Finance

Why Is PayPal Doing A Credit Inquiry

Published: March 5, 2024

Learn why PayPal conducts credit inquiries and how it may impact your financial situation. Understand the implications and make informed decisions in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit inquiries are a common aspect of the financial world, often occurring when individuals apply for loans, credit cards, or other forms of credit. However, when a well-established entity like PayPal, primarily known for its digital payment services, conducts a credit inquiry, it sparks curiosity and raises questions among its users. In this article, we will delve into the realm of credit inquiries, understand their significance, and explore why PayPal might be conducting them.

Credit inquiries play a pivotal role in assessing an individual's creditworthiness. They are typically categorized as either "hard inquiries" or "soft inquiries," each serving distinct purposes and carrying varying impacts on one's credit profile. Understanding the nature of these inquiries is crucial for comprehending their implications.

As we navigate through the intricacies of credit inquiries, we will specifically focus on PayPal's recent foray into this arena. The rationale behind PayPal's decision to conduct credit inquiries, its potential impact on users, and the broader implications of this maneuver will be thoroughly examined. By shedding light on these aspects, we aim to provide clarity and insight into a topic that directly affects PayPal's vast user base.

Join us on this exploration of credit inquiries and PayPal's involvement, as we unravel the complexities and unveil the underlying reasons for this intriguing development.

Understanding Credit Inquiries

Credit inquiries, also known as credit pulls or credit checks, are requests made by individuals or organizations to access an individual’s credit report and assess their creditworthiness. These inquiries serve as a means for lenders, financial institutions, and other entities to evaluate the risk associated with extending credit to an individual.

There are two primary types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries occur when a potential lender reviews an individual’s credit report as part of the decision-making process for a credit application. These inquiries are typically initiated when individuals apply for credit cards, mortgages, auto loans, or other forms of financing. Hard inquiries are recorded on the individual’s credit report and may have a temporary impact on their credit score.

In contrast, soft inquiries occur when an individual or entity checks their own credit report, or when a company conducts a background check not related to a credit application, such as pre-approved credit offers or employment verification. Soft inquiries do not affect the individual’s credit score and are not visible to lenders when assessing creditworthiness.

It’s essential for individuals to be aware of the distinction between these two types of inquiries, as hard inquiries can have a minor, short-term impact on their credit score. Multiple hard inquiries within a short timeframe may be interpreted as a sign of financial distress, potentially lowering the individual’s credit score and affecting their ability to secure favorable credit terms.

Understanding credit inquiries is integral to managing one’s financial health and making informed decisions when seeking credit. By comprehending the implications of these inquiries, individuals can navigate the credit application process with greater awareness and strategically minimize any adverse effects on their credit profile.

