Finance

Why IRS Soft Credit Inquiry

Published: March 5, 2024

Learn why the IRS conducts soft credit inquiries and how it impacts your finances. Understand the implications and how to manage them effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to tax matters, the Internal Revenue Service (IRS) is known for its thoroughness. The IRS employs various tools and techniques to ensure accurate assessment and collection of taxes. One such tool is the soft credit inquiry, a method that has sparked curiosity and concern among taxpayers. In this article, we will delve into the world of IRS soft credit inquiries, exploring what they are, why the IRS uses them, and the implications for taxpayers.

Soft credit inquiries have become a common practice in various financial and administrative processes. However, the IRS's use of soft credit inquiries has raised questions about privacy, accuracy, and the potential impact on taxpayers. By understanding the nature and purpose of these inquiries, taxpayers can gain insight into the IRS's methods and make informed decisions regarding their financial activities.

In the following sections, we will explore the concept of soft credit inquiries, the specific reasons behind the IRS's utilization of this tool, and the potential benefits and concerns associated with its implementation. By shedding light on this topic, we aim to provide taxpayers with a comprehensive understanding of IRS soft credit inquiries, empowering them to navigate their tax-related interactions with confidence and clarity.

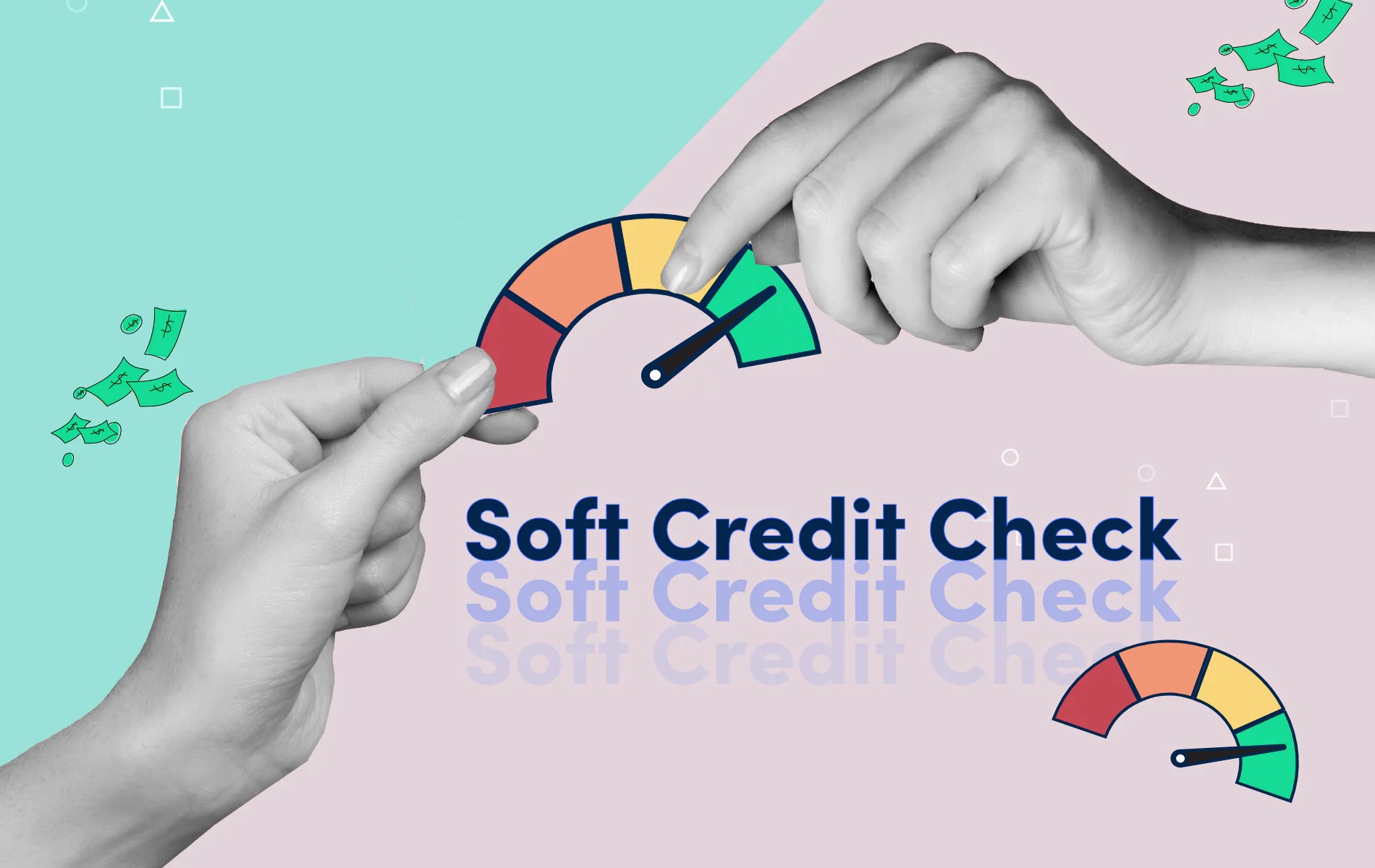

What is a soft credit inquiry?

