Finance

Why Is EBIT Capital Structure Dependent?

Modified: December 30, 2023

Discover the impact of EBIT on capital structure in finance. Learn why these two factors are interdependent and how they influence financial decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding the complex world of finance, one term that frequently arises is EBIT (Earnings Before Interest and Taxes). EBIT serves as a crucial indicator of a company’s operational profitability, excluding external financial factors such as interest and taxes. However, what many might not realize is that EBIT can also have a significant influence on a company’s capital structure.

Capital structure refers to the way a company funds its operations and investments through a combination of debt and equity. It determines the overall financial framework of a business and plays a pivotal role in its long-term sustainability and success. Companies carefully consider their capital structure to optimize their financial leverage and balance the costs and benefits of using debt and equity financing.

The relationship between EBIT and capital structure is inherently interconnected. EBIT directly affects a company’s ability to generate profits from its core operations. Consequently, this profitability impacts its decision-making process regarding the allocation of capital and the choice between debt and equity financing.

In this article, we will delve into the intricacies and importance of capital structure, explore the factors influencing it, and examine how EBIT impacts a company’s capital structure. We will also analyze case studies that highlight the significance of EBIT in shaping the financial framework of businesses.

By understanding the interplay between EBIT and capital structure, companies can make informed decisions to optimize their financial performance and navigate the dynamic landscape of business operations.

Definition of EBIT

Before delving into the relationship between EBIT and capital structure, it is essential to understand the concept of EBIT itself. EBIT stands for Earnings Before Interest and Taxes and is a financial metric used to assess a company’s operational profitability.

Also known as operating income or operating profit, EBIT measures a company’s ability to generate profits from its core business activities before accounting for interest expense and income taxes. By excluding these external factors, EBIT provides a clearer picture of a company’s operational performance and its ability to generate profits solely from its core operations.

