Finance

Where Is My Destiny Credit Card

Modified: March 1, 2024

Discover the perfect finance solution with the Destiny Credit Card. Find out where you can get this powerful tool to manage your finances and reach your goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Destiny Credit Card?

- Benefits of a Destiny Credit Card

- How to Apply for a Destiny Credit Card

- Eligibility Criteria for a Destiny Credit Card

- Features and Fees of a Destiny Credit Card

- Understanding the Rewards Program of a Destiny Credit Card

- Managing and Redeeming Destiny Credit Card Rewards

- Frequently Asked Questions about Destiny Credit Card

- Conclusion

Introduction

Welcome to the world of credit cards where financial freedom and convenience await. If you are on the lookout for a credit card that offers fantastic rewards, flexible terms, and exceptional benefits, then you’ll be thrilled to learn about the Destiny Credit Card.

Designed to cater to the needs and aspirations of individuals like you, the Destiny Credit Card is not just an ordinary credit card. It’s a powerful tool that can unlock a world of possibilities and rewards.

Whether you are dreaming of a luxurious vacation, planning to revamp your home, or simply looking for a card that suits your lifestyle, the Destiny Credit Card can be your ultimate financial companion.

In this article, we will delve into the details of what the Destiny Credit Card has to offer, the benefits it provides, and how you can apply for one. We will also explore the eligibility criteria, features, fees, and the rewards program associated with this exciting credit card.

So, let’s dive in and discover all the reasons why the Destiny Credit Card might just be the perfect financial tool for you.

What is a Destiny Credit Card?

A Destiny Credit Card is a type of credit card that is designed to provide cardholders with a range of benefits, rewards, and exclusive offers. It is issued by a financial institution and can be used for various purchases and transactions.

With a Destiny Credit Card, you have the flexibility to make purchases both online and offline, and enjoy the convenience of paying for them at a later date. This can be especially useful when making large purchases or during times when you need some financial flexibility.

What sets the Destiny Credit Card apart from other credit cards is its unique rewards program. Cardholders can earn points or cashback rewards on every purchase they make using the card. These rewards can then be redeemed for a variety of options, such as travel vouchers, merchandise, gift cards, or even statement credits.

In addition to the rewards program, a Destiny Credit Card may also come with other benefits and perks, such as travel insurance, extended warranty on purchases, roadside assistance, and access to exclusive events and discounts.

It’s important to note that while a Destiny Credit Card offers many advantages, it’s essential to use it responsibly. This means making timely payments, avoiding carrying a high balance, and staying within your credit limit. By doing so, you can enjoy the benefits without falling into debt.

Now that we understand what a Destiny Credit Card is, let’s explore the numerous benefits it offers and how it can enhance your financial life.

Benefits of a Destiny Credit Card

The Destiny Credit Card comes with a host of benefits that can make your financial journey more rewarding and convenient. Let’s explore some of the key advantages:

- Rewards Program: One of the standout features of the Destiny Credit Card is its rewards program. Every purchase you make with the card earns you points or cashback rewards, which can be redeemed for a wide range of options, including travel, merchandise, or even statement credits.

- Flexible Redemption Options: The rewards you earn on your Destiny Credit Card can be redeemed in a variety of ways, giving you the flexibility to choose the option that suits your needs best. Whether you prefer to use your rewards for travel, shopping, or simply reducing your statement balance, the choice is yours.

- Exclusive Discounts and Offers: As a Destiny Credit Card holder, you may be eligible for exclusive discounts and offers on a range of products and services. From dining to shopping to entertainment, these perks can help you save money and enhance your overall shopping experience.

- Travel Benefits: If you are a frequent traveler, you’ll be pleased to know that the Destiny Credit Card offers travel-related benefits, such as travel insurance coverage for accidents or trip cancellations. Additionally, some cards may provide access to airport lounges and discounted hotel bookings.