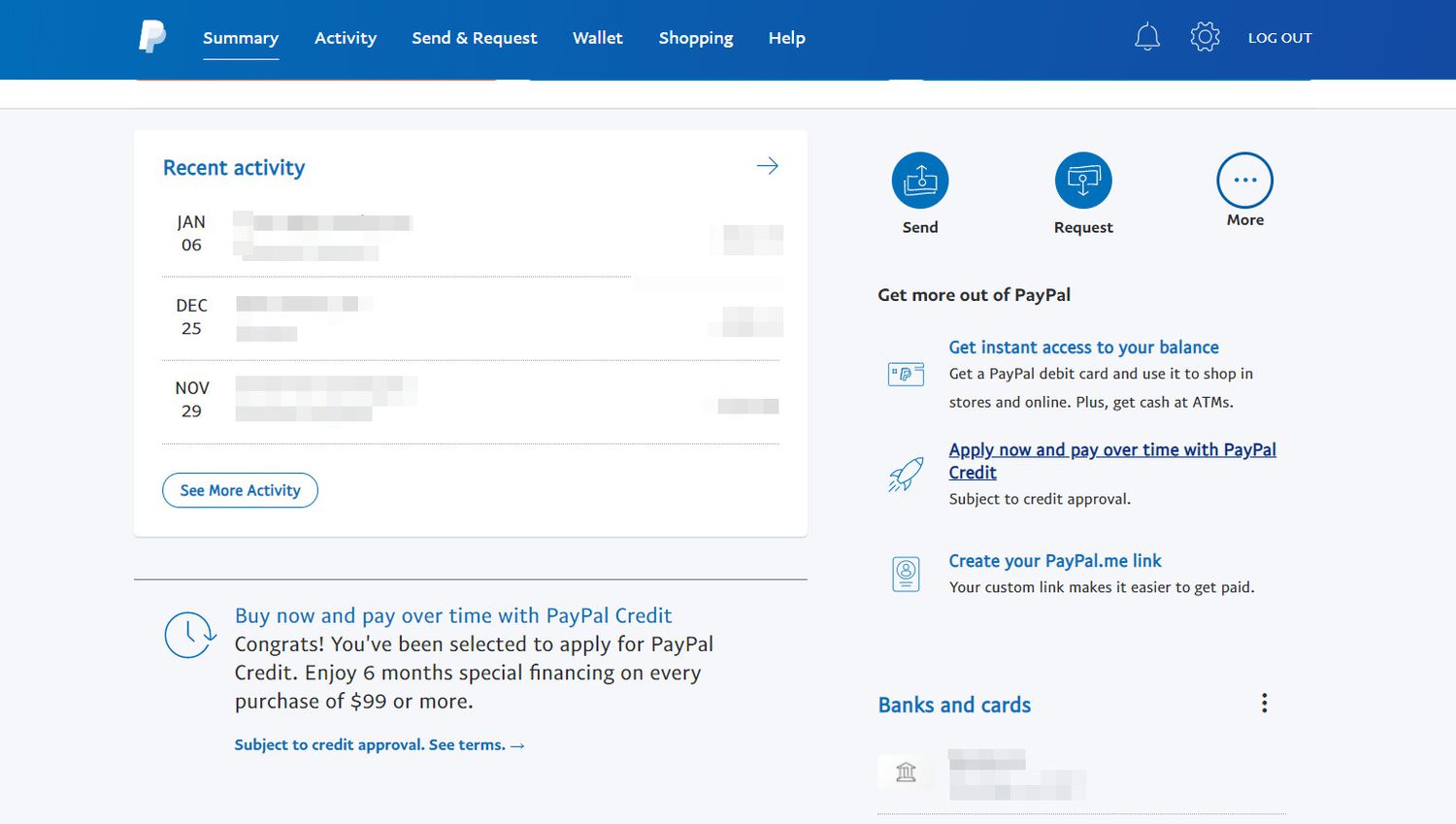

PayPal’s Credit Inquiry

PayPal, a leading digital payments platform, has recently garnered attention for its venture into conducting credit inquiries. This unexpected move has left many of its users intrigued and curious about the underlying motives and potential implications. While PayPal is primarily associated with facilitating online transactions and money transfers, its decision to delve into the realm of credit inquiries signifies a strategic expansion of its financial services.

The specifics of PayPal’s credit inquiry process, including the nature and scope of the inquiries, have prompted discussions and speculation within the financial community. Users and industry observers are keen to understand the extent to which PayPal’s credit inquiries may impact individuals’ credit profiles and financial standing.

Given PayPal’s extensive user base and its widespread integration into e-commerce and online payment ecosystems, the implications of its credit inquiries extend beyond mere curiosity. The potential influence on users’ credit scores, financial opportunities, and overall creditworthiness raises pertinent questions and underscores the significance of PayPal’s foray into this domain.

As we delve deeper into the rationale behind PayPal’s credit inquiries, it becomes evident that this development signifies a significant strategic shift for the company. By venturing into credit assessments and potentially offering credit products or services, PayPal aims to diversify its financial offerings and establish a more comprehensive suite of solutions for its users. This strategic evolution aligns with PayPal’s ambition to broaden its financial footprint and cater to a wider spectrum of financial needs within its user base.

Understanding the nature and implications of PayPal’s credit inquiries is crucial for users and industry stakeholders alike. By unraveling the intricacies of this initiative, we can gain valuable insights into PayPal’s strategic direction and the evolving landscape of digital financial services.

Impact on Users

PayPal’s venture into conducting credit inquiries has sparked concerns and curiosity regarding its potential impact on users. The implications of these credit inquiries extend beyond the realm of PayPal’s operational decisions, directly affecting the financial standing and credit profiles of its vast user base.

