Finance

Who Gets The Child Tax Credit In A Divorce

Published: January 6, 2024

Discover who is eligible for the child tax credit in a divorce and how it impacts your finances. Gain insights on claiming this tax benefit and optimizing your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Child Tax Credit

- The Child Tax Credit in Divorce Cases

- Custodial Parent and the Child Tax Credit

- Noncustodial Parent and the Child Tax Credit

- Qualifying for the Child Tax Credit in a Divorce

- Child Tax Credit and Child Support Payments

- Claiming the Child Tax Credit on Your Taxes

- Potential Changes to the Child Tax Credit Laws

- Conclusion

Introduction

Divorce can be a challenging and emotionally charged process, especially when children are involved. Apart from the many logistical and emotional considerations, there are also financial implications to consider, such as the Child Tax Credit. The Child Tax Credit is a tax benefit that can help alleviate some of the financial burden associated with raising a child.

In this article, we will explore who gets the Child Tax Credit in a divorce, how it is determined, and what implications it may have for both custodial and noncustodial parents. We will also discuss the qualifications needed to claim the Child Tax Credit in a divorce, as well as any potential changes to the laws that may affect eligibility.

Understanding how the Child Tax Credit works in a divorce is crucial for both parents to ensure they can receive the financial support they need to provide for their children. By being aware of the regulations and requirements surrounding the Child Tax Credit, parents can plan their financial strategy more effectively and ensure the well-being of their children.

Understanding the Child Tax Credit

The Child Tax Credit is a tax benefit provided by the Internal Revenue Service (IRS) to eligible taxpayers who have dependent children. It is designed to help offset the costs of raising a child and reduce the taxpayer’s overall tax liability. The credit is non-refundable, meaning it can only be used to reduce the amount of taxes owed, but not to generate a refund if the credit exceeds the tax liability.

For the tax year 2021, the Child Tax Credit allows eligible taxpayers to claim up to $3,000 per qualifying child aged 6 to 17, and up to $3,600 for children under the age of 6. These amounts are subject to income limits and may be reduced or phased out for high-income taxpayers.

It’s important to note that the Child Tax Credit is different from the Child and Dependent Care Credit, which is intended to offset the costs of child care expenses for working parents. The Child Tax Credit, on the other hand, provides a direct financial benefit based on the number of qualifying children in the household.

To claim the Child Tax Credit, taxpayers must meet certain eligibility requirements. They must have a qualifying child who meets the age, relationship, and residency criteria set by the IRS. Additionally, the taxpayer must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN) for the qualifying child.

The Child Tax Credit can significantly reduce a taxpayer’s tax liability, potentially resulting in a lower overall tax bill. It is important to keep records and documentation of the qualifying child’s information, such as birth certificates and social security numbers, to accurately claim the credit on the tax return.

Now that we have a basic understanding of the Child Tax Credit, let’s explore how it applies in divorce cases and how it may affect both the custodial and noncustodial parents.

The Child Tax Credit in Divorce Cases

Divorce can have significant implications for the Child Tax Credit, particularly in determining which parent is eligible to claim it. Generally, the custodial parent, or the parent who has the child for the majority of the year, is entitled to claim the Child Tax Credit. However, there are certain conditions and exceptions to this rule that we will explore further.

In most cases, the custodial parent is the one who has physical custody of the child for more than 50% of the year. This parent is typically responsible for the day-to-day care and financial support of the child. As such, they are eligible to claim the Child Tax Credit on their tax return and benefit from the tax savings associated with the credit.

It’s important to note that the noncustodial parent, or the parent who has the child for less than 50% of the year, cannot claim the Child Tax Credit on their tax return. However, there may be exceptions to this rule if the custodial parent agrees to release their claim to the credit.

In some cases, divorced parents may decide to alternate claiming the Child Tax Credit year by year. This arrangement is usually agreed upon and documented through a divorce decree or a separation agreement. It is essential to ensure that this agreement is legally binding and is recognized by the IRS to avoid any potential issues in the future.

It’s worth noting that the IRS has specific rules for determining the eligibility of each parent to claim the Child Tax Credit. These rules take into account factors such as the child’s residency, financial support, and the amount of time spent with each parent. If the divorce decree or separation agreement is not in alignment with these rules, the IRS will follow their guidelines to determine which parent is entitled to claim the credit.

