Finance

Why Is Fintech Important?

Published: October 29, 2023

Discover the significance of fintech in the world of finance and how it is revolutionizing the industry. Stay updated and understand the importance of embracing this technological advancement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Economic Impact of Fintech

- Increasing Financial Inclusion

- Enhanced Efficiency and Cost Reduction

- Disruption of Traditional Financial Institutions

- Technological Innovation in Financial Services

- Fostering Innovation and Entrepreneurship

- Regulatory Challenges and Opportunities

- Risks and Security Concerns in Fintech

- Conclusion

Introduction

In recent years, the world of finance has undergone a significant transformation due to the rise of financial technology, commonly known as Fintech. Fintech refers to the use of innovative technologies to provide financial services in a more efficient, accessible, and user-friendly manner. This includes mobile banking, digital payments, online lending platforms, robo-advisors, and blockchain technology.

The impact of Fintech has been revolutionary, disrupting traditional financial institutions and changing the way individuals and businesses manage their finances. With the use of smartphones and the internet becoming increasingly prevalent, Fintech has gained immense popularity and acceptance worldwide, offering a range of benefits and opportunities.

One of the primary reasons why Fintech has become so important is its significant economic impact. Fintech has not only revolutionized the financial services sector but also contributed to economic growth and development. The rapid adoption of Fintech solutions has led to the creation of new jobs, increased productivity, and stimulated innovation.

Furthermore, Fintech has played a crucial role in increasing financial inclusion. By leveraging technology, Fintech has made financial services accessible to individuals who were previously excluded from the formal banking system. This includes the unbanked and underbanked population, particularly in developing countries. Through mobile banking and digital payment solutions, individuals can now easily and securely access and manage their finances, empowering them with economic opportunities.

Fintech has also enhanced efficiency and reduced costs in the financial industry. Traditional financial institutions often have complex and time-consuming processes. However, Fintech has streamlined these processes through automation, artificial intelligence, and machine learning. This has resulted in faster transaction processing, improved customer experience, and reduced operational costs for both financial service providers and consumers.

Economic Impact of Fintech

The emergence of Fintech has had a profound impact on the global economy. It has not only transformed the financial sector but also contributed significantly to economic growth and development. Here are some key ways in which Fintech is shaping the economy:

- Creation of new jobs: The growth of Fintech has led to the creation of a multitude of new job opportunities. Fintech companies require professionals with expertise in technology, data analysis, cybersecurity, and finance, resulting in increased employment in these fields. Moreover, the collaborative ecosystem of Fintech encourages entrepreneurship and the launch of innovative startups, further boosting job creation.

- Innovation and productivity: Fintech fosters innovation by leveraging emerging technologies such as artificial intelligence, big data, and blockchain. This innovation drives productivity gains by automating routine tasks, reducing manual errors, and improving overall efficiency. For example, automated risk assessment algorithms enable faster and more accurate loan approvals, benefiting both borrowers and lenders.

- Increased access to finance: Fintech has expanded access to financial services, particularly in underserved and unbanked populations. The traditional banking system often fails to reach individuals in remote areas or those with limited financial resources. However, Fintech solutions such as mobile banking and digital wallets offer easy, affordable, and secure ways to access and manage money, empowering individuals with financial inclusion and economic opportunities.

- Support for small and medium enterprises (SMEs): Fintech has leveled the playing field for SMEs by providing them with easier access to financing and innovative financial tools. Online lending platforms and crowdfunding have made it easier for small businesses to secure loans and investments. Additionally, Fintech has enabled SMEs to efficiently manage tasks such as payroll, accounting, and inventory management, enhancing their competitiveness and growth potential.

- Global economic integration: Fintech has facilitated cross-border transactions and expanded international trade by enabling faster, more secure, and cost-effective payment solutions. Blockchain technology, for instance, has the potential to revolutionize supply chain management, reducing paperwork, enhancing transparency, and minimizing fraud in global trade. This increased efficiency in international transactions benefits businesses and consumers alike.

The economic impact of Fintech is not limited to individual sectors but extends to the overall economic landscape. Governments and regulatory bodies are increasingly recognizing the potential of Fintech to drive economic growth and are implementing supportive policies and regulations. This ensures a conducive environment for Fintech innovation and adoption, further fueling economic expansion.

