Finance

Where To Send NC State Tax Return

Published: November 2, 2023

Find out where to send your NC State tax return. Discover the best options for filing your taxes and maximizing your financial savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of tax filing! If you’re a resident of North Carolina, you may be wondering where to send your state tax return. Filing your state taxes is an important annual task that requires careful attention to detail. By understanding the filing deadlines and the various options available to you, you can ensure a smooth and timely submission of your NC state tax return.

Filing your state taxes accurately and on time is crucial to avoid penalties and interest charges. North Carolina has specific deadlines for filing state tax returns, which vary depending on your filing status and the type of income you have. It’s important to know these deadlines and plan accordingly to avoid any last-minute stress.

In this article, we will explore the different filing deadlines for NC state taxes and provide you with the information you need to know in order to effectively file your return. Additionally, we will discuss the various options available for mailing your NC state tax return, as well as electronic and in-person filing options.

So, whether you are a newcomer to the world of tax filing or just looking for a refresher, read on to discover the ins and outs of where to send your NC state tax return.

Filing Deadlines

When it comes to filing your NC state tax return, it’s essential to be aware of the deadlines set by the North Carolina Department of Revenue (NCDOR). Missing the deadline can result in penalties and interest charges, so it’s crucial to plan ahead and submit your return on time.

The filing deadline for individual taxpayers in North Carolina is generally April 15th, aligning with the federal tax deadline. However, if April 15th falls on a weekend or a holiday, the deadline is extended to the next business day. It’s essential to double-check the specific year’s deadline to ensure compliance.

For individuals who need more time to file their state tax return, North Carolina offers an automatic extension of time to file. The extension deadline is usually October 15th, but keep in mind that this only extends the time to file, not the time to pay any taxes owed. If you owe state taxes, you must still make a payment by the original filing deadline to avoid penalties and interest.

If you anticipate that you will need an extension, you can file Form NC-8822, Application for Extension for Filing Individual Income Tax Return, with the NCDOR. Make sure to submit this form by the original due date to request the extension.

It’s important to note that if you miss the filing deadline and fail to request an extension, the NCDOR may assess penalties and interest on any outstanding taxes owed. Therefore, it’s always best to file your return or request an extension on time to avoid any unnecessary complications.

Now that you have an understanding of the general filing deadlines for NC state tax returns, let’s move on to the next section, where we’ll discuss where you need to mail your completed tax return.

Where to Mail Your NC State Tax Return

Once you have completed your NC state tax return, it’s time to send it off to the appropriate address. The mailing address for your tax return depends on whether you are enclosing a payment or not.

If you are not enclosing a payment with your tax return, you should mail your completed return to the following address:

- North Carolina Department of Revenue

- P.O. Box 25000

- Raleigh, NC 27640-0640

However, if you need to include a payment with your tax return, the mailing address is slightly different. In that case, you should send your completed return and payment to this address:

- North Carolina Department of Revenue

- Income Processing

- P.O. Box 25000

- Raleigh, NC 27640-0640

When mailing your NC state tax return, it’s essential to ensure that you have the correct postage and proper documentation. Make sure to include all necessary forms, schedules, and supporting documents along with your return. It’s also a good idea to make copies of everything for your records.

Additionally, consider sending your tax return via certified mail or with a tracking number to confirm delivery. This can provide you with peace of mind and proof of mailing in case there are any disputes or issues with the delivery.

If you prefer a more convenient and faster way to file your NC state tax return, electronic filing options are available. Let’s explore them in the next section.

