Finance

Why Do You Like Accounting

Published: October 12, 2023

Explore the reasons why finance professionals are attracted to accounting. Gain insights into the benefits and prospects this field offers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- The Role of Accounting in Business

- The Precision and Accuracy of Accounting

- The Analytical and Problem-Solving Skills Required in Accounting

- The Opportunities for Career Advancement in Accounting

- The Satisfaction of Balancing the Books

- The Challenge of Keeping Up with Changing Regulations

- The Importance of Ethical Behavior in Accounting

- The Ability to Contribute to Financial Decision-Making

- Conclusion

Introduction

Accounting is often viewed as a dry and tedious field, filled with numbers, calculations, and spreadsheets. However, for those who are passionate about it, accounting is much more than simple number crunching. It is a vital aspect of business that plays a crucial role in decision-making, financial stability, and overall success.

So, why do people like accounting? The answer lies in the unique set of skills and opportunities that this field offers. In this article, we will explore some of the reasons why individuals are drawn to accounting and how it can be a fulfilling and rewarding career choice.

Before diving into the specifics, it is important to understand what accounting truly entails. At its core, accounting is the process of recording, analyzing, and interpreting financial information. It involves preparing financial statements, maintaining records, and ensuring compliance with regulations. This information provides a snapshot of a company’s financial health and guides decision-making at every level.

Now that we have a basic understanding of accounting, let’s delve into the reasons why it is an appealing profession for many.

The Role of Accounting in Business

Accounting serves as the backbone of any business, providing the necessary information to assess its financial position, profitability, and cash flow. It plays a pivotal role in facilitating strategic decision-making and ensuring the long-term sustainability of an organization.

One of the key functions of accounting is to track and record financial transactions. This includes recording sales, purchases, expenses, and other monetary activities. By maintaining accurate and detailed records, accountants are able to generate financial statements that reflect the true financial position of a company. These statements, such as the balance sheet, income statement, and cash flow statement, provide a comprehensive view of the business’s financial performance.

Another important aspect of accounting is budgeting. Accountants work closely with managers and executives to develop budgets that allocate resources effectively and efficiently. By analyzing past financial data and market trends, accountants can make informed projections and set realistic financial goals for the business. Monitoring actual performance against the budget allows for adjustments and corrective actions to be taken as necessary.

Accounting also plays a vital role in ensuring compliance with financial regulations. By adhering to accounting standards and regulations, businesses are able to maintain transparency, integrity, and credibility in their financial reporting. This is particularly important for publicly traded companies, as accurate and reliable financial statements are essential for investors and stakeholders to make informed decisions.

Moreover, accounting provides valuable insights into the financial health of the business. By analyzing financial ratios and key performance indicators, accountants can assess the liquidity, profitability, and efficiency of the company. This information is crucial for identifying areas of improvement, making strategic decisions regarding pricing, cost control, and resource allocation, and identifying potential risks and opportunities.

In summary, accounting serves as the language of business, allowing companies to communicate their financial performance and make informed decisions. Its role in financial record-keeping, budgeting, compliance, and performance analysis makes accounting an essential function within any organization.

The Precision and Accuracy of Accounting

One of the reasons why individuals are drawn to accounting is the emphasis on precision and accuracy. Accounting requires meticulous attention to detail, as even the smallest error can have significant implications on financial reports and decision-making.

Accounting professionals are responsible for ensuring that financial information is recorded accurately, following established accounting principles and standards. They must reconcile accounts, verify transactions, and ensure that the books balance. This attention to detail helps to maintain the integrity of financial statements and instills confidence in the information provided.

The precision in accounting goes beyond accuracy in recording financial transactions. It also involves ensuring that financial reports are prepared in a consistent and standardized manner. This enables comparisons across time periods and between different companies within the same industry. Investors, creditors, and other stakeholders rely on these reports to make informed decisions and assess the financial health of the organization.

Additionally, accounting requires the use of various mathematical and analytical techniques to analyze and interpret financial data. Accountants must be skilled in working with numbers, calculations, and formulas to accurately perform financial analyses and create meaningful reports.

With the advent of technology, accounting has become even more precise and accurate. Digital accounting software and systems automate many of the repetitive tasks, reducing the risk of human error. However, accountants still play a crucial role in reviewing the accuracy of data and interpreting the results.