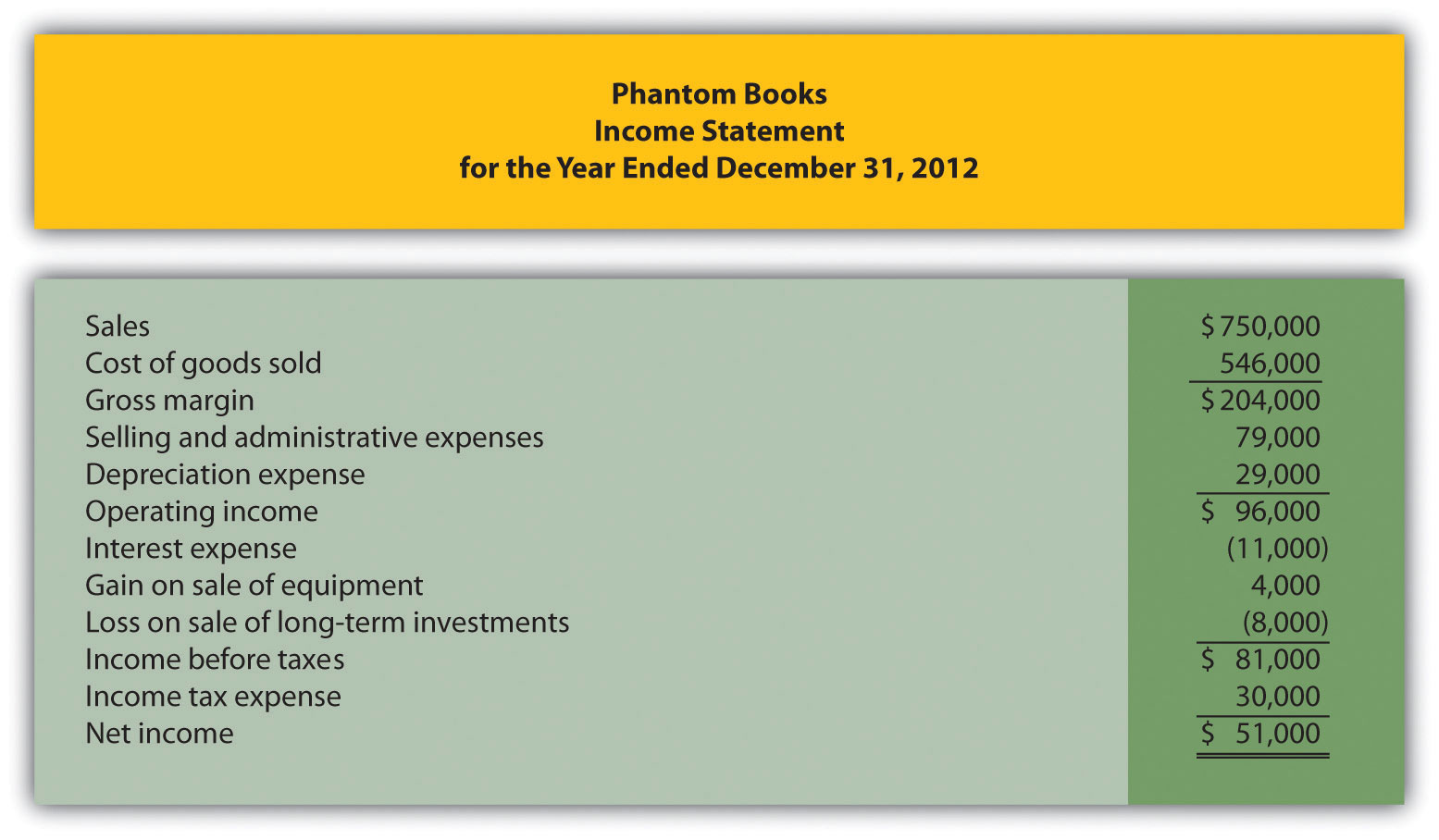

EBIT is calculated by subtracting a company’s operating expenses, such as cost of goods sold, operating expenses, and depreciation from its revenue. The resulting figure represents the earnings generated by the company’s operations before considering interest and taxes.

EBIT is a widely used metric in financial analysis as it allows investors, analysts, and stakeholders to assess a company’s profitability and compare it to its peers across different industries. It provides a standardized measure of a company’s operating performance and serves as a fundamental component in various financial ratios and valuation models.

It is important to note that EBIT does not take into account non-operating income or expenses, such as gains from investments or losses from the sale of assets. These items are typically excluded to provide a clearer representation of a company’s ongoing operational profitability.

While EBIT provides valuable insights into a company’s operational performance, it is not a comprehensive measure of its financial health. It is essential to consider other financial factors such as interest expense, taxes, and non-operating income when evaluating a company’s overall financial performance and health.

Having a solid understanding of EBIT is crucial for assessing a company’s operational profitability and its impact on the decision-making process, particularly concerning capital structure. In the next section, we will explore the concept of capital structure and its significance in the financial framework of a business.

Capital Structure

Capital structure refers to the composition of a company’s funding sources, specifically how it raises funds to finance its operations, investments, and growth. It represents the mix of debt and equity that a company utilizes to support its activities. The capital structure of a company has a profound impact on its financial stability, risk profile, and overall value.

Companies have two primary options for raising capital: debt and equity. Debt represents borrowed funds that the company must repay over time with interest, while equity represents ownership stakes in the company that are held by shareholders. The decision on how to structure the capital sources is driven by a multitude of factors, including the company’s risk appetite, growth aspirations, and financial flexibility.

Debt financing involves issuing bonds, taking out loans from financial institutions, or issuing other forms of debt instruments. By borrowing money, companies can benefit from tax advantages and leverage, allowing them to access a larger pool of capital and potentially amplify their returns on investment. However, excessive debt can increase financial risks and limit a company’s flexibility in difficult economic conditions.

Equity financing, on the other hand, involves selling ownership interests in the company to investors in exchange for capital. This can be done through public offerings or private placements. By raising equity, companies dilute their ownership stakes but gain access to long-term capital without requiring repayment. Equity financing provides companies with greater financial flexibility and can be attractive for startups and high-growth companies.

The ideal capital structure varies from company to company and is influenced by various factors, including industry norms, company size, growth prospects, and risk appetite. Striking the right balance between debt and equity is crucial to optimize capital structure and ensure the company’s financial stability and value maximization.

A well-structured capital framework can help companies achieve several objectives:

- Financial Leverage: By combining debt and equity, companies can achieve an optimal level of financial leverage, allowing them to efficiently utilize their capital resources and potentially amplify returns for shareholders.

- Risk Management: A balanced capital structure can help manage financial risk by spreading it across different sources. Diversifying the funding mix can reduce the impact of adverse events or market fluctuations on the company’s financial health.

- Flexibility: The right capital structure provides companies with the flexibility to adapt to changing market conditions, seize growth opportunities, and navigate economic downturns without facing excessive financial constraints.

- Creditworthiness: Maintaining an optimal capital structure enhances a company’s creditworthiness in the eyes of lenders and investors, allowing them to access funding at better terms and lower borrowing costs.