A soft credit inquiry, also known as a soft pull, occurs when an individual or organization checks your credit report as part of a background check, pre-approval offer, or account review. Unlike a hard inquiry, which typically happens when you apply for credit, a soft inquiry does not affect your credit score and is not visible to lenders. Instead, it provides a high-level overview of your credit history, including your current and past credit accounts, payment history, and any recent credit inquiries.

Soft credit inquiries are commonly used for pre-approval processes, background checks, and account maintenance. They allow individuals and organizations to assess a person’s creditworthiness without impacting their credit score or appearing as a red flag to potential lenders. This type of inquiry is especially valuable in situations where a comprehensive credit assessment is not necessary, but a general understanding of an individual’s credit profile is beneficial.

For taxpayers, understanding the distinction between soft and hard credit inquiries is essential, as it can influence their financial decisions and peace of mind. Soft inquiries play a role in various financial interactions, and their impact on credit reports is markedly different from that of hard inquiries. By grasping the nature of soft credit inquiries, taxpayers can approach credit-related activities with a clearer understanding of how their credit reports may be accessed and utilized.

Why does the IRS use soft credit inquiries?

The IRS employs soft credit inquiries as part of its efforts to verify taxpayer information and assess individuals’ financial situations. By accessing credit reports through soft inquiries, the IRS gains insight into taxpayers’ financial activities, including loans, mortgages, and other credit accounts. This information allows the IRS to corroborate the data provided on tax returns and identify potential discrepancies or inaccuracies.

Furthermore, soft credit inquiries enable the IRS to verify taxpayers’ identities and detect instances of identity theft or fraudulent tax filings. By comparing the information obtained from credit reports with the details provided on tax returns, the IRS can enhance its ability to combat tax-related identity theft and ensure the integrity of the tax system.

Another reason for the IRS’s use of soft credit inquiries is to assess individuals’ ability to pay outstanding tax liabilities. By reviewing credit reports, the IRS can gauge taxpayers’ financial standing and determine the most appropriate methods for collecting overdue taxes. This approach helps the IRS tailor its collection efforts to align with taxpayers’ financial circumstances, potentially offering more manageable repayment options and reducing the risk of prolonged delinquency.

Overall, the utilization of soft credit inquiries aligns with the IRS’s commitment to accurate tax assessment, identity verification, and tailored collection strategies. By leveraging this tool, the IRS aims to enhance the integrity of the tax system, protect taxpayers from identity theft, and facilitate fair and equitable tax collection practices.

How does the IRS use soft credit inquiries?

The IRS utilizes soft credit inquiries to gather pertinent financial information about taxpayers from credit reporting agencies. When conducting a soft inquiry, the IRS accesses an individual’s credit report to review their credit accounts, payment history, and other relevant financial details. This process allows the IRS to verify the accuracy of the information provided on tax returns and assess taxpayers’ financial standing.

Upon accessing credit reports through soft inquiries, the IRS compares the data obtained with the details disclosed on tax returns, enabling them to identify inconsistencies or discrepancies that may require further investigation. Additionally, the IRS employs soft credit inquiries to verify taxpayers’ identities, detect potential instances of identity theft, and prevent fraudulent tax activities.

It is important to note that the information obtained through soft credit inquiries is used exclusively for tax-related purposes and is subject to strict confidentiality and data security measures. The IRS leverages this financial insight to enhance the accuracy of tax assessments, combat tax-related identity theft, and tailor collection strategies to align with taxpayers’ financial capabilities.

By incorporating soft credit inquiries into its processes, the IRS aims to ensure the integrity of the tax system while safeguarding taxpayers’ financial well-being. This approach underscores the IRS’s commitment to leveraging appropriate and responsible methods to verify taxpayer information, protect against identity theft, and facilitate fair and equitable tax collection practices.

Benefits of IRS soft credit inquiries

IRS soft credit inquiries offer several potential benefits for both the tax agency and taxpayers. These advantages contribute to the accuracy of tax assessments, the protection of taxpayer identities, and the facilitation of fair and tailored tax collection practices.

