Finance

Where Is My Credit Card Information Stored

Modified: March 1, 2024

Discover where your credit card information is stored and learn about the importance of secure finance management in this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Information Storage

- Common Locations for Credit Card Information Storage

- Online Retailers and Payment Processors

- Physical Merchants and Point-of-Sale Systems

- Mobile Wallets and Payment Apps

- Credit Card Companies and Financial Institutions

- Risks and Security Measures

- Protecting Your Credit Card Information

- Conclusion

Introduction

When it comes to making purchases in today’s digital age, credit cards have become an essential tool for consumers. However, have you ever stopped to wonder where your credit card information is stored? With the increasing prevalence of data breaches and online fraud, understanding how and where your sensitive financial information is stored is crucial.

Every time you swipe your credit card or make an online purchase, your credit card information is being processed, transmitted, and stored by various entities involved in the payment process. From online retailers and payment processors to physical merchants and financial institutions, your credit card data goes through a complex network to ensure a smooth transaction.

In this article, we will delve into the world of credit card information storage and explore the common locations where your credit card data is stored. We will also discuss the potential risks associated with storing this information and the security measures in place to protect it. By understanding these key aspects, you will be better equipped to safeguard your credit card information and make informed decisions regarding your financial transactions.

Understanding Credit Card Information Storage

Before we delve into the specific locations where credit card information is stored, it’s essential to have a basic understanding of how this sensitive data is handled. Whenever you make a purchase using your credit card, your card details are collected and processed by the merchant or payment processor. This information typically includes your card number, expiry date, and security code on the back of the card.

Once the transaction is initiated, your credit card details are encrypted to protect them during transmission. Encryption ensures that the information is encoded in a way that makes it unintelligible to unauthorized parties. This process helps safeguard your credit card data as it travels from the point of sale to the storage location.

After the transaction is completed, the merchant or payment processor stores your credit card information in their systems for future reference. The storage of this data is subject to strict security protocols to ensure the protection of customer information. It’s important to note that credit card information is often stored separately from other details such as your name and address, further minimizing the risk of unauthorized access.

It’s crucial to understand that credit card information is stored in multiple locations throughout the payment process. This distribution of data helps mitigate the risk of a single point of failure and enhances the security of your information. In the following sections, we will explore some of the common locations where credit card information is stored.

Common Locations for Credit Card Information Storage

When it comes to the storage of credit card information, there are several common locations where your data may be stored. These include online retailers and payment processors, physical merchants and point-of-sale systems, mobile wallets and payment apps, as well as credit card companies and financial institutions.

Online Retailers and Payment Processors: When you make a purchase online, your credit card information is typically stored by the retailer or the payment processor handling the transaction. This allows for smoother and faster checkout experiences for returning customers. To ensure the security of your data, reputable online retailers and payment processors employ robust encryption techniques and comply with industry security standards.

Physical Merchants and Point-of-Sale Systems: When you make a purchase in a physical store, your credit card information may be stored within the merchant’s point-of-sale (POS) system. This enables them to process returns, refunds, and provide receipts. Merchants are required to comply with security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), to protect customer information stored within their systems.