Increasing Financial Inclusion

One of the key advantages of Fintech is its ability to promote financial inclusion by providing access to financial services to individuals who were previously excluded. In many parts of the world, a significant portion of the population remains unbanked or underbanked, meaning they have limited access to traditional banking services. Fintech bridges this gap by leveraging technology and innovative solutions. Here’s how Fintech is increasing financial inclusion:

- Mobile banking: Fintech has made banking services accessible to individuals through their mobile phones. This is especially significant in developing countries where smartphones are becoming increasingly prevalent. With mobile banking applications, individuals can open bank accounts, deposit and withdraw money, make payments, and access other financial services with ease, even without a physical branch nearby.

- Digital payments: Fintech has revolutionized how people make payments. Digital payment platforms, such as mobile wallets and payment apps, enable secure and convenient transactions without the need for physical cash or traditional banking infrastructure. This benefits individuals who may not have access to traditional banking services, allowing them to participate in the digital economy and make purchases online or in-person.

- Online lending platforms: Traditional lending institutions often have strict eligibility criteria that exclude many individuals, particularly those without a credit history or collateral. Fintech has introduced online lending platforms that make it easier for individuals to access loans. These platforms use alternative data sources and algorithms to assess creditworthiness, enabling a wider range of borrowers to obtain loans at competitive rates.

- Microfinance: Fintech has facilitated the growth of microfinance institutions and peer-to-peer lending platforms. These platforms connect lenders directly with borrowers, eliminating the need for intermediaries and reducing costs. Microfinance institutions leverage technology to provide small loans to individuals and small businesses, empowering them to start or expand their ventures and improve their livelihoods.

- Rural and remote access: Fintech has the potential to reach individuals in rural and remote areas through digital channels. Traditional banks often find it economically unviable to establish physical branches in such areas. However, Fintech enables individuals to access financial services through mobile devices and internet connectivity, overcoming geographical barriers and bringing banking services to previously underserved communities.

By increasing financial inclusion, Fintech not only provides individuals with access to basic financial services but also empowers them to participate in the formal economy, save money, build credit, and invest in their future. This leads to poverty reduction, economic growth, and improved quality of life.

Enhanced Efficiency and Cost Reduction

Fintech has brought about a paradigm shift in the financial industry by revolutionizing processes and significantly enhancing efficiency. Traditional financial institutions often have complex and time-consuming operations, which can lead to high costs and inefficiencies. Fintech solutions leverage technology to streamline processes and reduce costs, benefiting both service providers and consumers. Here are some key ways in which Fintech enhances efficiency and reduces costs:

- Automation: Fintech leverages automation to replace manual and repetitive tasks with advanced algorithms and artificial intelligence. For example, chatbots and virtual assistants can handle customer inquiries and provide support, reducing the need for human intervention. This not only saves time and resources but also improves the overall customer experience.

- Streamlined payment processes: Fintech has revolutionized payment systems, making transactions faster, more convenient, and secure. Traditional payment methods, such as checks and wire transfers, can be slow and cumbersome. However, with Fintech innovations like online banking, mobile wallets, and digital payment platforms, transactions can be completed instantly, eliminating the need for physical paperwork and reducing processing time.

- Reduced operational costs: By embracing Fintech, financial institutions can significantly reduce their operational costs. Digital processes eliminate the need for physical branches, reducing overhead expenses such as rent and maintenance. Additionally, Fintech enables the automation of back-office functions like accounting, documentation, and compliance, reducing the need for manual labor and minimizing errors.

- Improved risk assessment: Fintech utilizes advanced data analytics and algorithms to assess risk. This enables financial institutions to make more accurate and informed decisions regarding loan approvals, investment strategies, and risk mitigation. By leveraging technology to analyze a vast amount of data, Fintech solutions can identify potential risks, detect fraudulent activities, and make risk management more efficient.

- Personalized financial services: Fintech allows financial institutions to offer personalized services tailored to individual customer needs. With the help of machine learning algorithms, Fintech platforms can analyze consumer data in real-time, providing customized recommendations, investment advice, and tailored financial products. This not only enhances customer satisfaction but also saves time by eliminating the need for customers to search for suitable options themselves.

By enhancing efficiency and reducing costs, Fintech creates value for both financial service providers and consumers. In turn, this leads to increased profitability for businesses, lower fees for customers, and more accessible financial services for a broader population.