- Enhanced Accuracy: By utilizing soft credit inquiries, the IRS can corroborate the financial information provided on tax returns, leading to more accurate tax assessments. This verification process helps identify discrepancies and ensures that taxpayers’ financial details align with their reported income and deductions.

- Identity Verification: Soft credit inquiries enable the IRS to verify taxpayers’ identities and detect potential instances of identity theft. This proactive approach helps safeguard taxpayers from fraudulent tax activities and enhances the overall security of the tax system.

- Tailored Collection Strategies: Accessing credit reports through soft inquiries allows the IRS to assess taxpayers’ financial standing, facilitating the development of tailored collection strategies. By understanding individuals’ financial capabilities, the IRS can offer manageable repayment options and prevent undue financial hardship during the tax collection process.

- Combatting Tax-Related Identity Theft: The use of soft credit inquiries supports the IRS’s efforts to combat tax-related identity theft. By cross-referencing the information obtained from credit reports with the details provided on tax returns, the IRS can detect discrepancies that may indicate fraudulent activities, thereby protecting taxpayers and the integrity of the tax system.

Overall, the benefits of IRS soft credit inquiries contribute to the agency’s ability to accurately assess taxes, protect taxpayer identities, and tailor collection approaches to align with individuals’ financial circumstances. By leveraging this tool responsibly and ethically, the IRS aims to uphold the integrity of the tax system and provide taxpayers with fair and equitable treatment in tax-related matters.

Concerns about IRS soft credit inquiries

While IRS soft credit inquiries serve various purposes in tax assessment and identity verification, they have sparked concerns among taxpayers and privacy advocates. These concerns revolve around potential privacy implications, data security considerations, and the impact of soft credit inquiries on individuals’ financial information.

- Privacy Implications: Some taxpayers express apprehension about the extent of financial information accessed by the IRS through soft credit inquiries. The comprehensive nature of credit reports may raise concerns about the privacy of individuals’ financial details and the potential for unauthorized use or disclosure.

- Data Security: Given the sensitivity of financial information, concerns about data security and the protection of credit report data have emerged. Taxpayers may question the measures in place to safeguard the information obtained through soft credit inquiries and mitigate the risk of unauthorized access or misuse.

- Transparency and Communication: Concerns about transparency and communication regarding soft credit inquiries may arise, as taxpayers seek clarity on the IRS’s practices and the implications for their financial information. Clear and accessible information about the purpose and scope of soft credit inquiries can help alleviate uncertainty and build trust among taxpayers.

- Impact on Financial Standing: Some individuals may worry about the potential impact of soft credit inquiries on their credit scores or financial standing. While soft inquiries do not affect credit scores, concerns about the frequency and scope of these inquiries may lead to apprehension about their implications for individuals’ credit profiles.

Addressing these concerns involves transparent communication, robust data security measures, and clear guidelines regarding the ethical and responsible use of soft credit inquiries. By fostering an environment of trust and accountability, the IRS can mitigate concerns and ensure that the utilization of soft credit inquiries aligns with the principles of privacy protection, data security, and fair treatment of taxpayers.

Conclusion

IRS soft credit inquiries represent a multifaceted tool that serves to enhance the accuracy of tax assessments, protect taxpayer identities, and tailor collection strategies to align with individuals’ financial circumstances. While these inquiries offer valuable benefits, concerns about privacy, data security, and transparency have prompted discussions about their ethical and responsible use.

It is imperative for the IRS to address these concerns by prioritizing transparent communication, implementing robust data security measures, and upholding ethical standards in the utilization of soft credit inquiries. By fostering an environment of trust and accountability, the IRS can demonstrate its commitment to safeguarding taxpayer privacy, protecting sensitive financial information, and ensuring fair and equitable treatment in tax-related matters.

For taxpayers, understanding the nature and purpose of IRS soft credit inquiries empowers them to navigate tax-related interactions with clarity and confidence. By recognizing the benefits and potential concerns associated with these inquiries, individuals can make informed decisions and engage in proactive measures to protect their financial well-being.

As the landscape of tax administration continues to evolve, the responsible use of soft credit inquiries remains a pivotal aspect of the IRS’s efforts to maintain the integrity of the tax system and uphold the trust of taxpayers. By balancing the benefits of these inquiries with the need to address concerns, the IRS can foster a climate of accountability, transparency, and respect for taxpayer privacy, thereby reinforcing its commitment to fair and ethical tax administration.