Finance

Where Is The Main IRS Office Located?

Published: November 1, 2023

Looking for the main IRS office location? Find it here! Our finance experts guide you to the right place for all your IRS-related needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the main IRS office location. The Internal Revenue Service (IRS) is a pivotal government agency responsible for administering and enforcing the United States tax laws. As the primary body overseeing tax collection and enforcement, the IRS plays a crucial role in the functioning of the American financial system.

When it comes to conducting business with the IRS or seeking assistance regarding tax-related matters, it is important to know the location of the main IRS office. The main IRS office serves as the headquarters and hub for the agency’s operations, housing various departments and units that handle tax matters at a national level.

In this article, we will delve into the importance of the main IRS office location, discussing the factors considered in selecting this location and delving into the current main IRS office location. Furthermore, we will explore the significance of the current main IRS office location and its impact on the IRS’s accessibility and effectiveness.

Understanding the main IRS office location is essential for individuals and businesses alike, as it provides insights into how the agency operates and how to navigate the system effectively. So, let’s dive in and uncover the secrets behind the main IRS office location.

Understanding the IRS

Before we delve into the main IRS office location, it is crucial to have a comprehensive understanding of the IRS and its role in the American tax system. The Internal Revenue Service is a government agency under the jurisdiction of the Department of the Treasury. Its primary purpose is to administer and enforce the tax laws enacted by the U.S. Congress.

The IRS carries out a range of responsibilities, including tax collection, taxpayer assistance, and tax law enforcement. It ensures that individuals and businesses meet their tax obligations and that the federal government receives the necessary funds to finance public services and programs.

