Home>Finance>Who Does Money Management International Work With?

Finance

Who Does Money Management International Work With?

Published: February 28, 2024

Money Management International partners with individuals and organizations in the finance industry to provide expert money management solutions and support. Learn more about our collaborative approach.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit Counseling and Financial Education Services

Money Management International (MMI) is a leading nonprofit organization that offers a wide range of financial solutions to individuals, families, and communities. With a mission to improve lives through financial education and guidance, MMI provides credit counseling, debt management, housing counseling, and bankruptcy counseling services. Additionally, MMI offers financial education and resources to empower consumers with the knowledge and skills needed to make informed financial decisions.

Established in 1958, MMI has been at the forefront of promoting financial wellness and stability. Through partnerships with creditors, consumers, nonprofit organizations, financial institutions, and government agencies, MMI strives to create a positive impact on the financial well-being of individuals and communities across the nation.

In this article, we will explore the diverse network of partners and stakeholders that Money Management International collaborates with to deliver comprehensive financial solutions and support.

Join us as we delve into the world of credit counseling and financial education, uncovering the interconnected web of relationships that enables MMI to make a meaningful difference in the lives of those seeking to achieve financial stability and independence.

Creditors

Money Management International (MMI) works closely with a wide array of creditors, including credit card companies, banks, and other financial institutions. These partnerships are essential in facilitating debt management and repayment plans for consumers seeking to regain control of their finances.

By collaborating with creditors, MMI aims to negotiate reduced interest rates, waived fees, and affordable repayment terms on behalf of their clients. This cooperative approach not only benefits the consumers by making their debt more manageable but also allows creditors to recover funds owed to them in a structured manner.

Furthermore, MMI provides valuable financial education and budgeting resources to creditors, empowering them to make informed decisions about their financial well-being. Through these educational initiatives, creditors gain a deeper understanding of the challenges faced by their clients and can work collaboratively with MMI to develop sustainable solutions.

These partnerships with creditors are instrumental in fostering a supportive environment for individuals and families striving to overcome financial challenges. By working together, MMI and creditors can create pathways to financial stability, ultimately benefiting both the consumers and the financial institutions involved.

Consumers

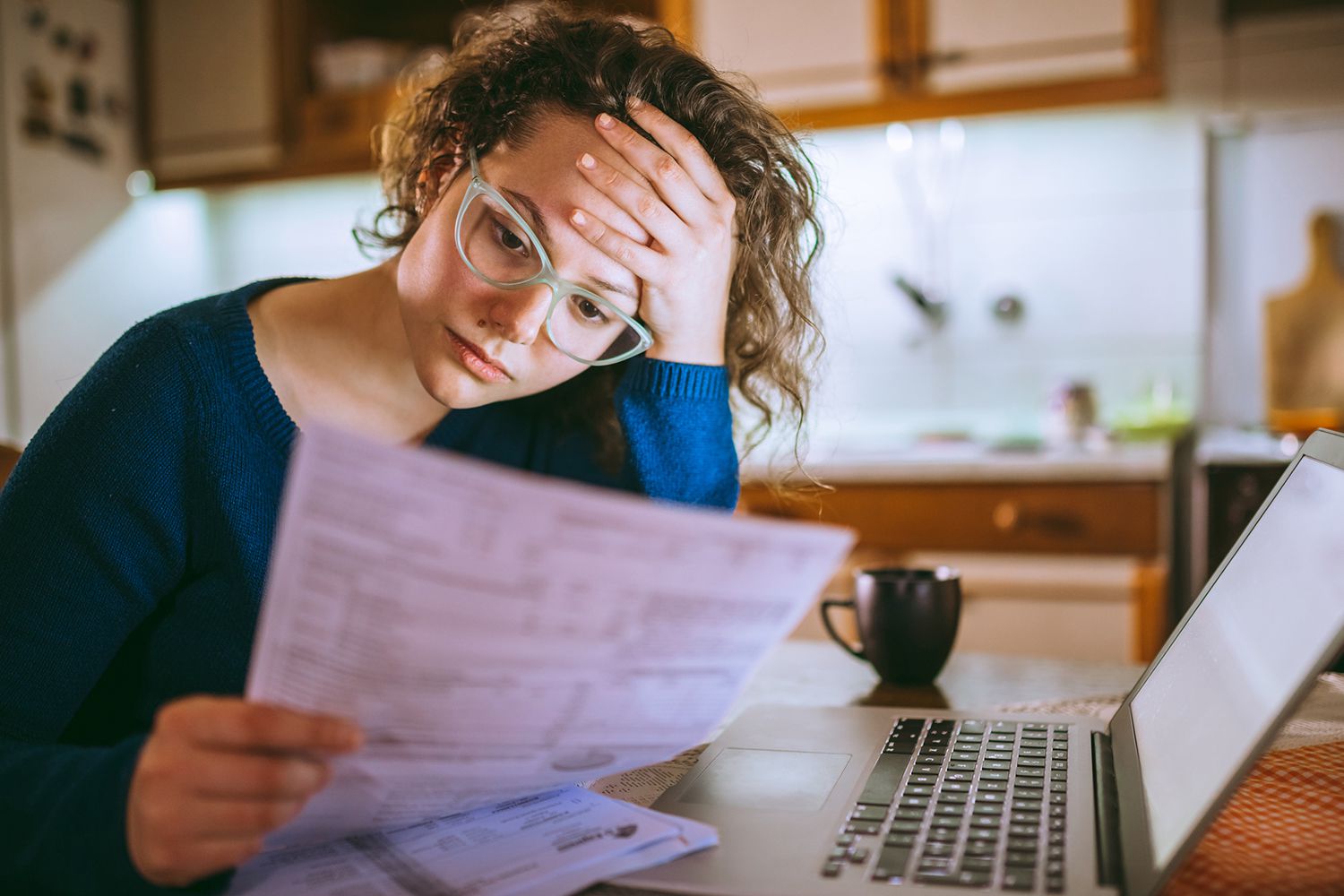

Money Management International (MMI) is dedicated to empowering consumers with the knowledge and resources needed to achieve financial stability and independence. Through personalized credit counseling and debt management services, MMI offers individuals and families the opportunity to gain control over their finances and work towards a debt-free future.