It’s crucial for divorced parents to communicate and collaborate on the issue of the Child Tax Credit to ensure that they are maximizing their tax benefits while also fulfilling their financial responsibilities towards their children. Seeking the advice of a tax professional or attorney specializing in divorce and taxation can provide guidance and clarity in navigating the complexities of the Child Tax Credit in divorce cases.

Now that we understand the general implications of the Child Tax Credit in divorce cases, let’s explore the specific rights and responsibilities of the custodial and noncustodial parents in relation to the credit.

Custodial Parent and the Child Tax Credit

The custodial parent, as the parent with primary physical custody of the child, is typically entitled to claim the Child Tax Credit on their tax return. This means they can benefit from the tax savings associated with the credit. However, there are a few considerations and qualifications that the custodial parent must meet in order to claim the credit.

Firstly, the custodial parent must meet the residency requirements set by the IRS. The child must have lived with the custodial parent for more than half of the year. In cases of joint custody or shared physical custody, where the child spends equal time with both parents, the IRS applies tiebreaker rules to determine which parent is considered the custodial parent for tax purposes.

Furthermore, the custodial parent must also meet all other eligibility criteria for the Child Tax Credit. This includes having a valid Social Security number or Individual Taxpayer Identification Number (ITIN) for the child, as well as meeting the income limits and other requirements set by the IRS.

It’s important for the custodial parent to keep thorough records and documentation to support their claim to the Child Tax Credit. This includes maintaining records of the child’s residency, such as school records or medical documents, as well as documentation of any financial support provided to the child.

However, it’s worth mentioning that in certain cases, the custodial parent may choose to release their claim to the Child Tax Credit to the noncustodial parent. This can be done through a written agreement, usually documented in a divorce decree or a separate written statement. By releasing the claim, the custodial parent forfeits their right to the tax credit, and the noncustodial parent can claim it on their tax return instead.

It’s important to note that the decision to release the claim to the Child Tax Credit should be carefully considered and agreed upon by both parents. The potential tax savings for the noncustodial parent should be weighed against the overall financial implications for both parties involved.

In summary, the custodial parent is generally entitled to claim the Child Tax Credit. They must meet the residency requirements, have a valid Social Security number or ITIN for the child, and meet all other eligibility criteria set by the IRS. However, there may be situations where the custodial parent chooses to release their claim to the credit, allowing the noncustodial parent to benefit from the tax savings.

Next, we will explore the rights and responsibilities of the noncustodial parent in relation to the Child Tax Credit.

Noncustodial Parent and the Child Tax Credit

The noncustodial parent, or the parent who does not have primary physical custody of the child, generally does not have the right to claim the Child Tax Credit on their tax return. However, there are some exceptions and options available for noncustodial parents to potentially benefit from the credit.

By default, the custodial parent is entitled to claim the Child Tax Credit based on their primary custody of the child. This is because they are the parent responsible for the day-to-day care and financial support of the child. The IRS recognizes this arrangement and allows the custodial parent to claim the credit as a means of providing financial assistance for raising the child.

However, there may be situations where the custodial parent agrees to release their claim to the Child Tax Credit, allowing the noncustodial parent to claim it instead. This can be outlined in a divorce decree or a separate written agreement between the parents. By doing so, the noncustodial parent can benefit from the tax savings associated with the credit.

It’s important to note that the noncustodial parent can only claim the Child Tax Credit if the custodial parent agrees to release their claim. This agreement must be in writing and meet the requirements set by the IRS. It is recommended to consult with a tax professional or attorney to ensure that the agreement is legally binding and recognized by the IRS.

In cases where the noncustodial parent is unable to secure the release of the Child Tax Credit from the custodial parent, they may still be eligible for other tax benefits related to the child. For example, they may be able to claim the Child and Dependent Care Credit if they incur child care expenses while caring for the child during their visitation periods.

It’s important to be aware of any potential state or local tax credits or deductions that may be available for noncustodial parents. Each jurisdiction may have different rules and provisions regarding tax benefits for noncustodial parents, so it’s worth exploring these options to maximize available tax savings.

In summary, the noncustodial parent does not have the automatic right to claim the Child Tax Credit. However, they may be able to claim the credit if the custodial parent agrees to release their claim. It’s crucial to have a legally binding written agreement in place to secure this release. Alternatively, noncustodial parents should explore other tax benefits that may be available to them in relation to caring for and supporting their child.