- Security and Fraud Protection: With advanced security features and fraud protection measures, you can have peace of mind knowing that your transactions with the Destiny Credit Card are safe and secure. Many cards offer zero-liability protection, meaning you won’t be held responsible for unauthorized charges.

- Build Your Credit History: Using a Destiny Credit Card responsibly can help you build a positive credit history. Timely payments and responsible credit usage demonstrate your financial reliability and can open doors to better credit options in the future, such as loans or mortgages.

These are just a few of the benefits you can enjoy with a Destiny Credit Card. Each card may have its own unique perks and rewards, so it’s important to carefully review the terms and conditions to choose the one that aligns with your lifestyle and financial goals.

Now that we understand the benefits of a Destiny Credit Card, let’s move on to the next step and explore how you can apply for one.

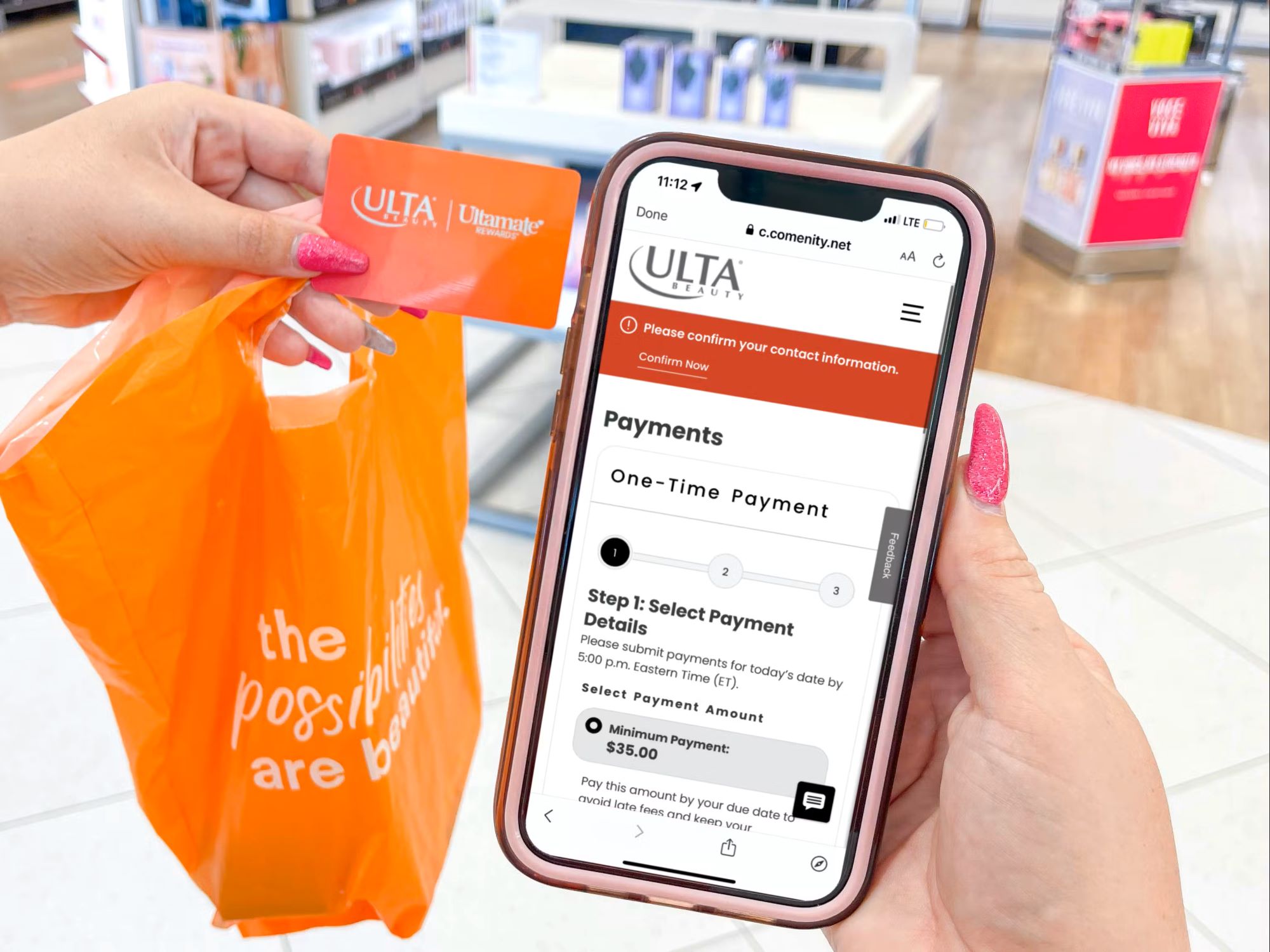

How to Apply for a Destiny Credit Card

Applying for a Destiny Credit Card is a straightforward process. Follow these steps to submit your application:

- Research: Before applying, take some time to research and compare different Destiny Credit Card options available in the market. Look for cards that offer the rewards, benefits, and features that align with your needs and preferences.

- Check Eligibility: Review the eligibility criteria for the Destiny Credit Card you are interested in. Typically, this includes factors such as age, income, employment status, and credit history. Make sure you meet the requirements before proceeding with the application.

- Start the Application: Once you have chosen the Destiny Credit Card you want to apply for, visit the issuer’s website or go to a local branch to start the application process. Many issuers also offer online applications for convenience.

- Provide Personal Information: Fill out the application form with accurate and up-to-date personal information. This includes details such as your name, contact information, date of birth, social security number, and residential address.

- Provide Financial Information: You will need to provide information about your employment status, income, and expenses. The issuer will use this information to assess your creditworthiness and determine your credit limit.

- Read and Agree to Terms: carefully review the terms and conditions of the Destiny Credit Card before submitting your application. Pay special attention to the interest rates, fees, and any additional requirements.