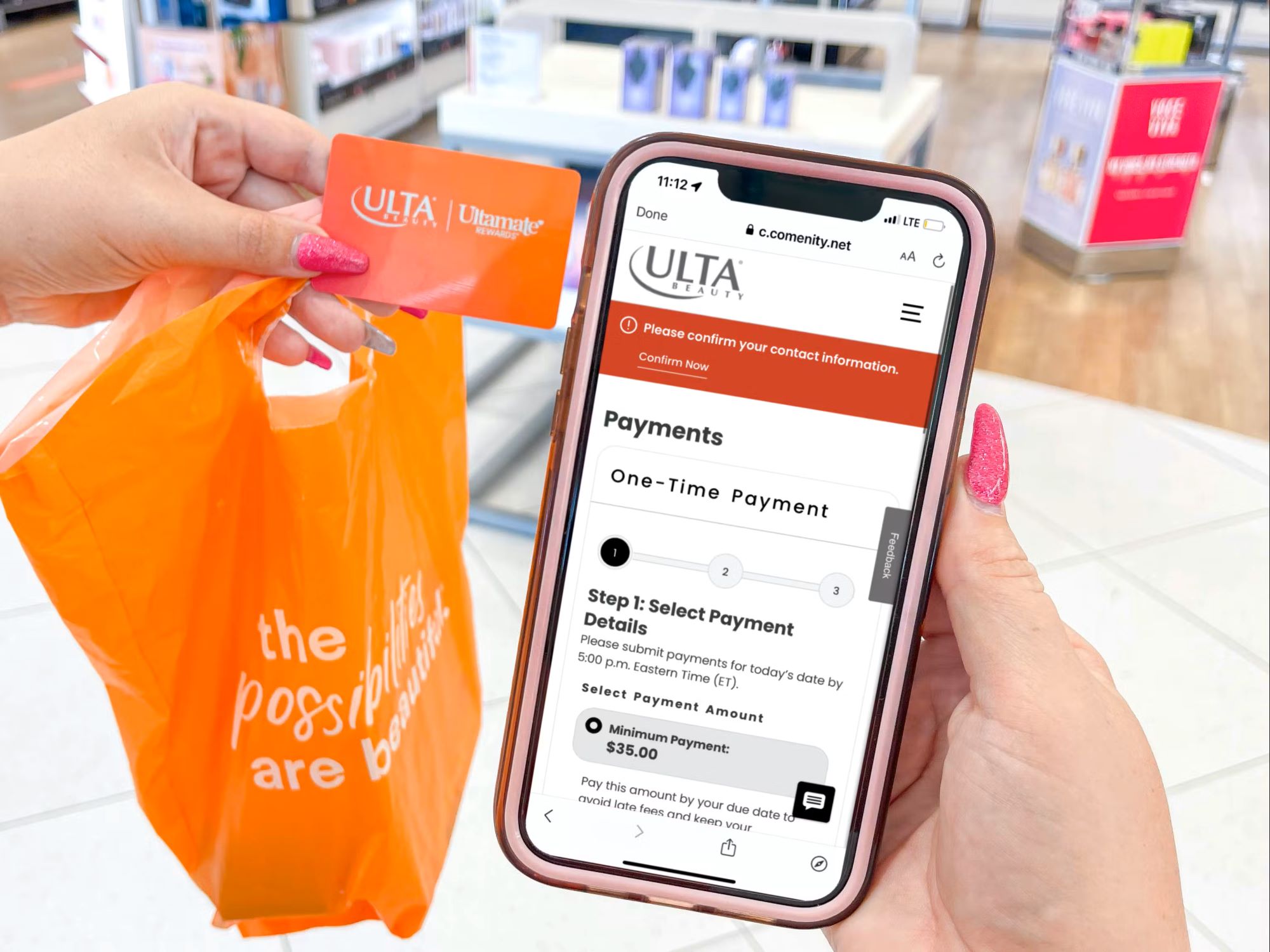

Mobile Wallets and Payment Apps: With the rise of mobile payment solutions, credit card information is often stored within mobile wallets and payment apps on your smartphone. These platforms offer convenience by allowing you to make contactless payments using your device. Similar to online retailers and payment processors, mobile wallets and payment apps employ encryption and other security measures to protect your credit card data.

Credit Card Companies and Financial Institutions: Credit card information is also stored by the credit card companies themselves and the financial institutions that issue the cards. This data is crucial for account management, billing, and fraud prevention. Credit card companies and financial institutions have extensive security measures in place to safeguard your sensitive information from unauthorized access.

While these are the common locations for credit card information storage, it’s important to note that the specific practices and security measures may vary among different entities. Regardless of where your credit card information is stored, stringent security protocols are implemented to protect your data and minimize the risk of unauthorized access or fraud.

Online Retailers and Payment Processors

One of the primary locations where credit card information is stored is with online retailers and payment processors. As more and more consumers opt for the convenience of shopping online, it has become necessary for retailers to securely store customers’ credit card data to facilitate smooth and seamless transactions.

When you make a purchase from an online retailer, your credit card information is typically captured during the checkout process. The retailer may store this information securely so that you can make future purchases without having to re-enter your details each time. This feature is especially popular among e-commerce platforms and online marketplaces that have a high volume of returning customers.

Payment processors play a crucial role in the online payment ecosystem. They act as intermediaries between the merchant and the customer’s bank, handling the processing and authorization of credit card transactions. Payment processors, such as PayPal, Stripe, or Square, are responsible for securely transmitting the credit card data from the customer to the bank for verification and approval.