One immediate area of impact is the potential effect on users’ credit scores. As PayPal initiates credit inquiries, particularly if they are classified as hard inquiries, there is a possibility of a temporary dip in individuals’ credit scores. This can be a source of apprehension for users, especially those who are actively managing their credit profiles and seeking to maintain or improve their creditworthiness.

Furthermore, the prospect of PayPal offering credit products or services, potentially linked to the outcomes of these inquiries, introduces a new dimension to users’ financial interactions with the platform. Users may encounter opportunities for credit offerings tailored to their financial behavior and history, presenting both advantages and considerations in managing their financial portfolios.

Another aspect of the impact pertains to the transparency and communication surrounding PayPal’s credit inquiries. Clarity regarding the nature of these inquiries, their implications for users, and the mechanisms for addressing any credit-related concerns is paramount. Users rely on transparent and informative communication from PayPal to understand the implications of these developments and make informed decisions regarding their financial activities and credit management.

Moreover, the broader perception of PayPal as a financial services provider may undergo a transformation as it delves deeper into credit assessments and potential credit offerings. Users’ perceptions of PayPal’s role in their financial lives, from a platform facilitating transactions to a comprehensive financial services provider, may evolve in response to these developments.

As users navigate the evolving landscape of PayPal’s financial services, understanding the impact of credit inquiries and potential credit offerings is essential. By staying informed and attuned to the implications of these developments, users can proactively manage their financial well-being and leverage the opportunities presented by PayPal’s expanding suite of financial solutions.

Reasons for PayPal’s Credit Inquiry

The decision by PayPal to conduct credit inquiries stems from strategic imperatives aimed at broadening its financial services and enhancing its value proposition to users. Several compelling reasons underpin PayPal’s foray into credit assessments, reflecting its strategic vision and the evolving landscape of digital financial services.

