Finance

Bear Tack Definition

Published: October 15, 2023

Learn the meaning of bear tack in finance and how it affects the market. Explore the strategy used to profit from declining stock prices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unveiling the Truth Behind Bear Tack Definition

When it comes to the world of finance, there is no shortage of jargon and terminology to navigate. One such term that often raises eyebrows is the bear tack. If you’re scratching your head and wondering what exactly this means, fear not! In this article, we will delve into the depths of the bear tack definition, shedding light on its meaning and significance.

Key Takeaways:

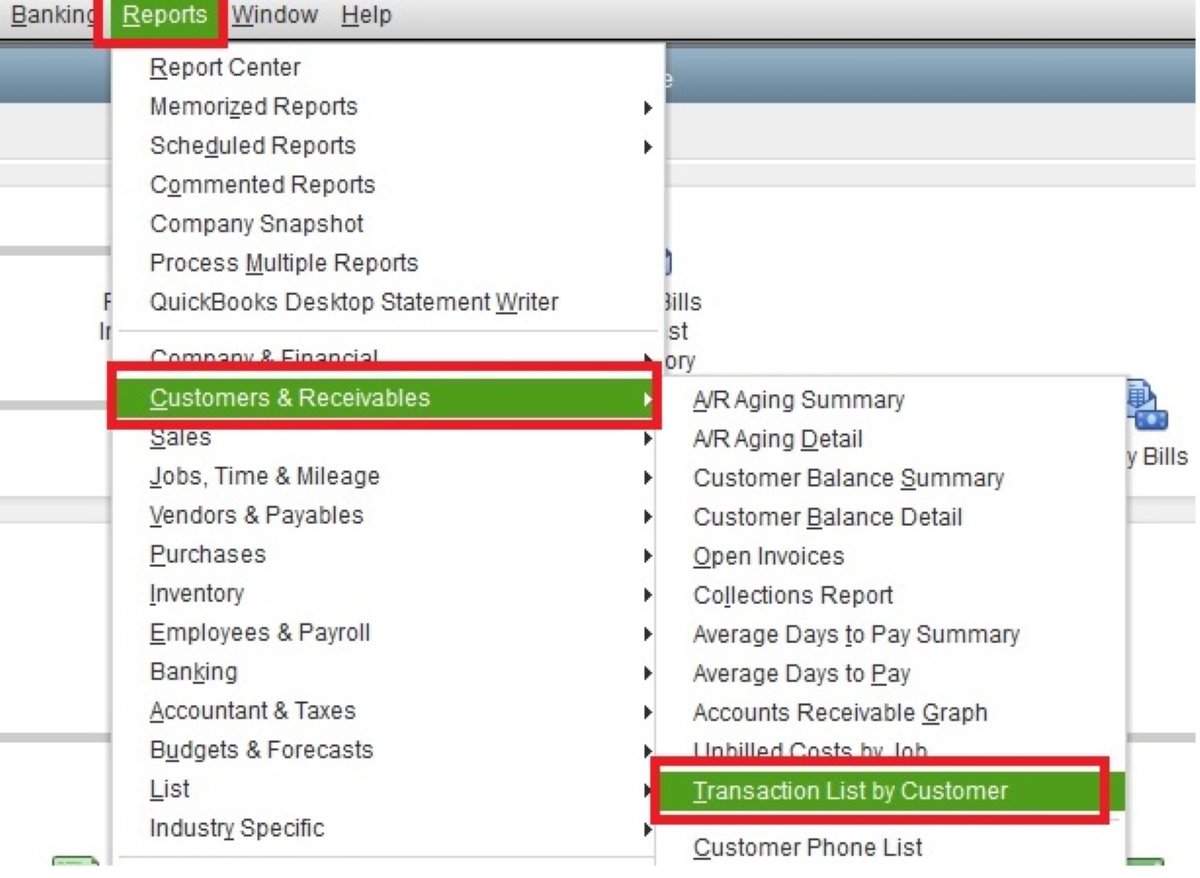

- The bear tack is a term commonly used in financial markets to describe a downward trend in prices or an anticipated decline in a specific asset or market.

- This term is often associated with pessimism, as it indicates a negative market sentiment and a belief that prices will continue to fall.

So, what exactly is a bear tack? To put it simply, a bear tack refers to a decline in prices or a downward trend in a specific asset or market. It is the complete opposite of a bull tack, which represents an upward trend. Just like a bear charges at its prey, causing it to retreat, a bear tack in the financial world indicates a forceful push in a downward direction.

Understanding the bear tack definition is essential for investors and traders who want to make informed decisions in the financial markets. By recognizing the signs of a bear tack, they can potentially protect their investments or even profit from market downturns.

Here are some key points to remember when it comes to bear tacks:

- Bearish Sentiment: A bear tack is often associated with a bearish sentiment in the market, meaning that investors expect prices to continue declining.

- Indicators of a Bear Tack: Some common indicators of a bear tack include downward price trends, increased selling volume, and negative market news.

- Contrarian Opportunities: While a bear tack may appear negative, it can also present contrarian opportunities for savvy investors who are willing to take risks. For those who can identify undervalued assets during a bear tack, there may be potential for significant gains when the market eventually rebounds.

Remember, however, that financial markets are complex and unpredictable. While the bear tack definition may provide some insights, it’s important to conduct thorough research and consult with financial professionals before making any investment decisions.

In conclusion, grasping the concept of bear tack definition is a valuable tool for anyone interested in the world of finance. By understanding this term and being aware of the indicators and opportunities it presents, investors can navigate the often unpredictable market with greater confidence.

Stay tuned to our Finance category for more insightful articles that cover various aspects of the financial world and help you make informed decisions!