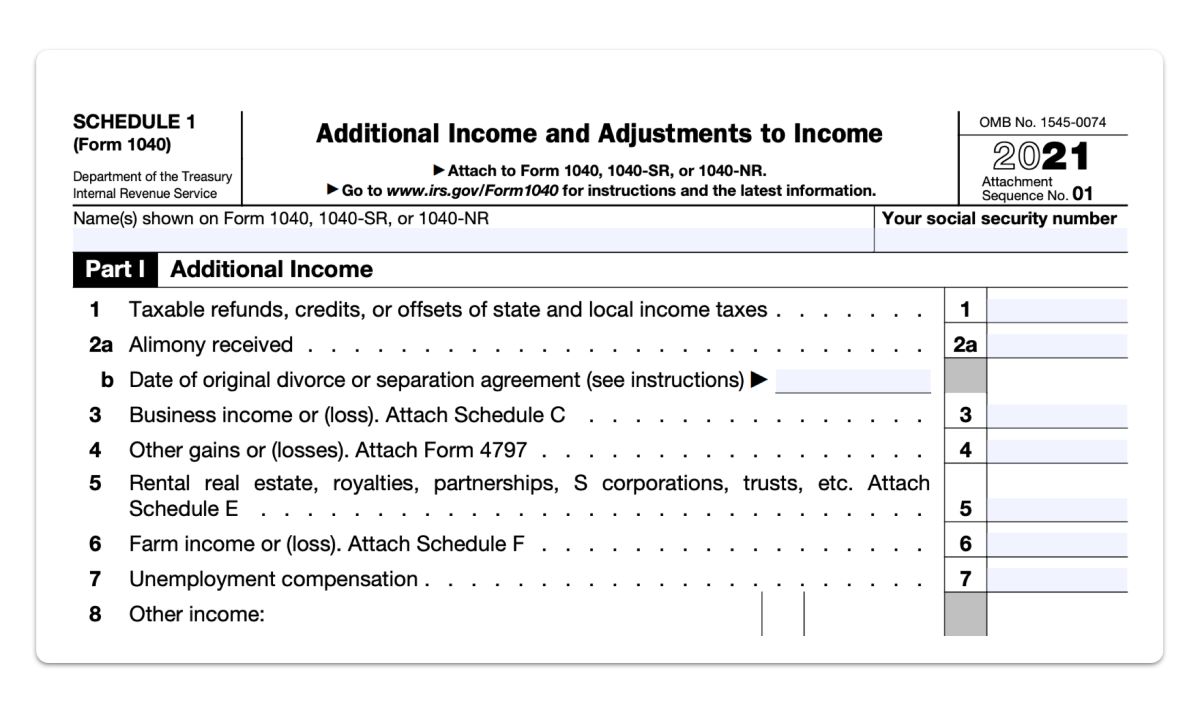

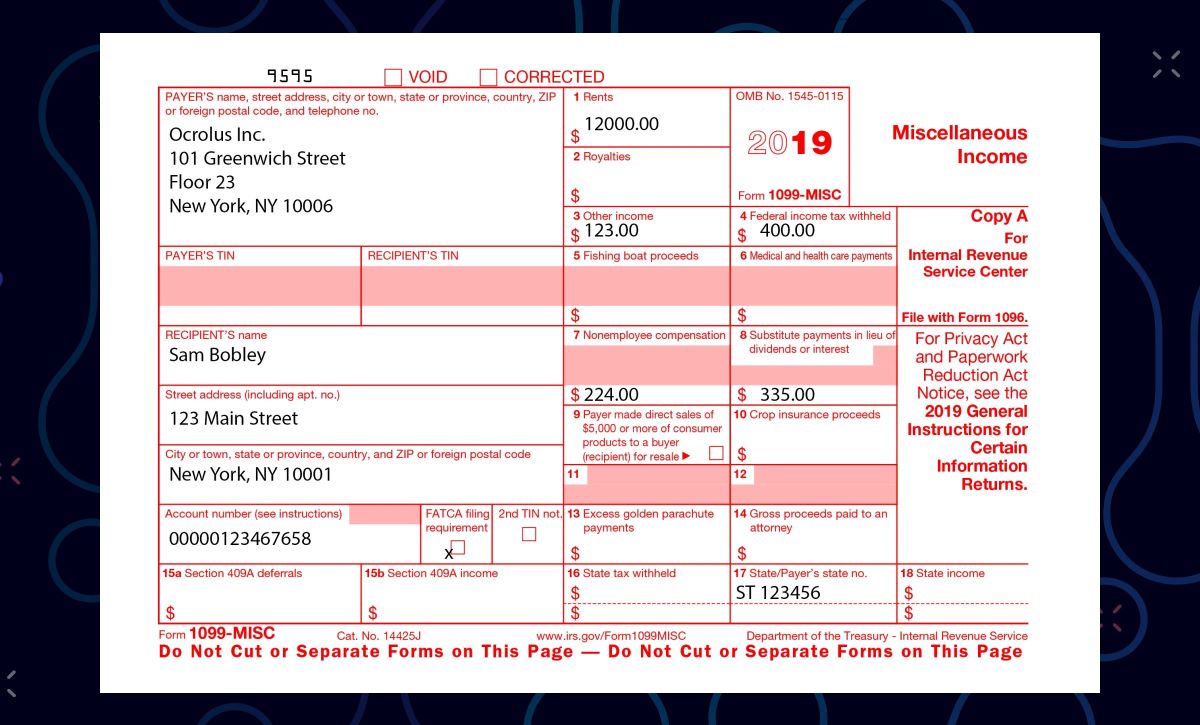

One of the IRS’s primary functions is to collect federal income taxes. Individuals and businesses are required to file tax returns annually, reporting their income and calculating the taxes owed. The IRS is responsible for processing these returns, assessing the correct amount of tax, and collecting any outstanding payments.

