Finance

Why Do You Want To Be An Investment Banker?

Modified: February 21, 2024

Interested in a career in finance? Discover why so many aspire to be investment bankers and unlock the world of opportunities that this field has to offer.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Role of an Investment Banker

- Attractive Financial Rewards

- Opportunities for Career Progression

- Challenging and Dynamic Work Environment

- Exposure to Global Markets and Big Deals

- Building a Strong Professional Network

- Gaining In-Depth Knowledge of Financial Markets

- The Prestige and Reputation Associated with Investment Banking

- Contributing to Economic Growth and Development

- Conclusion

Introduction

Considering a career in finance? Want to be at the forefront of the global financial industry? If so, becoming an investment banker might be the right path for you. Investment banking is a specialized field that offers a unique blend of financial expertise, strategic thinking, and deal-making skills. It is a highly sought-after profession, attracting ambitious individuals who are driven by success and have a passion for the intricacies of the financial world.

An investment banker plays a crucial role in facilitating major financial transactions, advising clients, and providing strategic guidance. They work closely with corporations, governments, and high-net-worth individuals, helping them raise capital, execute mergers and acquisitions, manage their assets, and navigate complex financial markets.

This article will delve deeper into the reasons why many aspiring finance professionals are drawn to the challenging yet rewarding career of an investment banker. From the prospect of attractive financial rewards to the opportunity for career progression, we will explore the many aspects that make investment banking an enticing career choice.

So, if you’re curious about the world of investment banking and wondering what it takes to thrive in this field, keep reading to discover why you might want to consider joining the ranks of investment bankers.

Understanding the Role of an Investment Banker

An investment banker is a financial professional who helps clients navigate the complexities of the financial market. They provide expert advice, structure and coordinate various financial transactions, and play a critical role in driving economic growth and development.

One of the key responsibilities of an investment banker is facilitating capital raising for companies through initial public offerings (IPOs) and secondary offerings. This involves understanding the financial needs of the client, conducting thorough market analysis, and devising strategies to attract investors. By successfully raising capital, investment bankers help companies expand their operations, fund research and development, and fuel their growth.

Another important aspect of an investment banker’s role is mergers and acquisitions (M&A) advisory. Investment bankers assist clients in identifying potential acquisition targets, evaluating the financial viability of a merger, negotiating deal terms, and facilitating the transaction process. M&A deals often involve complex financial structures and require meticulous attention to detail, making the expertise of investment bankers invaluable.

Investment bankers also offer strategic financial advisory services, guiding clients through major financial decisions such as restructuring, divestitures, and debt restructuring. They provide insights on market trends, assess financial risks, and help clients develop effective strategies to maximize their financial value.

Additionally, investment bankers play a crucial role in the capital markets, facilitating the buying and selling of financial assets such as stocks, bonds, and derivatives. They provide liquidity to the market and ensure efficient transactions between buyers and sellers. This involvement in the capital markets requires investment bankers to have a deep understanding of financial products, market conditions, and regulatory frameworks.

Overall, the role of an investment banker is multifaceted and requires a diverse skill set. It demands strong analytical abilities, financial acumen, and the ability to thrive in a fast-paced and often high-pressure environment. Investment bankers must be adaptable, problem-solving oriented, and possess excellent interpersonal and communication skills to effectively collaborate with clients, colleagues, and stakeholders.

Attractive Financial Rewards

One of the primary motivations for many individuals pursuing a career in investment banking is the attractive financial rewards it offers. Investment bankers are known to earn substantial salaries and enjoy lucrative bonuses that are often directly linked to their performance and the success of the deals they work on.

Starting salaries for investment banking analysts can be significantly higher than those in other industries, and as they gain experience and progress in their careers, their earning potential increases substantially. With each promotion, investment bankers can expect significant salary increments, making it a financially rewarding profession in the long run.

In addition to base salaries, investment bankers also receive substantial bonuses, which can be a significant portion of their total compensation. These bonuses are typically based on individual and team performance, as well as the profitability of the firm. Successful completion of high-value deals and exceeding performance targets can lead to substantial bonuses that can sometimes even surpass the annual base salary.