Next, we will discuss the qualifications for claiming the Child Tax Credit in a divorce and how child support payments may impact eligibility.

Qualifying for the Child Tax Credit in a Divorce

Qualifying for the Child Tax Credit in a divorce requires meeting specific criteria set by the IRS. These criteria determine the eligibility of the custodial parent to claim the credit. Let’s explore the qualifications that must be met to claim the Child Tax Credit in a divorce:

- Relationship: The child must be the biological child, adopted child, stepchild, or foster child of the taxpayer claiming the credit. They must also be a U.S. citizen, national, or resident alien.

- Age: The child must be under the age of 17 at the end of the tax year in order to qualify for the credit.

- Residency: The child must have lived with the custodial parent for more than half the year. In cases of joint custody or shared physical custody, the IRS applies tiebreaker rules to determine which parent is considered the custodial parent for tax purposes.

- Support: The child must not have provided more than half of their own financial support during the tax year.

- Dependent: The child must be claimed as a dependent on the custodial parent’s tax return.

- Income Limits: The custodial parent must also meet income limits to claim the full Child Tax Credit. The credit begins to phase out for single filers with an adjusted gross income (AGI) above $200,000 and married couples filing jointly with an AGI above $400,000.

It’s important to note that in cases of divorce, the custodial parent generally has the first right to claim the Child Tax Credit based on the IRS rules. However, if the custodial parent agrees to release their claim, the noncustodial parent may be able to claim the credit.

It’s recommended that divorced parents work together and communicate to determine the best course of action regarding the Child Tax Credit. Legal agreements, such as divorce decrees or written statements, should be in place to outline the custodial parent’s willingness to release the credit to the noncustodial parent if applicable.

Furthermore, it’s crucial to keep accurate records and documentation to support the claiming of the Child Tax Credit. This includes maintaining records of the child’s residency, such as school enrollment, medical records, and other relevant documents. Additionally, it’s important to have all necessary tax identification numbers, such as the child’s Social Security number or Individual Taxpayer Identification Number (ITIN).

By understanding the qualifications for claiming the Child Tax Credit in a divorce, parents can ensure they meet the necessary requirements and make informed decisions regarding the tax benefits available to them.

Next, we will explore the relationship between the Child Tax Credit and child support payments.

Child Tax Credit and Child Support Payments

Child support is a critical aspect of divorce cases involving children, and it’s important to understand how child support payments relate to the Child Tax Credit. While child support payments are intended to provide financial assistance for the care and well-being of children, they do not directly impact the eligibility to claim the Child Tax Credit.

The IRS does not consider child support payments as taxable income for the recipient, nor are they tax-deductible for the payer. Therefore, child support payments are not included in the custodial parent’s income when determining eligibility for the Child Tax Credit.

On the other hand, the Child Tax Credit is a separate tax benefit provided by the IRS to eligible taxpayers based on their dependent children. It is not strictly tied to the amount of child support payments received or paid. Even if a noncustodial parent is making child support payments, they may not automatically qualify to claim the Child Tax Credit unless they meet the criteria discussed earlier.

It’s essential for both custodial and noncustodial parents to understand the distinction between child support payments and the Child Tax Credit. Child support ensures the financial support of the child’s basic needs, while the Child Tax Credit provides additional tax relief for eligible parents raising dependent children.

In cases where the custodial parent releases their claim to the Child Tax Credit to the noncustodial parent, the child support payments made by the noncustodial parent do not necessarily impact the eligibility to claim the credit. The release of the credit is often a separate decision made by the custodial parent based on their assessment of the overall financial situation and the best interests of the child.

It’s important for both parents to communicate and be aware of the financial repercussions of child support and the Child Tax Credit. Working together and understanding the implications of both can help ensure the financial well-being of the child and a fair distribution of tax benefits.

In summary, child support payments and the Child Tax Credit are distinct entities. Child support payments do not impact the eligibility for the Child Tax Credit, nor do they count as taxable income for the custodial parent. The determination of eligibility for the Child Tax Credit is based on the qualifying criteria set by the IRS, independent of child support payments.

Next, we will discuss the process of claiming the Child Tax Credit on your taxes.