Disruption of Traditional Financial Institutions

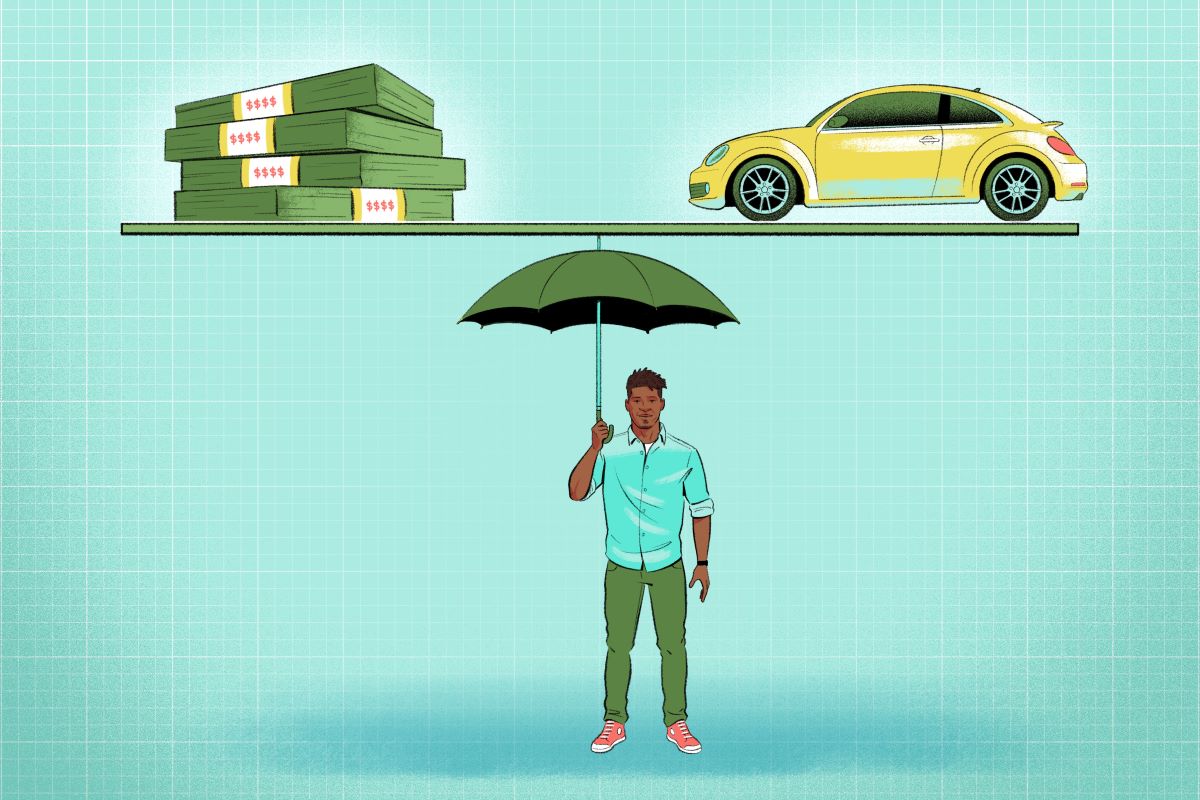

The rise of Fintech has disrupted the traditional financial landscape, challenging the dominance of traditional financial institutions such as banks and insurance companies. Fintech startups and innovative solutions have emerged as strong contenders, offering alternative ways of delivering financial services. Here are some key aspects of how Fintech is disrupting traditional financial institutions:

- Alternative lending: Fintech has revolutionized lending by providing alternative sources of funding. Traditional banks often have rigid lending criteria and lengthy approval processes. Fintech lending platforms, on the other hand, use advanced algorithms and alternative data sources to assess creditworthiness, making it faster and more accessible for individuals and small businesses to secure loans. This has challenged the traditional loan approval process and put pressure on banks to innovate and adapt.

- Digital banking: Fintech has introduced digital-only banks or neobanks that operate exclusively online, without physical branch locations. These digital banks offer a range of banking services, such as account opening, payments, and money management, through mobile apps and websites. The convenience, lower fees, and streamlined processes offered by digital banks have attracted a growing number of customers, posing a threat to traditional banks that rely on physical branches.