In summary, the precision and accuracy demanded by accounting make it an appealing profession for those who enjoy working with numbers and have a meticulous attention to detail. The satisfaction of ensuring that financial records are error-free and reliable is one of the reasons why individuals are drawn to this field.

The Analytical and Problem-Solving Skills Required in Accounting

Accounting is more than just recording financial transactions and preparing reports. It requires a high level of analytical and problem-solving skills to interpret the data and provide valuable insights to stakeholders. These skills are crucial in identifying trends, analyzing financial performance, and making informed business decisions.

One of the key analytical skills required in accounting is the ability to analyze financial statements and records. Accountants need to understand the meaning behind the numbers and identify patterns or inconsistencies in the data. By analyzing financial ratios, trends, and benchmarks, they can assess the financial health of a company and identify areas for improvement.

Problem-solving skills are also essential in accounting. Accountants often encounter complex financial issues that require careful analysis and critical thinking to resolve. They need to identify the root cause of a problem, consider different alternatives, and determine the best course of action. This could involve reconciling discrepancies in financial records, addressing cash flow issues, or resolving discrepancies in financial statements.

In addition, accountants must stay up-to-date with changing regulations and accounting standards. They need to interpret and apply these regulations to ensure compliance and accuracy in financial reporting. This requires a strong analytical mindset and the ability to understand complex regulations and apply them in a practical manner.

Furthermore, technological advancements and the increasing use of data analytics have transformed the accounting profession. Accountants are now required to have strong data analysis skills to extract valuable insights from large datasets. They must be proficient in using accounting software, spreadsheet applications, and data visualization tools to analyze and present financial information effectively.

Accounting professionals also need to possess strong problem-solving skills when faced with ethical dilemmas. They must adhere to ethical guidelines and principles, and make decisions that uphold the integrity of the financial information and protect the interests of stakeholders.

In summary, the analytical and problem-solving skills required in accounting are essential for analyzing financial data, identifying trends, and making informed business decisions. These skills, combined with a strong knowledge of regulations and ethical standards, contribute to the overall effectiveness and success of accounting professionals.