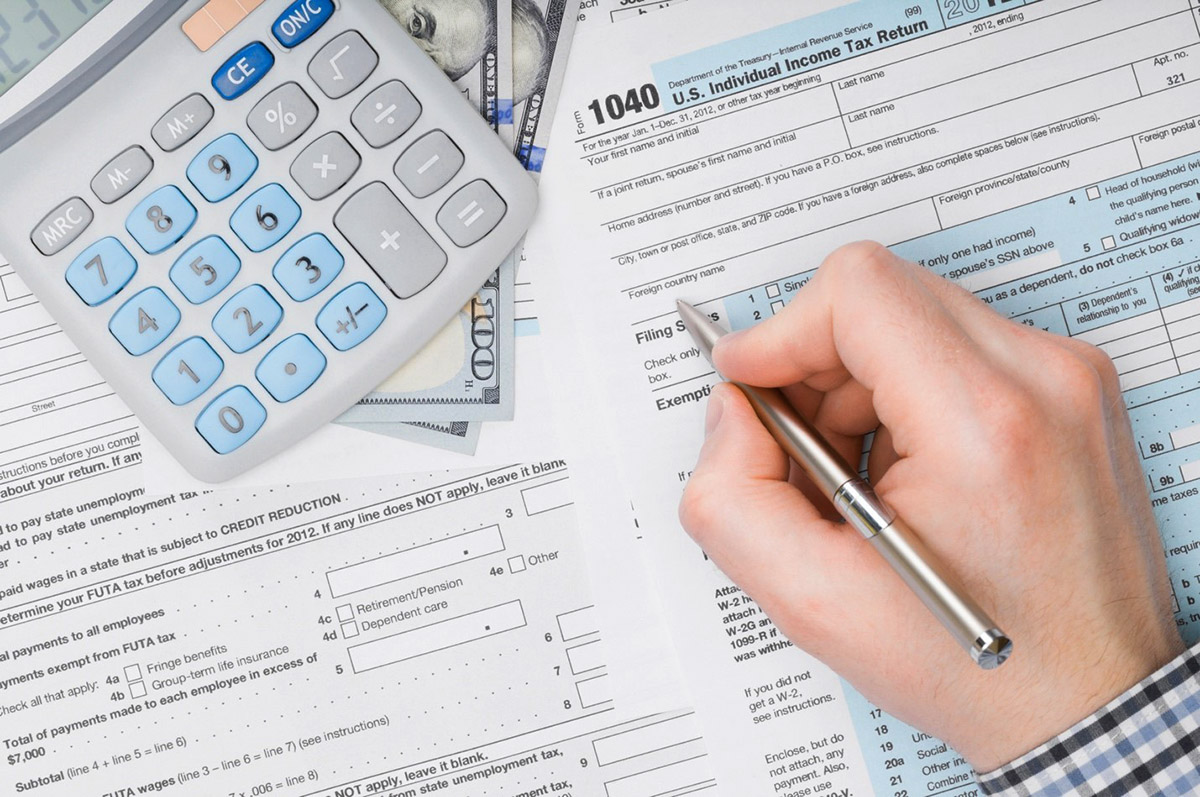

Claiming the Child Tax Credit on Your Taxes

Claiming the Child Tax Credit on your taxes requires careful attention to detail and adherence to the guidelines set by the IRS. By following the proper steps, you can ensure that you maximize the tax benefits available to you as a parent raising dependent children.

Here are the key points to consider when claiming the Child Tax Credit:

- Qualifications: First and foremost, you must meet the eligibility criteria mentioned earlier, including the child’s age, relationship, residency, and dependency status. Ensure that you have all the necessary documentation, such as birth certificates, social security numbers, or individual taxpayer identification numbers, to support your claim.

- Filing Status: Determine the appropriate filing status for your situation. Typically, this will be either “single” or “head of household” if you are the custodial parent.

- Tax Return Form: Choose the correct tax return form to claim the Child Tax Credit. For most taxpayers, this will be Form 1040 or Form 1040A.

- Child Tax Credit Amount: Calculate the amount of the credit you are eligible to claim based on the number of qualifying children and their ages. For the tax year 2021, the maximum credit is $3,000 per qualifying child aged 6 to 17, and $3,600 for children under the age of 6.

- Additional Child Tax Credit: If the Child Tax Credit exceeds your tax liability, you may be eligible for the Additional Child Tax Credit, which can provide a refundable credit up to $1,400 per child.