- Disintermediation: Fintech has facilitated direct transactions between individuals and businesses, reducing the need for intermediaries. Peer-to-peer lending, crowdfunding, and digital payment platforms enable individuals to lend or invest directly in projects or businesses, bypassing traditional financial intermediaries. This disintermediation disrupts the traditional banking model by offering more efficient and cost-effective alternatives for both borrowers and lenders.

- Robo-advisors: Fintech has introduced robo-advisors, which are automated investment platforms that provide financial advice based on algorithms and data analysis. Robo-advisors offer low fees, personalized recommendations, and accessibility to a wider range of investors. This has disrupted the wealth management industry where traditional financial advisors typically catered to high-net-worth individuals. Robo-advisors are now challenging traditional wealth management firms by providing accessible and cost-effective investment solutions.

- Open banking: Open banking initiatives, driven by regulatory requirements, allow customers to share their financial data securely with third-party Fintech companies. This enables Fintech startups to develop innovative products and services by leveraging customer data. Open banking disrupts the traditional banking model by encouraging competition and enabling Fintech companies to offer personalized, data-driven financial solutions that traditional banks may struggle to provide.

As Fintech continues to evolve and gain traction, traditional financial institutions are recognizing the need to adapt and embrace innovation. Many are forming partnerships with Fintech startups, investing in technology, and launching their own digital initiatives to stay competitive in the rapidly changing landscape. The disruption caused by Fintech is reshaping the financial industry, driving innovation, and ultimately benefiting consumers by providing them with more choices and improved financial services.

Technological Innovation in Financial Services

Fintech has brought about numerous technological innovations that have transformed the way financial services are provided and consumed. Technology has enabled financial institutions to enhance their offerings, improve efficiency, and deliver a better customer experience. Here are some key technological innovations in financial services driven by Fintech:

- Blockchain: Blockchain technology is revolutionizing various aspects of the financial industry, particularly in areas such as payments, identity verification, and smart contracts. By providing a secure and transparent decentralized ledger, blockchain enables faster and more secure transactions, reduces fraud, and eliminates the need for intermediaries in many financial processes.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms enable the processing of vast amounts of data and the extraction of valuable insights. In finance, AI is used for risk assessment, fraud detection, customer service chatbots, and investment recommendations. Machine learning algorithms analyze data and patterns to provide personalized financial advice, automate customer interactions, and improve decision-making processes.

- Big Data: The availability of large volumes of data has enabled financial institutions to gain deeper insights into customer behavior, market trends, and risk assessment. Big data analytics helps identify patterns, predict customer preferences, and detect fraudulent activities. By leveraging big data, financial institutions can offer personalized products and services, make data-driven decisions, and mitigate risks more effectively.

- Mobile and Digital Solutions: Fintech has leveraged the widespread adoption of smartphones and the internet to provide mobile banking solutions, digital wallets, and payment apps. These tools allow individuals to access financial services anytime, anywhere, making transactions more convenient and enhancing financial inclusion. Moreover, mobile and digital solutions enable real-time notifications, easy account management, and secure transactions.

- Robotic Process Automation (RPA): RPA automates repetitive and rule-based tasks, reducing human error and increasing operational efficiency. Financial institutions use RPA for tasks such as data entry, loan processing, and account reconciliation. By automating these processes, organizations can save time, reduce costs, and allocate human resources to more complex and strategic tasks.

- Internet of Things (IoT): IoT devices, such as wearable sensors and smart devices, allow for the collection of data related to personal finance, health, and insurance. This data enables personalized financial services, such as usage-based insurance, personalized health insurance, and personalized offers based on spending habits. The integration of IoT with financial services opens up new opportunities for customization and risk assessment.

These technological innovations have not only improved the efficiency and accuracy of financial services but also paved the way for new business models and opportunities. Financial institutions that embrace these advancements can gain a competitive edge, deliver superior customer experiences, and drive financial inclusion by reaching underserved populations.

Fostering Innovation and Entrepreneurship

Fintech has emerged as a catalyst for innovation and entrepreneurship in the financial sector. It has created a conducive environment that encourages the development of new ideas, technologies, and business models. Here are some key ways in which Fintech fosters innovation and entrepreneurship:

- Democratization of access: Fintech has significantly lowered the barriers to entry for entrepreneurs in the financial industry. With the availability of open APIs, cloud computing, and affordable technology, startups can access the necessary infrastructure and resources to build innovative financial solutions. This democratization of access has leveled the playing field, allowing new players to compete with established financial institutions.