Moreover, investment bankers often have access to various perks and benefits, such as expense accounts, health insurance, retirement plans, and generous vacation policies. These additional benefits further contribute to their overall financial well-being and job satisfaction.

It’s important to note that while the financial rewards in investment banking can be substantial, they are typically reflective of the demanding nature of the job. Investment bankers often work long hours, including weekends and holidays, to meet client demands and deadlines. The high-pressure environment and tight deadlines can be demanding, but for many, the attractive financial incentives make it worthwhile.

Overall, the potential for significant financial rewards is a major driver for individuals considering a career in investment banking. The combination of high salaries, performance-based bonuses, and additional benefits can make it a financially fulfilling profession for those who are willing to put in the hard work and dedication required.

Opportunities for Career Progression

Investment banking offers promising opportunities for career progression, making it an appealing choice for ambitious individuals looking to advance in the finance industry. The hierarchical structure of investment banks provides a clear path for growth and advancement.

Entry-level positions in investment banking often start with roles such as Analyst or Associate. These positions provide a solid foundation and valuable experience in financial analysis, modeling, and deal execution. As professionals gain expertise and demonstrate their capabilities, they can rise through the ranks to become Vice Presidents, Directors, Managing Directors, and even Partners in investment banks.

Advancement within investment banking is typically based on a combination of performance, experience, and client relationships. Successful completion of high-value deals, consistently meeting targets, and building a strong network of clients and industry contacts are crucial for career progression. Investment bankers who prove their ability to generate revenue and bring in new business are often fast-tracked for promotions.

Furthermore, as investment bankers progress in their careers, they have the opportunity to specialize in specific industry sectors or financial products. This allows them to develop expertise in niche areas and become trusted advisors in their respective fields. Specialization can open doors to more senior and prestigious roles, providing increased responsibility and influence in deal-making processes.

For ambitious individuals, investment banking also offers the potential to transition into executive roles within corporate finance departments or private equity firms. The strategic thinking, financial analysis, and negotiation skills developed in investment banking make professionals highly sought-after for senior-level positions in various industries.

It’s worth noting that career progression in investment banking requires commitment and continuous learning. Investment bankers often need to stay updated with market trends, regulatory changes, and industry developments. Pursuing advanced degrees such as an MBA or obtaining professional certifications like the Chartered Financial Analyst (CFA) designation can further enhance career prospects and open doors to senior leadership positions.

Overall, investment banking provides a clear and structured path for career progression. Through consistent achievement and continuous professional development, ambitious individuals can climb the corporate ladder, reach senior-level positions, and achieve both professional success and personal growth.

Challenging and Dynamic Work Environment

Investment banking is known for its challenging and dynamic work environment, attracting individuals who thrive on being constantly engaged and stimulated. The fast-paced nature of the industry keeps professionals on their toes and provides a unique set of intellectual challenges.

Investment bankers are often exposed to complex financial transactions that require analytical thinking, problem-solving skills, and strategic decision-making. These deals may involve intricate financial structures, regulatory considerations, and negotiations with multiple parties. The ability to navigate through these complexities and deliver innovative solutions is what sets investment bankers apart.

The job demands an unwavering attention to detail, as even minor errors can have significant financial consequences. The pressure to consistently deliver high-quality work within tight deadlines can be intense, but for individuals who enjoy working under pressure, the investment banking environment can be incredibly rewarding.

Moreover, the dynamic nature of the industry ensures that no two days are the same for investment bankers. The constant flow of deals and client demands means that professionals are constantly exposed to new challenges and opportunities. This variety keeps the work interesting, preventing monotony and allowing investment bankers to constantly learn and grow.

Working in investment banking also means being at the forefront of global finance. Investment bankers are part of a global network, constantly interacting with clients, colleagues, and industry experts from around the world. This exposure to different markets, cultures, and perspectives adds an element of excitement and diversity to the work, making each day a unique and enriching experience.

