Home>Finance>Consumption Tax: Definition, Types, Vs. Income Tax

Finance

Consumption Tax: Definition, Types, Vs. Income Tax

Published: November 2, 2023

Learn about consumption tax: its definition, types, and how it differs from income tax. Discover key insights in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Consumption Tax: Definition, Types, vs. Income Tax

Welcome to our finance blog series, where we explore various topics to help you make informed financial decisions. In this article, we will dive into the world of consumption tax and how it compares to income tax. Whether you’re a business owner or an individual taxpayer, it’s crucial to grasp the fundamentals of taxation to navigate the financial landscape effectively.

Key Takeaways:

- Consumption tax is a type of tax imposed on the purchase of goods and services, focusing on what individuals or businesses consume rather than their income.

- There are two main types of consumption tax: sales tax and value-added tax (VAT).

In a world dominated by taxation, understanding the different types of taxes is vital. While income tax may be the most well-known, consumption tax plays a crucial role in many countries’ revenue systems. So, let’s explore the concept of consumption tax, its types, and how it differs from income tax.

What is Consumption Tax?

Consumption tax can be defined as a type of tax levied on the purchase of goods and services. Unlike income tax, which focuses on the amount of money individuals or businesses earn, consumption tax revolves around what they consume. It aims to raise revenue for the government based on the assumption that individuals or businesses with higher consumption patterns should contribute more to government funds.

Types of Consumption Tax:

There are two primary types of consumption tax:

- Sales Tax: Sales taxes are imposed on the retail sale of goods and services. They are typically implemented at the state, provincial, or local levels and can vary in rates depending on the jurisdiction. When you purchase an item from a retailer, you pay a percentage of the item’s price as sales tax.

- Value-Added Tax (VAT): Unlike sales tax, which is levied only at the final point of sale, VAT is applied at every step of the production and distribution chain. Each entity involved in the process pays tax on the value they add, ultimately passed on to the end consumer. VAT is commonly used in many countries around the world and is known for its ability to generate substantial revenue.

Both sales tax and VAT serve as indirect taxes, meaning the burden is ultimately borne by the end consumer. While the mechanisms may differ, they have a similar objective of taxing consumption rather than income.

Now, let’s compare consumption tax to income tax:

Consumption Tax vs. Income Tax:

The fundamental difference between consumption tax and income tax lies in what they tax:

