Finance

Zeta Model Definition

Published: February 20, 2024

Discover the meaning and application of the Zeta model in finance. Learn how this financial tool can aid in analyzing risk and making informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Zeta Model: A Powerful Tool for Financial Analysis

Welcome to the finance category of our blog, where we discuss everything related to managing your money, investments, and financial planning. Today, we are diving into the fascinating world of the Zeta Model, a powerful tool that can help you make informed decisions in your financial analysis. If you’ve ever wondered what the Zeta Model is and how it can benefit you, keep reading to find out!

Key Takeaways:

- The Zeta Model is a robust financial analysis tool used to evaluate a company’s financial health.

- It assesses various financial ratios to determine the overall financial strength and stability of a company.

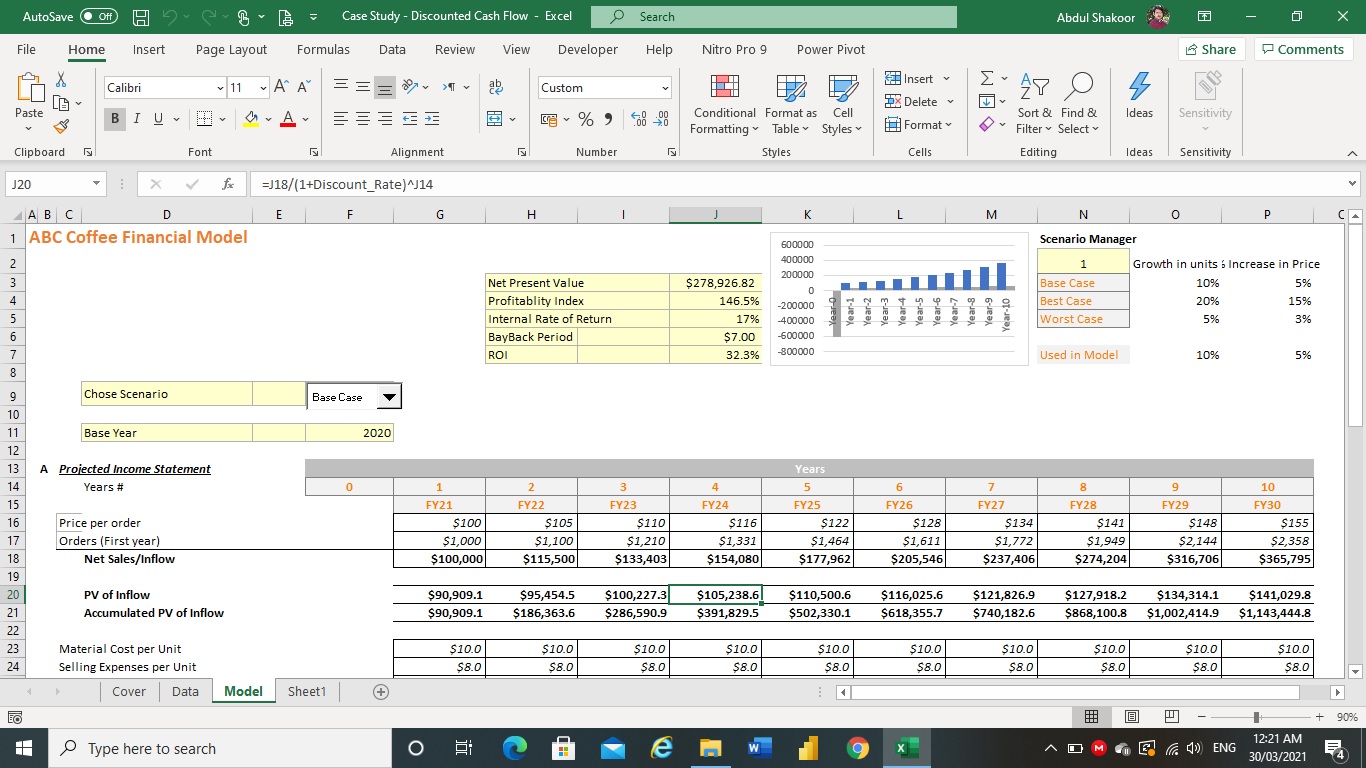

Now, let’s unravel the definition and significance of the Zeta Model. Developed by esteemed economist Edward I. Altman in 1968, the Zeta Model, also known as the Altman Z-Score, is a mathematical formula used to predict the probability of a company going bankrupt within a specific time frame, typically one to two years. It is widely utilized by investors, creditors, and financial analysts to assess a company’s creditworthiness and overall financial health.

The Zeta Model analyzes several financial ratios, such as working capital/total assets, retained earnings/total assets, earnings before interest and taxes/total assets, market value of equity/book value of total liabilities, and sales/total assets. By considering these ratios, the Zeta Model assigns a specific score to a company.

Now you might wonder, what does this score mean?

The Zeta Model calculates a numerical value ranging from negative to positive. If the score is higher, it indicates that the company is in a healthier financial position and thus, less likely to go bankrupt. Conversely, a lower score suggests a higher probability of insolvency. Generally, a score above 3 is considered safe, between 1.8 and 3 indicates moderate risk, and below 1.8 signifies a high likelihood of financial distress.

How Can the Zeta Model Benefit You?

Understanding and incorporating the Zeta Model into your financial analysis endeavors can provide numerous benefits. Here are two key takeaways:

- Improved decision-making: By utilizing the Zeta Model, you gain valuable insights to assess the financial stability of potential investments or business partners. This allows you to make more informed decisions and mitigate the risks associated with uncertain financial conditions.

- Risk management: Incorporating the Zeta Model into your financial analysis toolkit enables you to proactively identify and manage potential financial risks. It acts as an early warning system, helping you avoid companies that might be at high risk of bankruptcy, and focus on more stable and promising opportunities.

The Zeta Model serves as a valuable framework for evaluating financial health across various industries, from small businesses to large corporations. But it’s important to note that this model has certain limitations, especially when it comes to assessing industries with different financial dynamics. It is always recommended to use the Zeta Model in conjunction with other financial analysis tools and perform due diligence when evaluating investment opportunities.

So, if you’re looking to enhance your financial analysis skills and make smarter investment decisions, consider incorporating the Zeta Model into your toolkit. By understanding this powerful tool, you can strengthen your financial acumen and navigate the complex world of finance with confidence.

Stay tuned on our finance category page for more insightful articles and expert advice. Remember, knowledge is power when it comes to managing your finances.