To ensure the security of your credit card information, online retailers and payment processors implement various security measures. One of the key security measures is encryption, which converts your credit card data into an unreadable format during transmission. This cryptographic process makes it extremely difficult for hackers or unauthorized parties to intercept and decipher your information.

In addition to encryption, online retailers and payment processors adhere to strict industry security standards, such as the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS outlines a set of requirements for securely processing, storing, and transmitting credit card data, including guidelines for network security, access controls, and regular monitoring of systems for potential vulnerabilities.

To further protect your credit card information, it is common for online retailers and payment processors to tokenize the data. Tokenization is the process of replacing the actual credit card information with a unique identifier called a token. This token is then used for future transactions, keeping the sensitive data secure in a separate storage system.

When choosing to make a purchase online, it is important to ensure that you are dealing with reputable and trustworthy retailers and payment processors. Look for trusted security badges, such as SSL certificates or PCI compliance logos, on the website as indicators of the company’s commitment to protecting customer information.

By understanding the safeguards put in place by online retailers and payment processors, you can have peace of mind knowing that your credit card information is being stored securely during your online shopping experiences.

Physical Merchants and Point-of-Sale Systems

When you make a purchase at a physical store, your credit card information may be stored within the merchant’s point-of-sale (POS) system. Point-of-sale systems are the devices used by merchants to accept credit and debit card payments in-store. These systems are equipped with hardware and software components that facilitate the transaction process.

The primary purpose of storing credit card information within POS systems is to enable merchants to process returns, refunds, and provide receipts. By storing the necessary payment details, the merchant can retrieve the transaction information and complete these additional services efficiently.

However, it’s important to note that not all merchants store credit card information within their POS systems. Small businesses or those with lower transaction volumes may choose not to store card data due to the increased security risks associated with storage. In such cases, the merchant may only retain transaction receipts, without storing any sensitive payment information.

Merchants who do store credit card information within their POS systems must adhere to strict security standards to protect customer data. The most widely recognized standard is the Payment Card Industry Data Security Standard (PCI DSS), which sets standards for handling, storing, and transmitting credit card information securely.

Under the PCI DSS, merchants are required to implement various security measures to protect credit card data. These measures include firewall protection, data encryption, restricted access to stored information, regular security audits, and employee education on data security practices.

To mitigate the risk of data breaches, some modern point-of-sale systems implement end-to-end encryption (E2EE) technology. E2EE ensures that credit card data is encrypted at the point of capture and remains encrypted until it reaches the payment processor. This greatly reduces the risk of unauthorized access to the credit card information stored within the POS system.

Furthermore, many merchants are transitioning to tokenization methods to enhance security. Tokenization replaces the credit card information with a unique token that is stored within the POS system. Even if the POS system is compromised, the token is useless to attackers as it cannot be used to retrieve the original credit card data.

When making purchases at physical merchants, it’s important to be vigilant about the security practices they employ. Look for signs of PCI compliance or consult with the merchant to understand how they handle and store credit card information. Being aware of these practices can help ensure that your credit card data is handled securely during in-store transactions.

Mobile Wallets and Payment Apps

In the era of smartphones and digital payments, mobile wallets and payment apps have gained significant popularity. These platforms provide consumers with the convenience of making contactless payments using their mobile devices. Examples of popular mobile wallets and payment apps include Apple Pay, Google Pay, Samsung Pay, and various banking apps.

When it comes to storing credit card information, mobile wallets and payment apps employ advanced security measures to protect your data. These applications link your credit card details to a virtual representation of your card within the app, allowing you to make payments without physically presenting your physical card.

Mobile wallets and payment apps utilize a variety of security measures to ensure the protection of your credit card information. One of the key methods is tokenization. When you add your credit card to a mobile wallet or payment app, the app generates a unique token to represent your card details. This token is stored securely within the app, and the actual credit card number is not disclosed during the transaction process.

Additionally, mobile wallets and payment apps often require additional layers of security, such as biometric authentication (fingerprint or facial recognition) or a passcode, before allowing access to your stored credit card information. These authentication measures enhance the security of your data, ensuring that only authorized users can make payments using the stored credit card details.