It is important to note that capital structure decisions are not static and can evolve over time as companies grow, face different market conditions, or pursue strategic initiatives. The focus should always be on maintaining a balanced and sustainable capital structure that aligns with the company’s long-term objectives.

Now that we have established the importance of capital structure, let’s explore the factors that influence these decisions in the next section.

Importance of Capital Structure

The capital structure of a company plays a vital role in its overall financial management and success. Finding the right balance between debt and equity financing is essential, as it can significantly impact a company’s risk profile, profitability, and long-term sustainability. Here are several reasons why capital structure is of utmost importance.

1. Risk Management: A well-managed capital structure helps to mitigate financial risk by diversifying funding sources. By incorporating both debt and equity, companies can spread the risk across different stakeholders and reduce the potential negative effects of financial distress.

2. Cost of Capital: The capital structure directly influences a company’s cost of capital, which refers to the expenses associated with financing operations. By understanding the trade-off between debt and equity, companies can optimize their cost of capital and minimize their overall borrowing costs.

3. Financial Flexibility: An appropriately structured capital framework provides businesses with the flexibility to adapt to changing market conditions, seize growth opportunities, and navigate economic downturns effectively. Companies with a balance of debt and equity financing are better positioned to pursue strategic initiatives and invest in research and development.

4. Profitability and Returns: Capital structure decisions impact a company’s profitability and the returns it can generate for its shareholders. By leveraging debt financing effectively, companies can magnify their returns on equity and enhance shareholder value.

5. Investor Perception: The capital structure of a company influences how investors perceive its risk and potential for future growth. A well-balanced capital structure demonstrates prudent financial management and can attract a broader range of investors, thereby increasing market credibility and improving access to capital.

6. Tax Planning: Companies can strategically use debt financing to optimize their tax position. The interest paid on debt is typically tax-deductible, which can result in significant tax savings for the company. However, companies must be cautious not to over-leverage and risk financial instability.

7. Industry Norms and Standards: Capital structure decisions are influenced by industry norms and standards. Understanding how peer companies in the same industry structure their capital can provide insights into competitive positioning and financial health.

8. Long-term Sustainability: A well-thought-out and balanced capital structure promotes the long-term sustainability of a company. By considering the impact of capital structure decisions on cash flow, debt repayment obligations, and liquidity, companies can ensure their ability to meet financial commitments and maintain growth over time.

Ultimately, capital structure decisions are crucial for a company’s overall financial health, risk management, and ability to generate sustainable growth. It requires careful analysis, considering the company’s unique circumstances, industry dynamics, and long-term objectives. Striking the right balance between debt and equity is essential to optimize the capital structure and position the company for success.

Next, let’s explore the factors that influence a company’s capital structure decisions.

Factors Influencing Capital Structure

The decision on how to structure a company’s capital sources is influenced by various factors. Understanding these factors is crucial for making informed decisions regarding the optimal mix of debt and equity financing. Let’s explore some of the key factors that influence capital structure:

1. Business Risk: The nature and level of business risk directly impact capital structure decisions. Companies operating in inherently risky industries may opt for a lower proportion of debt to reduce the risk of financial distress. On the other hand, companies in more stable and predictable industries may leverage debt to enhance returns on equity.

2. Financial Flexibility: Companies with a higher degree of financial flexibility may have more latitude in capital structure decisions. This flexibility can come from factors such as strong cash flow, valuable assets, or a diversified business portfolio. These companies may be more comfortable taking on additional debt to support growth initiatives.

3. Tax Considerations: The tax environment and applicable tax regulations play a role in capital structure decisions. Interest payments on debt are generally tax-deductible, providing a tax shield that reduces the overall cost of debt financing. This makes debt an attractive option for companies seeking to minimize their tax liability.

4. Company Size and Growth Potential: The size and growth potential of a company can influence its capital structure decisions. Smaller companies with limited access to capital markets or higher perceived risk may rely more on equity financing. Conversely, larger companies with established market presence and growth prospects may have more access to debt financing options.

5. Industry Norms: Capital structure decisions are often influenced by industry norms and standards. Companies may look to their industry peers to understand the prevailing capital structure practices and assess their competitive positioning.

6. Interest Rates and Market Conditions: Interest rates and market conditions play a crucial role in capital structure decisions. Companies consider the prevailing interest rates, inflation expectations, and overall market conditions when determining the cost and availability of debt financing. Companies may opt for more debt during periods of low interest rates to take advantage of favorable borrowing conditions.

7. Stakeholder Preferences: The preferences of various stakeholders, including shareholders, lenders, and management, can influence capital structure decisions. For example, shareholders may prefer a higher proportion of equity to preserve ownership and control, while lenders may have specific requirements or limits on debt ratios.

