Home>Finance>Additional Child Tax Credit (ACTC): Definition And Who Qualifies

Finance

Additional Child Tax Credit (ACTC): Definition And Who Qualifies

Published: September 30, 2023

Learn about the Additional Child Tax Credit (ACTC) in finance, including its definition and the eligibility requirements for qualifying.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

A Complete Guide to Additional Child Tax Credit (ACTC): Definition and Who Qualifies

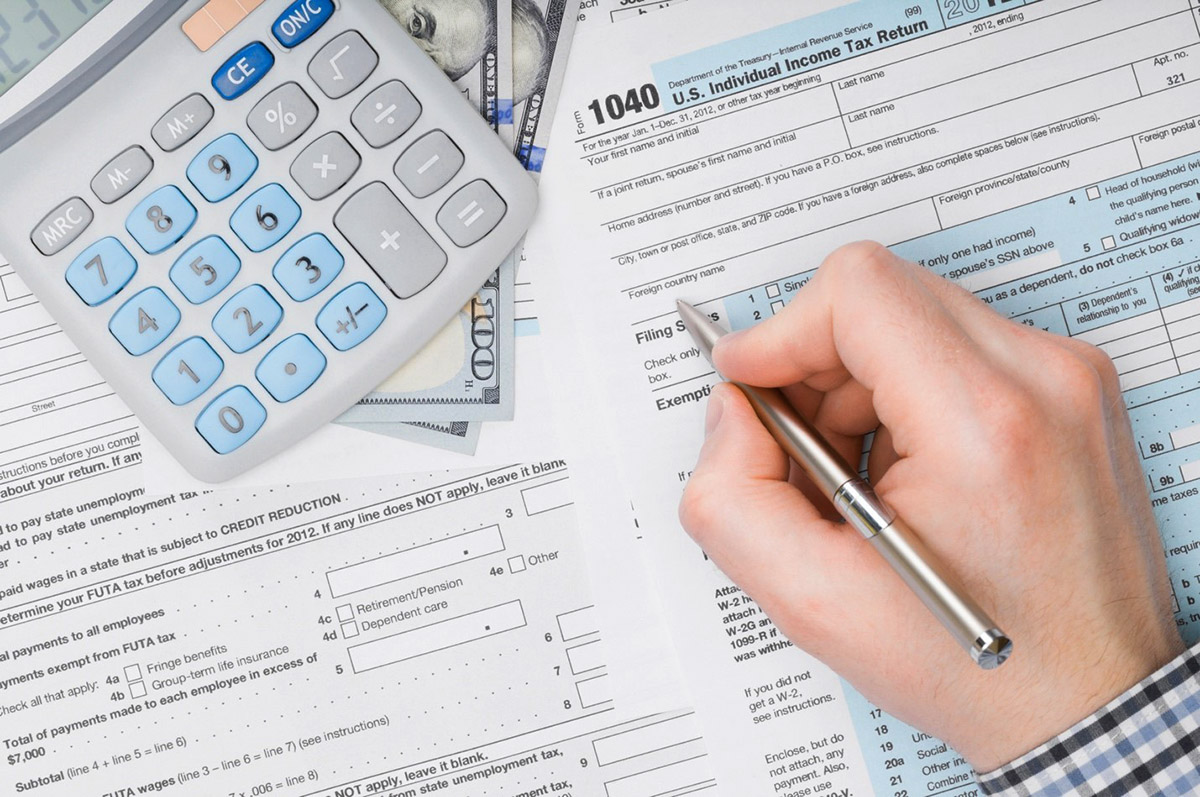

Are you a parent looking for some financial relief? The Additional Child Tax Credit (ACTC) might be just what you need. In this blog post, we’ll explore the definition of ACTC and discuss who qualifies for this often overlooked tax credit.

Key Takeaways:

- ACTC is a refundable tax credit available to parents who have earned income and qualify for the Child Tax Credit (CTC).

- Qualifying parents can potentially receive a refund even if their income tax liability is less than the credit amount.

What is Additional Child Tax Credit?

The Additional Child Tax Credit (ACTC) is an essential tax credit that can provide substantial financial assistance to eligible parents. This tax credit compiles upon the Child Tax Credit (CTC) and is refundable, meaning that even if your income tax liability is less than the credit, you can receive a refund for the remaining amount.

To be eligible for the ACTC, you must qualify for the CTC first. The CTC is a non-refundable credit, which means it can reduce your tax liability up to a certain amount. However, if your CTC exceeds the amount you owe in taxes, you may be eligible for the ACTC, and the excess amount can potentially be refunded to you.

Who Qualifies for the Additional Child Tax Credit?

Now that we understand the concept of the ACTC, let’s dive into eligibility requirements. To qualify for the Additional Child Tax Credit, you must meet the following criteria:

- Be eligible for the Child Tax Credit (CTC): You must have a child who is under the age of 17 and meets all the requirements to claim the CTC.

- Earned Income Requirement: You must have earned income, whether from employment or self-employment. Earned income includes wages, salaries, tips, and self-employment income.

- Income Threshold: Your modified adjusted gross income (MAGI) must be below a certain threshold. The limits vary depending on your filing status, such as single, married filing jointly, or head of household. It’s essential to consult current tax laws or a tax professional to determine the specific income limits for your situation.

- Social Security Number: Both you and your child must have valid Social Security numbers.

If you meet all the criteria mentioned above, you may qualify for the Additional Child Tax Credit, which could significantly increase your tax refund.

Benefits of Additional Child Tax Credit

The Additional Child Tax Credit can bring numerous benefits for eligible parents:

- Tax Refund: If your earned income tax liability is less than the total amount of Child Tax Credit you are eligible to claim, you may receive a refund for the excess amount through the ACTC.

- Financial Assistance: The ACTC can provide much-needed financial relief, helping parents cover various expenses related to raising their children, such as education, healthcare, and everyday costs.

- Reduced Tax Burden: By availing of the ACTC, eligible parents can potentially lower their overall tax burden and have more money available for other essential needs.

Remember, tax laws and regulations are subject to change, so it’s always advisable to consult with a tax professional to ensure you meet all the necessary eligibility requirements to claim the Additional Child Tax Credit.

In Conclusion

The Additional Child Tax Credit (ACTC) is a valuable tax credit that can provide substantial financial relief for qualifying parents. By combining with the Child Tax Credit (CTC), the ACTC can potentially increase your tax refund or lower your tax liability.

If you meet the eligibility requirements, don’t miss out on this opportunity to receive the financial assistance you deserve. Consult with a tax professional or refer to the latest tax laws to determine if you qualify for the Additional Child Tax Credit and how much you might be eligible to receive.