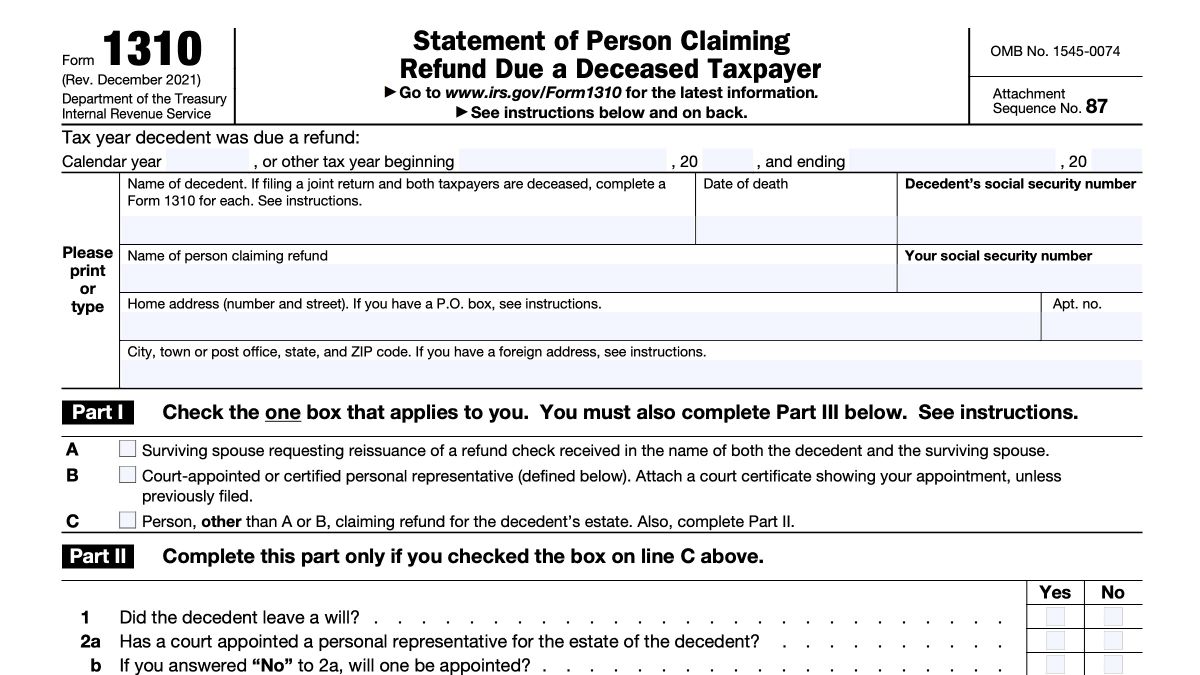

Besides tax collection, the IRS also provides taxpayer assistance and resources. It offers guidance on tax obligations, answers queries, and assists individuals and businesses in understanding the intricacies of the tax code. This support helps taxpayers comply with their obligations and navigate the often complex world of taxes.

Lastly, the IRS is responsible for tax law enforcement. It conducts audits and investigations to ensure compliance with the tax laws, investigates tax fraud, and takes legal action against those who attempt to evade their tax obligations.

Overall, the IRS plays a vital role in maintaining the integrity and fairness of the American tax system. Understanding its purpose and functions is essential for individuals and businesses seeking to fulfill their tax obligations and engage with the agency effectively.

Importance of the Main IRS Office Location

The main IRS office location holds significant importance due to its role as the headquarters and central hub of the agency’s operations. It serves as a key point of contact for individuals and businesses seeking IRS assistance, guidance, and services at a national level. The main IRS office location has several important implications:

- Centralized Decision-Making: Being the main office, it is where key decisions regarding tax policies, enforcement strategies, and operational guidelines are formulated. The centralized decision-making process ensures consistency, efficiency, and uniformity in the application of tax laws and policies across the country.

- Accessibility and Convenience: The main IRS office location is typically situated in a central, easily accessible location, ensuring that individuals and businesses can reach it conveniently. This accessibility is crucial for taxpayers who need to visit the office for in-person assistance, meetings, or to submit important documents.