8. Stage of Business Life Cycle: The stage of a company’s business life cycle can also affect capital structure decisions. Start-ups and high-growth companies may rely more on equity financing to fund their expansion plans. As companies mature and generate stable cash flows, they may consider incorporating debt to leverage their operations and enhance shareholder returns.

It is important to note that these factors are not mutually exclusive, and companies must consider the interplay of these factors when making capital structure decisions. There is no one-size-fits-all solution, and the optimal capital structure will vary based on the unique circumstances and objectives of each company.

Next, let’s explore the relationship between EBIT and capital structure, and how EBIT impacts a company’s overall financial framework.

Relationship between EBIT and Capital Structure

The relationship between EBIT and capital structure is interconnected and dynamic. EBIT, or Earnings Before Interest and Taxes, serves as a key driver in shaping a company’s capital structure decisions. The level of EBIT a company generates directly influences its capacity to service its debt obligations and impacts the overall risk profile of the business.

EBIT is an indicator of a company’s operational profitability before accounting for interest expenses and taxes. It represents the earnings generated solely from the core operational activities of a company. A healthy and robust EBIT indicates that the company’s primary business operations are generating sufficient profits to cover its operating expenses and interest obligations.

When evaluating their capital structure, companies consider the relationship between their EBIT and their debt levels. A higher EBIT provides companies with greater confidence in their ability to generate consistent cash flows to service their debt obligations. This, in turn, may enable companies to take on higher levels of debt and achieve a more leverage-oriented capital structure.

On the other hand, if a company’s EBIT is relatively low or unstable, it may result in higher risks associated with debt repayment. In such cases, companies may opt for a more conservative capital structure with lower levels of debt to minimize the financial risk and ensure sufficient cash flow coverage for their debt obligations.

The relationship between EBIT and capital structure also extends to equity financing decisions. A company with healthy and stable EBIT levels may have a higher propensity to rely on equity financing. By issuing additional shares, companies can raise capital without taking on additional debt, thereby maintaining a more conservative capital structure.

Furthermore, the level of EBIT can influence the attitudes of lenders and investors towards a company’s capital structure. A strong and consistent EBIT indicates financial stability and the ability to meet debt obligations, making the company more attractive to lenders. This can result in favorable borrowing terms, such as lower interest rates or higher borrowing limits, thereby facilitating the company’s capital structure decisions.

It is worth noting that while EBIT is a critical factor in capital structure decisions, it is not the sole determinant. Companies must also consider other financial factors, such as cash flow, industry dynamics, risk appetite, and growth potential, when deciding on the optimal mix of debt and equity in their capital structure.

Next, let’s examine the impact of EBIT on a company’s capital structure and explore real-life case studies that highlight its significance.

EBIT’s Impact on Capital Structure

EBIT, or Earnings Before Interest and Taxes, has a significant impact on a company’s capital structure. The level of EBIT generated by a company directly influences its ability to finance its operations, investments, and debt obligations, thereby shaping its capital structure decisions.

A company’s EBIT provides a measure of its operational profitability, representing the earnings generated solely from its core business activities before considering interest expenses and taxes. A higher EBIT indicates that the company’s operations are generating healthy profits, enhancing its capacity to cover its operating expenses and service its debt obligations.

When a company generates a strong and consistent EBIT, it signals financial stability, which can enhance its ability to access debt financing at favorable terms. Lenders perceive companies with higher levels of EBIT as having sufficient cash flow to meet their debt obligations, reducing the perceived risk of default. This can result in lower interest rates and higher borrowing limits, thus enabling companies to incorporate more debt into their capital structure.

Conversely, if a company’s EBIT is relatively low or unstable, it may limit its ability to service debt obligations. Lower EBIT levels may increase the perceived risk of default, leading to higher borrowing costs or restricted access to debt financing. In such cases, companies may opt for a more conservative capital structure with lower levels of debt to reduce their financial risk and ensure the availability of sufficient cash flow to meet their obligations.

EBIT also impacts capital structure decisions related to equity financing. Companies with strong and consistent EBIT levels may opt for equity financing to raise capital without taking on additional debt. By issuing new shares, companies maintain a conservative capital structure and dilute existing shareholders’ ownership stakes. This approach allows companies to maintain financial stability while still accessing the capital they need for growth and investment.

The impact of EBIT on capital structure decisions extends beyond financing considerations. It also influences the overall risk profile of the company. Companies with higher EBIT levels may be more willing to assume higher levels of debt, taking advantage of the potential financial leverage to maximize returns for shareholders. However, excessive leverage can increase the financial risk and volatility of a company, making a balance between debt and equity crucial for long-term sustainability.

