Finance

Econometrics: Definition, Models, And Methods

Published: November 16, 2023

Learn the definition, models, and methods of econometrics in finance. Explore how econometric analysis helps make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Econometrics: Understanding the Link Between Economics and Statistics

Are you ready to dive into the world of econometrics? In this article, we will explore the definition, models, and methods of econometrics, a field that combines and bridges the gap between economics and statistics. By harnessing the power of data and statistical analysis, econometrics helps us understand and predict economic phenomena, enabling policymakers, businesses, and researchers to make informed decisions.

Key Takeaways

- Econometrics is the application of statistical methods to economic data to understand and quantify economic relationships.

- It involves the use of mathematical models to analyze and predict economic outcomes.

What is Econometrics?

Econometrics can be thought of as a marriage between economics and statistics. It is the field that seeks to measure, explain, and forecast economic phenomena by applying statistical methods to economic data. By using econometrics, economists can test economic theories, evaluate policies, and provide empirical evidence to support their arguments.

Econometrics helps answer questions like:

- What is the relationship between education level and income?

- How does the change in interest rates affect consumer spending?

- What is the impact of government policies on employment?

To tackle such questions, econometricians collect data from various sources, including surveys, government reports, and financial statements. They then apply statistical techniques to analyze the data and estimate the parameters of economic models.

Econometric Models

Econometric models are mathematical representations of economic relationships. These models allow economists to capture the complexities of real-world economic systems and make predictions about future outcomes. Here are a few commonly used econometric models:

- Linear regression models: This model assumes a linear relationship between the dependent variable (e.g., income) and one or more independent variables (e.g., education level, experience). It estimates the coefficients that represent the slope and intercept of the linear equation.

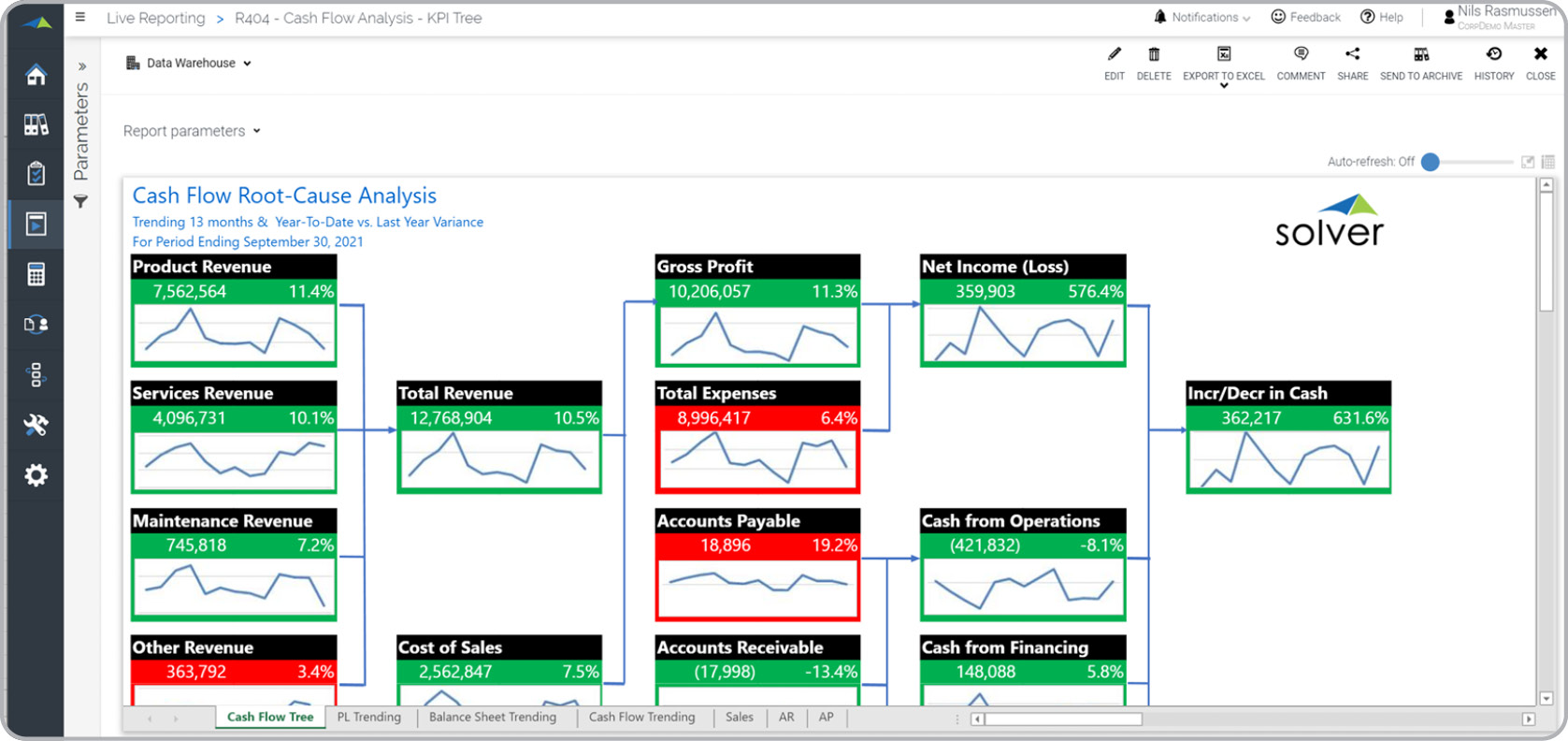

- Time series models: These models analyze data collected over time, such as stock prices or GDP growth, to identify patterns and forecast future values.

- Panel data models: Panel data combines cross-sectional and time-series data to examine the effects of both individual characteristics and time-specific variables on an outcome variable.

- Simultaneous equation models: These models capture the interdependence between multiple equations. For example, in a macroeconomic model, changes in government spending, taxes, and interest rates can impact each other and the overall economy.

Econometric Methods

Econometric analysis involves different methods to estimate model parameters and evaluate their statistical significance. Here are some commonly used econometric methods:

- Ordinary Least Squares (OLS): OLS is a popular method used in linear regression models. It minimizes the sum of the squared differences between the observed and predicted values to estimate the coefficients.

- Maximum Likelihood Estimation (MLE): MLE is a general estimation method that seeks to find the parameter values that maximize the likelihood of the observed data.

- Instrumental Variables: This method is used to address endogeneity issues, where there is a correlation between the explanatory variables and the error term in the regression model.

- Time Series Analysis: Time series analysis methods, such as ARIMA (Autoregressive Integrated Moving Average), help analyze and forecast data with a temporal component.

- Panel Data Analysis: Panel data analysis methods, such as fixed effects and random effects models, account for both individual and time effects in the data.

In Conclusion

Econometrics is a powerful tool that combines economics and statistics to provide insights into economic relationships and make predictions about future outcomes. By utilizing various econometric models and methods, economists and analysts can dissect complex economic systems, test hypotheses, and guide policy decisions. Understanding econometrics is essential for anyone aiming to grasp the intricacies of the economy and become a well-informed decision-maker in the business and policy realms.