Finance

Front-End Ratio Definition

Published: November 28, 2023

Learn the Front-End Ratio Definition in Finance and understand how it impacts your mortgage approval. Mastering this calculation is crucial for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Front-End Ratio: A Key Metric in Personal Finance

When it comes to managing personal finances, there are several important factors to consider. From budgeting and saving to investing and debt management, understanding the various metrics can be crucial in making sound financial decisions. One key metric that lenders and financial experts utilize to assess an individual’s financial health is the Front-End Ratio. But what exactly is the Front-End Ratio, and why is it important? Let’s delve into this financial indicator and gain a better understanding of its significance.

The First Impression: Defining the Front-End Ratio

The Front-End Ratio, also known as the Housing Expense Ratio, is a metric used by lenders to determine an individual’s eligibility for a mortgage loan. It represents the percentage of one’s gross income that goes towards housing expenses, including mortgage payments, property taxes, and homeowner’s insurance. In simpler terms, it assesses whether an individual or household has the financial capacity to afford the costs associated with homeownership.

Key Takeaways:

- The Front-End Ratio is a metric used by lenders to assess an individual’s eligibility for a mortgage loan.

- It represents the percentage of an individual’s gross income that goes towards housing expenses.

Why Does the Front-End Ratio Matter?

Now that we understand what the Front-End Ratio is, let’s explore why it is such an important metric. Here are two key reasons why the Front-End Ratio matters:

- Financial Stability: The Front-End Ratio serves as a measure of an individual’s financial stability. Lenders use this metric to ensure that borrowers can afford their mortgage payments without facing excessive financial strain. By assessing housing expenses as a percentage of one’s income, lenders can gauge the borrower’s ability to meet their financial obligations.

- Loan Eligibility: The Front-End Ratio plays a crucial role in determining an individual’s eligibility for a mortgage loan. Lenders typically have specific thresholds that borrowers must meet to qualify for a loan. These thresholds can vary depending on the lender’s requirements and the type of mortgage loan being considered. By understanding one’s Front-End Ratio, borrowers can assess their own eligibility and make informed decisions.

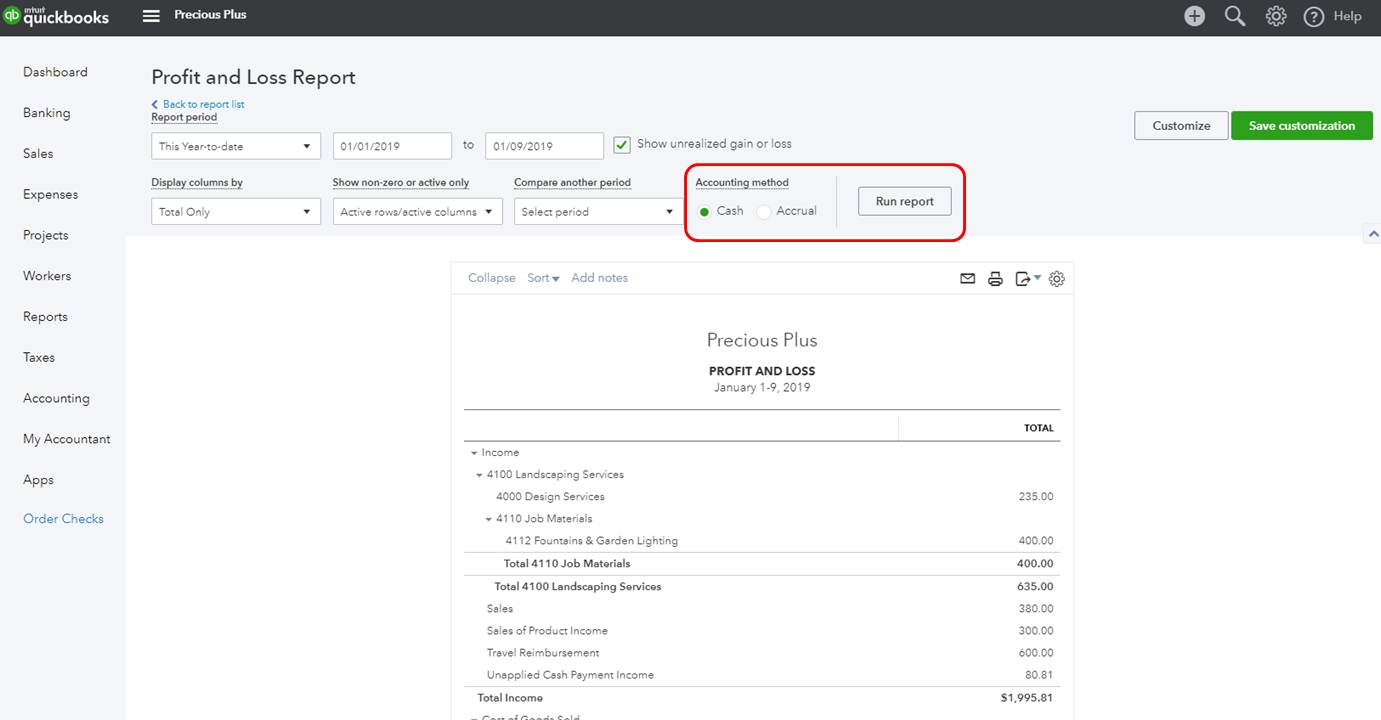

Calculating the Front-End Ratio

Calculating the Front-End Ratio is a straightforward process. To determine this metric, you need to divide your total monthly housing expenses by your gross monthly income and multiply the result by 100. The formula for the Front-End Ratio can be represented as:

Front-End Ratio = (Total Monthly Housing Expenses / Gross Monthly Income) x 100

For example, if your total monthly housing expenses amount to $1,500 and your gross monthly income is $5,000, your Front-End Ratio would be calculated as:

Front-End Ratio = ($1,500 / $5,000) x 100 = 30%

Final Thoughts

As you navigate the world of personal finance, being aware of the Front-End Ratio can provide you with valuable insights into your financial health. By understanding this metric and how it is calculated, you can make informed decisions when it comes to homeownership and mortgage loans. Remember, maintaining a healthy Front-End Ratio is vital to ensure long-term financial stability and avoid overburdening yourself with housing expenses.

So, the next time you consider taking on a mortgage, be sure to evaluate your Front-End Ratio and ensure that you are financially prepared for the responsibility. Your financial well-being depends on it!