- Taxpayer Assistance: The main IRS office location houses various departments and units dedicated to providing taxpayer assistance. These departments offer guidance, support, and resources to individuals and businesses navigating the complex landscape of tax regulations. Taxpayers can seek clarification on tax laws, get help with filing returns, and resolve any issues or disputes they may have.

- Enforcement and Compliance: The main IRS office location plays a critical role in enforcing tax laws and ensuring compliance. It coordinates with other IRS offices, both regionally and locally, to enforce tax regulations, conduct audits, and investigate potential cases of tax fraud or evasion. The proximity to key personnel and resources enhances the effectiveness of enforcement efforts.

Understanding the importance of the main IRS office location helps taxpayers and businesses comprehend the significance of engaging with the agency at a national level. Whether it is seeking assistance, obtaining guidance, or complying with tax obligations, knowing the location of the main IRS office enables individuals and businesses to navigate the tax system more effectively and access the necessary resources and support.

Factors Considered in Selecting the Main IRS Office Location

When selecting the main IRS office location, numerous factors come into play to ensure optimal efficiency, accessibility, and effectiveness. The decision involves a thoughtful evaluation of various aspects, including:

- Proximity to Government Centers: The main IRS office is often located in close proximity to other government centers, such as the Department of the Treasury, to facilitate collaboration and coordination among different federal agencies. This proximity streamlines communication and decision-making processes, allowing for more efficient operations.

- Transportation Infrastructure: The availability of robust transportation infrastructure is a crucial consideration. The main IRS office location should have convenient access to major roads, highways, airports, and public transportation systems. This ensures that taxpayers, employees, and stakeholders can easily reach the office and facilitates the movement of resources and personnel.

- Workforce Availability: The main IRS office location requires a skilled and diverse workforce to handle a wide range of tax-related tasks. Therefore, the location is chosen based on the availability of qualified professionals, including tax experts, auditors, investigators, and support staff. Proximity to educational institutions and a strong labor market are often factors in this decision.

- Facility Requirements: The main IRS office location must have adequate physical infrastructure to accommodate the various departments, units, and personnel. This includes office space, meeting rooms, technology infrastructure, and security systems. The facility should be capable of handling a large number of visitors and providing a conducive environment for the efficient administration of tax-related activities.

- Local Tax Regulations: The main IRS office location needs to have a favorable local tax environment that aligns with federal tax laws. This ensures consistency in tax processes and minimizes potential conflicts or challenges arising from discrepancies between federal and local tax regulations.

The selection of the main IRS office location is a strategic decision aimed at optimizing operational efficiency and ensuring the agency’s ability to fulfill its mission of administering and enforcing tax laws. Careful consideration of these factors helps create a centralized location that offers accessibility, collaboration, and the necessary resources to effectively carry out the agency’s responsibilities.

Current Main IRS Office Location

The current main IRS office is located in Washington, D.C., the capital of the United States. More specifically, it is situated at 1111 Constitution Avenue NW, a prominent address in the heart of the city. This central location allows the IRS to be in close proximity to other government institutions and key decision-making centers.

The main IRS office in Washington, D.C. serves as the headquarters of the agency, housing various departments, units, and personnel responsible for administering and enforcing the nation’s tax laws. It is a bustling hub of activity, as employees work diligently to ensure the smooth functioning of the American tax system.

With its strategic location in the nation’s capital, the current main IRS office benefits from an array of advantages. Firstly, it provides easy access to the highest levels of government, facilitating communication and collaboration with other federal agencies and departments. This close proximity allows for swift and efficient decision-making, ensuring a coordinated approach to tax administration.

In addition, the Washington, D.C. location offers a wealth of skilled professionals with expertise in tax matters. The city attracts top talent from diverse fields, including tax law, accounting, finance, and economics, thus providing the IRS with a pool of qualified individuals to recruit from.