- Submit Documentation: In some cases, you may be required to provide supporting documentation such as proof of income or identification. Ensure you have the necessary documents ready to complete the application process.

- Await Approval: After submitting your application, the issuer will review your information and assess your eligibility. This process may take a few days to a few weeks. Be patient and wait for the issuer to communicate their decision.

- Activate and Start Using: Once your application is approved, you will receive your Destiny Credit Card in the mail. Activate the card as instructed by the issuer and begin using it for your purchases.

It’s important to note that the application process may vary slightly depending on the issuer and the specific Destiny Credit Card you are applying for. It’s always a good idea to read the guidelines provided by the issuer and seek assistance if needed.

Now that you know how to apply for a Destiny Credit Card, let’s move on to the next section and explore the eligibility requirements in more detail.

Eligibility Criteria for a Destiny Credit Card

Before applying for a Destiny Credit Card, it’s important to familiarize yourself with the eligibility criteria set by the issuer. While specific requirements may vary depending on the card and the issuer, here are some common factors that determine your eligibility:

- Age: You must typically be at least 18 years old to apply for a credit card. In some cases, the minimum age requirement may be higher.

- Residency: You are usually required to be a resident of the country where the Destiny Credit Card is being issued. Proof of residence, such as a utility bill or driver’s license, may be necessary during the application process.

- Income: Many Destiny Credit Cards have a minimum income requirement. This ensures that you have the financial means to repay the credit card charges. The income threshold varies based on the card and your location.

- Credit History: Your credit history plays a significant role in determining your creditworthiness. A good credit score increases your chances of approval. If you have limited credit history or a poor credit score, you may have to consider secured credit card options or work on improving your credit before applying for a Destiny Credit Card.

- Employment: Some Destiny Credit Cards require you to have a steady source of income. While employment is often preferred, some issuers may consider alternative sources of income, such as retirement benefits or investments.

