Overall, check cashing outlets offer a dedicated and accessible option for cashing IRS checks, especially for individuals who do not have a traditional bank account. Just make sure to consider the fees and reputation of the outlet before proceeding with the transaction.

Online Payment Platforms

In an increasingly digital world, online payment platforms have become a popular option for cashing IRS checks. These platforms, such as PayPal, Venmo, and Cash App, offer convenient and efficient ways to receive and manage funds, including funds from IRS checks.

Using an online payment platform to cash your IRS check typically involves depositing the check electronically into your account. The process may vary slightly between platforms, but generally, you will need to provide information about the check, such as the amount and the check’s image for verification.

One of the advantages of using online payment platforms is the speed of the transaction. Once the check is deposited into your account, the funds are typically available for immediate use. This can be especially convenient if you need quick access to your IRS check funds.

Another benefit of online payment platforms is the low or no fees associated with depositing or cashing an IRS check. Many platforms offer free check deposits, saving you from potential fees charged by traditional banks or check cashing outlets. However, it’s important to note that additional fees may apply if you opt to transfer the funds to a bank account or use other features offered by the platform.

Using an online payment platform to cash your IRS check also offers the convenience of managing your funds digitally. You can easily track your transactions, transfer money, or use the funds to make online purchases. Additionally, some platforms offer features like budgeting tools and the ability to send money to others, providing further functionality beyond simply cashing your check.

It’s important to choose a reputable and secure online payment platform when cashing your IRS check. Look for platforms with strong security measures, user-friendly interfaces, and positive reviews from other users.

Overall, online payment platforms provide a convenient and modern option for cashing IRS checks. The ability to deposit the check digitally, access funds quickly, and potentially avoid fees make them an attractive choice for individuals seeking a streamlined and hassle-free experience.

IRS Offices

If you prefer a more direct approach, one option is to cash your IRS check at an IRS office. The IRS has offices located throughout the country, where you can receive various services related to your taxes, including cashing IRS checks.

When cashing an IRS check at an IRS office, you may need to schedule an appointment and provide proper identification. It’s important to check the specific requirements and procedures of the IRS office in your area, as they may vary.

One advantage of cashing your IRS check at an IRS office is the assurance of dealing directly with the source of the check. This can provide a sense of security and peace of mind, knowing that the check is coming from a reputable and authoritative entity.

In addition to cashing your IRS check, IRS offices can also assist with any inquiries or concerns you may have regarding the payment. They can provide clarification on the amount, discuss any potential deductions or penalties, and address any other tax-related matters you may need assistance with.

However, it’s important to note that not all IRS offices offer check cashing services. Some offices may only provide assistance with tax-related questions and concerns. It’s advisable to contact your local IRS office to confirm if they offer check cashing services and to inquire about any specific requirements or restrictions.

Another factor to consider is the potential wait time when visiting an IRS office. Depending on the season and location, there may be a significant number of individuals seeking assistance, which could result in longer wait times. It’s advisable to plan accordingly and allocate enough time for your visit to ensure a smooth and efficient experience.

Overall, cashing your IRS check at an IRS office provides a direct and reliable option, particularly if you have specific tax-related questions or concerns. Just make sure to check if the IRS office in your area offers check cashing services and to come prepared with proper identification and any necessary documentation.

Conclusion

Cashing an IRS check is an important step in accessing funds owed to you by the Internal Revenue Service. Fortunately, there are several options available to make this process convenient and hassle-free.

Traditional banks and credit unions offer reliable and secure options for cashing an IRS check, especially if you already have an account. These institutions have established check cashing policies and offer convenience with services like direct deposit and account management.

Retail stores and check cashing outlets provide accessibility and extended operating hours, making them a viable option for individuals without traditional bank accounts or those seeking immediate access to their funds. However, it’s crucial to consider the fees associated with these services and choose reputable establishments.

Online payment platforms offer a modern and convenient alternative for cashing IRS checks. These platforms allow for quick and secure electronic deposits, with the added benefit of low or no fees. They also provide the flexibility to manage funds digitally and utilize additional features.

If you prefer a direct and authoritative approach, cashing your IRS check at an IRS office may be the best option. However, it’s important to verify if the specific office offers check cashing services and to be prepared with proper identification and any required documentation.

Ultimately, the choice of where to cash your IRS check depends on your individual needs, preferences, and circumstances. Be sure to consider factors such as location, fees, convenience, and security when making this decision.

Remember, regardless of the option you choose, always review the specific requirements and policies of the institution or service provider beforehand to ensure a smooth and successful transaction. With careful consideration, you can easily cash your IRS check and access the funds you’re entitled to.