Collaboration and teamwork are essential in investment banking. Professionals often work in a team environment, collaborating with colleagues who have diverse backgrounds and areas of expertise. This fosters a culture of learning and knowledge sharing, enabling investment bankers to broaden their skill sets and gain exposure to different aspects of the business.

While the challenging nature of the work can be demanding, the sense of accomplishment that comes from successfully completing a challenging deal or delivering value to clients can be immensely gratifying. Investment banking appeals to individuals who are driven by ambitious goals, are motivated by intellectual challenges, and are willing to push their limits to achieve success.

Therefore, if you thrive in a fast-paced, intellectually demanding, and ever-changing work environment, investment banking may be the perfect fit for you.

Exposure to Global Markets and Big Deals

One of the most enticing aspects of a career in investment banking is the exposure to global markets and the opportunity to work on big deals that shape the financial landscape. Investment bankers are at the forefront, playing a pivotal role in major transactions that have a significant impact on companies, industries, and even economies.

Investment banks operate on a global scale, providing services to clients across borders. This global reach ensures that investment bankers have the opportunity to work with clients from various countries and experience different market dynamics. They gain insights into the cultural nuances, regulatory frameworks, and economic trends of different countries, broadening their understanding of the global business landscape.

Working on big deals gives investment bankers the chance to be involved in high-profile transactions that capture the attention of the business world. This may include mergers and acquisitions, initial public offerings (IPOs), debt issuances, and complex financial restructuring. These deals often involve multi-million or even billion-dollar transactions, making them both financially lucrative and intellectually stimulating.

Being a part of such big deals means investment bankers have the opportunity to collaborate with industry leaders, top executives, and high-net-worth individuals. This exposure not only builds their professional network but also provides invaluable learning opportunities from seasoned experts in the field. It offers a chance to develop strong relationships with influential individuals who can potentially open doors to future career opportunities.

The experience gained from working on big deals is highly valued in the finance industry. Investment bankers learn to navigate complex financial structures, conduct in-depth due diligence, negotiate deal terms, and manage diverse stakeholder relationships. These skills and experiences are transferable and can be applied to various roles within the finance sector, providing a solid foundation for long-term career growth.

Furthermore, working on big deals often means being involved in cutting-edge industries and sectors. Investment bankers have the opportunity to work with technology startups, renewable energy companies, healthcare providers, and more. This exposure to innovative industries not only keeps professionals at the forefront of market trends but also allows them to contribute to shaping the future of these sectors.

In summary, a career in investment banking provides exposure to global markets and the opportunity to work on big deals that have a transformative impact. The experience gained from working on these transactions is invaluable, opening doors to exciting career prospects and offering a deeper understanding of the intricacies of the financial world.

Building a Strong Professional Network

In the world of finance, building a strong professional network is paramount to success, and investment banking offers unparalleled opportunities to network with industry leaders, colleagues, and clients. A robust professional network can open doors to new career prospects, provide valuable insights, and contribute to personal and professional growth.

Investment bankers often interact with clients from various industries, including corporate executives, entrepreneurs, and institutional investors. These interactions create opportunities to forge meaningful connections, establish rapport, and gain the trust of influential individuals. As investment bankers build a reputation for delivering results and providing exceptional service, they can solidify their position within their network.

Networking events, conferences, and industry gatherings are common in the investment banking field. These events bring together professionals from different backgrounds and facilitate connections. Attending such events allows investment bankers to meet like-minded individuals, exchange industry knowledge, and expand their network further.

Investment banking also fosters a collaborative and team-oriented culture, providing opportunities to collaborate with colleagues who have diverse skill sets and perspectives. Building strong relationships with teammates and mentors can lead to valuable connections later in one’s career. Mentorship programs within investment banks can provide guidance and support, as well as opportunities to learn from experienced professionals.