- Debt-to-Income Ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards paying off debts. Most issuers set a maximum limit on this ratio to ensure that you are not overwhelmed by excessive debt.

- Existing Relationship: Certain issuers give priority to existing customers, such as those who have a savings or checking account with the bank. Having a relationship with the issuer can improve your chances of approval.

It’s important to remember that meeting the eligibility criteria does not guarantee approval for a Destiny Credit Card. Issuers have their own internal evaluation process, and other factors, such as the overall creditworthiness of applicants, may also be considered.

If you are unsure about your eligibility or have specific questions regarding the requirements, it’s best to reach out to the issuer directly for clarification.

Now that we’ve covered the eligibility criteria, let’s move on to explore the features and fees associated with a Destiny Credit Card.

Features and Fees of a Destiny Credit Card

Understanding the features and fees associated with a Destiny Credit Card is crucial before committing to one. Here are some key aspects to consider:

- Interest Rates: Destiny Credit Cards typically have an annual percentage rate (APR) that applies to balances carried forward from month to month. The interest rate will vary depending on factors such as your credit score and the issuer’s policies. It’s important to note that the interest charges can add up quickly if you carry a balance, so it’s advisable to pay off your balance in full each month.

- Credit Limit: The credit limit is the maximum amount you can borrow on your Destiny Credit Card. The initial credit limit is determined by the issuer based on factors like your creditworthiness, income, and other financial obligations. Responsible usage of the card may lead to credit limit increases over time.

- Annual Fee: Some Destiny Credit Cards may have an annual fee that is charged for the convenience and benefits offered by the card. Consider whether the rewards and perks outweigh the cost of the annual fee before choosing a card. Many credit cards offer no annual fee options, so explore different options to find the most suitable one for you.

- Foreign Transaction Fees: If you frequently travel abroad or make purchases in foreign currencies, you should be aware of any foreign transaction fees associated with the Destiny Credit Card. These fees are typically a percentage of the transaction amount and can add up quickly if you frequently engage in international transactions.

- Balance Transfer Fees: Some Destiny Credit Cards offer balance transfer facilities, allowing you to transfer balances from other credit cards to consolidate your debt or take advantage of promotional interest rates. However, balance transfers often come with a fee, usually a percentage of the transferred amount.

- Cash Advance Fees: If you plan to use your credit card for cash advances, be aware that there may be cash advance fees associated with the transaction. This fee is typically a percentage of the cash amount withdrawn and may also have a higher interest rate compared to regular purchases.

- Purchase Protection and Insurance: Many Destiny Credit Cards offer purchase protection, extended warranty coverage, and other insurance options to safeguard your purchases. Familiarize yourself with the specific benefits offered by the card to take advantage of these features if needed.

- Payment Flexibility: Consider whether the Destiny Credit Card offers flexible payment options that suit your needs. Some cards may provide options like minimum payment flexibility, which allows you to pay a smaller portion of the outstanding balance if needed. However, keep in mind that paying only the minimum amount will result in interest charges accumulating on the remaining balance.

It’s important to review the features and fees of each Destiny Credit Card option you are considering. By comparing different cards, you can choose the one that aligns with your financial goals and preferences.

Now that you are familiar with the features and fees, let’s move on to explore the rewards program of a Destiny Credit Card.

Understanding the Rewards Program of a Destiny Credit Card

The rewards program of a Destiny Credit Card is undoubtedly one of its most appealing features. By understanding the rewards program, you can make the most of your credit card spending and reap numerous benefits. Here’s what you need to know:

Earning Rewards: Each time you make a purchase with your Destiny Credit Card, you have the opportunity to earn rewards. The specific earning structure may vary depending on the card, but the general concept is that you receive a certain number of points or cashback for every dollar spent. Some cards may offer higher rewards for specific categories such as dining, travel, or gas purchases.