- Collaborative ecosystem: Fintech has fostered a collaborative ecosystem where partnerships between startups, financial institutions, and technology providers are common. This collaboration allows startups to leverage the expertise, resources, and distribution networks of established players. Financial institutions, on the other hand, benefit from the agility and innovation of startups. This collaborative approach encourages the development of disruptive ideas and accelerates their adoption in the market.

- Availability of funding: Fintech startups have access to a wide range of funding options, including venture capital, angel investors, and crowdfunding. The success stories of Fintech unicorns have attracted investors, making it easier for entrepreneurs to secure funding for their ventures. Additionally, Fintech-focused incubators and accelerators provide mentorship, networking opportunities, and financial support to early-stage startups, nurturing their growth and innovation.

- Regulatory sandboxes: Regulatory bodies around the world have recognized the importance of fostering innovation in the financial industry. As a result, they have established regulatory sandboxes, which allow startups to test their innovations in a controlled environment. These sandboxes provide a safe space for startups to explore new ideas, validate their business models, and seek regulatory guidance. By facilitating experimentation, regulatory sandboxes support the development of cutting-edge solutions without compromising consumer protection.

- Disruptive business models: Fintech has paved the way for new and disruptive business models that challenge traditional approaches. The rise of peer-to-peer lending, crowdfunding, robo-advisory, and digital currencies are examples of Fintech-driven business models that have gained traction in the market. These models offer innovative solutions to long-standing challenges and provide entrepreneurs with opportunities to disrupt established industries.

- Focus on user experience: Fintech has shifted the focus from traditional financial products to user-centric solutions. Startups in the Fintech space prioritize designing intuitive and user-friendly interfaces that enhance the customer experience. By placing users at the center of the innovation process, Fintech entrepreneurs can identify pain points, develop more tailored solutions, and differentiate themselves in a crowded market.

Fintech has created an environment that encourages innovation, collaboration, and entrepreneurship in the financial industry. By leveraging technology and disrupting traditional models, Fintech startups have the opportunity to transform the way financial services are delivered, driving efficiency, customer satisfaction, and financial inclusion.

Regulatory Challenges and Opportunities

As Fintech continues to revolutionize the financial industry, it also presents both regulatory challenges and opportunities for financial institutions and regulatory bodies. The rapid pace of technological innovation in Fintech often outpaces the development of regulatory frameworks. Here are some key regulatory challenges and opportunities associated with Fintech:

- Regulatory uncertainty: The evolving nature of Fintech poses challenges for regulators in terms of adapting existing regulations or creating new ones. As Fintech expands into areas such as blockchain, cryptocurrencies, and digital identity, regulatory bodies face the challenge of balancing innovation and consumer protection. Striking the right balance requires collaboration between regulators, policymakers, and industry stakeholders.

- Data privacy and security: Fintech relies heavily on the collection and analysis of large amounts of data. Regulatory frameworks need to address privacy concerns and ensure that consumer data is adequately protected. Fintech companies must comply with data protection regulations, establish robust cybersecurity measures, and provide transparency to users about how their data is used. Addressing these challenges fosters consumer trust and confidence in Fintech solutions.

- Consumer protection: Fintech brings new risks that regulators need to address to protect consumers. As financial services become more digital and decentralized, regulations must mitigate risks such as fraud, unauthorized access, and unfair practices. Regulatory initiatives to ensure transparency, disclose risks, and enforce fair lending practices are crucial to maintain consumer trust in the Fintech ecosystem.

- International coordination: Fintech operates across borders, requiring regulatory coordination between different jurisdictions. Harmonizing regulations and fostering international collaboration can promote innovation, facilitate cross-border transactions, and ensure a level playing field for Fintech startups and traditional financial institutions. Regulatory sandboxes and information-sharing platforms play a crucial role in facilitating this coordination.

- Opportunities for regulatory innovation: Fintech presents opportunities for regulatory innovation that can foster growth and innovation while protecting consumers. Regulatory sandboxes, for example, allow startups to test their innovations within a controlled environment, enabling regulators to gain insights and ensure compliance. Open banking initiatives, which promote the secure sharing of consumer information, can spur innovation and competition in the financial industry.