Mobile wallet providers also collaborate with payment networks and financial institutions to implement robust security standards. They comply with industry regulations and security frameworks to protect customer data and prevent unauthorized access or fraudulent transactions.

When you make a payment using a mobile wallet or payment app, your credit card information is securely transmitted through encrypted channels to the merchant’s payment processor. This process prevents interception and ensures that your payment details remain confidential.

In the event that your mobile device is lost or stolen, most mobile wallet providers offer remote functionality to disable or suspend your digital wallet, preventing any unauthorized access to your credit card information. This feature provides an added layer of security and peace of mind for users.

It’s important to note that the security measures implemented by mobile wallet providers and payment apps may vary. It’s recommended to use reputable and well-known apps, as they typically have robust security protocols in place to protect your credit card information.

By leveraging the security features of mobile wallets and payment apps, you can enjoy the convenience of contactless payments while keeping your credit card information safe and protected.

Credit Card Companies and Financial Institutions

When it comes to credit card information storage, credit card companies and financial institutions play a crucial role. These entities store and manage vast amounts of customer data as part of their card issuance and account management processes.

Credit card companies, such as Visa, Mastercard, American Express, and Discover, maintain comprehensive databases containing customer credit card information. This information is essential for identifying cardholders, tracking transactions, and ensuring account integrity.

Financial institutions, including banks and credit unions, are responsible for issuing credit cards to their customers. To effectively manage credit card accounts, these institutions store credit card information securely in their systems.

When you apply for a credit card, your personal and financial information is collected by the financial institution to assess your eligibility. This information includes your name, address, social security number, and credit card details. The credit card details typically consist of your credit card number, expiry date, and security code.

Once your application is approved, the financial institution retains your credit card details for account management purposes. This allows them to process transactions, handle billing, and enforce security measures. Credit card companies and financial institutions utilize highly sophisticated security systems to protect the confidentiality and integrity of their customers’ credit card information.

When it comes to credit card data storage, robust security measures are implemented by credit card companies and financial institutions. These security measures include advanced encryption techniques, restricted access to the stored information, regular security audits, and the implementation of strict security protocols.

Additionally, credit card companies and financial institutions comply with industry regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). This standard provides guidelines and requirements for secure storage, processing, and transmission of credit card data to prevent unauthorized access and data breaches.

It’s important to note that credit card companies and financial institutions have strict policies in place to prevent unauthorized access to customer information. These policies govern employee access, data handling procedures, and data retention practices.

If you suspect any unauthorized activity or potential fraud related to your credit card, it’s crucial to contact your credit card company or financial institution immediately. They have dedicated fraud detection and prevention teams that can take immediate action to safeguard your account and investigate any suspicious transactions.

By entrusting your credit card information to reputable credit card companies and financial institutions, you can have confidence that your data is stored securely and that appropriate measures are in place to protect your financial information.

Risks and Security Measures

While credit card information storage is essential for the smooth operation of our modern payment systems, it also comes with inherent risks. Cybercriminals are constantly devising new techniques to breach security measures and gain unauthorized access to sensitive financial data.

Some of the key risks associated with credit card information storage include:

- Data Breaches: Hackers may attempt to breach the security systems of entities storing credit card information, leading to the exposure of sensitive data. Large-scale data breaches can result in the compromise of thousands or even millions of individuals’ credit card details.

- Phishing Attacks: Cybercriminals may use fraudulent emails, websites, or phone calls to trick individuals into providing their credit card information voluntarily. These phishing attacks can be very sophisticated and convincing, making it easy for individuals to unknowingly disclose their card details.

- Malware and Spyware: Malicious software can infiltrate computer systems and mobile devices, capturing credit card information as it is being entered or transmitted. This can happen through infected websites, email attachments, or compromised mobile apps.

- Physical Theft: Physical theft of credit card information can occur when skimming devices or hidden cameras capture credit card details at point-of-sale terminals or ATMs. This stolen data can then be used for fraudulent transactions.

To combat these risks and protect credit card information, various security measures are implemented:

- Encryption: Encryption is utilized to convert credit card data into an unreadable format, thereby preventing unauthorized access and ensuring the confidentiality of the information during transmission.

- Tokenization: Tokenization replaces the actual credit card information with a unique identifier, or token, which is stored securely. Even if the token is somehow compromised, it cannot be used to decipher the original credit card data.