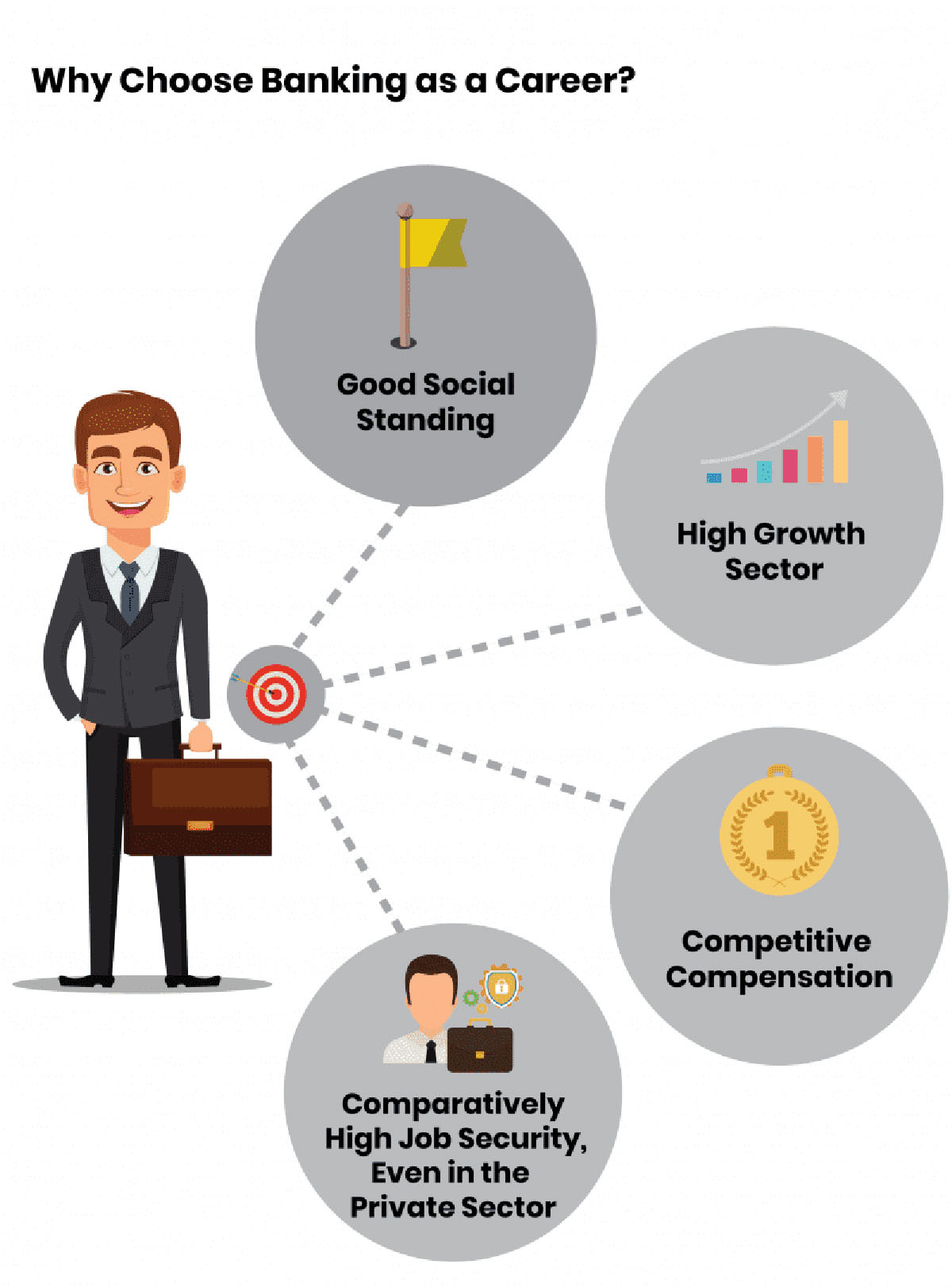

The Opportunities for Career Advancement in Accounting

Accounting offers a wide range of career opportunities, making it an attractive field for those looking for long-term growth and advancement. Whether you start as an entry-level accountant or pursue specialized certifications, there are numerous paths to progress in your accounting career.

One of the primary paths for career advancement in accounting is through professional certifications, such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designations. These certifications not only validate your expertise and knowledge but also open doors to higher-level positions and increased earning potential. Holding a CPA or CMA designation can lead to opportunities such as becoming a partner in an accounting firm, a CFO of a company, or even starting your own accounting practice.

In addition to certifications, gaining experience in different areas of accounting can also contribute to career advancement. Many accountants start their careers in public accounting firms, where they work on audits, tax filings, and financial consulting for various clients. This exposure provides a breadth of knowledge and skills that can later be applied in industry-specific roles or management positions within organizations.

Advancing to managerial positions is another common career trajectory in accounting. As your experience and expertise grow, you may have the opportunity to lead a team of accountants, oversee financial operations, or manage budgeting and forecasting processes. These roles require strong leadership and communication skills, as well as the ability to analyze financial data and guide strategic decision-making.

Furthermore, with the increasing adoption of technology in accounting, there is a growing demand for professionals skilled in data analysis and financial systems implementation. Roles such as financial analysts, business intelligence specialists, and technology consultants offer exciting opportunities for advancement and specialization within the field.

Additionally, accounting professionals who demonstrate strong business acumen and strategic thinking may find themselves advancing into executive-level positions. Financial expertise combined with a deep understanding of the organization’s goals and industry trends can position accountants for roles such as Chief Financial Officer (CFO) or Chief Executive Officer (CEO).

Overall, the opportunities for career advancement in accounting are diverse and plentiful. By continuously enhancing your knowledge, gaining experience in different areas, and pursuing certifications, you can carve a successful and fulfilling career path in this dynamic field.

The Satisfaction of Balancing the Books

For many accountants and bookkeepers, there is a unique sense of satisfaction that comes from balancing the books. The process of reconciling financial records, ensuring accuracy, and achieving balance is not only a fundamental aspect of accounting but also a source of professional fulfillment.

When it comes to balancing the books, precision and attention to detail are paramount. Accountants meticulously review financial transactions, compare them to supporting documentation, and ensure that everything is accounted for. This process can be time-consuming and requires a sharp eye for discrepancies or errors.

The satisfaction of balancing the books lies in the feeling of accomplishment that comes from successfully matching every dollar and cent. It provides a sense of order and completeness, confirming that all the financial data is in its rightful place. This meticulous attention to detail not only ensures accurate financial reporting but also contributes to the overall trustworthiness and integrity of the organization’s financial records.

In addition to the satisfaction of achieving balance, balancing the books also serves as a valuable tool for financial management. By reconciling accounts, accountants can identify and resolve discrepancies, detect fraudulent activities, and prevent errors from carrying over into subsequent reporting periods. This attention to detail helps to maintain the financial health and stability of the organization.