- Supporting financial inclusion: Regulatory frameworks can encourage Fintech solutions that promote financial inclusion. By providing clarity and support for innovative business models, regulators can foster greater access to financial services for underserved populations. Regulatory sandboxes and tailored regulations for startups targeting financial inclusion can create an enabling environment for Fintech to address the needs of unbanked and underbanked communities.

Overall, striking the right balance between fostering innovation and ensuring consumer protection is a key challenge for regulators in the Fintech space. By embracing innovation, collaborating with industry stakeholders, and tailoring regulations to support responsible Fintech practices, regulatory bodies can maximize the benefits of Fintech while mitigating potential risks.

Risks and Security Concerns in Fintech

While Fintech brings countless benefits and opportunities, it also introduces risks and security concerns that need to be addressed to ensure the stability and trustworthiness of financial systems. Here are some key risks and security concerns in the Fintech space:

- Cybersecurity threats: Fintech platforms handle sensitive financial data, making them prime targets for cyberattacks. Hackers may attempt to steal customer information, commit fraud, or disrupt financial operations. Fintech companies must invest in robust cybersecurity measures, encryption technologies, multi-factor authentication, and regular security audits to protect customer data and maintain the integrity of their systems.

- Data privacy: The collection, analysis, and storage of large volumes of personal and financial data raise privacy concerns. Fintech companies must adhere to data protection regulations and ensure transparent practices regarding data usage, sharing, and consent. Prioritizing robust data privacy measures and providing clear privacy policies builds trust and confidence among users.

- Lack of regulatory oversight: The rapid growth of Fintech often outpaces the development of regulatory frameworks. This can create gaps in oversight and expose users to potential risks. Regulators need to adapt and establish comprehensive guidelines that address Fintech-specific risks, enforce compliance with data privacy and consumer protection regulations, and ensure fair practices in the industry.

- Operational risks: Fintech companies may face operational risks, including system failures, technical glitches, and inadequate business continuity plans. Such risks can disrupt services, compromise customer data, and erode trust. Robust risk management practices, regular system testing, and disaster recovery plans can help mitigate operational risks and ensure the smooth operation of Fintech platforms.

- Financial fraud: Fintech platforms can be vulnerable to financial fraud, such as identity theft, phishing attacks, and unauthorized transactions. Rigorous user authentication measures, real-time transaction monitoring, and education on security best practices can safeguard against financial fraud and protect users’ financial assets.

- Regulatory compliance: Fintech companies must navigate complex regulatory landscapes to ensure compliance with financial regulations, consumer protection laws, and anti-money laundering (AML) practices. Failure to comply with regulations can result in legal consequences and reputational damage. Establishing a strong compliance framework and building partnerships with legal and compliance experts are essential for Fintech firms to navigate the regulatory landscape successfully.

Addressing these risks and security concerns requires a collaborative effort among Fintech companies, regulators, and users. Promoting cybersecurity awareness, implementing robust security measures, enforcing data privacy regulations, and enhancing regulatory oversight are crucial to safeguarding the Fintech ecosystem and ensuring a secure and trustworthy environment for financial transactions.

Conclusion

Fintech has revolutionized the financial industry, bringing about significant changes and opportunities. The economic impact of Fintech has driven innovation, created new jobs, and enhanced financial inclusion. By leveraging technology, Fintech has increased access to financial services, improved efficiency, and reduced costs.

However, Fintech also presents regulatory challenges and security concerns that need to be addressed. Regulatory bodies must adapt to the evolving Fintech landscape, establishing frameworks that encourage innovation while ensuring consumer protection. Cybersecurity threats, data privacy issues, and operational risks require robust measures to protect users’ information and financial assets.

Despite these challenges, Fintech offers immense potential for growth, collaboration, and customer-centric solutions. It fosters innovation and entrepreneurship by democratizing access to resources, supporting incubation programs, and encouraging collaboration between startups and established financial institutions. This collaboration drives the development of disruptive business models and promotes healthy competition.

As Fintech continues to evolve, it is crucial for all stakeholders, including financial institutions, regulators, entrepreneurs, and consumers, to stay informed, adapt to technological advancements, and safeguard against risks. By doing so, we can maximize the benefits of Fintech, drive financial inclusion, and create a more accessible, efficient, and secure financial ecosystem for all.