Furthermore, the central location of the main IRS office allows for convenient access for taxpayers, stakeholders, and employees. Its proximity to major transportation hubs, such as Union Station and Ronald Reagan Washington National Airport, makes it easily accessible for visitors from across the country.

In terms of facilities, the current main IRS office boasts state-of-the-art infrastructure to support the agency’s operations. It is equipped with advanced technology systems, secure data centers, meeting rooms, and modern office space to facilitate efficient tax administration and provide a conducive work environment for employees.

Overall, the current main IRS office location in Washington, D.C. serves as the nerve center of the agency, enabling it to fulfill its mission with strategic advantages. Its central location, proximity to government institutions, skilled workforce availability, and modern facilities contribute to the IRS’s effectiveness in administering and enforcing tax laws at a national level.

Significance of the Current Main IRS Office Location

The current main IRS office location in Washington, D.C. holds significant importance for the agency and the American tax system as a whole. Its strategic placement in the nation’s capital brings about several key significances:

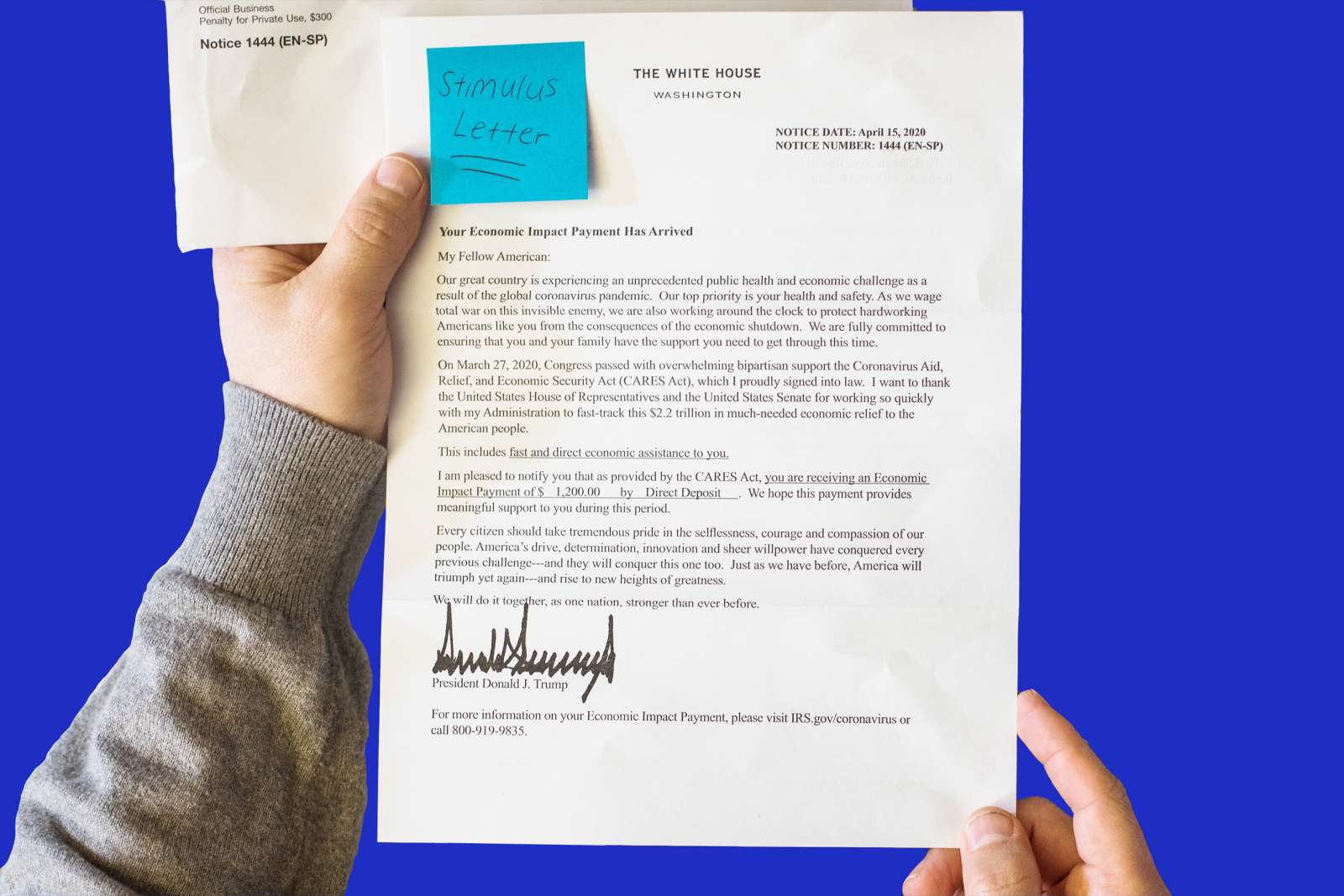

- Government Influence and Collaboration: The proximity to other government institutions in Washington, D.C. enhances the IRS’s ability to collaborate and coordinate with agencies such as the Department of the Treasury, Congress, and the White House. This allows for effective communication, decision-making, and alignment of tax policies to serve the best interests of the nation.

- Policy Development and Legislation: Being situated in the capital city provides the IRS with influences and insights on policy development and legislative changes related to tax laws. By having a closer connection to the decision-making processes, the IRS can actively contribute to shaping tax policies and providing valuable input on potential reforms.

- National Representation: As the main IRS office, the location in Washington, D.C. symbolizes the agency’s national presence and authority. It serves as a tangible representation of the IRS’s role in administering and enforcing tax laws across the entire country.

- Access to Skilled Workforce: The abundance of skilled professionals in Washington, D.C. ensures that the IRS has access to a diverse talent pool. This includes tax experts, lawyers, accountants, auditors, and other professionals with specialized knowledge in tax matters. The availability of such expertise strengthens the agency’s ability to carry out its responsibilities effectively.