Furthermore, balancing the books allows accountants to produce accurate and reliable financial reports. These reports serve as a crucial resource for decision-making, as they provide insights into the financial performance of the business. Having confidence in the accuracy of the numbers and the integrity of the accounting records enables leaders to make informed decisions about budgeting, resource allocation, and growth strategies.

Ultimately, the satisfaction of balancing the books is derived from knowing that the financial information is precise, trustworthy, and reflecting the true financial state of the organization. It is a testament to the accountant’s skills and expertise, as well as their dedication to maintaining the highest standards of accuracy and integrity.

In summary, balancing the books is a fundamental task in accounting that provides a sense of accomplishment and fulfillment. It showcases the precision and attention to detail that accountants bring to their work, ensuring accuracy in financial reporting and facilitating sound financial management.

The Challenge of Keeping Up with Changing Regulations

One of the ongoing challenges for accountants and finance professionals is the need to keep up with constantly changing regulations and standards. As governments and regulatory bodies update and modify financial reporting guidelines, tax laws, and compliance requirements, accountants must stay informed and adapt their practices accordingly.

Financial regulations and accounting standards are continuously evolving to reflect new business practices, technological advancements, and changes in the global economy. For example, the International Financial Reporting Standards (IFRS) undergo regular updates to ensure consistency and comparability in financial reporting across different countries.

The challenge lies in the complexity and frequency of these changes. Accountants need to invest time and effort into staying up-to-date with the latest regulatory updates, interpretations, and amendments. They must be knowledgeable about the changes and understand how they impact financial reporting, tax obligations, and compliance requirements.

Accountants must also consider the implications of new regulations on their organization or clients. They need to analyze the potential impact on financial statements, accounting treatments, and any additional disclosures that may be required. This requires a thorough understanding of the underlying principles and the ability to interpret and apply the new regulations accurately.

Furthermore, the challenge of keeping up with changing regulations goes beyond simply understanding the rules. Accountants must also ensure that their organization or clients comply with the new guidelines. This may involve implementing new accounting systems, training staff, and updating internal controls to meet the regulatory requirements.

Adapting to changing regulations can be demanding, requiring accountants to stay informed through continuous learning and professional development. This may involve attending seminars, webinars, and conferences, as well as participating in industry forums and networking events. Engaging in ongoing education and staying connected with professional accounting bodies can help accountants navigate the ever-changing regulatory landscape.

Despite the challenges, keeping up with changing regulations is essential for accountants to provide accurate financial information, maintain compliance, and uphold the integrity of their work. It ensures that financial statements are reliable and transparent, allowing stakeholders and investors to make informed decisions based on accurate information.

In summary, the challenge of keeping up with changing regulations is an inherent part of the accounting profession. Accountants must continuously update their knowledge, adapt their practices, and ensure compliance with evolving financial reporting, tax, and compliance requirements. By staying informed and proactive, accountants can continue to deliver high-quality financial services and maintain the trust of their clients and stakeholders.

The Importance of Ethical Behavior in Accounting

Ethical behavior is of utmost importance in the field of accounting. Accountants and financial professionals play a critical role in ensuring the accuracy and integrity of financial information, and maintaining the trust of stakeholders. Upholding ethical standards is not only morally right but also essential for maintaining the credibility and reputation of the accounting profession.

One of the primary reasons for the importance of ethical behavior in accounting is the fiduciary duty that accountants owe to their clients, employers, and the public. Accountants are entrusted with sensitive financial data and are expected to act in the best interests of those they serve. This includes ensuring the accuracy of financial records, maintaining confidentiality, and avoiding conflicts of interest.

Accounting decisions can have significant financial implications for individuals, businesses, and investors. Ethical behavior ensures that these decisions are made based on objective and unbiased judgments, rather than personal gain or manipulation of financial data. It promotes transparency and fairness in financial reporting, which in turn helps stakeholders make informed decisions.

Furthermore, ethical behavior in accounting is essential for maintaining the public’s trust. Investors, lenders, and other stakeholders rely on financial statements and reports to assess the financial health and performance of a company. If accountants engage in unethical practices such as fraudulent reporting or misleading information, it can lead to financial losses, damage to reputations, and erosion of trust in the profession as a whole.