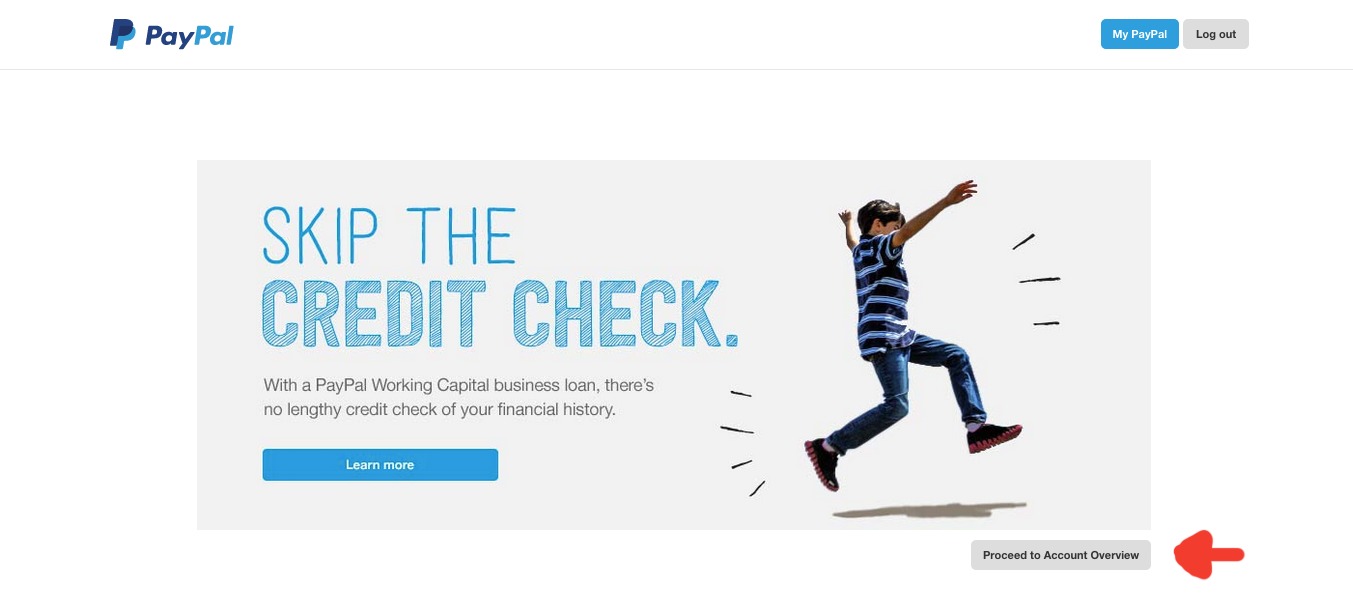

Diversification of Financial Offerings: PayPal’s expansion into credit inquiries aligns with its broader strategy to diversify its financial offerings. By integrating credit assessments and potentially offering credit products or services, PayPal seeks to cater to a more comprehensive range of financial needs within its user base. This strategic diversification enables PayPal to enhance user engagement and retention by providing a holistic suite of financial solutions.

Enhanced User Experience: The incorporation of credit inquiries may contribute to an enriched user experience by enabling personalized credit offerings tailored to individual financial behaviors and histories. By leveraging credit data, PayPal can potentially provide users with targeted credit products that align with their financial needs and aspirations, fostering a more tailored and engaging user experience.

Strategic Partnerships and Alliances: PayPal’s foray into credit assessments may be driven by its pursuit of strategic partnerships and alliances within the financial industry. By demonstrating a capacity for credit evaluations and potentially offering credit products, PayPal can position itself as an attractive collaborator for financial institutions and industry stakeholders seeking to expand their reach and offerings in the digital finance space.

Competitive Positioning: The incorporation of credit inquiries and potential credit offerings enables PayPal to fortify its competitive positioning within the digital financial services landscape. By expanding its suite of financial solutions to encompass credit products, PayPal can differentiate itself from competitors and strengthen its value proposition to users, thereby enhancing its market relevance and appeal.

Holistic Financial Ecosystem: PayPal’s engagement in credit assessments reflects its ambition to establish a more comprehensive financial ecosystem that transcends traditional payment processing. By incorporating credit evaluations, PayPal aspires to create a seamless and integrated financial platform that addresses diverse user needs, ranging from transactions and money transfers to credit management and financing.

These reasons collectively underscore the strategic rationale behind PayPal’s decision to conduct credit inquiries, illuminating its commitment to evolving as a multifaceted financial services provider and enhancing the financial well-being of its user base.

Conclusion

The emergence of PayPal’s credit inquiries marks a significant evolution in its role within the financial services landscape. As we navigate the implications and reasons behind this development, it becomes evident that PayPal’s strategic vision encompasses a comprehensive expansion of its financial offerings and a deeper integration into users’ financial lives.

By venturing into credit assessments and potentially offering credit products or services, PayPal aims to diversify its financial solutions, enhance user experiences, and fortify its competitive positioning. This strategic foray aligns with its broader ambition to establish a holistic financial ecosystem that caters to diverse user needs, transcending its traditional role as a payment processing platform.

As users engage with PayPal’s expanding suite of financial solutions, understanding the impact of credit inquiries and the rationale behind these initiatives is pivotal. Transparency, communication, and informed decision-making are essential as users navigate the evolving landscape of digital financial services and the opportunities presented by PayPal’s strategic evolution.

Furthermore, the integration of credit assessments underscores PayPal’s commitment to empowering users with tailored financial solutions and fostering a more comprehensive and personalized financial experience. By leveraging credit data to offer targeted credit products, PayPal seeks to enhance user engagement and satisfaction, thereby strengthening its value proposition within the digital finance space.

As we reflect on PayPal’s venture into credit inquiries, it is evident that this development signifies a pivotal juncture in its trajectory as a financial services provider. By embracing credit assessments and potential credit offerings, PayPal embarks on a transformative journey toward becoming a more encompassing and indispensable partner in users’ financial journeys.

Ultimately, the integration of credit inquiries within PayPal’s suite of services reflects its commitment to innovation, user-centric financial solutions, and a holistic approach to meeting diverse financial needs. As users embrace these developments, they are poised to experience a more integrated and personalized financial ecosystem, underpinned by PayPal’s strategic evolution and unwavering dedication to enhancing their financial well-being.