- Visibility and Influence: The prominence of the main IRS office location in the capital city offers increased visibility and influence. Media outlets, advocacy groups, and stakeholders regularly engage with the IRS in the nation’s center of political power, further amplifying the agency’s impact and reach.

The significance of the current main IRS office location extends beyond just administrative convenience. It represents the connection between the agency and the government, provides access to a skilled workforce, and serves as a visible symbol of the IRS’s key role in shaping tax policies and enforcing tax laws at a national level.

It is worth noting that while the current main IRS office is in Washington, D.C., the agency has regional and local offices throughout the country. These offices ensure that taxpayers across all states have access to IRS services and support, with the main office acting as the hub of coordination and national-level decision-making.

Conclusion

The main IRS office location plays a vital role in the efficient functioning of the Internal Revenue Service. Situated in Washington, D.C., the current main IRS office serves as the headquarters and central hub for the agency’s operations. Its strategic placement allows for close collaboration with other government institutions, convenient access for taxpayers, and access to a skilled workforce.

Understanding the main IRS office location is essential for individuals and businesses seeking assistance, guidance, or engagement with the agency at a national level. It offers numerous advantages, including centralized decision-making, accessibility, taxpayer assistance, and effective enforcement of tax laws.

The selection of the main IRS office location involves careful consideration of factors such as proximity to government centers, transportation infrastructure, workforce availability, and facility requirements. These factors contribute to the overall efficiency and effectiveness of the IRS and its ability to fulfill its mission of administering and enforcing tax laws.

The current main IRS office location in Washington, D.C. serves as an important symbol of the agency’s authority, national presence, and impact on tax policy development. It serves as the center of coordination and collaboration with other government agencies, allowing for the alignment of tax policies to serve the best interests of the country.

In conclusion, understanding the main IRS office location and its significance enables individuals and businesses to navigate the tax system more effectively, access the necessary resources and support, and contribute to the overall fairness and integrity of the American tax system.