Investment banks also often have a dedicated alumni network, connecting past and present employees. Alumni networks are valuable resources for career guidance, job referrals, and staying connected to industry trends. Alumni events and reunions offer opportunities to reconnect with former colleagues and expand one’s network within the investment banking community.

In addition, technology has made networking more accessible and efficient. Social media platforms like LinkedIn provide a digital space for professionals to connect, share insights, and collaborate. Investment bankers can leverage these platforms to build an online presence, showcase their expertise, and connect with individuals across different industries and geographies.

A strong professional network not only opens doors to job opportunities but also enables investment bankers to stay updated with market trends, gain a broader understanding of different industries, and seek advice from experienced professionals. It provides a support system, a sounding board for ideas, and a platform for knowledge exchange.

Overall, investment banking offers abundant opportunities to build a strong professional network. Cultivating meaningful relationships, attending networking events, and leveraging social media platforms can contribute to a robust network. A strong network is a valuable asset, providing a competitive advantage and opening doors to new opportunities throughout one’s career.

Gaining In-Depth Knowledge of Financial Markets

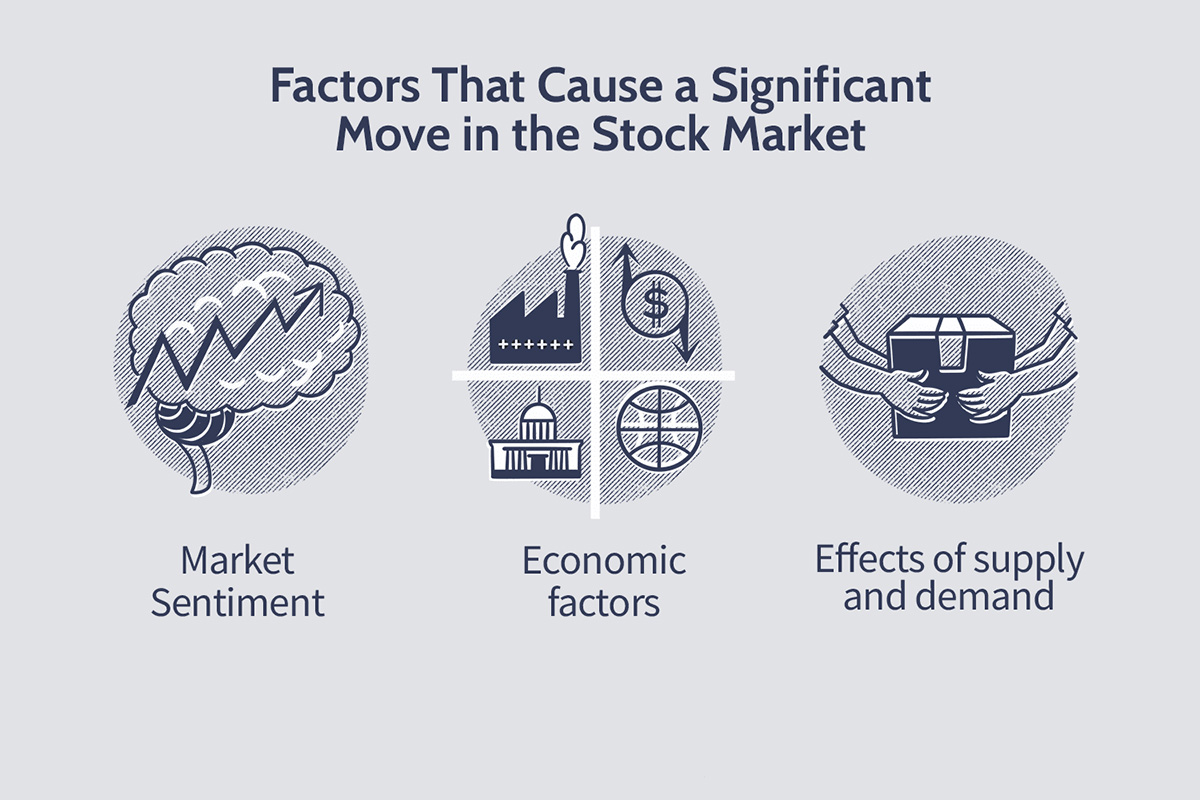

Investment banking provides a unique opportunity to gain in-depth knowledge of financial markets, making it an appealing career choice for individuals passionate about the intricacies of the financial world. Investment bankers are immersed in the ever-evolving landscape of global finance, allowing them to develop a deep understanding of market trends, economic forces, and investment strategies.