Redeeming Rewards: Once you have accumulated a certain number of rewards points or cashback, you can redeem them for various options. These options can include travel vouchers, flight bookings, hotel stays, merchandise, gift cards, statement credits, and more. It’s important to read the terms and conditions of the rewards program to understand how and where you can redeem your rewards.

Additional Benefits: In addition to the regular rewards structure, some Destiny Credit Cards offer additional benefits to enhance your rewards experience. This may include sign-up bonuses where you earn a large number of points after meeting certain spending requirements within a specified time frame. Other benefits could include access to exclusive events, concierge services, or special discounts with partner merchants.

Reward Expiration: It’s important to be aware of the expiration policy of your Destiny Credit Card’s reward program. Some rewards have an expiration date, meaning they must be redeemed within a certain time frame to avoid losing them. Keep track of your rewards balance and be sure to utilize them before they expire.

Managing Multiple Reward Programs: If you have multiple credit cards with different rewards programs, it can be challenging to keep track of your points and maximize your rewards. Utilize mobile apps or online platforms provided by the issuer to keep an organized record of your rewards and strategize your redemption options effectively.

Annual Fees and Rewards: Consider whether the rewards earned from the Destiny Credit Card outweigh any annual fees associated with the card. If the rewards earned far exceed the annual fee, it can be a worthwhile investment. However, if the rewards do not justify the fee, it may be worth exploring other options or negotiating with the issuer to waive the fee.

Remember to thoroughly read the terms and conditions of the rewards program, as each Destiny Credit Card may have specific rules and limitations that apply. Understanding the rewards program will enable you to make the most of your credit card usage and enjoy the benefits it offers.

Now that you have a good understanding of the rewards program, let’s move on to explore how to manage and redeem your Destiny Credit Card rewards.

Managing and Redeeming Destiny Credit Card Rewards

Managing and redeeming your Destiny Credit Card rewards is an essential aspect of maximizing the benefits and value of your credit card. By following these steps, you can effectively manage and make the most of your rewards:

- Keep Track of Your Rewards: Stay informed about your rewards balance by regularly reviewing your credit card statements, accessing your online account, or using the issuer’s mobile app. It’s essential to understand how many rewards you have accumulated and when they will expire.

- Understand Redemption Options: Familiarize yourself with the redemption options offered by your Destiny Credit Card. This can range from travel vouchers and merchandise to gift cards or statement credits. Some issuers have online portals or dedicated customer service lines to assist you in redeeming your rewards.

- Consider Value and Flexibility: When deciding how to redeem your rewards, carefully evaluate the value and flexibility of each option. For example, using rewards for travel may give you a higher value compared to gift cards, while statement credits can provide more immediate financial relief.

- Check for Promotions: Keep an eye out for any promotional offers or deals that may provide extra value when redeeming your rewards. Some issuers offer limited-time promotions where you can get more rewards or exclusive perks by utilizing your rewards within a specific timeframe.

- Plan Ahead for Travel: If you plan to redeem your rewards for travel, it’s advisable to plan and book in advance. Many travel-related rewards have limited availability, and booking early can help secure your desired flights or accommodations.

- Combine Points and Cash: Some Destiny Credit Cards offer the option to combine points and cash when making a redemption. This can be useful if you have a partial points balance and want to maximize their value by combining them with a smaller cash payment.

- Utilize Bonus Categories: Take advantage of any bonus categories that offer higher rewards for specific types of purchases. If your card provides extra rewards for dining or travel, be sure to use it for those purchases to maximize your rewards potential.

- Regularly Review Rewards Program Terms: Rewards programs can evolve and change over time, so make it a habit to review the terms and conditions of your Destiny Credit Card’s rewards program. This will help you stay informed about any updates, rule changes, or new redemption opportunities.

By effectively managing and redeeming your Destiny Credit Card rewards, you can enjoy the benefits, discounts, and perks that come with your credit card. Remember to stay organized, plan ahead, and make informed decisions to make the most of your rewards.