It is important to note that EBIT is not the sole determinant of capital structure decisions. Companies must consider other factors such as cash flow, industry dynamics, growth prospects, and risk tolerance when determining the optimal mix of debt and equity. Striking a balance between risk and profitability is essential to ensure a sustainable and flexible capital structure that aligns with the company’s long-term objectives.

Next, let’s explore real-life case studies that demonstrate the relationship between EBIT and capital structure and the impact on companies.

Case Studies on EBIT and Capital Structure

Examining real-life case studies can provide valuable insights into the relationship between EBIT and capital structure and highlight the impact of these factors on companies. Let’s explore two notable case studies:

Case Study 1: Company A is a growing tech startup with substantial revenue growth and a strong EBIT. The company’s management decides to pursue an aggressive growth strategy that requires significant investment in research and development and expansion into new markets. To finance this growth, Company A evaluates its capital structure and decides to raise additional capital through a combination of equity and debt financing.

Given the strong EBIT and the positive market perception of the company, Company A is successful in securing both equity investments from venture capitalists and debt financing from institutional lenders. The high EBIT provides a foundation of financial stability and increases the company’s attractiveness to lenders. With the infusion of capital, Company A is able to fuel its growth initiatives while maintaining a healthy balance between debt and equity in its capital structure.

Case Study 2: Company B operates in a mature industry with stable revenue streams but faces increasing competition and margin pressures. The company’s EBIT has been declining due to market saturation and rising operating costs. To address its financial challenges, Company B assesses its capital structure and debt levels.

Recognizing the impact of the declining EBIT on its debt-servicing capacity, Company B implements a debt reduction strategy to strengthen its financial position. This includes refinancing existing debt at more favorable terms, engaging in cost-cutting initiatives, and optimizing its operational efficiency. By reducing its debt burden and improving its EBIT, Company B is able to stabilize its financial situation and maintain a conservative capital structure conducive to long-term sustainability.

These case studies demonstrate how EBIT can influence capital structure decisions and impact the financial health of companies. A strong and consistent EBIT can provide companies with opportunities to access debt financing and leverage their operations to enhance shareholder returns. On the other hand, a declining or unstable EBIT may necessitate a more conservative capital structure with lower levels of debt to mitigate financial risks and ensure cash flow sufficiency.

It is important for companies to conduct thorough assessments of their EBIT, market conditions, risk tolerance, and growth prospects when making capital structure decisions. By carefully considering these factors, companies can optimize their financing mix, strike a balance between debt and equity, and position themselves for long-term success.

Now, let’s summarize the key insights from our discussions on EBIT and capital structure.

Conclusion

The relationship between EBIT and capital structure is a critical aspect of financial management for companies. EBIT, representing a company’s operational profitability, directly impacts its capital structure decisions by influencing its debt levels, equity financing choices, and overall risk profile.

A higher EBIT provides companies with greater confidence in their ability to generate consistent cash flows to service their debt obligations. This can result in more favorable terms for debt financing, enabling companies to incorporate more debt into their capital structure and potentially maximize returns for shareholders. Conversely, a lower or unstable EBIT may lead to more conservative capital structure decisions with lower debt levels to mitigate financial risk.

EBIT also plays a role in equity financing decisions, as companies with strong EBIT levels may opt for equity financing to raise capital without increasing their debt burden. This approach helps companies maintain financial stability while still accessing the necessary funds for growth and investment.

Factors such as business risk, financial flexibility, tax considerations, industry norms, interest rates, stakeholder preferences, company size, growth potential, and the stage of the business life cycle also influence capital structure decisions. Companies must carefully consider these factors alongside EBIT when determining the optimal mix of debt and equity in their capital structure.

Real-life case studies highlight how companies navigate the interplay between EBIT and capital structure. Successful companies leverage their EBIT to access debt financing for growth initiatives, while others may reduce debt levels to stabilize financial positions. These case studies underscore the importance of EBIT and its impact on a company’s financial health and strategic choices.

In conclusion, understanding the relationship between EBIT and capital structure is crucial for companies in optimizing their funding sources, managing risks, and maximizing shareholder value. By carefully assessing their EBIT, market dynamics, risk tolerance, and growth prospects, companies can make informed capital structure decisions that align with their long-term objectives and support sustainable growth.

Now armed with a deeper understanding of EBIT’s impact on capital structure, companies can navigate the complexities of finance while optimizing their operational profitability and financial stability.