Investment bankers are involved in a wide range of financial transactions, including mergers and acquisitions, initial public offerings (IPOs), debt and equity issuances, and restructuring deals. These deals expose them to the inner workings of various industries, giving them insights into market dynamics, competitive landscapes, and regulatory frameworks.

By closely analyzing financial statements, conducting due diligence, and assessing market conditions, investment bankers gain a comprehensive understanding of different asset classes, valuation methodologies, and risk management techniques. They learn to navigate complex financial structures and develop a keen sense of market trends and investor sentiment.

Investment bankers also have the opportunity to work closely with seasoned professionals in research departments, providing them access to in-depth financial analysis and insights. The exposure to research reports, market analysis, and economic forecasts further enhances their knowledge and keeps them up to date with the latest developments in the financial world.

Furthermore, investment bankers often work with a diverse array of clients, ranging from startups to established corporations and institutional investors. Each client brings unique challenges and opportunities, offering investment bankers a chance to broaden their expertise and gain insights into different investment strategies, capital allocation decisions, and risk management practices.

Investment banking professionals are constantly engaged with regulatory guidelines and compliance requirements. This exposure ensures that they stay informed about changing regulatory landscapes and understand the impact of regulatory decisions on financial markets. They develop a deep appreciation for the legal and regulatory frameworks that govern the financial industry.

Continual learning and professional development are integral to investment banking. Investment bankers are encouraged to pursue advanced degrees, such as an MBA or professional certifications like the Chartered Financial Analyst (CFA), to deepen their knowledge and enhance their expertise. This commitment to ongoing education helps investment bankers stay on top of industry trends and adapt to the evolving financial landscape.

In summary, investment banking offers a unique opportunity to gain in-depth knowledge of financial markets. Through complex transactions, collaboration with research departments, exposure to diverse clients, and a commitment to continuous learning, investment bankers develop a comprehensive understanding of market dynamics, investment strategies, and regulatory frameworks. This knowledge is not only invaluable for their own professional growth but also positions them as trusted advisors and experts in their field.

