Home>Finance>Low-Income Housing Tax Credit (LIHTC) Definition

Finance

Low-Income Housing Tax Credit (LIHTC) Definition

Published: December 21, 2023

Learn about the definition of Low-Income Housing Tax Credit (LIHTC) and its role in finance to promote affordable housing for low-income individuals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Low-Income Housing Tax Credit (LIHTC) Definition

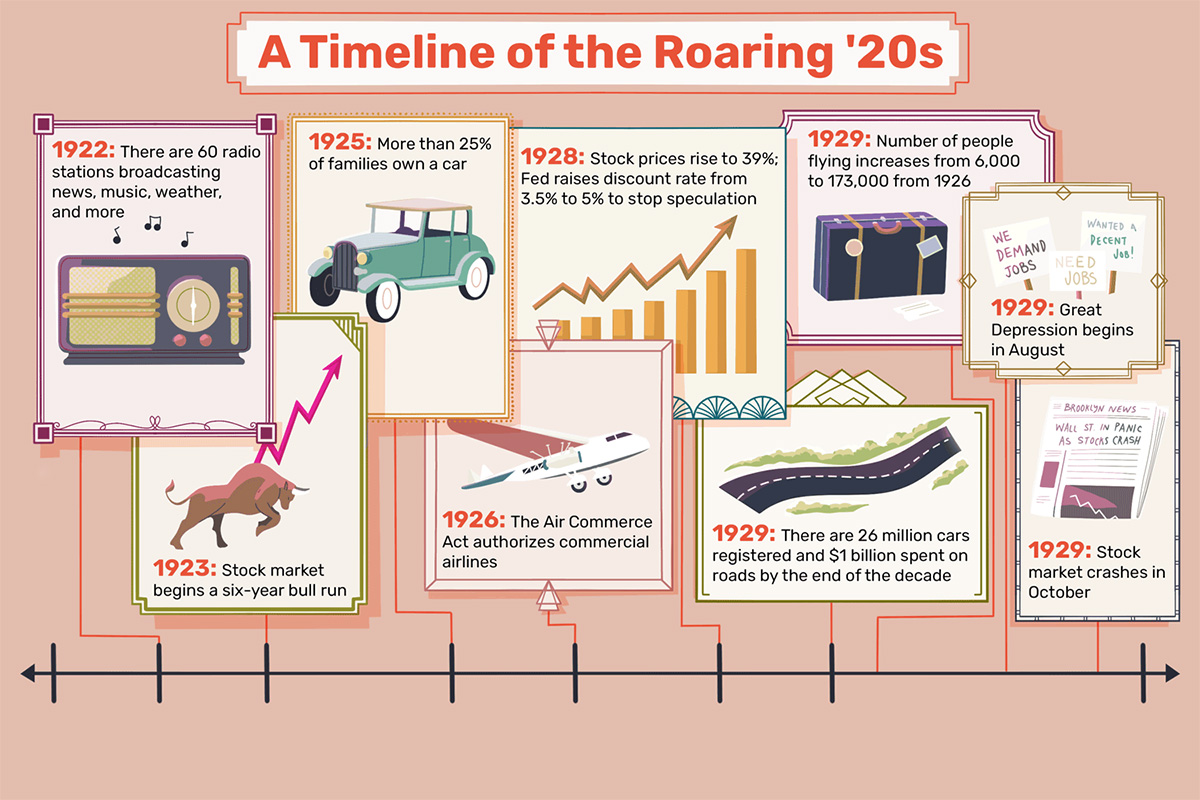

When it comes to financing affordable housing developments, the Low-Income Housing Tax Credit (LIHTC) is a vital tool. Developed by Congress in 1986, LIHTC provides a tax incentive for investors to fund the construction or rehabilitation of low-income rental housing. This article aims to provide a comprehensive understanding of the LIHTC definition and its significance in driving affordable housing initiatives.

Key Takeaways:

- The Low-Income Housing Tax Credit (LIHTC) is a tax incentive program created by Congress in 1986 to encourage investment in affordable housing.

- LIHTC provides tax credits to investors that finance the construction or rehabilitation of low-income rental properties, fostering the development of affordable housing communities.

Driving Affordable Housing through Tax Incentives

The high cost of housing remains a significant challenge for many low-income individuals and families. The LIHTC program addresses this issue by offering tax credits to incentivize private investment in affordable housing. Through this program, investors receive tax credits over a period of 10 years, which reduces their federal tax liability.

So, how does the LIHTC program work? Let’s break it down:

- Allocation: Each state government is allocated a specific amount of LIHTC dollars each year. These credits are then awarded to eligible developers who propose affordable housing projects in their state.

- Investment: Developers obtain private investment by selling the tax credits to investors looking to offset their tax liabilities. The amount of credit allocated is based on the cost of constructing or rehabilitating low-income rental housing units.

- Affordability: LIHTC properties must meet strict income requirements to ensure they are accessible to individuals and families with limited resources. Typically, a certain percentage of units must be set aside for households with incomes below a specified threshold.

- Compliance: Developers, as beneficiaries of the LIHTC, must adhere to certain compliance regulations. This includes maintaining the designated affordability levels throughout the compliance period, which typically lasts for 15 years.

This combination of tax incentives, private investment, and affordability measures helps bridge the gap between the demand for affordable housing and its availability. By encouraging private sector participation, the LIHTC program has become one of the most successful mechanisms in promoting the development of affordable rental properties across the United States.

It is important to note that while LIHTC is a valuable funding tool, it is not a direct rental subsidy program or a housing voucher. Rather, it focuses on leveraging private investment to create sustainable and affordable housing solutions.

In Conclusion

The Low-Income Housing Tax Credit (LIHTC) program plays a crucial role in advancing the availability of affordable housing in the United States. By providing tax credits to investors, this program encourages the development and rehabilitation of rental properties targeted towards low-income individuals and families. As a result, LIHTC fosters the growth of sustainable communities and ensures that more individuals have access to safe and affordable housing.