MMI’s certified credit counselors provide one-on-one guidance to consumers, helping them create realistic budgets, understand their credit reports, and develop effective strategies for managing their debt. By offering tailored solutions, MMI equips consumers with the tools to make informed financial decisions and navigate their unique financial challenges.

Moreover, MMI’s commitment to financial education extends beyond debt management, encompassing a wide range of topics such as homeownership, retirement planning, and money management skills. Through workshops, online resources, and educational materials, consumers have access to valuable information that empowers them to build a solid financial foundation.

Additionally, MMI’s housing counseling services assist consumers in various aspects of homeownership, including foreclosure prevention, pre-purchase education, and reverse mortgage counseling. These comprehensive resources enable individuals and families to make informed decisions about their housing options and financial well-being.

By working with Money Management International, consumers can embark on a journey towards financial wellness, armed with the knowledge, support, and guidance necessary to achieve their long-term financial goals.

Nonprofit Organizations

Money Management International (MMI) collaborates with a diverse network of nonprofit organizations to expand the reach of its financial education and counseling services. By partnering with nonprofits dedicated to community development, housing assistance, and financial empowerment, MMI extends its impact to underserved populations and diverse communities.

Through these partnerships, MMI contributes its expertise in credit counseling, debt management, and financial education to support the initiatives of nonprofit organizations. By integrating financial wellness programs into the services offered by these nonprofits, MMI helps enhance the overall well-being of individuals and families facing financial challenges.

Furthermore, MMI’s collaboration with nonprofit organizations fosters a holistic approach to addressing the multifaceted needs of communities. By combining resources and expertise, MMI and its nonprofit partners can provide comprehensive support, including housing counseling, budgeting assistance, and debt management solutions, to those in need.

These partnerships also enable MMI to engage with local communities and tailor its services to address specific regional needs effectively. By understanding the unique challenges faced by different populations, MMI and its nonprofit partners can develop targeted outreach and educational programs to promote financial literacy and empowerment.

Ultimately, the collaboration between Money Management International and nonprofit organizations amplifies the impact of financial education and counseling, reaching individuals and communities who can benefit greatly from these valuable resources.

Financial Institutions

Money Management International (MMI) works in partnership with a wide spectrum of financial institutions, including banks, credit unions, and other financial service providers. These collaborations are instrumental in promoting financial wellness and empowering individuals to achieve greater control over their financial lives.

By working with financial institutions, MMI aims to enhance access to affordable financial products and services for individuals and families seeking to improve their financial well-being. This may include promoting the availability of low-cost banking products, financial literacy programs, and resources designed to help consumers make informed financial decisions.

Moreover, MMI’s partnerships with financial institutions extend to the development of innovative solutions to address the evolving needs of consumers. By leveraging the expertise of financial institutions and the insights gained from working with individuals facing financial challenges, MMI can contribute to the creation of tailored financial products and services that better serve the community.

Additionally, these collaborations enable MMI to advocate for the fair and ethical treatment of consumers within the financial industry. By fostering open communication and cooperation with financial institutions, MMI works to ensure that consumers are provided with transparent and responsible financial solutions that align with their best interests.

Furthermore, the partnership between Money Management International and financial institutions contributes to the promotion of financial education and empowerment. By joining forces, MMI and financial institutions can expand the reach of financial literacy programs, offer valuable resources to consumers, and create a more inclusive financial landscape for all individuals and families.

Through these partnerships, Money Management International continues to drive positive change in the financial industry, advocating for the well-being and empowerment of consumers while fostering collaborative efforts to enhance financial stability and resilience.

Government Agencies

Money Management International (MMI) collaborates with various government agencies to support initiatives aimed at promoting financial stability and empowering individuals and families through comprehensive financial education and counseling services.

Through these partnerships, MMI contributes its expertise in credit counseling, debt management, housing counseling, and financial education to complement the efforts of government agencies in addressing the financial well-being of citizens. By aligning with government initiatives, MMI extends its reach to diverse communities and populations, ensuring that valuable resources are accessible to those in need.

Moreover, MMI’s collaboration with government agencies enables the organization to stay abreast of regulatory changes, policy developments, and emerging trends in the financial industry. This allows MMI to adapt its services and programs to align with evolving standards and best practices, ensuring that consumers receive relevant and effective support.

Furthermore, these partnerships facilitate the exchange of valuable insights and data, enabling MMI to contribute to informed decision-making processes and policy discussions related to financial empowerment and consumer protection. By leveraging its experience and expertise, MMI can provide valuable input to government agencies, contributing to the development of initiatives that address the financial challenges faced by individuals and families.

Additionally, the collaboration between Money Management International and government agencies enhances the visibility and impact of financial education and counseling services. By working in tandem with government entities, MMI can amplify its efforts to promote financial literacy, debt management, and housing counseling, reaching a broader audience and making a meaningful difference in the lives of citizens.

Ultimately, the partnership between MMI and government agencies underscores a shared commitment to advancing financial wellness, consumer protection, and equitable access to valuable financial resources, fostering a supportive environment for individuals and communities striving to achieve lasting financial stability.