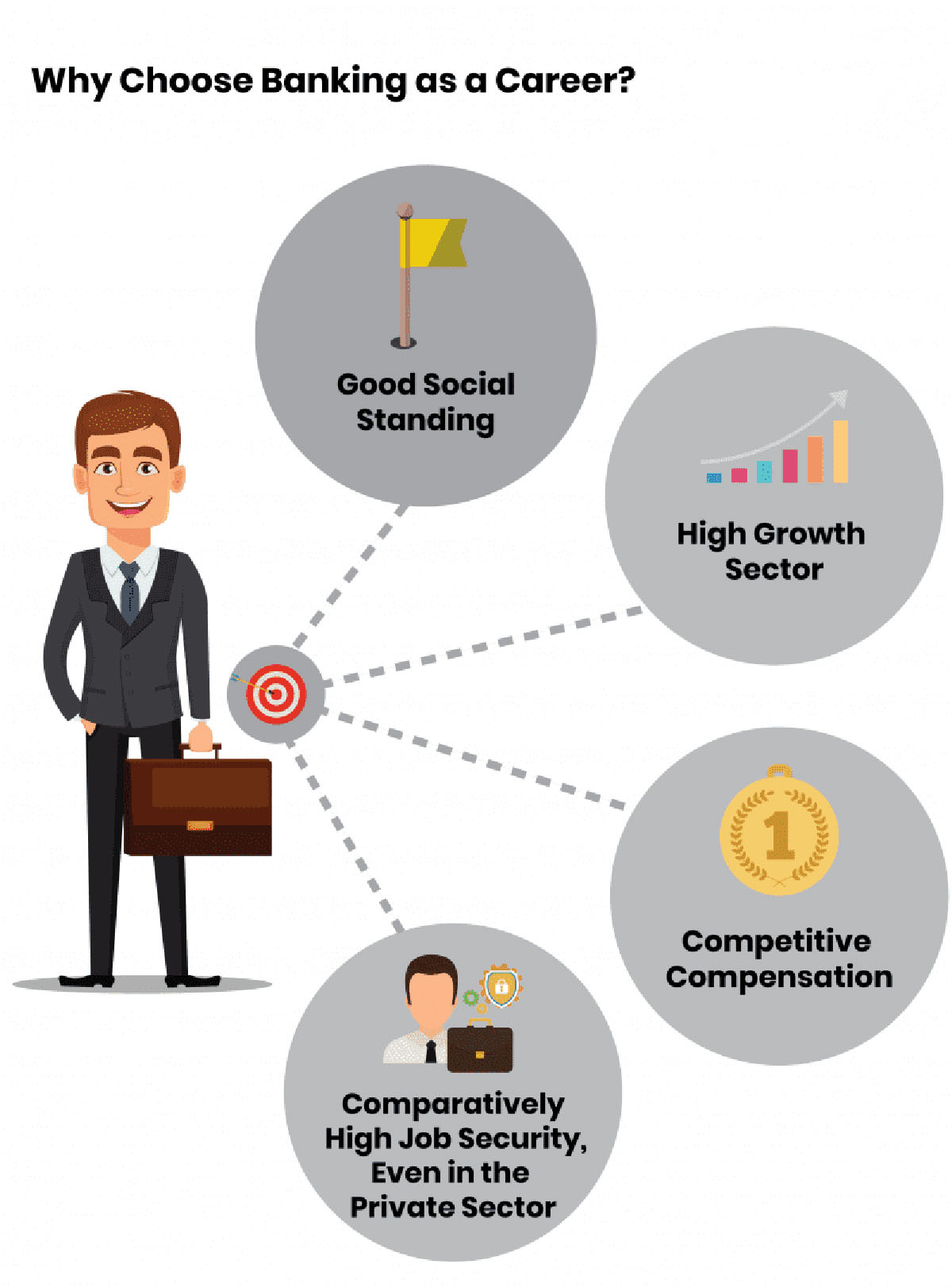

The Prestige and Reputation Associated with Investment Banking

Investment banking carries a considerable amount of prestige and is often associated with a strong reputation in the finance industry. The allure of the industry lies not only in the financial rewards and intellectual challenges but also in the prestige that comes with being an investment banker.

Investment banks are reputable institutions that have a long history of advising on high-profile transactions and working with prestigious clients. The association with renowned financial institutions lends credibility and prestige to investment bankers, enhancing their professional reputation. The reputation of investment banks is built on their track record of successfully executing complex deals and their ability to navigate the intricacies of the financial markets.

The reputation of investment bankers extends beyond the individual. Investment banking professionals are often seen as trusted advisors and industry experts. Their opinions and insights carry weight and can influence investment decisions. This reputation as a trusted advisor positions investment bankers as valuable resources for clients seeking strategic advice and guidance.

The prestigious image of investment banking is also bolstered by the high entry barriers and rigorous selection process. Investment banks typically hire top talent from prestigious universities and look for individuals with outstanding academic achievements, strong analytical skills, and a track record of success. Being selected to join an investment bank is seen as an accomplishment in itself, reflecting the individual’s competence and potential.

Moreover, the challenging work environment and the demanding nature of investment banking contribute to its prestigious reputation. Investment bankers are known for their work ethic, professionalism, and ability to handle high-pressure situations. The dedication required to succeed in investment banking is often admired and respected by peers and industry professionals.

The prestige associated with investment banking is not limited to professional circles. The general public often holds investment banking in high regard due to its association with high-value transactions, influential clients, and its role in driving economic growth. Investment bankers are seen as key players in the financial industry, contributing to the overall prosperity and development of the economy.