In the next section, we will address some frequently asked questions about Destiny Credit Cards to provide you with further clarity and guidance.

Frequently Asked Questions about Destiny Credit Card

Here are some commonly asked questions about Destiny Credit Cards along with their answers:

- What is the minimum credit score required to be eligible for a Destiny Credit Card?

- Can I apply for a Destiny Credit Card if I have no credit history?

- Can I upgrade or downgrade my Destiny Credit Card?

- Is there a fee to redeem rewards from a Destiny Credit Card?

- Will my Destiny Credit Card rewards expire?

- Can I transfer my Destiny Credit Card rewards to another credit card or loyalty program?

- What happens to my rewards if I close my Destiny Credit Card account?

- What should I do if I notice unauthorized charges on my Destiny Credit Card statement?

The minimum credit score required can vary depending on the specific Destiny Credit Card and the issuer. Generally, a good credit score (around 670 or higher) increases your chances of approval. However, some issuers may offer options for individuals with limited credit history or lower credit scores.

Yes, some Destiny Credit Cards cater to individuals with limited or no credit history. These cards may require a co-signer or a security deposit to mitigate the risk for the issuer. Responsible usage of such a card can help build your credit history.

Some issuers allow cardholders to upgrade or downgrade their credit cards within their product lineup. This can be done to avail of better benefits or to switch to a card with a lower annual fee. Contact your issuer to inquire about their upgrade or downgrade options.

Typically, there are no fees associated with redeeming rewards from a Destiny Credit Card. However, it’s important to review the terms and conditions of your specific card to ensure there are no surprise fees.

Rewards expiration varies depending on the card and the issuer. Some rewards may have an expiration period, while others may have no expiration. It’s important to keep track of the expiration dates and utilize your rewards before they expire.

The ability to transfer rewards from your Destiny Credit Card to another credit card or loyalty program depends on the specific card and issuer. Some issuers may allow transfers to partner programs or other credit cards within their portfolio. Check with your issuer for any available transfer options.

When you close your Destiny Credit Card account, you may lose any unredeemed rewards associated with that account. It’s generally advised to redeem your rewards before closing the account to ensure you maximize their value.

If you notice any unauthorized charges on your Destiny Credit Card statement, contact your issuer immediately. They will guide you on the necessary steps to dispute the charges and protect your account from further unauthorized activity.

These are just a few frequently asked questions about Destiny Credit Cards. If you have specific inquiries or concerns, it’s best to reach out to the issuer directly for assistance and clarifications.

Now that we have addressed some common questions, let’s move on to the concluding section.

Conclusion

Choosing the right credit card can significantly impact your financial journey, and the Destiny Credit Card offers a range of benefits and rewards that can enhance your overall experience. By understanding the features, fees, rewards program, and eligibility criteria of the Destiny Credit Card, you can make an informed decision and maximize the benefits it provides.

The Destiny Credit Card’s rewards program allows you to earn points or cashback on your purchases, which can be redeemed for various options that align with your lifestyle and preferences. The flexibility in redemption, exclusive discounts, and additional perks make the Destiny Credit Card a valuable financial tool.

However, it’s important to manage your credit card responsibly and be aware of the fees and interest rates associated with carrying a balance. By paying your bills on time and avoiding unnecessary debt, you can make the most of the Destiny Credit Card’s benefits without falling into financial stress.

Before applying for a Destiny Credit Card, take the time to compare options, understand the rewards program, and ensure that you meet the eligibility criteria. Make sure to read and review the terms and conditions, including any annual fees, foreign transaction fees, and other charges.

Ultimately, a Destiny Credit Card can be a powerful financial tool that provides convenience, rewards, and peace of mind. With responsible usage and strategic redemption of rewards, this credit card can become an invaluable asset in your financial journey.

Take the next step and apply for a Destiny Credit Card today to unlock a world of possibilities and rewards that will enhance your financial well-being.