Electronic Filing Options

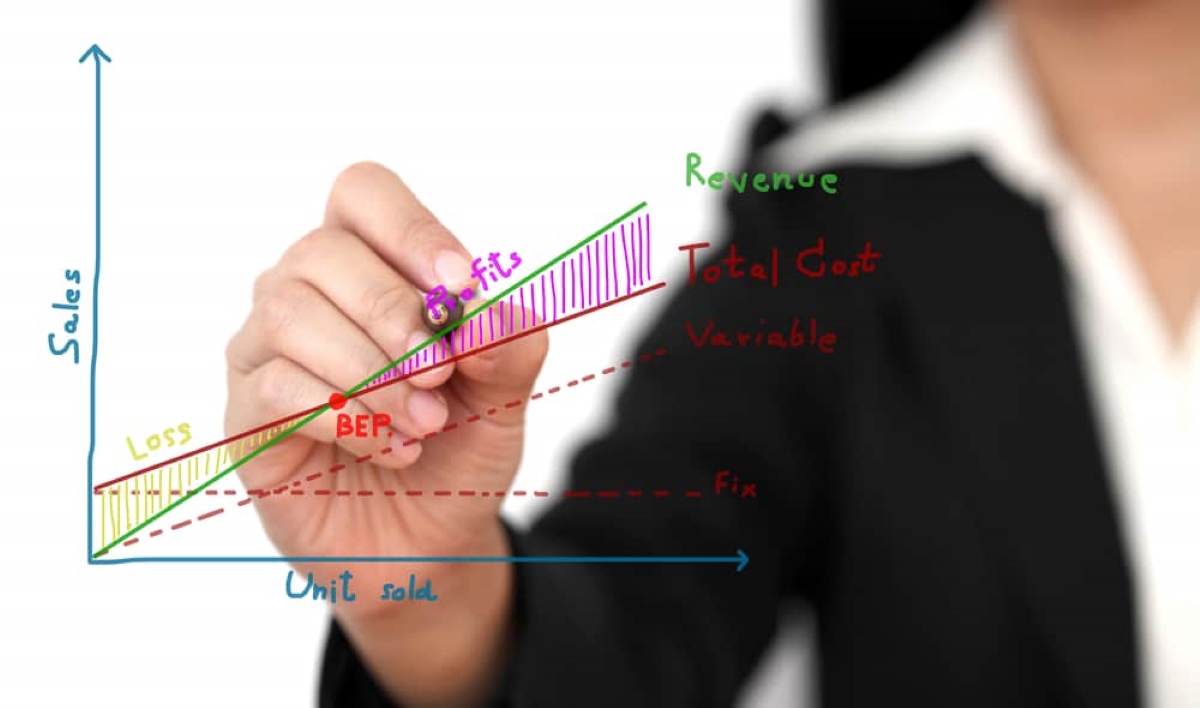

Electronic filing, also known as e-filing, has become an increasingly popular method for individuals to submit their NC state tax returns. E-filing offers several advantages over traditional paper filing, including increased accuracy, faster processing times, and the option to receive your refund more quickly. North Carolina provides electronic filing options for both individual taxpayers and businesses.

For individual taxpayers, one of the most convenient ways to electronically file your NC state tax return is through the NCDOR’s website. The NCDOR partners with various approved tax software providers, allowing you to prepare and file your return online. These software options guide you through the tax filing process, help you identify eligible deductions and credits, and ensure accurate calculations. Once you complete your return, you can submit it directly through the software, eliminating the need to mail a physical copy.

If your income is below a certain threshold, you may be eligible to use NC Free File, a program offered by the NCDOR in partnership with leading tax software companies. NC Free File provides free tax preparation and filing services for qualified individuals, making it an affordable option for those with simpler tax situations.

Businesses in North Carolina can also take advantage of electronic filing options. The NCDOR offers an e-Services platform for businesses to file and pay various state tax types, including income tax, sales and use tax, and withholding tax. This streamlined online portal allows businesses to access their tax accounts, complete necessary forms, and submit payments securely and efficiently.

When e-filing your NC state tax return, it’s important to gather all relevant documents and information beforehand. This includes your Social Security number, W-2 forms, 1099 forms, and any other documentation related to your income, deductions, and credits. Ensure that you have accurate and up-to-date information to avoid any errors during the filing process.

Now that we’ve discussed electronic filing options, let’s delve into the various in-person filing options available for those who prefer a more hands-on approach.

In-Person Filing Options

If you prefer a more personal touch and want assistance with filing your NC state tax return, there are several in-person filing options available to you. These options can provide you with the opportunity to ask questions, seek guidance, and ensure that your tax return is completed accurately.

One in-person filing option is to visit a local North Carolina Department of Revenue (NCDOR) office. The NCDOR has offices located throughout the state, where taxpayers can receive support in preparing and filing their state tax returns. At these offices, you can find knowledgeable staff who can help you navigate the tax filing process, answer any questions you may have, and ensure that your return is filed correctly.