However, it is important to note that while the prestige and reputation associated with investment banking can be appealing, it should not be the sole reason for pursuing a career in the field. The demanding work environment and the commitment required should be taken into consideration as well. Ultimately, it is the combination of financial rewards, intellectual challenges, and the potential for personal growth that make investment banking a compelling choice for many aspiring finance professionals.

Contributing to Economic Growth and Development

Investment banking plays a significant role in driving economic growth and development. Through their involvement in major financial transactions and strategic advisory services, investment bankers contribute to the overall health and prosperity of the economy.

One key way in which investment banking contributes to economic growth is by facilitating capital raising for companies. Through initial public offerings (IPOs) and secondary offerings, investment bankers help companies access capital from investors. This infusion of capital allows companies to expand their operations, invest in research and development, create job opportunities, and contribute to economic growth.

In addition to capital raising, investment bankers play a vital role in supporting mergers and acquisitions (M&A) activities. By facilitating M&A deals, investment bankers help companies consolidate their operations, achieve economies of scale, and streamline their business processes. This leads to increased efficiency, improved market competitiveness, and ultimately, economic growth.

Furthermore, investment bankers provide strategic financial advisory services to clients, guiding them through major financial decisions such as debt restructuring, divestitures, and restructuring. By providing expertise and insights, investment bankers help companies navigate financial challenges and unlock potential value. This, in turn, contributes to the stability and growth of the economy.

Investment banking also fuels economic development by fostering innovation and entrepreneurship. Investment bankers work closely with startups and emerging companies, providing them with access to capital, strategic advice, and connections to potential investors. This support enables young and innovative companies to grow and create new products, technologies, and job opportunities, stimulating economic development.

Moreover, the contribution of investment banking extends beyond individual companies. Investment bankers assist government entities in raising capital through bond issuances and provide financial advice on infrastructure development projects. These initiatives help fund public infrastructure, such as transportation networks, schools, and hospitals, enhancing the overall quality of life and promoting economic development in communities.

Investment banking’s role in financial markets is also crucial for economic growth. Investment bankers provide liquidity to the market, facilitating the buying and selling of financial assets. This ensures efficient allocation of capital, encourages investment, and supports the smooth functioning of the financial system. A robust and well-functioning financial market is a key driver of economic growth and stability.

In summary, investment banking plays a pivotal role in contributing to economic growth and development. By assisting companies in raising capital, facilitating mergers and acquisitions, providing strategic financial advice, supporting innovation and entrepreneurship, and ensuring the efficiency of financial markets, investment bankers drive economic prosperity and create opportunities for growth throughout the economy.

Conclusion

Choosing a career in investment banking can be an exceptional opportunity for individuals with a passion for finance, a hunger for intellectual challenges, and a desire to make a significant impact in the financial world. The reasons to pursue a career in investment banking are varied and compelling.

From attractive financial rewards to the potential for career progression, investment banking offers the opportunity for personal and professional growth. The challenging and dynamic work environment keeps professionals engaged, allows them to develop a diverse skill set, and broadens their horizons. Investment bankers gain in-depth knowledge of financial markets, positioning themselves as experts in their field.

The prestigious nature of investment banking, associated with powerful institutions and a solid professional network, enhances career prospects and opens doors to new opportunities. By contributing to economic growth and development, investment bankers drive the prosperity of companies, industries, and communities.

While the road to success in investment banking is not without its challenges, those who thrive in this industry find immense satisfaction in the high-stakes deals, the ability to influence market trends, and the opportunity to work with influential clients and colleagues.

In conclusion, investment banking offers a stimulating and rewarding career path for individuals who are ambitious, driven, and passionate about finance. By joining the ranks of investment bankers, you become part of a dynamic and influential industry that shapes not only the financial landscape but also the broader economy. So, if you’re ready to embark on a journey that brings together finance, strategy, and global markets, investment banking might be the perfect fit for you.