- Fill Out the Forms: Complete the appropriate sections of your tax return form to claim the Child Tax Credit. This may include providing the necessary information about your qualifying children and their eligibility for the credit.

- Child and Dependent Care Expenses: If you also incurred child care expenses, you may be able to claim the Child and Dependent Care Credit in addition to the Child Tax Credit. Be sure to provide the necessary information and documentation related to these expenses.

- Review and File: Double-check all the information provided on your tax return form to ensure accuracy. Consider seeking assistance from a tax professional or utilizing tax software to minimize errors. Once you’ve reviewed your return, file it with the IRS.

It’s important to note that tax laws can change, and the specific instructions for claiming the Child Tax Credit may vary from year to year. Stay informed about the latest updates and consult the IRS website or a tax professional to ensure you are following the current guidelines.

By understanding the qualifications, completing the necessary forms accurately, and staying up to date with any changes, you can successfully claim the Child Tax Credit and benefit from the tax savings it provides.

Next, we will discuss potential changes to the Child Tax Credit laws that may impact eligibility and benefits.

Potential Changes to the Child Tax Credit Laws

As with any tax legislation, the Child Tax Credit laws are subject to potential changes that can impact eligibility and benefits. It’s important to stay informed about these changes to ensure you are aware of any updates that may affect your taxes and financial planning as a parent.

One notable change to the Child Tax Credit is the result of the American Rescue Plan Act of 2021. This legislation expanded the credit for the tax year 2021, providing higher credit amounts and making the credit partially refundable. The maximum credit increased to $3,000 per qualifying child aged 6 to 17, and $3,600 for children under the age of 6. Additionally, the credit became partially refundable, allowing eligible taxpayers to receive a portion of the credit as a refund, even if it exceeds their tax liability.

It’s important to note that these changes to the Child Tax Credit are temporary and currently apply only to the tax year 2021. However, there have been discussions about potentially extending or making permanent some of these changes. It’s crucial to stay updated on any legislative developments that may affect the Child Tax Credit.

Aside from the temporary changes, there may be future discussions and potential changes to the Child Tax Credit laws that could impact eligibility criteria, income limits, and the overall benefit amount. Proposed alterations could include adjustments to income thresholds, phasing out of the credit, or modifications to age requirements.

Changes in political leadership and shifts in policy priorities can also result in potential amendments to the Child Tax Credit. It is essential to monitor any proposed legislation or tax reforms that may impact the credit and stay informed about updates from reliable sources, such as the IRS or trusted tax advisors.

By staying informed about potential changes to the Child Tax Credit laws, you can proactively adjust your financial planning and take advantage of any new opportunities or benefits that may arise. Consult with a tax professional to understand how these changes may specifically affect your circumstances and seek their guidance in navigating the evolving landscape of tax legislation.

Next, let’s conclude our discussion on the Child Tax Credit in divorce cases.

Conclusion

Navigating the Child Tax Credit in divorce cases requires an understanding of the eligibility criteria, rights, and responsibilities of both custodial and noncustodial parents. By understanding how the Child Tax Credit works and its implications in divorce, parents can effectively plan their finances and ensure that their children receive the necessary support.

The Child Tax Credit is typically claimed by the custodial parent, who has primary physical custody of the child. However, there are options for the noncustodial parent to claim the credit if the custodial parent agrees to release their claim. This agreement should be documented in a written agreement or divorce decree to ensure its validity.

Both custodial and noncustodial parents must meet specific qualifications set by the IRS to claim the Child Tax Credit, including the child’s age, relationship, residency, and dependency status. It’s crucial to keep accurate records and documentation to support the claim.

Child support payments, while essential for the child’s financial well-being, do not directly impact the eligibility to claim the Child Tax Credit. The Child Tax Credit is a separate tax benefit that provides additional financial relief for eligible parents.

It’s important to understand that tax laws are subject to potential changes, including alterations to the Child Tax Credit. Staying informed about these changes and consulting with tax professionals can help parents adapt their financial strategies accordingly.

In conclusion, the Child Tax Credit plays a significant role in providing financial support to divorced parents raising dependent children. By understanding the eligibility criteria, effectively communicating, and seeking professional guidance, parents can ensure that they maximize the available tax benefits and provide the best financial support for their children.