Another option is to seek assistance from a tax professional or accountant. Tax professionals have vast experience in tax preparation and can guide you through the process while maximizing your deductions and credits. They can help you identify any potential red flags or areas of concern and ensure that your return complies with North Carolina tax laws.

When utilizing in-person filing options, it’s important to come prepared with all necessary documentation, such as your W-2 forms, 1099 forms, and other relevant income and expense records. Having this information readily available will facilitate the filing process and ensure that your return is accurate and complete.

While in-person filing options provide additional support and expertise, it’s essential to consider any associated costs. Tax professionals may charge a fee for their services, and visiting an NCDOR office may require travel expenses. Take these factors into account when deciding which filing method is best for you.

Now that you have learned about in-person filing options, let’s explore some online resources that can assist you during the tax filing process.

Online Filing Resources

When it comes to filing your NC state tax return, online resources can be invaluable tools to simplify the process and ensure accuracy. Utilizing these resources can provide you with the necessary information, forms, and guidance to complete your tax return with confidence.

The North Carolina Department of Revenue (NCDOR) website is a central hub of information and resources for taxpayers. It offers a variety of online tools and resources to assist you in filing your state tax return. On the NCDOR website, you can find downloadable forms, instructions, and publications that provide detailed guidance on various tax topics.

In addition to downloadable forms, the NCDOR website also offers interactive tools and calculators to help you estimate your tax liability, calculate deductions, and determine your eligibility for certain credits. These tools can be incredibly useful in providing a clearer picture of your tax situation and ensuring accurate calculations.

Another online resource to consider is the NCDOR’s Taxpayer Assistance Center. This center provides a wealth of information, including frequently asked questions, instructional videos, and access to online chat support. The chat support feature can be particularly helpful if you have specific questions or need clarifications during the filing process.

Furthermore, the NCDOR website provides updated news and announcements related to state taxes. Staying informed about any changes or updates can help you navigate the filing process more effectively and avoid any potential pitfalls.

It’s also worth mentioning that there are several reputable online tax preparation software options available. These software programs, such as TurboTax or H&R Block, guide you through the tax filing process, prompt you for necessary information, and ensure accurate calculations. These software options often have built-in error-checking mechanisms to help catch any potential mistakes or omissions.

Whether you choose to utilize the resources on the NCDOR website or opt for an online tax preparation software, take advantage of the online filing resources available to simplify your tax filing experience.

As we conclude this article, remember to file your NC state tax return accurately and on time. Stay informed about the deadlines, choose the appropriate filing method, and leverage the available resources to ensure a smooth and successful tax filing process.

Conclusion

Filing your NC state tax return doesn’t have to be a daunting task. By understanding the filing deadlines, knowing where to mail your completed tax return, and exploring the various filing options available, you can navigate the process with ease and confidence.

Remember to adhere to the filing deadlines set by the North Carolina Department of Revenue (NCDOR) to avoid penalties and interest charges. If you need more time to file, consider requesting an extension, but don’t forget to make any necessary tax payments by the original deadline.

When it comes to mailing your NC state tax return, ensure that you have the correct address, depending on whether or not you are enclosing a payment. Double-check the postage and consider using certified mail or a tracking number for added security and peace of mind.

Electronic filing options provide a convenient and efficient way to submit your tax return. Take advantage of the NCDOR’s approved tax software providers or explore the NC Free File program if you qualify. Businesses can also benefit from the e-Services platform for online filing and payment of various state taxes.

If you prefer a more personal touch, consider in-person filing options such as visiting an NCDOR office or seeking assistance from a tax professional. These options can provide guidance and support throughout the filing process.

Don’t forget to explore the online filing resources offered by the NCDOR, including downloadable forms, interactive tools, and chat support. These resources can help you gather the necessary information, understand tax requirements, and ensure accurate calculations.

As you approach the tax filing season, equip yourself with the knowledge and resources you need to successfully file your NC state tax return. Remember, accuracy and timeliness are key to a smooth filing process. Consult the NCDOR website, utilize helpful software, seek professional assistance if needed, and stay informed about any updates or changes that may impact your tax situation.

With careful planning and the right resources at your disposal, you can confidently submit your NC state tax return and fulfill your tax obligations. Happy filing!