- Multi-Factor Authentication: Multi-factor authentication adds an extra layer of security by requiring users to provide additional proof of identity, such as a fingerprint scan or a one-time passcode, when accessing or using credit card information.

- Regular Audits and Penetration Testing: Entities storing credit card information often conduct regular security audits and penetration testing to identify vulnerabilities and address them promptly. This helps ensure that security protocols are up-to-date and effective.

- Security Awareness and Training: Organizations educate their employees about security best practices and conduct training sessions to increase awareness of potential risks, such as phishing attacks or physical theft, to prevent unintended disclosures of credit card information.

It’s important for individuals to also take responsibility for protecting their credit card information. Some measures individuals should consider include:

- Only sharing credit card information on trusted and secure websites.

- Regularly monitoring bank and credit card statements for any suspicious activity.

- Keeping credit card information confidential and avoiding sharing it with unauthorized individuals.

- Using strong, unique passwords for online accounts.

- Updating software and apps regularly to ensure you have the latest security patches.

By implementing these security measures and staying vigilant, we can collectively work towards minimizing the risks associated with credit card information storage and protect our sensitive financial data.

Protecting Your Credit Card Information

In today’s digital age, protecting your credit card information is of paramount importance. By following some simple yet effective practices, you can minimize the risk of unauthorized access and potential fraud. Here are some key steps to help protect your credit card information:

- Keep Your Physical Card Secure: Ensure that you keep your credit card in a safe place, such as a wallet or purse, and avoid leaving it unattended. Be mindful of your surroundings when using your card in public locations to prevent others from stealing your card information.

- Only Share Information with Trusted Sources: Be cautious when sharing your credit card details, whether online, over the phone, or in person. Only provide your information to trusted and reputable organizations that have secure payment systems.

- Secure Your Online Transactions: When making online purchases, ensure that the website has a secure connection. Look for “https://” and a padlock icon in the browser’s address bar, indicating encryption and a secure connection.

- Be Wary of Phishing Attempts: Stay vigilant for phishing emails or fraudulent websites that attempt to trick you into disclosing your credit card information. Avoid clicking on suspicious links and never provide your personal or financial details in response to unsolicited communications.

- Monitor Your Account Regularly: Take the time to review your credit card statements and transaction history regularly. Report any unauthorized transactions to your credit card issuer immediately.

- Utilize Two-Factor Authentication: Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring an additional verification step, such as a one-time passcode sent to your mobile device, when accessing your credit card information.

- Use Secure Networks: Avoid entering your credit card information when connected to public Wi-Fi networks, as they may not be secure. Use trusted and encrypted networks when conducting online transactions.

- Regularly Update Software: Keep your devices and software up to date with the latest security patches. This helps protect against vulnerabilities that cybercriminals may exploit to gain unauthorized access to your credit card information.

- Be Cautious of Card Skimmers: When using ATMs or point-of-sale terminals, be vigilant for any signs of tampering on the devices. Avoid using machines that appear suspicious or have loose or unusual attachments, as they may be equipped with skimming devices.

By implementing these practices, you can significantly enhance the security and safeguarding of your credit card information. Remember, being proactive and staying informed is crucial in the battle against financial fraud and theft.

Conclusion

Understanding where your credit card information is stored and taking steps to protect it is essential in today’s interconnected world. Throughout the payment process, your credit card information is stored by various entities, including online retailers, payment processors, physical merchants, mobile wallets, and financial institutions.

While credit card information storage comes with inherent risks, it’s important to note that significant security measures are in place to protect your data. Encryption, tokenization, multi-factor authentication, and adherence to industry security standards, such as PCI DSS, are just some of the measures implemented to safeguard your credit card information.

To further protect your credit card information, it’s crucial to take personal responsibility. Keep your physical credit card secure, only share your information with trusted sources, and be vigilant for phishing attempts and unauthorized access to your card details.

Regularly monitor your accounts, use secure networks, and ensure that your software is up to date with the latest security patches. By following these best practices, you can minimize the risks associated with credit card information storage and maintain a high level of security for your financial transactions.

In the dynamic and evolving landscape of digital payments, both businesses and individuals must remain proactive in staying informed about the latest security measures and potential risks. By doing so, we can collectively work towards ensuring the protection of credit card information and enjoy the convenience and peace of mind that comes with secure financial transactions.