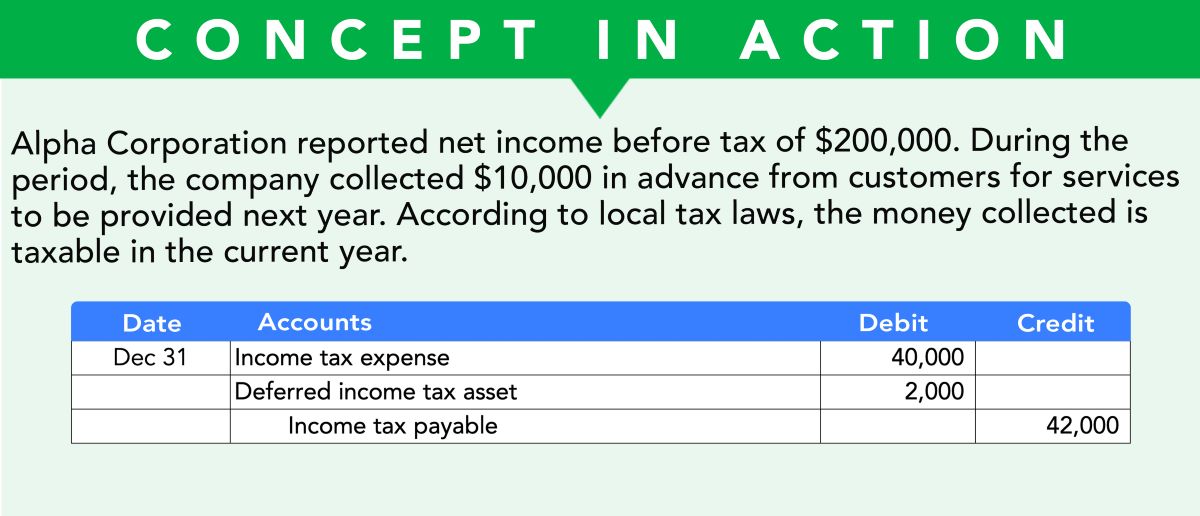

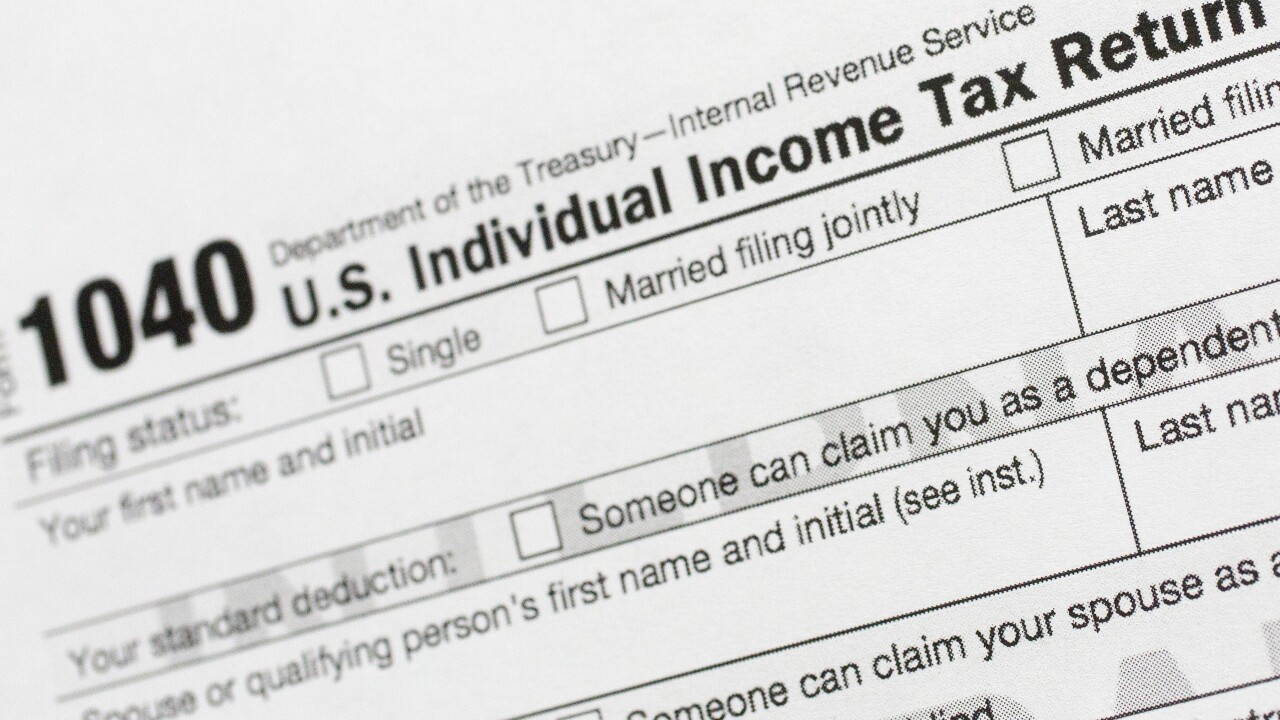

- Income Tax: Income tax is levied on the earnings of individuals or businesses. It takes a percentage of their income or profits, depending on the tax bracket they fall into. The more you earn, the higher the percentage of your income that goes towards income tax.

- Consumption Tax: As mentioned earlier, consumption tax is imposed on what individuals or businesses consume. It focuses on the purchase of goods and services. Therefore, the burden of consumption tax is determined by a person or business’s spending habits rather than their income.

While income tax targets your earnings, consumption tax takes into account your spending habits. Some believe that consumption tax is fairer as it puts the onus of taxation on those who choose to spend more. On the other hand, income tax is often progressive, meaning it taxes higher earners at a higher rate to provide a more equitable system.

It’s important to note that various countries may have different combinations of income tax and consumption tax, depending on their economic systems and fiscal policies.

Conclusion

Understanding the concepts of consumption tax, the different types, and how it compares to income tax is essential for everyone, whether you’re an individual taxpayer or a business owner. By grasping these fundamental aspects of taxation, you can make informed decisions regarding your financial planning, budgeting, and spending habits.

We hope this article helped shed light on the world of consumption tax and its relationship with income tax. Stay tuned for more informative finance articles in our blog series!