Professional accounting bodies, such as the American Institute of Certified Public Accountants (AICPA) and the International Federation of Accountants (IFAC), have established codes of ethics that guide the behavior of accountants. These codes emphasize principles such as integrity, objectivity, confidentiality, and professional competence. Adhering to these principles is not only expected but also required for accountants to maintain their professional licenses and certifications.

Additionally, ethical behavior in accounting helps mitigate the risk of legal and regulatory consequences. Violations of ethical standards can not only lead to disciplinary actions but also result in legal penalties, fines, and damage to personal and professional reputations. By acting ethically, accountants protect themselves, their organizations, and the individuals they serve from potentially harmful legal and financial repercussions.

In summary, ethical behavior is the cornerstone of the accounting profession. It ensures the accuracy and integrity of financial information, maintains public trust, and upholds the reputation of the profession. By adhering to ethical standards, accountants fulfill their fiduciary duty, promote transparency in financial reporting, and contribute to a fair and reliable financial ecosystem.

The Ability to Contribute to Financial Decision-Making

Accountants possess a unique set of skills and knowledge that allows them to contribute significantly to financial decision-making within organizations. Their expertise in analyzing, interpreting, and communicating financial information enables them to provide valuable insights and guidance to management, helping shape strategic plans and improve business performance.

One of the key contributions that accountants make to financial decision-making is their ability to assess the financial viability of different initiatives and projects. By analyzing financial data and performing cost and benefit analysis, accountants can evaluate the potential risks and returns associated with various investment opportunities. This helps management make informed decisions about resource allocation and prioritize initiatives that will maximize financial return.

Accountants also play a critical role in budgeting and forecasting. They use their knowledge of the organization’s financial position, historical performance, and market trends to develop realistic and accurate budgets. By monitoring actual performance against these budgets, accountants identify areas of potential savings or inefficiencies, enabling management to make adjustments and optimize financial resources.

Furthermore, accountants contribute to financial decision-making through their ability to assess the financial health and stability of the organization. They analyze financial statements, key performance indicators, and financial ratios to provide insights into the company’s profitability, liquidity, and efficiency. This information helps management identify areas for improvement, make informed decisions regarding pricing, cost control, and investment strategies, and assess the overall financial performance of the business.

Accountants also assist in risk management by assessing and monitoring financial risks. They evaluate the impact of financial risks such as exchange rate fluctuations, interest rate changes, and commodity price volatility on the organization’s financial performance. This information helps management develop risk mitigation strategies and make informed decisions to protect the organization’s financial well-being.

Additionally, accountants contribute to decision-making by ensuring compliance with financial regulations and reporting standards. They stay informed about changes in accounting rules and ensure accurate and timely reporting. This allows management to have confidence in the financial information and make decisions based on accurate and reliable data.

In summary, accountants have the ability to contribute significantly to financial decision-making within organizations. Their expertise in analyzing financial data, assessing risks, developing budgets, and ensuring compliance allows them to provide valuable insights and guidance to management. By leveraging their skills and knowledge, accountants enhance decision-making processes, improve financial performance, and add value to the organization as a whole.

Conclusion

Accounting is a dynamic and rewarding field that offers a range of benefits and opportunities. From the precision and accuracy required to balancing the books to the analytical skills needed for financial decision-making, accounting provides a fulfilling career path for those with a passion for numbers, problem-solving, and ethical behavior.

Through their role in financial record-keeping, accountants play a crucial part in providing reliable information that guides strategic decision-making within organizations. Their ability to analyze financial data, interpret trends, and identify areas for improvement contributes to the overall success and growth of businesses.

Furthermore, the demand for accountants continues to grow as businesses seek professionals who can navigate complex regulations and provide valuable insights. The ability to stay up-to-date with changing regulations, technologies, and industry trends is essential to remain competitive and ensure compliance in the accounting profession.

Ethical behavior is paramount in accounting, as accountants must act with integrity, objectivity, and confidentiality to protect the interests of their clients and stakeholders. Upholding ethical standards helps to maintain the public’s trust and ensures the credibility and reliability of financial information.

In conclusion, accounting offers a fulfilling and promising career path for those with a passion for finance, problem-solving, ethical behavior, and continuous learning. The opportunities for career advancement, the satisfaction of balancing the books, and the ability to contribute to financial decision-making make accounting a rewarding profession. Whether in public accounting, private industry, or governmental organizations, accountants are essential in providing accurate financial information to support strategic decision-making and drive business success.